[CNBCfix Fast Money Review Archive — February 2014]

[Friday, February 28, 2014]

No escaping ‘Gravity’

Ranking art is not really a good thing, but for Oscar picks, it's a necessity:

1. "Gravity" — Not quite out of this world, and probably not a long-term thinker, but easily the most satisfying theater experience of all the nominees. 3-D so smooth, it's practically immersible. Pulsating soundtrack and conclusion. Not an all-time great, but good enough; almost certainly best picture winner in this field.

2. "Dallas Buyers Club" — Struggles as an indictment of big pharma (menacing physician meetings), thrives on its unyielding protagonist and celebration of unlikely allies. Script seems to want the Jared Leto character more than it needs it. A bit too reliant on wild sex scenes.

3. "12 Years a Slave" — Episodic to a fault. Unfortunately, the timing is off, coming a year after the edgier "Django Unchained," much different tone, same injustice. Story arc needs stronger drama at the end. Buzz as co-favorite seems overstated.

4. "Philomena" — Powerful story of ultimate forgiveness, but promises more than it delivers. Not really enough here for a feature film, decided padding in hotel scenes and bizarre obstacles from a key U.S. character just to nearly reach 100 minutes.

5. "Captain Phillips" — The action's compelling and nonstop; so is the annoying hand-held camera. Like "Philomena," is hampered by trying to stick to the truth of a story that probably doesn't merit a feature film.

6. "The Wolf of Wall Street" — A mini-tragedy, but laden with bikinis. A spectacularly bloated, wasteful 3 hours does have its moments; nearly all occur within the first 75 minutes.

7. "American Hustle" — Saved by great acting, but the further we get into awards season, the more useless this seems. Hairstyles, De Niro language trick suggest this could achieve "Mommy Dearest"-esque parody status in later years.

8. "Her" — Not a bad concept, worth trying, falls apart around the 45-minute mark in the same manner as "A.I." Would love to get that job of typing up people's personalized notes.

9. "Nebraska" — Goodness knows how it reached nominee status. The ultimate crutch, a profane elderly woman, drags down sleepy character study. Conflicting messages about money's effect on behavior. Best wishes to Bruce Dern; let's not overdo it here.

Tim’s right; Steve is wrong

In what could be his finest hour — ever — on Fast Money, Tim Seymour on Friday delivered assessments of the Ukrainian crisis that were the envy of any television reporter, including fellow CNBCer Michelle Caruso-Cabrera, who (despite being gorjus) was dusted on this one.

Seymour pointed out that "War with Ukraine would be terribly unpopular in Russia," where the Ukrainians are considered "brothers," and then suggested, probably accurately, that Russia's deployment/commandeering/reinforcement of the Crimean airports is getting unduly harsh treatment already.

"In the West, I have to tell you, the press — and I've been doing this a long time — against Russia is very biased," Seymour said.

Honestly, perspective is hugely needed here; we've still somehow got guys dying in Afghanistan, we drone-bomb thugs in Pakistan and Yemen, Iraq is hardly Switzerland, and some people are having a cow because unmarked Russian troops are standing around what's basically a couple of Russian airports.

So far the real monstrosity passed with barely a mention, if any, on Fast Money, the use of snipers in Kiev against protesters.

Yanukovych is a fool (whatever we hadn't read in the papers, we got clued in quickly in the 10-minute speech from our Ukrainian insider right here at CNBCfix HQ). His comrade in Moscow is not. And the truth is that the rest of the world needs this individual in the Kremlin. Otherwise it's radicals or buffoons. He's a chest-thumping egomaniac, but he gets it. Nobody's endorsing him or comparing him to George Washington. This situation's potential as a global crisis is going utterly nowhere.

That was further confirmed by the assessments of President Barack Obama's remarks by Eamon Javers and Michelle Caruso-Cabrera, both indicating as MCC said that "he did not draw a line here," but unfortunately neither connected the dots well enough to point out that he didn't say a damn thing and why in the world did we have to walk out and read a piece of paper instead of just tweeting it like Carl Icahn does?

Yet, Wesley Clark, who once unleashed upon the world an utterly bogus comment about John Kerry that DrudgeReport picked up, told Friday's Fast Money that this is "Act I of a 3-act play by Putin to take over Ukraine," which means maybe Hillary will hopefully ask him to join the team at some point as she crafts her own statement.

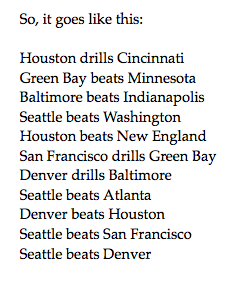

Brian Kelly and Steve Grasso, like the Denver Broncos in Super Bowl 48, caved on the first snap, Kelly predicting that Sunday night, "You're gonna see some serious risk-off," and Grasso declaring, "This is gonna be a sell signal ... I would not start buying stocks."

Seymour made the far more credible argument for his Final Trade. "If anything, I think you've got a bounce Monday on this news."

Grasso countered with his own (wrong) prediction, that if there's a bounce, "you sell that bounce."

Grasso said at the top of the show that "nobody wants to own this market at the highs right here," which is odd, because they've been doing that all week. Guy Adami even admitted the late-day rally was the "most impressive part of the day."

Adami cited "relative strength of the bond market" as a disconnect with stock gains, and he's "gotta believe the bond market's probably right."

Brian Kelly revealed, "I did actually sell gold today," oh joy, and said to watch the Swiss franc for his Final Trade. Guy Adami said he'll watch to see if gold bounces. (How exciting.)

Brian Kelly said "Angela" (sic) Merkel with a soft "g," as Americans do.

Tim Seymour mentioned his favorite regular statistic, "China PMI numbers, tonight."

How in the world does

Simon Baker get away with pronouncing ‘Sony’ like ‘Cerner’?

Judge stumbled and bumbled while trying to flatter dynamite Jane Wells on Friday's Halftime and after a discussion on non-Hollywood movie production was reduced to cliche-land, "At the end of the day, it's the incentives."

So, you mean people are going to bring their projects to places that offer them the most money? What a discovery.

Variety's Tim Gray also reported quite a discovery, that "Argo" made a lot of money after winning best picture last year.

Judge did offer a gem (assuming it's true, and we don't know how Hollywood dollar amounts are ever actually verified unless someone has seen the tax returns) in pointing out that Sandra Bullock is already getting $70 million out of "Gravity" (so when you see it, you can know it's like you're paying Sandra herself) and could get more, as Gray indicated, depending on what happens Sunday. "That film is going to keep paying her for the rest of her life," Gray said. (Translation: She won't have to run back to Jesse James.)

Judge asked Gray to pick best picture. "It's a really close year this year ... I'm guessing 'Gravity'," said Gray.

Simon Baker said he likes SNE, which was backed by Pete Najarian. Mike Murphy said Viacom.

We like the other CNBC ‘Wolf of Wall Street’ observation, Carter Worth saying Wall Street-related movies signal a market top (but only the ones conveniently popular in October 1987, 2000 and 2007)

Josh Brown on Friday's Halftime Report opted to make a social statement, that it's only been 5 years since Bernie Madoff and now here we have "The Wolf of Wall Street" up for all kinds of awards.

It's "really surprising how quickly the pendulum has shifted," Brown said, in that "we're willing to celebrate these guys."

First of all, people who actually like "The Wolf of Wall Street" like the bikinis, not much else.

Second, Brown is inadvertently correct (but didn't realize it) on another level, which is that this particular individual does not deserve a 3-hour movie or really even a 2-hour one, for artistic reasons, not moral ones. (See, that's why you get a bikini every 5 minutes.)

Third, despite what Brown said, "Wolf" is actually a mini-tragedy, a likable salesman who is corrupted by fantasies of greed.

Fourth, no matter how many criminals make waves in the financial system, there is a fascination among many people (generally male and younger) for the quick-buck artist, somebody who figures out a way to rake it in, legal or otherwise. Rather than chiding people for purportedly glorifying such activities, Brown should encourage them to save their money and stop buying lottery tickets.

Don Yacktman draws

a parallel to 2007

Judge Wapner, promising more than he delivered, brought in large PEP investor Don Yacktman to Friday's Halftime Report to evaluate Nelson Peltz's proposals, and we're not even really sure why Don bothered.

Yacktman insisted he really wasn't taking sides except for one; "I'm on the side of the shareholder," but he made clear (a couple times) he thinks some of Peltz's arguments are "apples and oranges," and he's "yet to be convinced" that a breakup is needed.

However, Yacktman allowed that he would like to see better capital allocation.

Translation: Not totally happy with company performance, but not willing to have a rabble-rouser upset the applecart for what may just be a short-term gambit.

Mike Murphy said he prefers PEP to KO.

Yacktman's most intriguing remark was on the state of the stock market. "It seems more like '07 than it does '09," Yacktman said.

Pete: AAPL should buy EBAY ... or ‘Net-’ ... or the next YouTube ...

