[CNBCfix Fast Money/Halftime Report Review Archive — July 2022]

Tom Lee in driver’s seat

They say, What goes around, comes around.

Tom Lee's bull case tends to come around a lot more often than the alternative.

Such has been the case this week, in a jaw-dropping rally so ferocious, we've started to wonder if they're going to open the Nasdaq on Saturday 7/30 so that people can buy some more stock.

Lee, in fact, turned up on Friday's (7/29) Halftime Report. Though ever modest and not taking a victory lap, he actually suggested there might be a lot more fuel for the fire.

Lee said the market has been anticipating a "turning point in inflation." He pointed to 1982 (kind of a sample size of 1, but whatever) and asserted, "That inflation-driven bear market was erased in 4 months. You had almost a 3-year bear market that was completely recovered in 4 months."

Lee added, "By some measures, I'd actually say that leading indicators say for the next 6 months, month over month inflation will annualize under 2%."

Bryn Talkington questioned Lee's reference to the '80s, saying that in 1971, the S&P P.E. was 16, and in 1982, it was 8, also there were "huge tax cuts" in 1981, whereas now, we have tax hikes coming and inflation lingering. Lee said earnings fell from 1982-87, but the multiple shot to nearly 25, and the 10-year was either 6% or 8%, though we're not sure how any of that rebutted Bryn's apparent argument of 1982 being a historic oversold level.

The stock market — especially forecasting it on TV — is generally a what-have-you-done-for-me-lately type of business. Lee was floating 4,800 year-end.

A week ago, this page would've scoffed.

Lessee ... historically, what’s been the bigger fear, Hillary/drug prices or Liz/bank trading

Jim Lebenthal on Friday's (7/29) Halftime Report said the market rally is just a "tone change" or "sentiment change."

But Jim predicted "bouncy for a while" rather than "off to the races."

Nevertheless, Jim thinks we're overdue for a happy CPI. "It's been a year since you've had a benign inflation report," Jim said.

Everyone touted energy. Jim said he's "very happy" to have bought XOM. (This writer is long XOM.) Jim said energy supply will remain constrained, that's the only headwind on his overall market bullishness. Jason Snipe seconded Jim's comments in regard to CVX. (This writer is long CVX.) Bryn Talkington suggested the White House will make an "issue" of those "huge profits." Bryn also mentioned Elizabeth Warren. We're not aware yet of Elizabeth Warren ever thwarting a bull market despite how often that's been feared on CNBC ... but maybe it happens. Rob Sechan (Happy Birthday) talked up EOG.

Jim said the risks to energy are 1) political, and 2) a head-scratcher, "regime change in Russia" (the kind that would lead to a more pro-West government).

Bryn Talkington refreshingly admitted her "worst trade of the year," selling AMZN in May around $110, then buying META "in the 190s."

Jim Lebenthal said he no longer trades ROKU, though it's a "cool company," its fall is a "lesson for everyone" that "price matters." Bryn said ROKU is a "great company" but there's no "g" or "e."

Bryn faulted the C-suite for a couple bad PYPL quarters, but she's holding it now because of the "great ecosystem."

Jim said he has no time for PARA analysts who can't see beyond 3 months.

Weiss busy backpedaling

One of the permanent issues with stock calls on CNBC is that there really is no endpoint or endgame.

If you're wrong today, you might be right tomorrow, or vice versa.

(Translation: These opinions are for entertainment purposes only.)

Which is kind of where Halftime Report viewers find themselves with Steve Weiss, who just on July 18 was stating that the time to buy is "maybe 5 months away; maybe 4 months away."

Evidently, that timeline has accelerated significantly, because on Thursday's (7/28) Halftime, Judge asked Weiss if the market got the Fed meeting right.

"I do think the market got it right," Weiss admitted, before revealing, "When the press conference started, I did put on some pretty sizable positions in the Q's, VOO and SMH."

"I think the market can continue to rally here for a little bit," Weiss said, adding, "You've got the big news out of the way."

But he predicted a "different story" in the fall.

Later in the show, Weiss revealed he bought DE. "There's a food shortage around the world," Weiss explained. But then we got the parsing. "It's not a full position yet," Weiss said.

Judge refused to guess at the No. 1 survey finding for fixing inflation

The biggest skeptic on Thursday's (7/28) Halftime Report was not an investment pro, but CNBC's own Fed watcher Steve Liesman.

"I didn't hear the dovishness that the market seemed to react to," said Steve, who focused with Judge on expectations of where interest rates ultimately will land.

Steve told Judge, "If you think that we're gonna have inflation come back under control, um, and do so fairly quickly without the Fed going into punishing territory of 3 1/2 to 4%, um, you should not be anchoring television. You should be taking all of your money and going all in on the stock market, if that's your uh, uh, trajectory."

Then again, "There's Larry Summers out there," Liesman acknowledged, saying Larry thinks the Fed might have to go into "punishing, 4-5% territory." (Snicker)

Liesman harped on the "labor problem that's not being focused on." Steve said the CNBC survey asked what's the No. 1 thing the government could do to curb inflation. "Increase legal immigration" is the answer, Liesman said.

Nancy Davis said the Fed activity this week was "super boring" and the meeting a "big yawn."

New economic definitions (cont’d)

The headline comment from Jay Powell during Wednesday's Fed dialogue surely was, "I do not think the U.S. is currently in a recession."

But something else caught our ear.

Powell told CNBC's Steve Liesman, "Price stability is really the bedrock of the economy."

That's yet another effect mistaken as a cause. But then again, when the Fed's "mandate" of making sure banks have enough money every day has been twisted over time into "price stability" and "maximum employment," why does anyone need to take them literally?

Weiss’ market call getting manhandled since June

As best as we can tell, the 2022 low of the S&P 500 was 3,636.87 on June 17.

Which means, after Wednesday's (7/27) rip-roaring rally, the stock market is up 10% from the bottom in a fairly short time.

Which means the persistently bearish calls of a select few Halftime Report panelists are sounding more and more tiresome inaccurate.

This page doesn't quite get the 10% rally ... but on the other hand, this page in April and May didn't see 3,636 coming in June.

It may be as simple as the S&P chart trading inversely to the wholesale gasoline price.

Or it may be that actual data isn't matching the "No one's buying used Rolexes anymore!!" commentary heard on business television.

Whatever the case, there's no Fed meeting until Sept. 20. Enjoy.

What happened to

the non-V-shapers?

On Wednesday's (7/27) Halftime Report, Liz Young predicted the market "is gonna start to bounce I think in August."

Liz admitted she told producers it's "irresponsible" not to be in the stock market," then clarified later what she meant.

Steve Weiss claimed he told Judge off the air a day earlier that the market would be up Wednesday, but that doesn't mean it's going in a "sustainable direction."

Weiss said it's never "irresponsible" to "worry about managing risk" and joked that if it's irresponsible, then those who were fully invested all the way down 50% maybe should be "drawn and quartered or shot for capital offenses."

Weiss was also picking fights for some reason over META, claiming it has a "very very uncertain future." Degas Wright said the Metaverse is a "platform" and not a product. Weiss demanded to know the "fundamental basis" for investing in the Metaverse, then kept interrupting Degas to say META is "depleting" cash as Degas tried to explain why he likes the stock.

Jim Lebenthal actually said with a straight face about Boeing's CEO, "I actually think he is doing a good job," a comment met with disbelief from both Joe Terranova and Steve Weiss.

At least we didn’t hear Jim say that anyone losing their job can get one right away in a more relevant industry

In the process of absorbing Tuesday's (7/26) Halftime Report, this page was prepared to report, "Just what we need — another hour of hearing about Jim Lebenthal's favorite stocks and rosy outlook."

But then we came around to a superseding opinion: "Just what we need — another hour of hearing Josh Brown implying that guys driving Lexuses can no longer procure a hot meal."

On Tuesday, in a session that refreshingly included 3 people at the same table who weren't affected by satellite delays, Brown was at it again on consumer spending.

"This is like another pandemic trend that's reversing. Why is that the case? Because the buyers aren't showing up. And you could look across the entire spectrum, the used Rolex market, baseball cards, NFT nonsense, it's one thing after another after another."

So we did a small amount of research. Yes, we found an article from 3 weeks ago about sluggish used-Rolex sales. The baseball card market, however, sounds like it's still having more problems with guys hoarding boxes as soon as they hit store shelves than with disinterested buyers. This excellent article last week by Bill Shea in The Athletic quotes Ken Goldin, who runs a popular sports memorabilia auction site that we learned was bought by none other than Steven Cohen (remember him?). Goldin says, "Goldin as a company is doing more business in 2022 than we did in 2021," but he concedes, "It's a lot easier to sell a $500,000 card when the S&P is at 4,000 instead of at 3,000."

And that latter comment is what Brown is missing. Sluggish baseball card or Rolex sales are not causing a downturn in the economy or stock market. They are an effect of what is happening in the economy and stock market. Brown could just as easily say "Look at how far down the Nasdaq Composite is this year" and make a stronger, more concise point (and only have to appear about once every couple weeks).

No one on Halftime seems concerned about the possibility of a leadership vacuum

What was most interesting about Monday's (7/25) Halftime Report (and basically all other episodes this year) is what was not heard.