It seems like nothing these days can stop the Najarians (at least one but often both) from declaring on CNBC that Apple needs to buy some sort of big company.

Somehow the Najarians never concede that this isn't Apple's style and never has been. Its execs think they're the premium best (and by many metrics, they are) and consider it laughable that they need to buy some upstart to improve their stock performance.

Nevertheless, Pete Najarian said on Friday's Halftime first that Apple needs to buy the next YouTube, then later stating Apple could "buy somebody like eBay."

Mike Murphy disagreed with that notion, stating that Apple's innovation "better come from inside."

Najarian said none of the companies AAPL has bought are "major acquisitions," then said, "they should buy Net- (sic cut himself off)" before adding the last 4 letters.

Guest Leander Kahney said people have gotten "prematurely judgmental" on Apple, while "the products are as beautiful as ever."

Kahney said TV, wearables and cars appear to be the next frontiers.

Simon: 15% more in EBAY

Josh Brown bluntly said at the top of Friday's Halftime Report that recent stock market action is "definitely not a sign of topping out."

Mike Murphy basically agreed, stating you should only worry about the Nasdaq if you're short.

Murphy downplayed Judge's concerns about AAPL. "This S&P can go a lot higher without Apple leading it," and reported, "This morning we were in buying Citi" (Gee, how exciting).

Judge tried to quell the enthusiasm, suggesting stocks had been moving up on "next to no news whatsoever."

But Pete Najarian said that if financials continue to gain traction, "We're going to 1,900," and then he predicted GS would lead the next leg higher.

Simon Baker, practically shut out in this program, said he expects "15% or so from here" in EBAY. (Probably more, if Pete persuades AAPL to buy them, if he doesn't persuade AAPL to buy NFLX or the next YouTube first.)

Brown: Bubble in art market is ‘almost embarrassing’

CNBC's Wealth Editor Robert Frank explained on Friday's Halftime Report how Sotheby's sold the "Pink Star" diamond last year for $83 million to Isaac Wolf on behalf of a mystery buyer, who backed out, so Sotheby's has to buy it for $60 million.

But, Frank clarified that Sotheby's values the jewel at $72 million.

Mike Murphy called it a "one-off" for BID, and we can't see how it would be anything but, just an adjustment to last year's earnings that will be at least mostly made up this year or next.

Josh Brown contended that there's a "massive bubble" in the art market that is "almost embarrassing," and if you agree with that at all, you can't be in Sotheby's.

However, Brown evidently sees no bubble in Chinese Internet names, which he endorsed heartily via KWEB. Pete Najarian said BIDU is the most appealing with "single digits" forward valuation.

Ben Kallo and Craig Irwin must’ve been unavailable

Few subjects are more dreadful on Fast Money/Halftime than the (daily) discussion as to whether F or GM is better.

Mike Murphy said on Friday's Halftime that F has "a lot of upside."

There was, surprisingly, no Tesla talk this time, but viewers got the next best thing: AMZN.

Simon Baker said the recent selloff has been a "rare opportunity to get into Amazon," evidently not realizing it's available 5 days a week from 9:30 p.m. Eastern until 4 p.m. Eastern, and afterhours also.

Baker offered 3 reasons why, "increasing the margins over there," a "better warehouse print" (whatever that means) and ... drum roll ... our favorite ... "they're gonna increase the price of Prime."

Yes. And what SHOULD the price of Prime be? (Didn't think so.) (Bet Baker just wants to see a higher minimum wage too, doesn't matter what level.)

Anyway, "I think it's very buyable here," Baker concluded.

(Mark Mahaney happened to discuss Amazon devices later in the day on Street Signs and said, "They're not as Ubikitous" (sic, corrected himself) as Apple's.)

Josh Brown said SPLK has been "one of the biggest tech winners I've ever seen."

Pete Najarian said UAL experienced "enough of a correction that it's buyable; I bought more today."

Kate Kelly was apparently sent to Texas to watch guys with natural gas charts on their computer screens. Mike Murphy said, "We're trading it through Cabot Oil & Gas ... I think it's a buy." Pete Najarian touted DVN but didn't say that DVN should buy EBAY, NFLX or the next YouTube.

Pete said he detected "May 8 calls being bought" in NOK. Josh Brown is bullish in the name, "why not?"

Pete Najarian's Final Trade was NKE. Simon Baker said SNE ("Cerner"), Josh Brown said DFE and Mike Murphy said HTZ.

Joe breaks our heart but apparently avoids face-ripped-off land in SHLD

Dr. New World dialed into Friday's Halftime Report to reveal yet another trade (sic he's exhausting them way too soon; leads in this contest are very fleeting) in his 2014 Playbook Playoffs portfolio.

Of course, we were quickly on the edge of our seats, thinking "AAPL gone."

Instead, Joe said that he's unloading PANW.

As the Nasdaq races to its all-time high (a trend this page identified a year ago), Joe's purpose was to get into the financials, evidently because he's been absorbing too much of Pete Najarian's helium.

"Part of being a good investor is listening to the comments of others," Joe said, a troubling statement on a host of levels.

But he at least did OK in deciding, "Let's go back (sic hasn't owned the stock in this portfolio yet) into Morgan Stanley."

Pete Najarian called MS a "great name," and Mike Murphy said it's a "great entry point."

Meanwhile, last month Joe was talking tough about a SHLD short, price about $37, insisting he was going to ride it into the low 20s.

What Joe didn't report on his call Friday, as SHLD reached double the low 20s, was what he reported on Twitter: "Flat $SHLD for now, Will establish short position again."

So, we'll at least credit him for avoiding face-ripped-off land ... but doubtful we'll be seeing "short SHLD" in the Playbook Playoffs portfolio anytime soon.

More from Friday's Halftime and Fast Money later.

[Thursday, February 27, 2014]

Brian Kelly recommends shorting GOOG against an AAPL long

The stock market makes a new high and further embarrasses Steve Grasso's bungled selloff prediction (not to mention Carter Worth's hideous 1,600s, when are we gonna revisit that one?), but Thursday's Fast Money opted to spend the first 10 minutes on ... AAPL.

Tim Seymour said, "This is a stalled growth stock," but Brian Kelly stated, "You could certainly buy Apple right here." (Probably with bitcoins, because exchanges aren't actually needed.)

Guy Adami sounded like he was following Bill Clinton's parsing playbook, first declaring the stock is in "probably somewhat no-man's land," then adding the "downside is 15-20 dollars max," and "I think 575 on the upside is where it gets to."

Pete Najarian said he'd add to his longtime AAPL stake if it pulls back to 495, but he's doubtful it's going to get there.

Pete announced, "I don't want them to buy back shares," but rather "make some acquisitions."

"But what are those," Tim Seymour rightly asked.

Najarian insisted there are "multiple different companies" that would move the needle right away, without actually naming any of them.

Brian Kelly suggested you could "short Google and buy Apple."

Gene Munster said not to expect much from Apple's investor day but played along with Melissa Lee's ridiculous emphasis from every angle on institutional holders, asserting "there's clearly money on the sidelines."

Pete insists he has nothing negative to say about YOKU

The YOKU discussion on Thursday's Fast Money produced the first "Hulu" reference we've heard in ages (probably since Joe heard that Netflix was gonna "miss" the last quarter).

On YOKU, Tim Seymour was as wishy-washy as Christopher Reeve in "Superman II" (before he restored his powers), explaining that "50% of their traffic is mobile" but stopping short of a table-pounding buy with the chicken(bleep), "I think this is an interesting time to look at this stock."

Brian Kelly flat out declared YOKU a great "slow-money trade."

Pete Najarian played contrarian, stating, "They don't make money," though stressing, "I'm not being negative on the stock."

Tim Seymour chided that opinion. "You're playing growth, you're not playing EPS here," Seymour said.

How come Brian was on the show and we didn’t hear a word about bitcoin?

Guy Adami told Thursday's Fast Money gang that "I think you can actually own Best buy here."

And that was bolstered by Tim Seymour's revelation that after busting on February 28 BBY calls, he's trying again with March 28s.

Guy said he'd prefer BBY to JCP, which is still in a "very well-defined downtrend."

Pete Najarian said he's "sort of baffled" as to why DECK's guidance is so low. (This writer is long DECK as of Thursday's afterhours.)

Tim Seymour's GM bull case was positively bone-headed. "Valuation-wise, there's so much wiggle room," Seymour said, which makes zero sense.

Pete Najarian grudgingly said that if he had to pick F or GM, which show panelists tend to think they must do for some bizarre reason, "I think I'd really go with Ford," but really he doesn't like either, "both have more downside."

GM's problem, Najarian said, is "they aren't selling enough vehicles right now."

Brian Kelly said "everybody" is talking about how financials would lead the market higher.

Guy Adami said "this is the deep end of the pool" if you're in JOSB, but it's "probably the right trade still."

Heaven on earth

Sara Eisen is one of those people who has no idea how gorgeous she is, which makes her even more gorgeous; hence you see this page's problem not in making screen grabs, but knowing when to stop.

Why the producers insisted on putting Lawrence Delevingne (a fine chap, but ...) on ahead of Eisen, to speak of what he always speaks about, hedge funds employing a strategy that everyone knows they've been employing for months, is a head-scratcher.

Eisen spoke about the details of the weakening yuan, but to be honest, we were so focused on her dazzling outfit that we lost track of the conversation.

We did hear Brian Kelly say "I'm short copper," and Tim Seymour said the yuan move is a policy move, not a market move, but apparently one they can't fully control (which means it's both).

Delevingne said activist investors have "clearly established themselves as a major hedge fund strategy."

Guy Adami used Delevingne's appearance to start the bickering-married-couple routine with Melissa Lee, calling her "what a hashtag jerk" for revealing Delevingne's nickname or something like that (omg why in the WORLD do we pay attention to the details of this program??).

Mel mentions Seattle’s 1st Super Bowl win, but not its first loss

Pete Najarian said on Thursday's Fast Money that the March 62.5/65 call spread was hot.

Mike Khouw said July 80 calls in PEP were hot.

Brian Kelly said NDLS had a setback but "it actually traded fairly well today," so you can try it.

Guy Adami said he normally wouldn't chase a name like MYL, but you "probably still have to."

Tim Seymour said CTRX has been "gliding through waters."

Pete Najarian said of WEN, "I think this stock's going higher."

Proving himself (as if there were any doubt) one of the most impressive individuals in pro football, Russell Wilson visited with the Fast Money gang and said absolutely, 100% the right thing on every subject.

Wilson even tossed in an "at the end of the day," and conceded he does have some stocks, but he's "very conservative" in that regard.

We couldn't figure out why exactly he was on the show; apparently it's a deal with Vizio as that company's "top value performer."

The panelists spoke a little bit about some goofy idea of taking a lump sum now in exchange for future earnings. Pete Najarian scoffed at that; "I don't wanna give up my upside."

Melissa Lee reported that "The Seattle Seahawks took home its (sic) first ever Super Bowl win," and dubbed Wilson "very well-spoken."

Tim Seymour's Final Trade was selling half his TTM stake. Pete Najarian said long EBAY, Brian Kelly said SPY puts and Guy Adami said TEVA.

Can’t imagine that interest on cash balances is too lucrative at this point

Baiju Bhatt and Vlad Tenev, the founders of the Robinhood online trading platform that will charge $0 commissions, told Judge on Thursday's Halftime they've still got "several monetization revenue streams on Day 1."

Those are "margin lending, payment for order flow, interest on cash balances," Tenev said.

This is real money we're talking about, so let's not get carried away just yet that this is Charles Schwab Jr., but Stephen Weiss was overly curmudgeonly in trashing the concept; "I'm not willing to send them my money. And I think it's like leading lambs to slaughter in terms of no money to trade."

Anthony Scaramucci claims shipping stocks are forward indicators for Best Buy

Anthony Scaramucci on Thursday's abbreviated Halftime Report made a bull case for BBY, starting with, "Take a look at where the shippers are now" from the last time he argued for that sector, and meanwhile BBY has a "strong balance sheet" and "they're gonna see earnings momentum."

Josh Brown stood his ground on the other side, claiming "this is a failed turnaround," and "this is the ultimate sell-the-rally name."

Stephanie Link revealed "I lean towards Josh," because "I'm worried about margins."

Stephen Weiss said he leans bearish because the company strikes him like Toys R Us.

Meanwhile, Brown reported "same-store sales not so hot" at NDLS, and "I would just avoid it."

Stephen Weiss called WEN "still expensive."

Stephanie Link said VALE had its "5th beat on EBITDA in a row," for those not keeping score at home.

Anthony Scaramucci didn't seem to have many specifics on BIDU but said, "Look for this stock to do better next year."

If John Harwood thought the Halftime crew would praise his feature, he was wrong

Stephen Weiss made a mockery of John Harwood's Aging America segment on Thursday's Halftime, suggesting HI, SCI, AGN, CVS and ESRX as his plays on this trend.

Josh Brown chimed in with "all things Angela Lansbury," then made a cogent case for XLV, stating 25% of everyone alive will make it to 93.

Anthony Scaramucci respectfully offered BDX.

Scaramucci said he's biased in praising Dan Loeb and Nelson Peltz because "a billion dollars of SkyBridge's money" is invested with them. Stephen Weiss said he wouldn't go against Loeb.

Phil LeBeau said Tesla's (heroic) battery plant could help them sell "a million vehicles ... by 2027." Josh Brown was avoiding; "the trade is to watch this from afar."

Weiss' Final Trade seemed to be PEP, though the online account says he said to sell rather than buy. Stephanie Link said APC, Anthony Scaramucci said CRI and Josh Brown said DFE.

Anthony Scaramucci refers to Fed chief as ‘Mrs. Yellen’

CNBC's Thursday Halftime Report had barely cut away from Janet Yellen's testimony when Steve Grasso declared a "sell signal right here."

But Stephen Weiss bluntly disagreed. "I think we're going higher," Weiss said.

Anthony Scaramucci, calling Yellen an "intellectual stud," agreed with Weiss, the "market's going higher."

Stephanie Link stated, "I think we're actually in a trading range for the near-term."

Josh Brown observed that "the market really had no reaction" to Yellen's comments, so it looks like "business as usual" on the QE front.

Guest Scott Siegel of Morgan Stanley told Judge, "I think we're gonna kind of stay in this range," but by the end of the year expect a "9-10% type of return."

"We really like municipal bonds," Siegel said.

More from Thursday's Halftime Report and Fast Money later.

[Wednesday, February 26, 2014]

Where are these ‘studies’ that Steve Grasso shamelessly claims validate tax-dodging?

Wednesday's Fast Money got a visit from Robert Frank — but not Dolly Lenz — to tackle the Credit Suisse concealed-banking controversy.

It "sounds like a scene from 'Ocean's 11'," Frank said, pointing out other jurisdictions land accounts when there's Swiss heat, "so it's sort of like Wack-a-mole tax evasion."

Guy Adami attempted some sort of political statement denouncing the notion of "rogue trader."

Karen Finerman singled out JPM for banking imperviousness to these probes. "They announced tons of settlements .. and it just doesn't matter," the stock moves higher, Finerman said.

Steve Grasso conceded, "They've all been buyable dips," then asked everyone to "think out of the box" while making a case for a tax cut that not even Republican leaders seem to want now. "Studies have been done, when you have a more affordable, lower rate, broaden the base, people look for ways to save their money and shelter it a lot less, they bring their money back home," Grasso said.

So, tax cuts = crime prevention.

Perhaps he also believes exchanges aren't needed for stocks or bitcoins or anything, and 10 years from now he'll be able to transfer DIS shares to his kids for free using bitcoin.

Dan Nathan was the contrarian, stating banks could be "dead money" for a while. Guy Adami sided with that, adding, "I really think Goldman has to hold 160."

Mel thinks analysts should move price targets every day based on stock action

It's basically either Craig Irwin or Ben Kallo.

Either way, we've heard the routine so often, we could do it on TV ourselves.

Wednesday on Fast Money, it was Kallo who talked about how great Tesla's doing but how his price target will remain conservative, stating "2 things" are pushing the stock higher, the equity offering and (borrowing Joe's cliche book), "Capex around the plant."

But Kallo admitted there's a lot we don't know about this 2017 venture that purportedly is moving the stock in February 2014; "they're gonna keep it close to the vest."

Steve Grasso was compelled to ask the "Chinatown" question. Kallo answered, "It's a consumer basic technology company."

Mel told Kallo that his price target is now $15 below the share price. "I'm still not raising my price target on your show," Kallo chuckled.

Karen Finerman, always the go-to person on offering details, stated, "We don't know the exact terms" of this one, but Tesla has included a 100% anti-dilutive threshold so that if the offering were issued at, say, $250, the company would "be able to not dilute the stock up to $500."

Dan Nathan chided No. 386 for trying and failing to put TSLA in a "bucket" and declared, "I'll put it in a bucket: It's a mania.."

Grasso said if you're long TSLA, "I would be locking in profits here."

If nothing else, Mel's red top Wednesday took about 8 years off.

Guy: JCP could see 7.25

Karen Finerman was asked to open Wednesday's Fast Money with a TGT analysis but couldn't resist a Macy's (Drink) reference.

"They set the bar low enough," Finerman said of Target, but even a name like M is still not expensive.

Guy Adami said of TGT, "I think you can still buy it."

Jerry Storch contended that TGT has "exceeded already low expectations" and insisted the data breach is "a one-time event," while conceding the Canada losses are "just atrocious."

Karen Finerman asked Storch if a cosmetic outlet such as Ulta is immune to Web encroachment. "Nobody's immune," said Storch, who nevertheless said M (Drink) is "way ahead on the Internet."