No one mentioned the government as a possible headwind.

We couldn't count how many times during the existence of CNBC we've heard people during midterm election cycles pronounce the stock market a "hold" until November.

This year, it's a lot worse than just the typical bunch of midterms that flood your mailbox and cable TV breaks with advertisements.

There's a lot of concern about the top.

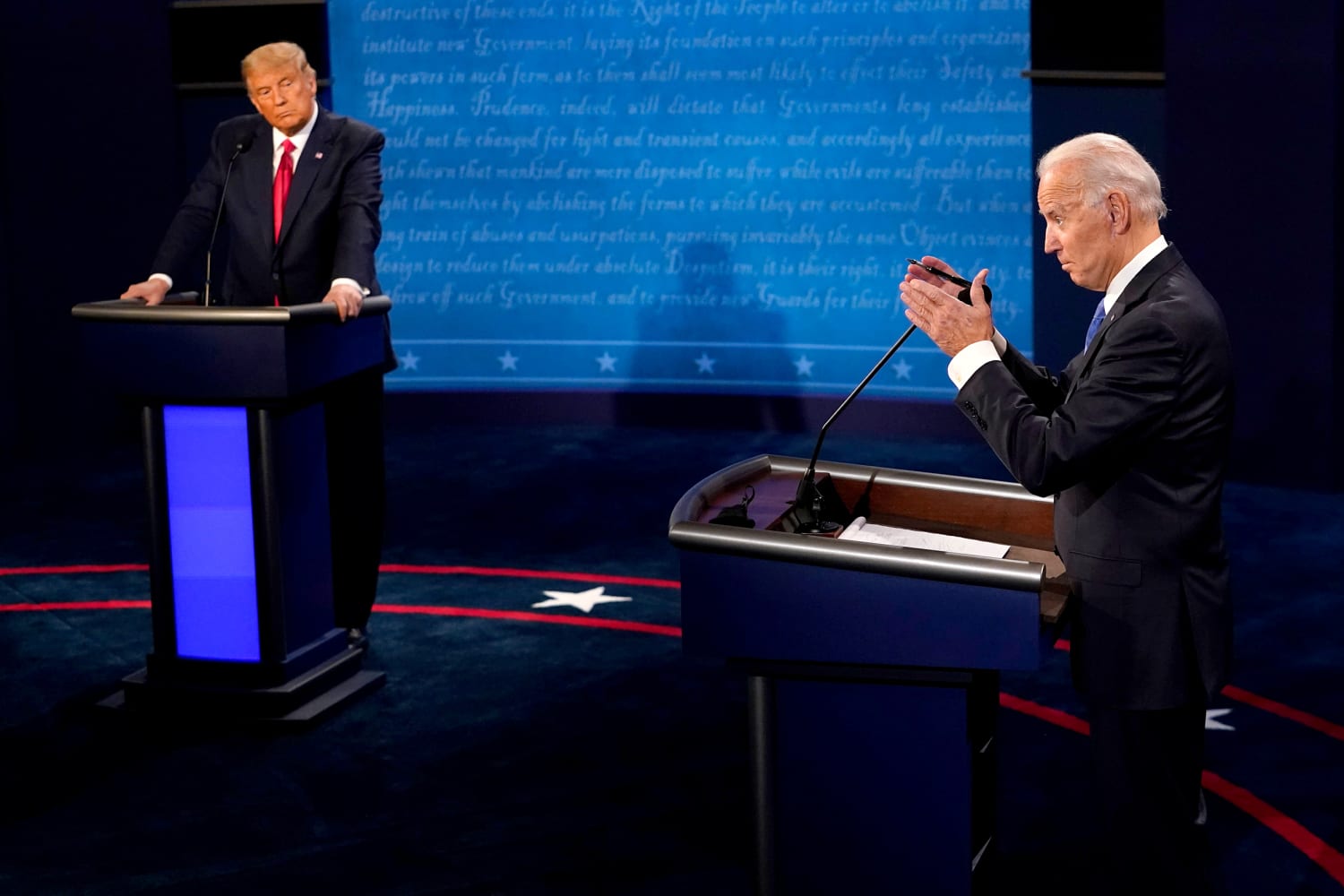

As to whether the 2024 presidential race is going to feature an 81-year-old incumbent who gets 5% in the Iowa caucuses and New Hamphire primary vs. a twice-impeached fellow who 1) can't lose a nomination and 2) can't get a majority of the country to vote for him and 3) evidently (correctly) thinks the best way to handle his legal problems is to continue to run for office.

If you think, as Halftime panelists apparently do, that confidence in the presidency has no bearing on the stock market, you might be a bit surprised in the next 2+ years.

Judge misread the statement, said ‘While we are convinced’ when it was ‘aren’t,’ not ‘are’

Evidently, we're starting to see some capitulation.

Not from the bulls ... but the bears.

Judge on Monday's (7/25) Halftime Report said the Morgan Stanley guy insists he's not "convinced" this is anything but a bear market rally (see headline above for Judge's grammar glitch while reading the statement), he admits to actually wondering, "Is something going on here we're missing?" that could even mean the "end" of the bear market.

Jenny Harrington opined on that statement, explaining, "If he just pivots hard-core back and forth, he's gonna lose credibility. So he needs to start paving the way."

(When does a strategist ever "lose credibility"? What is possibly the criteria? We've never seen it happen on CNBC. Not even -50% return on stock picks.)

And Jenny thinks he's "starting to see it the way I'm seeing it now."

"I'm gonna bet that we've seen the worst," Jenny concluded.

Meanwhile, Joe explained that "the bullish momentum" will be "challenged" this week. Joe said he bought the QQQ's last week, saying "It is not Joe that's buying the Q's, it's the market is dictating to me, I'm reacting to it." (Translation: Run-of-the-mill Momentum Trading.)

Jenny talked up how far MMM has fallen as a reason to like it. (But when it's stocks she doesn't like, then you can't call them "oversold.")

Judge did make a good joke, referring to Joe Terranova as "SPF-negative," while Josh Brown, on Monday, looked like "SPF-zero."

Joe said the Fed has to be "extremely hawkish" (snicker) (yeah right) about fighting inflation and can't pull the plug too soon.

Brown harped on AT&T's disclosure of "having trouble collecting" on "delinquent cellphone bills."

Jenny Harrington made a strange argument about the year being half-done as some kind of good thing for earnings or earnings estimates.

Judge actually said with a straight face about Tom Lee, "We don't read his notes every single day."

Judge brought back Jim Lebenthal for a soundbite; we're not sure why Jim's same-as-February outlook, the most often-repeated on the show by far, needs to be mentioned every single day.

No one buys a new car today if they think they’ll get it 10% cheaper in 2 weeks

On Friday's (7/22) Halftime Report, Steve Weiss made about the only comment that mattered:

"More so than earnings Scott is what the Fed will say."

Can't argue with that in the slightest.

(On the other hand, hang on — Weiss made a second comment that bears repeating.)

Judge rattled off a whole bunch of names that Weiss, despite being "still bearish," is long. Weiss said he traded BA and DAL based on the Farnborough air show, but he's out now; he gushed about POAHY, which, as a "luxury brand," isn't affected by most consumer sluggishness.

He also was parsing how much of the "bounce" he's been catching. (Zzzzzzz)

Later in the show, Weiss tried to explain why buying stocks must include short-term considerations as well as long-term. "I don't buy a new car today because I'm gonna drive it 2 years from now. I buy a new car today because I'm gonna drive it today."

Jim actually did NOT mention that everyone who gets laid off finds a great job right away #streakbroken

In the day's most tiresome (by far) discussion, Jim Lebenthal was asked on Friday's (7/22) Halftime Report to report on his conversation with Lourenco Goncalves, the famous CEO who runs a stock worth $16.

Jim said Goncalves is "extraordinarily happy" because of "cash flow." (Sure, a CEO is going to come across as super-grim when meeting with a TV personality.)

But Steve Weiss insisted "this is not the market" for a company like CLF.

Judge predicted that despite Weiss' stated skepticism of CLF, "He's gonna end up buying the stock."

Weiss made a great joke about Jim and "Payne Capital."

‘Bravery is not the absence of fear’

On Friday's (7/22) Halftime Report, Jim Lebenthal explained why he says he's "nervous" about markets, because he sees the "risks that are out there."

Then Jim gave viewers a slogan: "Bravery is not the absence of fear. It's action in the face of fear."

Jim said there hasn't been "kitchen-sinking" in earnings reports.

Rob Sechan complained that Arthur Burns' move in the '70s to lower rates "when nominally GDP started to decelerate" only ended up "exacerbating and prolonging" the inflationary nightmare into the '80s. (Because the free-market economy is always great; it's only the Federal Reserve that screws it up.)

Jim said he's "pretty sanguine" about GOOGL because he thinks we're just in a growth slowdown.

Jonathany Krinsky isn't high on buying AAPL right now. (Jenny Harrington said a month ago she'd buy it at $100.)

Courtney Garcia touted EQT and DE. Jim said DE seems a "no-brainer."

Jim disagreed with the "sell" call on PARA.