Finerman said JCP's results were decent, but it's "such a low bar."

Guy Adami said JCP still has "ridiculous short interest" and could trade up to 7.25, but at that point he'd have to sell.

Steve Grasso repeated his buying-ANF-at-30 story for all to enjoy; "everyone threw this name out," but right now, "I'm still long the name; I think it moves higher."

But Grasso said of the S&P 500 that too many people are unwilling to buy right at the top and want to see a new leg, so "I don't think we're breakin' out here."

Dan Nathan suggested WFM might be experiencing a "Triangle of Death," given that "growth is starting to decelerate" and the stock is "sitting on a massive support level."

If that breaks, WFM could suffer a "10% swoosh (sic Nike trademark infringement) very quickly," Nathan said.

Nathan halfheartedly put SBUX in a similar situation. Guy Adami said he likes DNKN.

Melissa does some sleuthing about KATE’s Japan presence

Melissa Lee on Wednesday's Fast Money finally aired her long-promised exclusive interview with Kate Spade chief Craig Leavitt, who says his stores produce $1,265 sales per square foot and that there is "great consistency in the product" that somehow works both low end and high end (uh oh, another chance for a marijuana joke).

Melissa Lee inferred for the gang that Leavitt's reference to gaining market share in Japan likely means "Coach is getting it from a lot of different sides."

Dan Nathan claimed he bought his wife a Kate Spade bag in 1997 and hasn't heard the name until Wednesday's conference call before the show. "I don't know who has these things," Nathan scoffed.

Karen Finerman, who referred to KATE as "Kors-lite" (gee, how can we do a pot joke off of that), said that in the "entire Liz Claiborne universe" (honestly we're not really sure what that means), Spade is the "absolute crown jewel."

Guy & Mel use Harvard (again) as the day’s springboard to the bickering-married-couple routine

Dan Nathan, echoing Joe Terranova from Halftime, said on Wednesday's Fast Money that "the momentum seems broken here" in LNKD.

Steve Grasso said he prefers SCTY over FSLR but warned SCTY trades "in lockstep" with TSLA.

Guy Adami said of BUD that it's "imperative that it closes above 107," or else expect it to fail to 94.

Karen Finerman believes that NADL's space is "way, way, way too cheap."

Guest Ed Morse said a lot of petro products are being shipped out of our newfound shale space, and "explosions recently might have some consequences in North Dakota."

Steve Grasso said the more we get from there, the more the WTI spread "dissipates," and if so, the refiners are in free fall. He thinks it's the "late innings for refiners ... maybe the 6th or 7th inning," and when it's over the downside can be 1/3 of the stock price.

Dan Nathan suggested "the transports seem like a difficult sector."

Nathan said Jan 50 calls in DOW were hot, and implied volatility in the name is at 3-year lows.

Steve Grasso meekly said of KO, "I think there's some support here," but keep it on a "short leash," which would be a "37 top (sic)," er, "37 stop."

Melissa Lee made marijuana jokes at every opportunity, as the Fast Money crew continues to endorse mind-altering substances.

Dan Nathan's Final Trade was long GM with a 35 stop. Steve Grasso said PAY and received a good crack from Karen about the amount of letters. Karen Finerman said to sell XBI, and Guy Adami suggested CBI.

We’re getting tired of Judge’s

‘eye-ther’ pronunciation, even though it’s acceptable

We gotta ask CNBC viewers one thing.

But first, the backstory.

Josh Brown claimed on Wednesday's Halftime Report that he has studied the great secular bull markets in history, and today's solar space is one of them.

He even said that in a California desert, they are building "the Hoover Dam of solar."

How exactly does that work? Can you drink the sunlight?

Joe Terranova, enlisted to be the curmudgeon here, told Brown that solar is growing, but "we are seeing a slowing in that momentum ... I agree with you there is growth, but it is growth that is slowing."

Pete Najarian could only restate Joe's argument, acknowledging growth but questioning, "Are they maybe a little bit in front of themselves," and suggesting he'd maybe buy a pullback.

Brown conceded that with SCTY's rise, "a great deal of it is the Musk factor," but he's the guy who smartly came up with the notion of leasing rooftops rather than selling them.

Mr. New Land told Brown that Brown should hand the ball to the ref if he "wins" the debate, despite the fact Mr. New Land was crowing about his place in the 2014 Playbook Playoffs, which would be even stronger if he had listened to this page on 1) that useless AAPL long and 2) that head-scratching dumping of KORS just when it was re-igniting.

Now, here's our question. Judge regularly asks viewers to vote and says you can "use eye-ther (sic pronunciation) the hashtag bull ..." etc.

But if CNBC needs your contribution so badly, shouldn't they be paying you for it?

If for example Judge asked you to "eye-ther sweep the floors or clean the john," would you immediately hop a jet to Englewood Cliffs with your dustpan and pail?

Oh well. Happy voting.

Josh Brown suggests there’s a ‘possibility’ that bitcoin could be the next PayPal

We freely admit, we don't have a clue about bitcoins, don't know how to make one, don't know why anyone can't just make one, and don't understand in the slightest how they could evaluated in any manner without an exchange, as Brian Kelly seems to think based on his commentary Tuesday.

On Wednesday's Halftime Report, Josh Brown took this fascination to a new low, telling Judge, "I think there's room to be bullish on bitcoin in terms of its usage and the proliferation of it, rather than be bullish on the price."

So, if we understand this correctly (unlikely), it's not actually a currency but an exchange device, a transaction processor, a token that people will purchase with dollars so that they can redeem it into dollars.

Brown even said he'd "leave open the possibility" that it'll be reminiscent of years ago when some might've wondered, "Why would anyone need PayPal?"

Dr. New World at least said he's not buying this and questioned whether it would replace currencies but didn't have the brass to tell it like it is like Doc and Weiss did a day earlier.

3 buyers for nat gas

Jeff Kilburg said on Wednesday's Halftime Report that front-month expiration in nat gas has "exasperated (sic) the price movement down."

However, Kilburg still sees "insatiable demand," so he recommends "buy it against a 4.40 level."

Brian Stutland said he's willing to buy at the 4.55 level, but he'd be concerned if it presses 4.40.

Mr. New Land said, "I think natural gas is actually a buy right around here," and then, continuing the trend from Ivy Zelman's appearance, spread stocks like backyard fertilizer, including BBG, CXO, SWN and UPL.

Instead of chiding Pete for being clueless, Joe retreats and ‘corrects’ what he accurately said the first time

Pete Najarian on Wednesday's Halftime Report eyed LNKD with a starry-eyed gaze, noting the potential amount of users in China and declaring, "That's insane."

Simon Baker pronounced Mark Mahaney's last name as "Mahoney" (sic).

Mr. New Land, echoing Guy Adami's theme which we believe to be long in the tooth (this writer has no current position in LNKD), asserted, "I actually think you wanna sell rallies in LinkedIn at this point."

Pete Najarian, asleep at the switch, accused Joe of advocating a short, which Joe did not, calling such a move "dangerous" and somehow asserting the stock is "trading very similar to Tel- Tesla right now." Joe backpedaled and insisted he wasn't recommending a short.

Speaking of TSLA (or is that "Telsa"), Pete said the 295, 300 and 310 calls were all roaring, but "I'm not in there now."

Pete: CAM calls hot

Pete Najarian said at the top of Wednesday's Halftime Report that 1,900 in the S&P is possible because when you look at old tech, "None of those areas are way overpriced."

In his own assessment, Joe Terranova slyly inserted his new favorite word; "stay focused on technology, that's where the capex is."

Cute Courtney Reagan questioned whether ANF is connecting with consumers; "they really gotta shake up that management team."

Pete Najarian hailed TJX again, while Joe said he's "still short Sears" but could be tempted by Best Buy.

Simon Baker backed BBY himself, stating, "The stock was overblown when it got sold."

Simon Baker and others hailed the frequent flier move by DAL, a "good decision." Mr. New Land once again suggested "more airline weighting in the S&P 500."

Pete Najarian admitted he does like IBM, but "I've been preferring Hewlett Packard," in part for its "hybrid cloud."

Josh Brown admitted, "I've been so wrong about HP for so long, it's not even funny," but opining on both IBM and HPQ said, "I would avoid both of 'em at this point."

Pete Najarian said someone bullish on CAM was selling March 62.50 calls and buying the March 65 calls. Pete said he'd be in this trade "at least a week, maybe 2 weeks."

Harry Smith, who's doing yet another CNBC documentary on marijuana, told the crew "there is no drug-testing policy" at dispensaries. Pete Najarian said that volume in stocks associated with hemp can be "unmeasurably low."

Josh Brown's Final Trade was FSLR. Pete Najarian said VMW, Simon Baker said SSD and Joe Terranova said VZ.

Housing discussion produces

17 stocks called buys

It would've been easier to ask them which ones they DON'T like.