Judge has no idea whether Katy Huberty still works for Morgan Stanley

On every edition of the Halftime Report, Judge fails to note that nearly (nearly, but not quite all) every one of his panelists — bullish or bearish — is making the same call in July that he/she was making in February. (#whocaresaboutfactsontheground)

But one person who's prone to shift is not a panelist but Mark Newtown, Tom Lee's sidekick at FundStrat who apparently specializes in 3-week market predictions.

On Thursday (7/21), Judge brought up Newton's now-daily oh-looks-like-the-bottom-may-be-in realization.

Jim Lebenthal said there's still much we don't know from earnings. But Jim made his usual gasoline-futures-are-lower argument. (He also made his usual anyone-who's-laid-off-can-"immediately"-get-a-new-job argument.) Judge and Josh jumped on Jim for saying the effect of lower gas "hasn't shown up at the pump yet." After telling Josh to "take a breath," Jim said it hasn't "fully" shown up yet, which prompted an eye roll from Judge: "Well you didn't say 'fully.'" (See, in live TV, sometimes observations get adjusted on the fly.)

Josh Brown said "the sure-fire way to trade this year" is to buy stocks with VIX at 30-34 and sell at 20; a strategy that has worked "flawlessly."

Judge announced the name of the new AAPL analyst at MS. "We have called over to Morgan Stanley; we have asked if Ms. Huberty has left the firm, if she's moved on to different coverage, and we're waiting to hear back," Judge said.

At the moment Jim was speaking, Nasdaq was down about 26% from its 52-week high (because the whole crew couldn’t supply viewers with that info in an hourlong show)

On Thursday's (7/21) Halftime Report, Jim Lebenthal said the CLF earnings will be a "win-win," if the stock price on Friday's earnings doesn't "respect" the results, the company will just buy more of it back.

Judge said the stock is "down 43% in 3 months." Jim said it's been up 200% in 2 years. Judge said, "Our viewers may not have the luxury of having been in the name for the last couple of years, or few years, or whatever time frame."

Josh Brown said you have to think of REITs "strategically," that everyone should have some, but it's not ever "yes or no REITs." He cautioned that in REITs, you're not being taxed with dividends but at ordinary income rates.

Brenda Vingiello said there's "no question" that AMT will continue to be a "relevant" REIT.

Jim said he's long CPT; he didn't sound terribly enthusiastic about REITs but that's the one he picked.

Jim said the average age of cars on the road is 12.2 years, "a record." (That's probably going higher, given that dealers don't have enough cars to sell.)

Brenda Vingiello called INTC "a company everybody loves to hate," but "at the end of the day," she's sticking with it because it's "incredibly cheap."

At one point, Jim said, "I don't even know what the Nasdaq's down from its peak; maybe Josh knows, maybe somebody else knows."

Judge kept talking up the importance of SNAP earnings (snicker) later in the day.

‘The worst is probably behind us’

Jenny Harrington and Rob Sechan staked out interestingly contrasting stock market views on Wednesday (7/20), while Joe Terranova ... as he's prone to do ... tried to make a convincing argument for both sides.

Jenny said she's been thinking about the current rally and "the nuance of, Can it last."

Her conclusion? "I do think the worst is probably- probably behind us," Jenny said.

Rob, though, shrugged, "I think we continue to believe it's a rally you should sell," predicting it'll be "short-lived."

Jenny said it's somehow "really dangerous" (snicker) to "carefully wait for a big pullback." Rather, long-term investors should "wait it out."

But Rob said you have to be "invested with context," which means, staying long names such as AAPL and CRM and MSFT, but then other names are "Kenny Rogers names," which of course are the ones you need to know when to ... and when to ... (yep).

Sechan, though, suggested you "sit on your hands right now" because it seems like just another rally that fades until the Fed pivots.

(So in other words, commentary from each person that sounds a lot like the commentary in the ... winter.)

Joe claimed "the only thing" that hasn't been priced in to the market is an "apocalyptic type of deep recession," and he even said that "Momentum for the very first time, is back on the sides of the bulls."

Despite those seemingly positive observations, Joe still cautioned that "your time horizon has to be short."

He said he doesn't think the last 3 days is a "March 2009 moment." Rather, he thinks the market will "kind of vacillate" around 4,000.

Jenny said with a straight face that "I don't look at charts."

Judge said Mark Newton may be coming around to the idea that the bottom is in. (#last3hoursoftape)

‘Nothing’s falling off a cliff’

It's an absolute nothing market ... but the Fast Money Halftime Report is obliged to put on a television show every business day.

Judge managed to fill time on Tuesday (7/19) with Jim Lebenthal, who (stop if you've heard this before) once again found himself fending off a wall of skepticism from others including Judge.

One debate was over the prospect of a "pivot."

"Are we so sure that the Fed pivot is bullish for the market beyond one day?" asked Josh Brown.

Stephanie Link said we're "so far away" from 2% inflation, "Who knows if they're gonna pivot in September."

Brown said we're "maybe a little bit too confident" in how many "open jobs" exist or will continue to exist.

Anastasia Amoroso said 2% inflation is a "pipe dream" and the Fed needs to "bring down demand much more than they previously expected."

Jim insisted that stats show, "as jobs are laid off, people are finding replacement work right away."

Eventually, Judge got to his favorite angle for hectoring Jim. "None of what you've said in terms of onshoring has anything to do with where the stock market goes in the next 10 months. It just. Does. Not," Judge said.

Jim said, "Earnings are projected right now to fall off a cliff," but "right now, nothing's falling off a cliff."

Weiss claims he could land a sitcom gig if he wasn’t on the Halftime Report

On a fairly sleepy episode of the Halftime Report on Monday (7/18) that neither asserted nor proved anything, Judge sensed that the entire panel seems to think, whatever long-term optimism was expressed, that stocks are still going lower.

Joe Terranova indicated at the top of the show that he's suddenly interested in "technicals," for whatever reason. (Bottom line: He thinks stocks will move "a little bit higher.")

Judge tried to do a transition from Joe to Steve Weiss by saying Weiss is "stepping away from risk." Weiss apparently objected to that characterization, stating he was "dead right" for stepping away "earlier in the year," every stock he sold is lower than when he sold it, now he can "cherry-pick" the really great stocks, etc.

"Nobody suggested that you've been wrong on the market," Judge said.

"I'm not a natural pessimist," Weiss insisted, explaining that if he wasn't on this show, he'd be "proudly doing a sitcom."

Joe, meanwhile, said the market has priced in "a shallow recession," but that it's had a "tradeable bounce."

"I think we could see 4,800 at some point in 2023," Joe said.

Weiss said the time to buy is "maybe 5 months away; maybe 4 months away."

Sarat Sethi referred to Weiss (he called him "Weiss" during the show) as "Mr. Optimist."

Judge's guest on Overtime for the first 15 minutes was Jim Cramer; it was unwatchable.

Overtime guest dubs

Tom Lee a ‘permabull’

On Friday's (7/15) Overtime, Tom Lee was once again ... bullish.

Lee said a "majority" of people want to sell the rip, but he thinks anticipation of inflation or rate hikes is "stabilizing or rolling over." (We did hear "rolling over" a couple of times from Lee.)

Lee predicted a "quite strong" 2nd half for stocks.

"I think that- that the upside risk is much greater now than the downside risk," Lee said.

"I'm in the camp that stocks have bottomed," he added.

Judge then asked Malcolm Ethridge whether this is "gloom and doom" or not.

"I think my main concern here is that the Fed starts to share the same sentiments as permabulls like Tom and eases off of the, the gas pedal a little bit," Ethridge said.

Lee, though, contended that the market is operating under a "very central narrative" that a "hard landing" is ahead and inflation is "sticky," but June data suggests it's not that "sticky."

In fact, "I think the bubble is in hyper-inflation fears," Lee said.

"I don't know what numbers Tom is looking at," Ethridge shrugged.

That's OK, Tom. #They'rejustjealous #You'vebeenright #Notnecessarilyrightnow,butbeenright

Ethridge used the term "gouging," in terms of, increasing the housing supply so landlords will "stop gouging people on rent."

On a virtually news-less Halftime Report ("virtually" is being kind), Rob Sechan actually claimed the day's data indicated a "Goldilocks environment," though he cautioned, "a lot of that's really sensitive to gas prices."

Sechan thinks we're "still in a downtrend" but that this is a rally to sell into.

‘You make this case repeatedly, and it literally is repeatedly-’

In case you missed it, as this page did, Judge (who's supposed to be an effective communicator) posted a quirky tweet related to Jim Lebenthal this week that Jim didn't quite get.

On Thursday's (7/14) Halftime Report, Judge clarified.

Jim had insisted, "I've never seen a recession where the job market is this strong."

Discussing CSCO, Jim said ... again ... that "this decade is just getting started with supply chain onshoring."

"You make this case repeatedly, and it literally is repeatedly-" Judge sighed.

"Because it keeps coming out," Jim said.

"-Of this onshoring phenomenon that is gonna have some dramatic impact on the near-term of, of the stock market," Judge continued.

Then Judge told Jim that there's no ground broken yet on Intel's Ohio plant, "so we're not meetin' there this Saturday morning."

"That's what your tweet meant. I didn't know what your tweet meant," Jim said.

"That's what it meant," Judge said, as if he was actually going to meet anyone, anywhere for a breakfast meal on Saturday.

Exasperated, Judge wondered if there's "ANY thing" out there that Jim feels negative about.

"I've been punched in the face every day this year," Jim insisted.

Does anyone on CNBC ever compliment strategists?

What made us chuckle more than anything on Thursday's (7/14) Halftime Report was the realization, and you know this HAS to be true, that Savita Subramanian was quietly watching the episode somewhere, eye rolling and frowns evident.

Judge announced at the top of the show that Savita has cut her target to 3,600 from 4,500. Josh Brown shrugged that Savita is just "mirroring reality" and "playing catch-up."

Then things detoured from Savita into an old rivalry as Steve Weiss said there are "2 ways to look at this market," one of them being "as the way you want things to be" with a "rosy, bullish picture," which sounded like a possible reference to Jim Lebenthal.

Judge said, "Jim just slumped back in his chair. He literally just slumped back in his chair as you said that."

"He can slump all he wants," Weiss said.

"The only reason I did that is because we're all saying the same thing," Jim said.

"Jim, Jim, I'm talking ... we're actually not," Weiss claimed.

"No, we're saying the same thing we've said all year," Jim insisted.

Drawing a curious parallel, Weiss asserted that "this is one of the easiest markets to analyze that we've seen since I've been in the business. '08 was another one."

"The Fed is just starting," Weiss explained, adding Savita is "too high" and offering, in contrast to Josh Brown, that Savita is "somewhat emotionally involved" in her S&P target.

‘For the most part, they’re not right’

When Jim Lebenthal's onshoring wasn't the topic of discussion on Thursday's (7/14) Halftime, Jenny Harrington was giving a 4-point speech (we can't handle more than 3) in which she talked about how you can "channel your inner Warren Buffett" (snicker).

Jenny said that when she was an intern in 1986, her shop analyzed 20 years worth (snicker) of predictions of the "top 120 (snicker) strategists and technicians" and found, with the rare exception such as Elaine Garzarelli in 1987, "for the most part, they're not right."

Judge said we got the "Bostic bombshell" (snicker) on Wednesday.

Judge simply won’t ask whether the stock market fears inflation or a recession

From doughnut stops in Maine at 3 p.m. to Gatorade shelves at grocery stores, everyone on the Halftime Report has become an economic sleuth this year. (Wouldn't it be a better use of their time analyzing companies rather than attempting macro calls that the whole world is also making?)

Joe Terranova on Wednesday's (7/13) Halftime Report offered, "I think people are dismissing that rate hikes might not work. They are working."

Judge, of course, didn't bother to ask Joe what "working" means.

If Joe means "working" in that gasoline prices have fallen over the last few weeks, fine.

When did 1 of the 3 Fed mandates become LOW GAS PRICES!!!!!!!!?

What really matters is 1) whether gasoline is still the same proportion of people's spending that it was 3 months ago, and 2) whether any price cut is seasonal or permanent.

For those who haven't been awake the last 6 months, Judge said Tom Lee thinks this will be the last "extra ugly" CPI print. (And if it's not, then we're sure the next one will be.) (And what's better — inflation surges 9% and stays there for 5 years, or inflation climbs 2% for 5 straight years?)

For all of the time Judge spends complaining about Jim Lebenthal's basically-bullish thesis, he never asks whether inflation is a giant effect mistaken as a cause, a common bungle on Wall Street.

Doesn’t matter what CPI says; it’s always peak inflation is behind us

Mike Farr, on the other hand, in some of the day's best commentary on Wednesday's (7/13) Halftime Report, said he doesn't know why people are so "desperate" to say inflation is "peaking," which he likened to saying "the forest fire is slowing down a little bit."

Steve Liesman said Farr has it right, "it's the uncertainty that really matters."

Liesman said that what Wednesday's number means is that a Fed that wants to see 3 straight months of improving inflation has to "restart counting."

Steve told Judge he doesn't know what the Fed gains by an inter-meeting move in August.

Bryn Talkington said she knew what CPI would be because "the past 3 days," the White House press secretary "as well as Biden" have been "telling us that this inflation number was gonna be really hot."

Judge asked star guest Jeremy Siegel what the Fed should do know. Siegel said Jay Powell needs to be "forward-looking." Siegel added, "I think most of our inflation is behind us," then he said the Fed will have to "turn around" after 75 points because "the economy is really slowing."

Judge asked Jim Lebenthal about DAL. Jim said "there's no crack in consumer demand" and that international and business travel is up. Jim said it's a good stock to own if demand "hangs in there." Judge said margins were below recent guidance and questioned how there will be a "giant reprieve" from jet fuel prices. Jim pointed to oil's recent slide.

"I have too much agriculture exposure. It's not working," Joe Terranova admitted.

Judge said Mike Mayo only has "highly tempered" enthusiasm about bank earnings.

Judge doesn’t agree with Jim (so obviously, Jim’s wrong)

At the top of Monday's (7/11) Halftime Report, Liz Young was classifying how the immediate stock market will go down in history.

"This week we're back to the rate story," Liz declared.

Judge said with a straight face that "it's hard to overstate what's at stake."

Things got a little grim when Judge turned to Joe Terranova, who opined, "I still think there is a clear economic contraction that's unfolding right now."

That wasn't going to sway Jim "Onshoring" Lebenthal, who sees positive trends as well as basically no job losses in the economy.

Jim said that looking into 2023, he thinks earnings estimates "should stay intact because of supply chain onshoring and infrastructure spending."

He thinks the "malaise" will stop when "the Fed pivots," probably a couple months away, according to Jim.

"I have a problem with that view," Judge said, explaining that Jim and Joe Terranova's views are "diametrically opposed." And that "the data suggests that Joe is correct in that view" of a slowdown underway.

"I just don't get it," Judge added, describing Jim's view as the Fed pivoting, and "All of a sudden, the economy's just gonna roar ahead." Judge said if the Fed pivots at all, "it's because the economy has forced their hand by being too weak."

"I'm reporting the facts here, OK," Jim said, pointing to supply chain onshoring.

"No. ... I don't buy this argument," Judge asserted.

Jim insisted "there isn't a hint of a crack" in the labor report.

But Judge said Jan Hatzius says the labor market is "sputtering."

Could do the same panel in October; Jim, Brian Belski and Tom Lee will be bullish, Weiss will be bearish, Joe will predict a U ...

On Monday's (7/11) Halftime Report, Joe Terranova said that if you're a "cyclical investor," the Fed isn't your friend, because it doesn't want the "Roaring '20s" to happen.

Judge said the Fed would've wanted the Roaring '20s to happen if not for inflation.

Joe said it's clear to him that the Fed will try to step on any "accelerating demand."

Jim Lebenthal got back into the debate, saying (as he has throughout spring and summer) that folks getting laid off by Peloton have "jobs for them to go to."

Joe said Jim is looking for a "pause" rather than a "pivot" by the Fed.

Steve Weiss said he appreciates Jim's rose-colored glasses, which Weiss said Jim never seems "to take off."

The two interrupted each other a couple times. "Are you getting paid by the word?" Jim asked Weiss. Jim said the thing we should be "terrified" of is people losing jobs, and that's not happening.

Judge insisted there's one case (the Joe case) that is "facts," and then there's "a large part" of Jim's case that is quite frankly "fantasy."

Joe insisted we're in the "Classic U-recovery" (it's "classic" though it hasn't been seen for "decades").

Brian Belski admitted, "oh by the way" to no one's surprise, "We're bullish." (He also claims this is a "generational opportunity" to buy stocks.)

‘Transitory’ is back — inflation cured in 3 weeks (partly because, apparently, no one’s interested in eating anymore)

Tom Lee, who like everyone on the Halftime Report hasn't skipped a beat in 2022 (see below), insisted Friday (7/8) that the 2nd half is "shaping up" to be strong, because of "a lot of catalysts in place."

"The real massacre happened on June 10th," Lee explained, but commodities and real estate have "rolled hard" since then.

Judge asked how Lee can be sure the drop in energy is "sustainable." Lee gave a lengthy response about the "bullwhip effect" (Zzzzzzz) and, more importantly, how price hikes spurred by the Ukraine war seem to be reversing and how things people thought were "sticky" are more (uh oh) "transitory."

Judge kept asking Lee if he agrees with fellow FundStratter Mark Newton that there's one more leg down before the S&P recovers for good. Lee waffled like Legg'o my Egg'o and didn't take a position. Lee said he'd both be "buying tech here" and also "buying the low" (whatever that is).

No question, Lee has been a king of the since-2008 bull market, and this page will be giving him the benefit of the doubt for a long time to come.

And we hope his bullish forecast is correct.

But some of his opinions in 2022 sound as much like wishful thinking as in-depth analysis.

Lee said gas could go to February 2020 levels and actually claimed with a straight face that there's "piles" of protein food sitting around, so food prices could be coming down, then there's "more money in people's pockets."

Evidently, Voyager Digital has tentacles within the Halftime Report

As he did a day earlier with Jon Najarian (see below), Judge on Friday's (7/8) Halftime Report took up Voyager Digital with Tom Lee, stating Voyager made a $6 million investment in Lee's FundStrat to "be FundStrat's exclusive U.S. partner."