Housing bull Ivy Zelman, who was a little too polite to her interviewers, told Judge Wapner on Wednesday's Halftime Report, "I think nirvana took a pause" last year, but "I think we're back to seeing very strong activity."

Zelman said the rate-hike concerns of last year have faded, and the consumer is going to roar once the weather warms. "I would say California is back to where it was during nirvana ... I think we're gonna see things rip when we see the weather thaw and the consumers are coming out ... there's not enough supply," Zelman said.

Josh Brown said there seems to be a "bifurcated debate" (sic terminology) as to whether buyers this spring will "show up in force."

Zelman brought up one of the magic Fast Money phrases, suggesting rising rates aren't a problem, it's about the "order of magnitude" (Drink) of a higher move.

Zelman said that in housing starts, we're going to see the "most massive mean revision that we have ever seen," at least post-World War II, then rattled off these names she likes: LEN, PHM, SPF, TMHC, BZH, WCIC, MDC, FBHS, MAS, HD, MHK and SHW.

In the affluent sector, there's just "so much pent-up demand," Zelman said.

Dr. New World backed this outlook and carped about his inbox. "I've already got an email from someone who's dismissing the positives in (sic) today," Joe said, but 2014 is "going to be about the actual homebuilders." He threw in NBR; "don't be afraid of the high price."

Simon Baker touted an old favorite, SSD.

Pete Najarian said he wasn't sure if he heard Ivy mention DHI, but he likes that, pointing to a "stealth rally" in the shares.

Diana Olick said Ivy is focuing on demand, and "I would disagree on some levels of the affordability," that would-be buyers still can't get a lot of financing.

Josh Brown offered TOL and USG, presumably because they hadn't already been mentioned.

Later delving into retailers, Brown added, "I think Lowe's has more upside than Home Depot from here."

More from Wednesday's Halftime later.

[Tuesday, February 25, 2014]

Fast Money trader actually says it’s a ‘great opportunity’ to buy bitcoins

Some things, even those on business televisision, just defy belief.

CNBC's Brian Kelly actually declared on Tuesday's Fast Money that it's a "great opportunity to buy" bitcoins in the wake of the Mt. Gox debacle.

However, Kelly advised viewers, "there's no government protection ... you could lose your entire investment."

Kelly shrugged off the demise of Gox, claiming "You don't need an exchange anymore" even to trade stocks.

Guy Adami, even more incredibly, actually sort of defended this knuckleheadedness, asserting "this should've been catastrophic" for the bitcoin world ... "and it really wasn't."

We've probably never appreciated Stephen Weiss and Jon Najarian as much as Tuesday, when at Halftime (see below) Weiss acknowledged he "sort of" feels badly for the "fools" playing this, and Doc asserted that "people are just gettin' their pockets picked."

Honestly, people should trade whatever they want to trade, but this one has smelled like a bust from Day 1.

At one point Missy Lee brought in Mt. Gox protester Kolin Burges, who said on a muffled phone connection, "I'm definitely worried about using other exchanges" and revealed, "I'll speak to a lawyer" and apparently a "banking regulator."

TSLA analyst keeps urging caution in upping valuations while suggesting $60 EPS

King TSLA watcher Craig Irwin visited with Fast Money Tuesday and suggested Tesla's battery developments figure to be a big deal; "it'll affect a bunch of different things."

Tim Seymour asked Irwin if the "energy storage" angle is being factored into the valuation, which would make it more than reasonable. Irwin responded, "We need to be careful in how we discount the future," essentially shrugging off such calculations.

Then, after having to suffer through Guy Adami pointlessly telling everyone he's missed the run in the stock, Irwin claimed that if certain initiatives come through, "50-60 bucks in earnings is doable."

Irwin told Melissa Lee he has 2 "superbullish scenarios" for TSLA, which include an "electrolyte-free manufacturing process" and acquiring "silicon anode from Panasonic."

Steve Grasso sounded wishy-washy on the stock but allowed, "I think it does have room to go higher."

Tim Seymour was spineless in making a call; "I think it's phenomenally interesting."

Karen Finerman said the short interest is formidable; "I definitely wouldn't short it either."

Later, Jared Rowe joined the group after a teaser (Teslas fetching more used than new) that promised more than it delivered, stating 40 vehicles are in the used-car market, "but not a lot," and that it's more popular in the warm-weather states.

Mike Khouw said weekly 260 TSLA calls were hot.

Oh well, it's safer than a bitcoin exchange.

Grasso: ‘I would be trimming’

Steve Grasso, forced to deal on Tuesday's Fast Money with the embarrassment of his bungled S&P 1,700-correction call (at least it wasn't as bad as Dennis Gartman's), admitted he was wrong but asserted, "I would be trimming positions."

Guy Adami said, "I think the consumers are spending," but then questioned whether they should be spending as much as they are.

Adami said if the IWM fails, that would be bad for the broad market.

Karen Finerman called the market "somewhat frothy."

Tim Seymour said he's not "happy" about a 17 multiple on the S&P 500.

It’s Karen’s birthday, and we managed another gorgeous picture

The Fast Money crew, which sometimes lets birthdays quietly pass, refreshingly did the right thing Tuesday and heeded our call for a big shout-out for Karen Finerman.

The only problem was that Melissa Lee utterly whiffed on the opportunity to question one of the premier names in banking, which is like having Seema Mody drop by CNBCfix headquarters asking for directions, and not even ... stop that. Absolutely stop that right now.

That is, assuming it really was Jamie Dimon who dialed in to tell Karen "You are my favorite" and suggesting a "big martini," and not, as we sort of suspect, Simon Baker.

Tim Seymour seemed fascinated by guessing the decade of each of Karen's song selections. Karen said Billy Joel's "The Stranger" was her first album.

Guy Adami is getting a little shaggy on top; expect a trim by the next appearance.

Kate Spade, a ‘mini-KORS’

Guy Adami on Tuesday's Fast Money had bad news for everyone wishing to plow into LNKD; "unfortunately you have to wait" till it breaks out above 220, because the previous handful of apparent breakouts all failed, and Guy's not saying this one will, but you have to wait.

Tim Seymour, unwilling to commit to absolutely anything Tuesday, was handed BBRY and said, "I would say it's very interesting at these levels."

Karen Finerman said she's been long FNP but, "Unfortunately it wasn't a big enough position ... it is a mini-KORS."

Tim Seymour brought up one of Fast Money's Magic Words in regard to COH, "lifestyle brand." Finerman indicated FNP might not have the same setbacks; "I think they did it incrementally."

Finerman said that what's "so great" about M is that while it's the "best operator in their space," they push themselves as though they were 2nd or 3rd.

Steve Grasso questioned wearing a smartwatch on the wrist as well as having a smartphone in the pocket, suggesting the watch will be "more of an athletic thing." Tim Seymour indicated that Samsung smartwatches are "far and away the best things out there."

You didn’t think that just because it was Karen’s birthday, we would ignore Seema Mody?

Melissa Lee declared on Tuesday's Fast Money that the tweets addressed at the end of the show were the "best tweets of the day," which means that someone asking for Tim Seymour's opinion on AMC Networks is among the best.

The problem with that was, while the question almost certainly referred to AMCX, the chart shown was AMC, and we had no idea which one Seymour was talking about.

Karen Finerman said GameStop seemed like a melting ice cube, but actually "is a cash cow." And, "We actually are long some."

Guy Adami said SWHC "could get squeezed up to 14½, 15."

Tim Seymour, in a line Karen Finerman would surely quibble over, said of TSCO, "Stay in this name if you're there." (But what if you're not?)

Karen Finerman said the LYV story is "early still."

Guy Adami thinks you can own THC around 41½.

No. 386 said "I probably wouldn't be a buyer" of nat gas.

Guy Adami hung a 90 on HD and said "I like Home Depot."

Seema Mody, stupendous in a red sleeveless ensemble, delivered a "mixed report from Boston Beer." Tim Seymour clumsily endorsed BUD.

Seymour said he prefers SCTY and Chinese solar names to FSLR.

Steve Grasso said SCTY and TSLA are the "exact same chart." Karen Finerman started to say that is very dubious, but was cut off.

Tim Seymour's Final Trade was GM. Steve Grasso said QCOM. Guy Adami said WFT. Karen Finerman had a curious rationale for AAPL, stating, "people are bored," and some are following Carl into EBAY, which she finds "absolutely ridiculous."

Judge actually implies a link between stock performance and CEO trash-talking

It's undoubtedly one of the most bizarre conversations on Fast Money/Halftime in recent memory.

Judge brought in Fast Company writer Max Chafkin to lead Tuesday's Halftime panel in a discussion of whether CEO trash-talking makes a company better.

In fact, Chafkin chalked up T-Mobile's high ranking as an innovative company to "John Legere's smack-talking."

"Customers don't need to like the CEO of the company. What they want is the truth," Chafkin claimed.