Judge asked Lee to "expand" on the details. Lee said Voyager has been a "good business partner for us" and made a "minority sub- sub-well under sub- 10% investment in our company." (But that had to be clarified moments later.)

"It's had no effect on our business ... just unfortunate what's happened," Lee said.

Judge asked if the value of the investment was written down to zero. Lee said the investment "wasn't into FundStrat, it was made to the existing other equity holders." (Somehow, that added up to a "sub- 10% investment in our company.")

We gotta credit Judge here. About all we knew about this Voyager entity is that it's possibly having some dispute or clarification issues with its bank. Judge's revelations should indicate, to anyone who thinks Halftime Report panelists are making 100% (or, frankly, any %) of their income on day-to-day stock market calls, well ...

In July 2015, panelists were concerned about the Fed ‘normalizing’ (snicker) rates with a September hike

One of the curious things about CNBC's Halftime Report is that each panelist in July is basically striking the same tone — positive or negative — that he or she was articulating in February.

Jim Lebenthal on Friday's (7/8) show insisted that good news is good news for the economy/stock market, though he said the Fed will have to "back off" to make this more than a bear-market rally.

"All rallies are suspect," Jim cautioned, before adding, "There is reason to believe that inflation has peaked. Period."

Honestly, that's fine ... but we do recall hearing that from any number of voices probably back in February, March, April ...

Kevin O'Leary asserted that the "narrative toward softer landing" is more "prominent" than 3 weeks ago.

O'Leary said he's not seeing any signs of recession; he thinks supply chain issues are getting just "a little better," based on Gatorade shelf emptiness.

That's interesting, because a few weeks ago, Jeremy Siegel declared we're probably already in recession. (So whether we are or not basically depends on the last 3 hours of tape.)

O'Leary said it seems to him that the $6 trillion printed over 30 months is "still sloshing around the economy."

Jim Lebenthal again returned to his curious theme of "supply chain onshoring" and all the factories now being built in the U.S. Steve Liesman, who doesn't host programs on CNBC but just marked 7 years since his masterful performance as backstage emcee of the Grateful Dead's Fare Thee Well concerts on pay per view (picture above is from a Halftime Report hit ahead of that concert weekend) (and in fact, this site is going to start clamoring for Steve to do such works for other bands' special performances), effectively dismissed that notion of deglobalization a couple weeks ago (see below).

Kevin O'Leary said ARK has a had a "phenomenal week."

If you’re wondering what the hell is this garbage about crypto referrals, you’re not alone

While we'd been hoping Judge might make it back from vacation to the helm of the Halftime Report before the next recession (that's correct, the next recession, not the apparent current one), his tepid return Thursday (7/7) kicked into overdrive during a late-in-the-show exchange about Voyager Digital.

Judge said Market Rebellion (that's the Najarians' company that has to be announced at the beginning of every program) was an investor in Voyager Digital; "we need to discuss this," he told Jon Najarian.

Doc said Steve Ehrlich was wrong to call Doc a "partner" in a YouTube video; Doc said he was just a "shareholder."

Judge asked Doc if Market Rebellion was paid fees for referrals by Voyager. Doc said, "I can't comment on that right now." (Not exactly a denial.)

Doc reiterated he's "never been a partner" of Voyager Digital, but, "I still own a fairly substantial piece of this company."

Quite frankly, Judge's persistence on this subject was one of his strongest moments of 2022. (No, we're not calling for Doc to get grilled; rather, we've heard a lot of garbage about the crypto industry for nearly a decade on CNBC programs, and viewers need to hear the bad and the ugly as well as the good.)

Doc referred to Sam Bankman-Fried as "probably the biggest guy in crypto." What about the Winklevi?

Doc said he liked bitcoin at 18,000 and ethereum at 1,000.

If there's no V-shaped recovery, why rush to buy anything?

Jenny Harrington on Thursday's (7/7) Halftime Report suggested the stock market is "at peace" (snicker) with the Fed.

To explain what that means, Jenny stated, "I'm 47 years old, I can't eat a pint of ice cream every day without a problem like I used to, I'm not content with that, but I'm at peace with that."

That's a curious analogy.

Jenny said "at peace" about 7 times.

Jenny predicted this won't be like "past bear markets" in that there won't be a V-shaped return, rather we'll "bounce along the bottom."

Judge said earnings forecasts remain "stubbornly high" and cited Oppenheimer's S&P target of 4,800 (down from 5,330).

Josh Brown said finishing the year at 4,800 would be a "major, major victory for the bulls."

Brown said that companies lowering guidance generally "has not happened yet," which is why the estimates are still as high as they are.

Brown said the rally seems to be based on "peak inflation" being in the past.

While it was unclear whether he's "at peace" with what's going on, Jon Najarian said he didn't want to unleash the "bunting" for this week's rally.

"It's more or less hopium," Doc said.

Grandpa Steve Weiss said he actually bought QQQ "today and this week" even though he calls the market "treacherous" because, in part, "QT really hasn't gotten going yet."

Weiss predicted the 10-year yield "continues to rise."

Judge asked Jenny Harrington about earnings estimates and whether 230 is possible. Jenny suggested it's possible that a rotation of stocks could keep that number afloat, but Josh Brown kept interrupting.

Weiss said he had dinner last week with Lee Cooperman (and suggested Judge might not've been invited) and said that Lee's earnings number is $195.

How many times did we hear baby thrown out with the bathwater on this episode?

Things got a bit combative on Thursday's (7/7) Halftime Report when Judge asked panelists to opine on semiconductor stocks.

Steve Weiss said companies have "excess inventory" of chips but won't admit it. Weiss said NVDA is still "ridiculously expensive." Josh Brown said all the semi companies are moving in "lockstep."

Jenny Harrington insisted AMAT is one of the "great companies" in the semi space, one of those unlike NVDA that has a "fair valuation." Brown shrugged that it's the "same chart" as others. Jenny said you have to "parse out" all the babies thrown out with the bathwater. Then Steve Weiss jumped in and said Jenny is picking a "moment in time."

Jenny claimed "all you guys" were "all psyched" about buying "frothy" semi stocks early in the year. Weiss insisted it's "not true."

Jenny said "seriously," they had arguments on QRVO and NVDA. "This is when you DO buy things," Jenny said.

Weiss said that's fine for someone who always has to be invested; he doesn't need to make up "excuses" for putting on positions.

Judge asked Weiss about being long a couple banks while short the XLF. "I don't wanna pay taxes," Weiss claimed, a notion that this page has pointed out doesn't really make any sense when it comes to trading decisions.

Josh Brown: White House in ‘fantasyland’ on energy; leadership ‘embarrassing’

Viewers who stuck around past the A Block of Tuesday's (7/5) Judge-less Halftime Report got their money's worth from Josh Brown's assessment of the energy situation:

"Almost everything Biden and his economic advisors have to say about the energy sector, the energy problem, how to fix it, uh, is, is embarrassing," Brown stated. "Uh, there's really no leadership from the White House on this issue. They live in a fantasyland where you can go on Twitter and yell at gas station owners to lower the price, not understanding that gas station owners barely make money, which is why they sell gum and tobacco ... opening up the Strategic Petroleum Reserve was laughable."

Joe Terranova, who was obsessed for some reason with whether the Nasdaq Composite Index finished the day in the green, said if the Biden administration wants to help Americans, it should suspend tariffs, that's the "low-hanging fruit."

Bryn Talkington said energy and some high-growth companies can "both succeed." She said she'd wait a couple weeks to buy energy because she thinks there could be downside activity from the "rhetoric" of Joe Biden's upcoming Saudi visit.

‘The fake trend is ARK stocks going up’

Jon Najarian on Tuesday's (7/5) Halftime Report said Europe appears to be in recession, and it's "likely" there's one in the U.S. also.

Doc actually said we could have "textbooks" (snicker) (Zzzzzzzz) written about the Fed's and government's appproach to inflation in the 2020s.

Doc said consumer spending has cut back "dramatically" in some areas.

Joe Terranova made the case (again) (Zzzzzzzz) for "time" being the enemy more than price. (Then why do we need a daily TV program of this material?)

Josh Brown mentioned a defense-industry ETF and said "we're in a world of war, maybe permanent war," with individual NATO countries "arming up."

Bryn Talkington said ZM and RBLX have been making "higher lows."

Brown said he's adding to energy positions because that's the winner beyond the near term. "The fake trend — no offense to anyone — is ARK stocks going up. That's countertrend ... that has no legs," Brown said.

Steve Liesman, who 7 years ago this past weekend was backstage pay-per-view emcee of the Grateful Dead's Fare Thee Well concerts and frankly did a sensational job, said it sounded to him like all the panelists had "burnt hamburgers at the beach."

Whatever happened to

the ‘Roarin’ 20s’?

Friday's (7/1) Halftime Report featured an interesting contrast of 2nd-half outlooks.

Jenny Harrington, often a chatterbox, said, "I don't think we're going to have nearly as bad a 2nd half as we had a 1st half. ... The bottom line is that you're buying way more cheaply today than you were in January."

Jim Lebenthal also said he's optimistic for the 2nd half. He said there has to be a "rationale" for that, and he said inflation has "peaked."

Jim also cited "supply chain onshoring" over years to come as "too powerful a force" to ignore.

Jim asserted, "This is not where we were 15 years ago."

On the other hand, Pete Najarian said he's seeing "a lot" of call-buying in the VIX.

And while Jenny made a bull case for oil, Rob Sechan said he agrees but thinks the trade should be kept on a "short leash."

In a halfhearted endorsement, Sechan said you can own banks "surgically" without owning the "entire sector."

Jenny Harrington, mentioning Mike Mayo, said even the people who spend "100% of their days" researching a handful of banks "got it wrong" in 2009.

Jenny also said we've "lost sight of" how, in the past couple years, "we turned all these chip companies into stories," when they're all "cyclical commodities."

‘Probably at least a year’ until people stop complaining about gas prices

Jon Najarian on Thursday's (6/30) Halftime Report said he's "primarily" looking at the 10-year.

Doc said people don't think the Fed has the "gumption" to keep driving rates higher. (Well, "gumption" is one term for it ... swatting flies with a baseball bat is another.)

Doc said controlling inflation will take "probably at least a year." He's looking for a "soft recession."

Maybe he was joking, but Frank Holland indicated he hadn't heard of the famous options trader 50 Cent.

If you’ve got a long-term perspective, 1980 is a great time to buy (just be careful in October ’87)

For those looking for indicators ...

Josh Brown on Thursday's (6/30) Halftime Report said there have been 3 times (talk about a huge sample size) where both stocks and bonds have 2 consecutive negative quarters. Those were 1980, 1981 and 2008.

Brown said, "unfortunately, in all 3 of those moments," bonds outperformed stocks in the following quarter.

He cited RH as a sign that consumers might be in trouble. (Steve Weiss prefers the TGT double downer.)

Brown said it's "really fascinating" that a lot of "libertarian voices" in the crypto market are now "screaming" for some kind of regulatory oversight.

Perhaps people can ‘nibble’ on more than just those $3 doughnuts in Maine at 3 p.m.

On Thursday's (6/30) Halftime, Jon Najarian bought bitcoin and ethereum and predicted those are "the two that survive." (What about those crypto coins that were invented on episodes of Fast Money?) He said he got out of crypto equities.

Bryn Talkington said there's been "so much carnage" in the crypto world. She mentioned "3 analogs" hitting the space that curiously included "Bernie Madoff sprinkled in there."

Bryn said there's a "high" probability that tech multiples have to come down.

Bryn said she bought LEN, believing something would have to "fall off a cliff" for the numbers not to come in.

She also bought GM, "worth a position ... at these prices." But Jon Najarian said he sold his GM calls. Doc said GM and F aren't selling EV pickups at $39,000; the actual prices are typically "optioned" at $70,000-$100,000, so they're selling a "much more expensive vehicle."

Josh Brown said he "fortunately" sold GM. He doesn't hate it in the low 30s, and he said there's not much risk buying with a 2 handle.

Jason Snipe said you can "start to look at growth areas" and "nibble." He also mentioned the term "dollar cost average," which always means we think we're probably going down in the short term.

In what must be hyperbole, Josh Brown said TSM "structurally is the most important corporation on the planet."

Doc said he bought CLF, apparently because someone was buying the calls.

When stocks go up, it’s the free market; when they go down, it’s the Fed’s fault (cont’d)

On Wednesday's (6/29) Halftime Report, guest-hosted by Melissa Lee, Joe Terranova was identifying every problem under the Tuscan sun.

Joe said what he's most negative about is not "price," but "time," stating we've been "conditioned" for a long time to expect V-shaped recoveries. This time, "It's a U. It's not coming back quickly."

(But actually, if he's so concerned about markets not going up fast enough, won't people quickly start unloading when they believe the same thing, and then don't we get a V anyway?)

Later, Mel asked Joe if it's time to buy Big Tech. Joe said if you don't own those names already, "what else are you waiting for," but right now, they may be a way of "losing less."

Joe also said all of our market/econ problems are "self-inflicted" because "these are all policy mistakes" (Ah, that one again). (Which policy told people "ABSOLUTELY DO NOT BE A PILOT/LIFEGUARD/TRUCKER/NURSE/IRS WORKER/SEMICONDUCTOR FACTORY STAFFER/RESTAURANT EMPLOYEE"?)

He added that "there's such a divisive nature in the country."

Finally, Joe said he wouldn't buy a cruise stock with a $9 billion market cap and $30 billion in debt, saying they'll "obviously" have to sell shares.

Liz Young said you can "enter" Big Tech trades now, but don't have "high expectations" for a while.

TGT’s outlook, vs. the line at the Maine $3 doughnut shop at 3 p.m.

Near the top of Wednesday's (6/29) Halftime Report, Steve Weiss said the "best use of my time" now is to "stage an intervention" to his bullish friends who are "addicted" to buying the dip.

This time, Weiss didn't have Jenny Harrington around to argue with, but Weiss still insisted, "The consumer is under siege."

He said TGT's twice-lowering of outlook in a short time shows the "velocity" of the decline we're in.

Actually, we doubt very many people are buying the dip since May. In February and March, yes, absolutely.

Liz Young opened the show saying the market can't sustain a rally and that the idea that a possible recession is enough to end inflation is a "very unanswered question."

Pete Najarian evidently feels the same way. "I've been buying puts all around the world," said Pete, who questioned the strength of consumers.

For those seeking a bright spot, Pete did say they "finally have stopped" buying bearish options paper in China.

Though he bought GS at 312, Pete gushed about making all these "premiums" by selling calls.

Liz said the way it works is the market "usually bottoms first," then earnings bottom, then the economy bottoms.

Phil LeBeau said he's "not sure" (translation: "doubts") we'll see any action from the FAA and Department of Transportation to punish airlines for cancellations, as Sen. Bernie Sanders is demanding. LeBeau also said an air traffic controller shortage is also affecting flight schedules. He said he's not sure Sanders' letter will gain "traction."

Steve Weiss questioned why Bernie Sanders is focused on this topic with everything else going on. "There's nothin' there," Weiss concluded.

Weiss' Final Trade was BITI, a crypto short.

Maine doughnuts at 3 p.m. ...

"I think we've been in a bottoming process," said Jenny Harrington on Monday's (6/27) Halftime Report, asserting the consumer is "not in as bad shape as people think."

Moments later, Steve Weiss said he's trying to figure out "the veracity of Jenny's statement" that the "consumer is still strong" (not Jenny's exact term).

Weiss said consumer confidence is at 40- or 50-year lows, and "I don't know how they can be strong," given that 15% of all renters are late on rent.

"The consumer's not strong. That's a pure myth," Weiss concluded, stressing the Fed being in tightening mode.

Later, Jenny got a chance to correct Weiss but was a little too kind. "I am not bullish on the consumer. I am bullish on the consumer relative to where expectations are," Jenny explained.

Jenny suggested we'll find the consumer is "OK."

At one point, Jenny said she was at a doughnut shop in Maine that had a "line out the door" for $3 doughnuts at "3 o'clock" (in the afternoon). "People are still spending," Jenny insisted. (Yes, but at most doughnut shops, there aren't enough employees to keep the shop open at 3 p.m., that's the problem that Jerome Powell and Lael Brainard are throwing rate hikes at.)

Weiss thought Jenny meant 3 a.m. rather than 3 p.m., at least the 2nd time he misquoted or misunderstood her commentary.

Um, not going to overshoot

Steve Weiss on Monday's (6/27) Halftime Report reiterated his market pessimism, pointing out the cycle that the Federal Reserve finds itself in.

Guest host Frank Holland said he wanted to "push back" on liquidity, given Friday's market volume. Weiss said they're talking about "2 different types of liquidity" and that the Fed is pulling back on the "liquidity that greases the economy."

Weiss said Friday's liquidity is "meaningless" in terms of "the overall scheme."

Holland told Weiss that Tom Lee thinks inflation is "a bit overhyped." Weiss wondered where the "news flash" is on Lee being bullish and "trying to find something supportive."

Weiss insisted that while inflation may dip, the Fed will still "overshoot."

Market’s had a few good days; no mention of dollar-cost averaging

Joe Terranova on Monday's (6/27) Halftime Report was invoking famous years.

Joe said we've had "extreme pessimism," something like "September or October of 2008."

Joe believes this is a "John Mayer Market" (snicker) in which "we're waiting on the world to change."

Joe said he "didn't get very much right" at the beginning of the year, but he got health care right.

Jon Najarian said we may be within 10% of a bottom, but he doesn't expect much market move until the next CPI number, and if that number is not huge, we might "keep climbing this wall of worry."

Jenny Harrington said of COIN, "They're probably earning about a third of what they were."

Doc said COIN is a "real problem right now."

Doc touted XPO and credited Steve Weiss for liking the name.

Amy Raskin dialed in to say she trimmed NKE based on China lockdowns. Doc said "they're buying" 100, 95 and 90 puts in NKE. Jenny said she thinks there's already "extreme pessimism" in NKE's price.