Usually goofy segments like this are limited to a couple of soundbites from the guest. For whatever reason, this went on and on, with Mr. New World questioning results of AAPL, "They've talked smack over the last couple of years."

"2 words: Ron Johnson. ... It just doesn't mean anything," said Stephen Weiss, who also cited the problems of Thorsten Heins.

Jon Najarian said the point of it is, "You're trying to bolster morale."

Brian Kelly claims bitcoin will be used to transfer shares of DIS to your kid 10 years from now

Melissa Lee on Fast Money tends to talk about bitcoin as though it's the next FB.

She even likes to bring on "Beekers" to make the bull case for it.

The Halftime crew isn't nearly as impressed, with Steve Weiss explaining Tuesday that "I sort of feel bad for the fools that contingue to play this," and Jon Najarian demanding, "When is our Treasury gonna comment on this ... people are just gettin' their pockets picked."

Meanwhile, Anthony Grisanti said "I like gold," and "I don't think we have to see a lot" for more gains. Rich Ilczyszyn said that if it closes north of 1,338, "all arrows point higher," but think about the "exit button" at 1,360.

Weiss: ObamaCare could be pushed back to 2022

Bertha Coombs, reporting from a sleepy health-care conference, told Tuesday's Halftime Report that investors like CYA, HCA and BSX.

Pete Najarian predicted TEVA goes a "lot higher," and said BMY looks "very expensive" but does have the pipeline.

Stephen Weiss observed, "ObamaCare keeps getting pushed out; I wouldn't be surprised if it pushed out to 2022," and said he likes GILD as well as AMGN.

Jon Najarian recommended TMO and ILMN. Joe Terranova wrung his hands over trying to do this with individual stocks and said "I would go to the XLV."

Sister Golden Hair pays

visit to Halftime crew

The opening of Tuesday's Halftime Report was flat as a pancake, featuring a weak go-round on energy.

Addison Armstrong contended that "WTI is showing some signs of weakness." But Armstrong backed natural gas; "once March comes off the board, we're gonna see some strength in April."

Dr. New World, who once again talked about "capex," suggested crude "might pull back to 95" and endorsed EOG and OAS.

Pete Najarian said his energy favorites are BP, BHI and DVN.

Jon Najarian said he likes FTK and of course made sure to make his daily mention of BHI, his Playbook Playoffs pick that he said is up 14%.

Speaking of obligatory Najarian daily mentions, Pete likes UA, even against NKE, which he says has "matured." Stephen Weiss knocked UA's valuation, which has "no room for it to fall," a statement that makes no sense. Dr. New World backed Pete; "I think Under Armour is the better buy."

Crew once again goes to great lengths to make excuses for F

It's the stock they just can't bring themselves to knock.

Tuesday's Halftime Report gang traded around excuses for F as Phil LeBeau reluctantly reported that it's the "2nd-worst brand" in Consumer Reports, its lowest ranking under Alan Mulally.

LeBeau stressed that "in-car connectivity" is the major culprit.

Now, think about how virtually any other company finishing this low in the rankings would be skewered on the Halftime Report; "this isn't just a new CEO or turnaround; he's been there many years," but because everyone for some reason adores F shares (hey, they didn't take a bailout, we like that too, but ...), once again the company got the kid-gloves treatment, starting with Doc asserting the F-150 is the No. 1-selling car in the world, and Stephen Weiss for some reason delving into BBRY, claiming his daughter "loves her new BlackBerry."

Jon Najarian nevertheless said his top picks in the space are ORLY and BWA. Joe Terranova said a lot of GM investors' money has recently gone into F, and "maybe it reverses." Pete Najarian said, "I think it's about the suppliers," specifically GT and LEA.

Weiss thinks TSLA sees 400, but won’t buy it

Pete Najarian frankly declared on Tuesday's Halftime Report that in TSLA, "the shorts got toasted."

Joe Terranova suggested it's not just a loopy momentum stock; "that was a solid earnings report."

Stephen Weiss strangely said of TSLA, "I still can't buy it here even though I think it'll go to 400."

Weiss said M benefits from "perfect execution."

Pete Najarian said LNKD's China venture "could be huge."

Dr. New Land indicated strength in PANW and recommended CHKP and "Fire-eyre (sic), FireEye."

Jon Najarian questioned why CSCO issued "floating rate" bonds.

Stephen Weiss touted HD and LOW in the housing space. Jon Najarian said, "I still like Toll Brothers" and PHM. Pete Najarian picked LEN and DHI. Dr. New Land said 2014 will be a good year for builders.

Joe Terranova said LNKD has a "lot of inventory of sellers" (sic phrasing) around 220 and "I like Facebook better here."

Stephen Weiss endorsed FB, "I think the acquisition's a great acquisition," and added, "I'm in Twitter," a name which no one else seemed to like, curiously enough.

Joe Terranova said "I would never own" BBRY.

Jon Najarian reported "strong upside call buying" in UAL for April and thinks it's "gonna push through 49."

Pete Najarian's Final Trade was DAL. Jon Najarian said RAI, and Steve Weiss said to sell GMCR. Mr. New World refreshingly admitted something this page said on Day 1 of his KORS sale, that he exited too early and it's a buy as his Final Trade.

[Monday, February 24, 2014]

Karen’s birthday today

She turns 33.

Guy mistakenly said ‘Facebook’ when he meant ‘Twitter,’ fooled us all with ‘high 40s’ call

Laura Martin, the star witness on NFLX on Monday's Fast Money (see below), made her most provocative comments on the FB deal.

Martin said FB trades at $160 per monthly average user, but only paid $42 per monthly average WhatsApp user.

So, "We think Facebook gets multiple expansion," Martin said.

Tim Seymour endorsed the deal. "I like it," Seymour said.

Guy Adami said the "trade in Facebook" and then startlingly hung a "high 40s" price target on the name while clearly talking about Twitter's earnings call, then said "Facebook" again and predicted a "67 print." Tim Seymour didn't seem to get the glitch and called high 40s "pretty aggressive" for FB. Guy too didn't get his own glitch and told Seymour the stock was just there a week and a half ago (that was the case for TWTR, not FB, which hasn't seen the 40s since early December).

‘$2,000 lifetime value,’

in something or other

NFLX watcher Laura Martin brought her razor-sharp A game to Monday's Fast Money, outlining a stronger bull case than even Carl Icahn (who actually sold a bit early, didn't he, Doc? Didn't he, Doc?) could make.

Basically everything involving the stock is a win-win, in Martin's mind, including the Comcast deal, given that it's a faster speed with no middleman, while Netflix has experienced "big bottlenecks at Cogent."

Furthermore, Martin contends that Comcast was compelled to "really cut the price" because of D.C. deal scrutiny, and this low price will be the benchmark for negotiations with other providers.

Missy Lee stressed that in a few years, Netflix will have to pay again. But Martin twisted that into a success, asserting that it's "encouraging Netflix to start tiering its pricing ... Netflix undercharges for the consumer value it predates (sic)." ("Predates?")

Guy Adami rationalized Martin's assessment. "This is how you get around their 60-times forward earnings valuation," he said, suggesting a retest of 385 will happen.

Tim Seymour said he "wouldn't touch it." Martin said, "I respectfully disagree with all of them."

Karen Finerman asked Martin, "Why not do an equity offering here" that would be a "relatively modest" dilution?

"I mean you can," said Martin, unconvinced, but insisting that Reed Hastings instead is smartly putting his free cash flow into new markets. "Netflix is a big international story that Wall Street is underestimating," Martin said.

In what sounds like a stretch, Martin claimed, "Every time you add- add a subscriber, it's worth probably $2,000 lifetime value, we calculate." (Whether that means $2,000 revenue, or market cap, or Tim Seymour's hair gel, we have no clue, and Mel didn't bother to ask.)

Only Tim Seymour does not make wishy-washy calls about this maybe being a top

Stocks roared for no reason Monday, and Brian Kelly couldn't wait to make a (snicker) bear case on Monday's Fast Money.

"I'm stunned by today's market move," Kelly said, before pointing to the failure near the top and asserting, "Some people are gonna start saying, 'Was that a false breakout?'"

Tim Seymour, who clearly has watched Oliver Stone's "JFK" on cable recently, claimed there's "some big conspiracy theory" behind why people now wanting to sell the high were selling the bottom 7% ago.

Guy Adami clumsily indicated at first that he likes biotech but sees a "pretty wide divide there" between valuations and revenue, and so maybe it's a good time to take profits.

Karen Finerman cited XBI as an example of what she's doing, selling out-of-the-money calls; according to Finerman they have to be more than a month away and out of the money so as not to affect holding periods. "We have been selling into the rally," Finerman said.

Tim Seymour and Brian Kelly bickered over whether China reports were significant; "I don't think we got new news this week," Seymour said.

Guy Adami said that FIG "all of a sudden looks interesting," and he pointed to strength in NVDA as well.

Dennis Gartman reveals that it’s freezing in Winnipeg

We're not sure why Dennis Gartman elected to call into Monday's Fast Money, unless he was simply meeting a quota.

Gartman stressed that Ukraine will not have much impact on the natural gas market and so it's "illogical" to make a trade in it based on the weekend's events.

Gartman called Venezuela leader Nicolas Maduro "a stupid communist" and said that nation's upheaval figures to be bullish for oil.

Gartman also tepidly said recent price action in copper isn't great for the U.S. economy, but that it's only been a few days.

Tim Seymour declared, "I wouldn't be going short copper here."

Scott Nations said January 20 calls in WFT were hot.

Tim Seymour said of FSLR, "I'm not sure I need to gamble on this one," but regarding SCTY, Seymour advised viewers to "take advantage of the weakness."

However, Karen Finerman said an earnings delay for SCTY is never good, and Guy Adami called the stock a "no-touch."

Back on Jan. 17, Joe was building a ‘bigger and bigger’ SHLD short position, predicting ‘low 20s’

Tim Seymour on Monday's Fast Money issued a Brag Trade on SINA, saying he bought recently in the high 60s, and "I do believe they are starting to monetize," but he thinks you should never chase this stock.

Brian Kelly actually claimed that QNX is not only gonna be in Fords, but is in parking meters, so you could drive up and learn where the parking spaces are, "That's what the value of the QNX is," and if that's the bull case for BBRY, goodness help them.

Kelly called eBay a buy.

Guest Sarbjit Nahal took up one of Mel's favorite subjects (even though it's incredibly boring), cybercrime. "Cyber is increasingly morphing into a national security issue," Nahal said, Zzzzzzz, adding that only "3.8% of IT budgets" are allocated to this concern.

Brian Kelly suggested FEYE and ORCL as the plays here, the latter because "companies are gonna have to decentralize their databases."

Tim Seymour said of DDD, "I would not be in this space."

Karen Finerman said the latest offer for JOSB will be hard to pass up. "We bought some stock, sold some April calls against it," Finerman revealed.

Guy Adami thinks DAL gets to 35.

Karen Finerman said too many factors aside from the retail environment are involved in SHLD's price, and "I wouldn't short that" on the DDS news; she'd much rather short JCP.

According to Brian Kelly, buying CMP never makes sense because you can’t know if next year’s winter will be horrible

Steve Tanger visited Monday's Fast Money set basically just to explain what an outlet mall is. Melissa Lee reported an intriguing number, that the average household income of an outlet mall shopper is $93,000, which actually isn't surprising given that these places are generally in upscale areas.

But Tanger, who admitted the number is "somewhere in that area," said the malls also serve those who "want to aspirationally shop."

Karen Finerman said Ralph Lauren has managed to keep itself a premium brand while thriving in the outlet space as well, while Coach hasn't.

Guy Adami said of SKT, "Decent (sic, not "benign") tape, the stock goes higher."

Adami congratulated himself on suggesting last week waiting to get into GRPN, stating Wednesday is the day and that it might hit $7.50.

Karen Finerman said she'd buy CVS over WAG.

Brian Kelly insisted pricing for CMP this year is over, so the reason to buy it is if you think next year will require just as much road salt, which doesn't make any sense; actually you'd be buying it on the possibility that municipalities start committing to more of it next year, which could in fact be prompted by more storms this season (there's a month to go).

Tim Seymour's Final Trade was SINA. Brian Kelly said HFC, Karen Finerman said NADL (that's one we haven't heard on the show), and Guy Adami said NVDA.

Mel’s got everything working

Monday's Fast Money opened with a treat — Mel in new blue top with new hairstyle.

More from Monday's Fast Money later.

Apparently Andrew Left really got under Josh’s skin

Josh Brown said just last week he was in DDD for the long haul (and chortled about those who had criticized his position on-air), then reported on Monday's Halftime Report that he changed his mind.

"I can hear the needle going across the record right now," said Judge, as Brown revealed "I had some 2nd thoughts" that involved sentiment for the name and the company's emphasis on investment.

Jon Najarian however was positive on DDD. "Somebody would be out there shopping, and it might indeed be Hewlett," Najarian said.

Herb flies all the way in to ask panel how much Netflix’s Comcast deal costs

Herb Greenberg sat down with Monday's Halftime Crew and scoffed that this is a "Pete Najarian-type market where all news is good news" before asking the group about Netflix's Comcast deal: "What is the cost of this."

Nobody seemed to know, but Stephanie Link suggested "that's already baked in to the margin guidance."

Josh Brown flung it back at Herb, questioning the cost of NOT doing such a deal, an observation backed by Judge.

Zuck placed in tech Rushmore

Judge's directionless Monday Halftime Report started off with a tentative rehash of Facebook's WhatsApp buy as viewers were led to believe they'd be getting live clips of Zuck in "Barthelona."

Josh Brown said of FB, "It just seems unstoppable," and Jon Najarian defended the buy (strictly because of the stock performance for the last 3 days, not because he really knows whether it makes sense); "I think that's a great purchase."

Stephanie Link said it "makes me more frustrated at Apple," but Doc decided he didn't have to join into that refrain for the 4th time in about 3 CNBC programs.

Guest Ekaterina Walter listed Mark Zuckerberg in elite company, that of Steve Jobs and Jeff Bezos, the latter being our favorite (hence the image above). Walter called the WhatsApp deal a "vintage Zuck move," and you'd think he was Barry Diller.

BBRY’s goal: Crash Zuck’s next Valentine’s Day dinner, get an offer

Evidently feeling an aftereffect of WhatsApp animal spirits, Jon Najarian on Monday's Halftime Report insisted his bull call on BBRY had nothing to do with Facebook.

Doc instead somehow called the stock a buy based on Ford dumping some MSFT system and "now they're gonna go with BlackBerry."

Brother Pete actually played the bear, unfortunately with Simon-style metrics, shrugging that the stock is already up "30% for the year."

Asked to opine, Josh Brown backed Doc. "This is not really a hard trade to do. It double-bottomed at $6," Brown said, but the funny thing was, Brown ended up getting into it with fellow observer Stephanie Link, who wrung her hands and said, "It's hard because the fundamentals are horrible."

‘Lack of sellers’ detected

Monday's Halftime gang was practically clueless about Monday's rally, with Pete Najarian guessing that the "huge thrust" from integrated oil companies was a sign of strength.

Stephanie Link crowed that Cramer is "way overweight energy now."

Ben Willis, who for the last couple weeks has been warning that the correction isn't done, could do no better, stating "We are in the midst of a global recovery" and that there "appears to be a lack of sellers."

"The only impediment to this market is gonna continue to be the central banks," Willis asserted.

CNBC's Chief International Correspondent, Michelle Caruso-Cabrera, zipped over from Sochi to Kiev to report that Ukrainian bond buyers in the last few days are making money, that's the time to buy, "quite literally when there is blood in the streets."

It took until the end of the program for Pete to make his obligatory UA reference

David Snoddy, whose credentials were extolled by Judge, told Monday's Halftime gang that Japan realized a couple years ago that if it didn't take radical steps, it would be "completely overshadowed by China."

Snoddy sort of concurred with Josh Brown's point that the apparent smooth decline of U.S. QE is a positive sign for Japan and added that the U.S. exit of QE is good for a weaker yen.

Snoddy said casinos are another element to the Japan story. "It's totally gonna happen," he said, by 2020, and he thinks Mitsubishi will be the primary entity seeking blue-chip partners.

Back home, Mike Solimano said Killington Resort has gotten just an average snowfall this year, but the excess in New York and Boston has prompted people to think more about skiing.

Jon Najarian suggested COLM as a play. Stephanie Link suggested MTN, Pete Najarian said UA and Josh Brown, in a good line, said he would play the hospital REIT for himself.

Joe crushing it;

Simon down 13% already

Pete Najarian on Monday's Halftime Report said of EBAY, "I think this goes a lot higher."

Stephanie Link said of DRI, "Under 50 it's interesting."

Jon Najarian in a case of wishful thinking said CHK's move might bring more focus to (his Playbook Playoffs choice that he talks about once a week and his only decent winner) BHI as well as HAL.

Josh Brown said the Blue Harbor-Tribune negotiations are promising.

Steve Cortes was heard to say on Street Signs that defense stocks will continue to receive endless "corporate welfare."

Pete Najarian's Final Trade was DFS. Stephanie Link said IPW, Josh Brown said TAN and Jon Najarian said RKUS.

Important birthday Tuesday

Our Birthday Notification Dept. has spent the last several months quite frankly bungling nearly every early announcement of CNBC-related birthdays. (That means, in other words, not actually announcing them.)

Not this time.

Karen Finerman will observe a special day on Tuesday, so you've got ample time to convey your happy wishes. (Note that it's not yet one of those milestone numbers.)