It was only 10 minutes, but Frank Holland put together a great little show

The first 50 minutes of Friday's (6/24) Halftime Report was preempted by Supreme Court coverage, during which, the stock market was quite on fire.

Is it on fire to such an extent that the bottom is in?

Jim Lebenthal, whose last name was pronounced "Leebenthal" by guest host Frank Holland, said "it can't be answered right now" whether this is a bull-market rally or bear-market rally.

"We've gotta wait until the June CPI comes out in 2 and a half weeks," Jim said. This page agrees.

Steve Weiss, though, said, "I think that this is a bear-market rally." He said the market's in a "news void" in which no negative information is surfacing.

Weiss predicted the Fed would "overshoot" on rate increases. Jon Najarian disagreed (as does this page) and pointed out that the 10-year has gone from 3.48% a week ago to 3.04% on Friday morning. He said someone or other is thinking the Fed is "done" by September.

Amy Raskin said, "We're due for a rally and we're getting it."

Degas Wright said he sees "recession looming" and that this is just a "relief rally."

Doc predicted a "sideways market," not a 7% rally next week.

Weiss said to "ignore" people calling for buy the dip.

NFLX an affordable luxury

It's been a slightly preempted week on the Halftime Report because of Fed testimony (even though Wednesday's show wasn't really preempted) ... and let's face it, Judge isn't in the house this week to ask Jim Lebenthal about that 4,900 S&P target ... so it hasn't been a humdinger of commentary.

On Thursday (6/23), guest hosted by Frank Holland when at least half the show was wiped out by Jay Powell testimony, Josh Brown said the inflation "scare" might be "overplayed" regarding NFLX. Brown suggested NFLX and SBUX are 2 "affordable luxuries" that people won't give up amid inflation.

Pete Najarian said he was scratching his head over the big buying in XLE October 52 puts.

Wednesday, guest host Missy Lee asked Joe Terranova about GNRC. Joe said he's holding on to this "awful purchase," explaining that sometimes you make a bad trade; "like the banana that's sitting out on the counter for the last 6 weeks."

Bryn Talkington said, "I would never, never count out Mark Zuckerberg."

Waiting for the whoosh

On Tuesday's (6/21) Halftime Report, guest host Melissa Lee said people have been making the point that we haven't seen the "whoosh" to the downside. (Actually we've seen a bunch of them ... but, whatever.)

Jon Najarian said his analyst still predicts "lower lows." Doc said we're still not seeing the volume on up days. He noted that he correctly called the reversal after the Fed-day rally.

Joe Terranova said that 6-9 months from now, today's market should look like a bargain, but the next several weeks depend on the White House decision on tariffs.

"I've been talking about this for months," Joe affirmed (but we wonder why it's necessary to say that). (Regular viewers already know he's been talking about it ... other viewers, why would they care?)

Mike Santoli (who was probably on this show because he subbed for Judge on Overtime later) pointed out that a "cloudy" earnings outlook is not a "clinching" argument for continued bearishness, however that helps people.

Josh Brown bought ZM, noting it's about a year and a half since its peak, and he thinks May's bottom could be a "tradeable low." He said he's got a stop "just below 100." Brown said a lot of "ARK-type names" made lows in May, not in the past week.

Joe said he's not long ZM but that it's a candidate for JOET. He said it's one you want to own, if it can demonstrate a "more diversified type of strategy" (snicker) (don't hold your breath) (#bidforTwitter?).

Doc pointed out the heavy put-buying in XLE that started June 6. He's looking for a "bounce back" in that sector and predicted "130 in a month" in crude oil.

Stephanie Link bought NKE, "quality on sale." Joe Terranova said he thinks the shares reflect a lot of bad news already. Link also bought SBUX.

Guest Courtney Garcia said it's possible the economy can get through the next couple of months without recession.

Jon Najarian owns CZR and LVS calls and said people are flooding to Vegas.

Answer: When CPI reports have a 5 handle or less, for more than 1 month

Judge on Friday's (6/17) Halftime Report asked Jason Snipe, "How are the viewers gonna know when it's the time to buy."

Snipe correctly said it has "a lot to do with CPI."

But then again, Snipe recommended dollar-cost-averaging (Translation: He thinks the market's heading lower for months) starting now.

The ‘run of the mill bear market pullback’

On Friday's (6/17) Halftime Report, Judge said Michael Hartnett wants to "gorge" on stocks at 3,000.

But Jenny Harrington said it's "highly unlikely" we get to 3,000. "You should be putting money to work today," Jenny advised, warning to be "very, very careful" in not waiting for 3,000, which she said might well not happen and if it did, it would be like March 2020.

(Be "very, very careful" in NOT buying stocks? That's a new one in 2022.)

Jenny crowed about how we're guaranteed closer to a bottom now than in January or February and how this market "makes sense" to her and how the market that didn't make sense to her was the one in which PTON traded to "178." (Actually, it appears it never got that high.)

Jenny actually said with a straight face that this feels like a "run of the mill bear market pullback."

"I'm still concerned," said Degas Wright, who sees a recession "on the horizon."

Pete Najarian said he's more "cautious" than "negative" and, as he always does, opined far more on what's happening in put-buying land than in what's happening with his own gut feeling.

Pete got to the point, albeit much later in the show, in pointing out the price of oil is "by far the biggest component of what we're looking at here," affecting things in a "monstrous way."

Grasping for some kind of pushback/counterweight to this ghastly market, Judge said Ron Baron is talking about a "HUGE" buying opportunity.

Judge also referenced FundStrat's Mark Newton (who was on Overtime, see below) for the usual opinion that we're "nearing a bottoming process."

Judge said the market feels like it's pricing in a "steep recession."

Judge brought in Brian Belski for another go-round on the 4,800 target (that's basically Jim Lebenthal's target too). Belski insisted earnings won't crash and even twice tossed in an "oh by the way."

Belski insisted on a "surprise in the 2nd half that no one's positioned for."

If ‘bounce around’ is as bad as it gets for ‘a while,’ we'll be lucky

On Overtime, Jim Lebenthal predicted we "kind of bounce around here for a while."

Jim also repeated one of his recent refrains, that for anyone who gets laid off, there are "plenty of job openings."

Judge told Jim that earnings expectations "defy logic." Jim said that if you hold for 1-3 years, you can make "fabulous" stock purchases today (though he's "discouraging" people from buying the "Cathie Wood stocks").

Jim advised people to "dollar-cost-average your way in." (Translation: Market's probably going down in short term.)

Mark Newton said he sees "great risk/reward," given how far some stocks have sold off, though he thinks we could see 3,500 or 3,600 in the "next couple weeks."

Jay Powell, Cathie Wood

should’ve retired last year

On Thursday's (6/16) Halftime Report, Jon Najarian pronounced as "ludicrous" the theory from Scott Minerd about crypto-as-canary and stocks not bottoming until crypto does.

Najarian said the crypto market is worth about $1 trillion; he said Minerd's theory is as ludicrous as when Minerd called for $250,000 bitcoin (we didn't know about or recall that one).

"We don't need to relitigate Scott Minerd's career in calls," Judge stated.

"Some people put out these kinds of statements Scott to get headlines," Doc said, before using the term "ludicrous" for about the 5th time (seriously) and offering to sell Judge the Brooklyn Bridge.

Judge protested that maybe Minerd's referring to market sentiment and "risk factor." Josh Brown had to cut in to say that's correct, but only as to how it relates to M2 money supply.

Last September, ‘HE SAID ONE RATE HIKE IN 2022!!!!!!!!!!!’

On Thursday's (6/16) Halftime Report, Jon Najarian mentioned the upcoming 3-day weekend and how that might affect selling (in a bad way) through the end of this week.

Josh Brown, who (as is often the case) had to opine not on a couple select angles of the stock market but every business-media story that's been circulating this week (OK, he didn't say anything about Revlon), stressed, "It already feels like a recession," and that discussing that word is just "semantics." (Well, yes. That's how it works. Some bureau of economists gets custody of that word.)

(Jeremy Siegel on Overtime said we are indeed in a "recession," though it's not "official" now.)

Brown predicted a "bust" in durables and said the idea of a soft landing is "laughable."

"We've not seen the worst yet," Brown asserted.

Shannon Saccocia said we're "absolutely in a no-man's land."

Amazing the kinds of theories we’re hearing because of one CPI number

Jim Lebenthal on Wednesday's (6/15) Halftime Report opened a hornet's nest of skepticism with his suggestion that we're entering a new paradigm of globalization.

"There's a long-term aftereffect of the pandemic, which is really powerful, and it's supply chains moving out of China, moving out of Russia, moving out of hostile countries, back here to the U.S. and to the greater North American region," Jim contended. "Building middle class incomes again that- Ross Perot in the '90s came up with the idea of a great sucking sound of jobs going overseas. They're comin' back, all right, and that's a positive thing to look forward to."

"No it's not. No it's not," said Steve Liesman, listening remotely, saying "the idea of deglobalization is bad for the stock market and bad for the economy-"

"That's not what I'm saying," said Jim, correctly. (Note: Liesman appeared to be saying what he literally said, deglobalization is bad, but by saying "the idea of," it apparently made Jim (and viewers) think Liesman was suggesting that was Jim's point.)