Now, are we gonna get a call from Karen stating, "Hi it's Karen, let me ask you something, are you gonna meet me at Campagnola to discuss Finerman's Rules?"

No, we're probably not gonna get a call from Karen stating, "Hi it's Karen, let me ask you something, are you gonna meet me at Campagnola to discuss Finerman's Rules."

And that's OK. We'll just hope to see some sort of celebration on Fast Money.

[Friday, February 21, 2014]

Doc wants AAPL to buy something. Anything.

Jon Najarian on Friday's Fast Money Freestyle piled on to his own AAPL Halftime Report tirade, explaining he "absolutely" agrees with the downgrade and thinks it could become the next MSFT.

Tim Seymour pointed out, correctly, that Najarian recently was Katie-barring-the-door in the stock, and asked him what's changed.

Najarian first said it was seeing them buy back $14 billion worth of shares, and then hearing about WhatsApp going to Facebook, "To me that was it."

Seymour, though, said "I would've been very scared" to see Apple buy WhatsApp, and called the shares interesting around 525.

Guy Adami put AAPL in "no-man's land" and called it a "no-touch."

Brian Kelly first said, for a pairs trade, "I would be long Apple and short Facebook," which elicited a "Wow" from Melissa Lee. (Not the "Sham-Wow" in the later reference to Mel's Shamu outfit.)

But moments later, Kelly said he wouldn't be long AAPL at all.

So you figure that out.

Mel: Ukraine contained

Gold happened to get considerable attention on Friday's Fast Money Freestyle, with Guy Adami endorsing NEM.

"I still think you can own these names," Adami said, later offering PAAS as his Final Trade.

Tim Seymour said, "I like Barrick at these levels," and made ABX his Final Trade.

Jon Najarian said he likes ABX as well as GFI and GG.

Brian Kelly said, "I'm short copper right now."

Melissa Lee's academic way of addressing Ukrainian turmoil was to say, "The contagion hasn't really spread too much."

Tim Seymour told everyone, "It's not 'The' Ukraine."

Somebody was turned on by Mel saying "Arabica."

Hard to believe no one

mentioned Lions Gate

John Jannarone, given the nickname "JJ Flash," actually for a couple moments expressed evidence of a sliver of a sense of humor on Friday's Fast Money Freestyle while asserting Starz could be another HBO because it has overcome lackluster original programming by being conservative and because "EBITDA looks great ... they've got runway."

Jon Najarian rather lukewarmly said he'd take a look at Starz, and Guy Adami equally lukewarmly said it looks OK on the beloved benign tape.

Guy said his wait-a-few-days call on GRPN a day earlier was a "prescient call by us."

Doc indicated he wish he'd paid attention, having paid $8.40 for GRPN on Friday.

Doc gushed that UA screamed higher on Friday amid a supposedly difficult week.

Brian Kelly said of STX, "I would stay away from this if not short it."

Tim Seymour said BKS is worth following because "these guys will not give up on this name."

Najarian said HD 78 calls with a Feb. 28 expiration were hot. Tim Seymour said one thing helping housing is that "there's not a lot of supply."

Movidius chief Remi el-Ouazzane said something along the lines of the goal being to bring human vision capabilities into devices.

Guy Adami said the weather has "wreaked havoc" with AGU and it can see $100 on a "benign tape."

Jon Najarian said of MRVL, "I like it," but "I think you can wait a little bit."

Tim Seymour said, not surprisingly, "I would be buying weakness in Yandex" and advised a 35 stop. But he fumbled at making a call on MA, which Guy Adami would clearly take over EBAY, a "face job" to Carl.

Jon Najarian gets a vibrating wake-up call from Fitbit.

Najarian's Final Trade(s) was JOY and HD. Brian Kelly said to sell EWZ.

Judge sort of overstated the greatness of Friday’s JWN debate

At least it didn't begin with Stephanie Link stating, "This is NOT a play on the earnings report."

But the JWN debate on Friday's Halftime Report lacked oomph, largely because Josh Brown brought almost nothing to the table.

"They'll figure it out," was Brown's bull case. "It's ridiculously cheap."

Link, the bear this time, asserted that "2014 is a year of further investments," and the company has "zero operating leverage."

Brown's argument was strange, not just because he really had no catalyst, but because recent support has been around 55, and buying at 59 looks like a questionable place on the chart.

That's perhaps why Jon Najarian said Brown's case was OK for the long term, but in the short term he expects more selling, to 55, where he'd be an "aggressive buyer."

Brown told Link, "Stephanie, what I really want is for you to take me shopping at Nordstrom."

Great idea. Brown can go with Link, and we'll go to JWN with Seema Mody.

Doc: Tim Cook mulling a deal is like an ‘ice-cube thawing’

Jon Najarian on Friday's Halftime Report continued to pound away at AAPL inertia as the stock market claimed victory for FB post-WhatsApp.

Najarian hilariously stated that Facebook executives (um, there's about 1 or maybe 2 people who count) "don't take like an ice-cube thawing" to evaluate whether to make a deal, while we never hear anything about Apple mulling something like an Instagram or a WhatsApp.

Najarian said that news reports indicate Google was willing to pay the same price for WhatsApp, but was rebuffed. Stephanie Link said Google has still spent $5 billion on acquisitions but that Cramer "sold some Apple yesterday."

Guest Terry Kawaja said the price for WhatsApp is steep, but "there's a there there," and it "feels entirely different" than 1999 because these are serious companies fetching the high multiples.

Kawaja said the WhatsApp price was worth it to Facebook because "this was a defensive play" that keeps it out of the hands of Google and others.

Josh Brown said it's "obviously a runaway year for M&A" that could get even more interesting if it seeps into the security space.

Superfox Seema Mody, who wore a stunning lilac outfit but wasn't given enough of a screen for us to get a good picture, told Judge that tech companies are flush with cash, and "when you got more dough, it's easier to spend."

TSLA hit for valuation

TSLA watcher Efraim Levy downgraded the stock and told Judge Wapner with a straight face on Friday's Halftime Report exactly why:

"Valuation ... I think it's ahead of itself," Levy said.

Levy predicted the stock would be volatile and asserted, "It's really hard for me to be positive on the valuation at any point," but admitted, "There is risk of further price appreciation."

Ya think?

Dr. J repeated his long-standing point that Tesla was made a monopoly in high-end electric cars when Fisker went out of business.

Judge actually claims the NFL brand is ‘in jeopardy’ because a Baltimore Raven got arrested

Jon Najarian, in the day's most interesting trading call, backed GRPN on Friday's Halftime Report. "I like the company here at this level," Najarian said.

That didn't sit well with Josh Brown. "No way ... I don't get it," Brown said.

Brown, though, was able to crow about DDD, pointing out "lots of guys like to come on TV and bash me about it," while conceding that at Friday's level, it's a "great opportunity" to sell.

Stephanie Link grimaced at HPQ. "I would not chase this stock," Link said.

Link cheered HOT and its special dividend. Doc noted the stock was his Final Trade recently because of options activity, and whether those buyers knew of a special dividend "would bear some looking into."

Link grumbled that UA is trading at "53 times forward estimates."

Anthony Grisanti said crude was sliding in part because the Houston ship channel was clearing up. Jim Iuorio said crude actually "looks good" as long as it stays over $101.50.

Judge for whatever reason brought in Sports Illustrated's Andrew Lawrence to ask about damage to the NFL's reputation. Lawrence first indicated that the combine is getting going, and basically that's all the league cares about.

Lawrence said the league's biggest hit came from the "Frontline" episode about concussion effects and somehow implied that mothers never were concerned about their sons playing football until the last year or 2.

Jon Najarian suggested the NFL could test for steroids during the season, which would make the players smaller and not hitting with such force. Lawrence sounded skeptical that would make a big difference. What he should've told Doc is that it's in nobody's interest to have the big stars suspended, which certainly would happen in this case.

Judge said CNBC asked the NFL for a response, but "we have yet to hear back."

Jon Najarian said the SWY move isn't a surprise, "they were going to be putting themselves up for sale."

Lawrence Delevingne, who has written a few hedge fund articles on CNBC.com and thus occasionally gets summoned to the Halftime Report, called HLF "officially the worst investment ever made by Pershing Square."

Showing he's got the hang of it, Delevingne added, "At the end of the day, hedge funds are a numbers-driven industry."

Keith Banks twice said his investment approach right now is "rational optimism." Translation: JWN could bounce up to 65 ... but you won't be going shopping there with Seema Mody anytime soon.

Banks sees a market multiple of 16-17 in 2014.

Final Trades were cut off because Judge lollygagged at the end of the program. Stephanie Link was able to mention BAC, Josh Brown didn't even get the name KWEB in, and Doc was left silent, but according to CNBC.com, Doc likes CRM.

[Thursday, February 20, 2014]

Karen still doesn’t get it

In not the most convincing opinion, Karen Finerman on Thursday's Fast Money Freestyle said if she had to do anything with WMT, she'd buy it.