"We have 1.7 billion Chinese workers working for us, and now we want to cut that off. And we don't have enough workers to do half of the things Jim wants to do," Liesman stated. "God bless his ideas on it. We don't have the workers here; we don't have immigration. And if we deglobalize, and that means lower multiples on the stock market, from deglobalization. Thank you."

Jim suggested if we're "worried" about layoffs at Peloton, "let's keep them employed." (It's interesting all the central planning going on this year in CNBC punditry, people trying to direct rates and workers to where these people want them to be.)

Judge, practically in disbelief, said, "You speak about it Jim as if this is happening in 10 minutes."

Jim said that's not what he intended to say; "This is 2023 and beyond."

"That's not gonna happen in 2023. You're not onshoring everything in 2023," Judge said.

"You absolutely are doing it right now. Are you paying attention to what Intel is saying?" Jim responded.

"So the economy is gonna be completely transformed in the next 6 months, ladies and gentlemen," Judge declared.

"That is not what I'm saying, and you know that," Jim said.

"He didn't say that," Doc chimed in.

Why did the 75 basis points have to be reported in a WSJ article on Monday? Why not just announce it Wednesday?

Judge was shooting down more than just Jim Lebenthal's theories on Wednesday's (6/15) Halftime Report.

Joe Terranova said he was expecting a "pivot" from Jerome Powell; "we need to hear from the chairman that the Fed is willing to do an inter-meeting rate hike."

"They're not gonna tell you that," Judge scoffed.

"They have to. They have to," Joe insisted.

Steve Liesman said the answer to the question of high how the Fed must go is "meeting to meeting."

Judge called the Fed meeting "incredibly consequential."

Judge and Jeffrey Gundlach on Overtime (see below) talked about the WSJ 75-basis-point story that surfaced in afterhours Monday. Neither Judge nor Jeffrey addressed a curious issue — why this information had to be disseminated unofficially Monday after-hours rather than in the Wednesday Fed release. Is the Fed scared THAT THE STOCK MARKET WILL GO DOWN A FEW POINTS (OMIGOD!!!!!!) ON WEDNESDAY AFTERNOON?

C’mon, Doc: If this is the end of NFLX, it’s not because of ‘Freevee’

Media exec Tom Rogers, who often mentioned "legacy media" in a bad way, asserted on Wednesday's (6/15) Halftime Report that Netflix will "continue" to have the "pole position" in streaming and future TV-watching.

Jon Najarian, who exited most of his NFLX position, claimed that Freevee, the "former IMBD (sic meant 'IMDB')," is a "category-killer," and he doesn't think NFLX has the sales force to get to the ad-supported model quickly enough, so he shifted his under-$2 million NFLX stake into AMZN.

Rogers said Freevee is a "tiny little pimple in the scheme of what moves Amazon."

Judge said he's heard about the death of "legacy media" many times.

David Tepper is obsessed with Powell terminology (because if the remarks were different, stocks would undeniably have higher prices!!!)

Jeffrey Gundlach, star guest of Wednesday's (6/15) post-Fed Overtime, mentioned "credibility" a bunch of times. What if someone doesn't like the "credibility" of the Federal Reserve? Write your congressman? Subscribe to a new central bank? Convert your dollars into dogecoin?

Judge allowed Jeffrey to deliver a speech about Larry Summers recalculating today's inflation under 1980 methodology. #Forthosewithoutenoughtodo (how about staffing a semiconductor factory rather than re-adding inflation data and complaining about it).

Jeffrey did raise an interesting point, suggesting that Jay Powell "has cause and effect backwards" in claiming the Fed's "forward guidance" has created the tightening conditions, rather than tightening conditions leading the guidance.

Judge told Gundlach that David Tepper said in a phone call that "Last time was ridiculous" regarding Jay Powell's 75 basis points either on or off the table. (Speaking of cause-and-effect issues...)

Mistaking effects as causes, again (cont’d)

This page has noted, repeatedly, that Judge simply won't ask panelists and guests whether the 2022 stock market fears 1) $29 sweatshirts at Old Navy or 2) a recession (that will obviously be softened by a bunch of $600/$1,400/$2,000 checks from the government).

So our ears perked up when Judge made a statement on Tuesday's (6/14) Overtime following Adam Parker's correct assertion that rate hikes won't "solve" some inflation issues.

Judge explained, "It doesn't help with supply chain issues, but it does help with demand, which has made supply-chain issues worse."

Now we're getting somewhere. (Slowly. Glacially.)

Judge's use of the term "help" is curious.

It's like claiming that "moving back the outfield fences, as well as the infield seats to give infielders more room on foul balls, is going to make our pitchers better."

It's not making your pitchers ANY BETTER.

It's improving pitchers' stats — your team's AND other teams' — at the expense of hitting.

And so if it makes people happy to pay $3 for gasoline even though it'll still be the same 10-20-whatever% bigger bite of people's household budgets than it was prior to 2020, then well, whatever. Enjoy.

Meanwhile, back to Judge's comment. Parker had a great response.

"So crush the economy, and then have to cut rates again next year. Fantastic," Parker said.

"That's really what you think's gonna happen?" Judge said.

Parker didn't answer that, but this page will.

Yes.

Absolutely.

Those rates will be coming down, Judge. Just wait.

Bitcoin a ‘complete fraud’

Judge on Tuesday's (6/14) Halftime Report asked Steve Weiss if he's "100% in cash."

Weiss asked if that's a "serious question."

Judge said it is a serious question and doesn't know why Weiss is "all worked up about it."

"I'm not worked up about it at all," Weiss said.

Judge asked "What is relevant," if the Fed conversation isn't relevant. Weiss said what happens Wednesday isn't relevant to his outlook.

But in his most questionable call, Weiss predicted earnings will "really collapse." (Let's wait and see on that.)

Weiss said valuations and fundamentals don't matter now, only that we're in a "tightening credit cycle."

Then things really got good.

Weiss said, "When bitcoin trades to zero, I'll start investing in the market," because it's a "complete fraud" with "no value" or "store of value."

Later, Bryn Talkington said there are "plumbing issues" in the crypto market, but Coinbase is a place where investors can be confident. She said it's too bad it has to let new hires go, but the company can't spend $6 billion on workers who "aren't doing anything."

Why not 300 points?

Rate-hike euphoria (snicker) was taking hold again on Tuesday's (6/14) Halftime Report.

Josh Brown said if the Fed did a 100-point hike, it "immediately shifts the narrative" and would create a "restoration of credibility" (snicker).

He said he wouldn't be "shocked" if that happened.

"I don't think a hundred's gonna happen," countered Steve Liesman, who called 75 points "very likely."

Liesman and Judge agreed the Fed is merely "trying to catch up with the Treasury market."

Liesman also said the Fed has to catch up "in terms of credibility" (Snicker). (C'mon, Steve — when the market's going up, the Fed is too easy; when the market's going down, the Fed is too easy ... and when the Fed is too easy, EVEN LAZY CORPORATIONS can do well!)

Liesman said the market's rate-hike outlook is basically 275 points higher through year-end, which Liesman called "credible."

"Why nibble," Brown responded.

"You need the Treasury market to function," Liesman said. (He could've just said, "Instead of those silly mandates you keep hearing about in congressional hearings, the Fed's job is simply to make sure banks have enough money every morning.")

But what if you’re too late and are reduced to handouts of day-old bread in the alley?

Reigning Grandpa Steve Weiss — whose bearish market outlook has been easily the Halftime Report's Call of the Year thus far, even though Weiss has missed week-to-week rallies and it's supposed to be a trading show, but whatever — said on Tuesday's (6/14) Halftime Report that maybe there's a "relief rally" on Wednesday, but "you're gonna sell it."

Weiss said this is a bear market and while Josh Brown, Steve Liesman and Judge were having a "great conversation," it "means nothing" as far as his investment outlook.

Then Weiss uncorked an admittedly great line: "I'd rather show up for a dinner reservation and miss the appetizer than show up a week ahead of time and wait outside the restaurant."

Weiss complained there's "no capitulation so far," and if the Fed does 100, "Who cares."

"Yes, inflation will come down to the extent the Fed can control it. But there'll be elements it can't control," Weiss said.

Jim’s optimism has been a colossal bungle, but it’s quite possibly only a matter of time

Jim Lebenthal contended on Tuesday's (6/14) Halftime Report that by year's end, the Fed will have done its "heavy lifting."

Jim said the economy is affected by China shutdowns and Russian belligerence, and he said the U.S. is "no longer in the globalization mode."

Judge kept asking if the Fed can or can't "pull it off." (Snicker)

Jim complained about the "derision" he's getting from Judge and others about Jim's S&P target, which Judge repeated or asked Jim to verify.

Judge said the market has been going against Jim's calls, which keeps leading Judge back to those calls.

After the A block, Judge wondered what happens if Jim and other bulls such as Tom Lee are correct. Bryn Talkington said you have to have a "lens" that's much broader than just today.

Bryn pointed out something Judge never mentions, the midyear/2nd year cycle of a presidency. (That's a great point. Not all of those years are bad, which is why those 2nd- or 3rd-year theories don't always work, but a lot of times 2nd years are terrible, as is the case now.)