[CNBCfix Fast Money Review Archive — April-May 2020]

Pete says no one wanted DIS at 100; Joe says he did

Thursday's (5/28) Halftime Report was marked mostly by Grandpa Joe's grumbling.

Joe Terranova said that on the one hand, there's the Nasdaq giants powering the market, but now there are "Dash for Trash" names linked to a U or L curve that have recently lifted the indexes. Joe resoundingly declared he approves of the former and not latter: "I'm not going to bite and jump across and buy the Dash for Trash," Joe said, because it's "irrational exuberance."

Wow. That's kind of a harsh description of a 2-week rally.

Liz Young said "95% of the S&P 500" is trading above its 50-day, so you can argue the whole index is "slightly ahead of itself" (snicker).

Jim Lebenthal, however, differed with Joe, stating that if we don't get a "second wave" of COVID-19, then sectors such as airlines and cruise lines still have room to go. (This writer is long AAL and UAL.)

Trying to throw water on the rally, Joe questioned the level of interest rates and — this was a good one — the VIX trading over 25.

"We're still in the midst of a pandemic!" Judge blurted, regarding the latter complaint. Pete Najarian seconded Judge on that.

Joe, who's kind of got Jim's skepticism this season as far as not believing the market could be this strong, said he "absolutely" would like to see rates going up.

Pete chortled about the analyst who downgraded DIS, as he often does about any analyst opinion against his favorite stocks. Pete said he couldn't talk anyone on the panel into buying it at 100. But Joe claimed, "I bought Disney down at a hundred dollars."

Pete said if DIS gets to 130, "I'm probably gonna take that off." Joe agreed that 130 might be "rich," but he'd buy again at 105. (See, it's not a "Dash for Trash" name.) (It's interesting that nobody thinks DIS should have less of a premium because it's Chapek and not Iger.) (If the stock carried a premium because Iger is running it, shouldn't it lose that premium when he's not?)

Judge said there's "pent-up demand times a thousand" for watching sports on TV.

Judge said the Mark Zuckerberg interview was a "huge get for ARS and CNBC."

Joe handled a viewer question about how many stocks a person should own, suggesting somewhere ranging from 9 to 29. Judge jokingly called Joe "29 and 9" at the closing, when Joe said HD for a final trade, "Buy high, sell higher." Judge asked if Joe's book with that title is still for sale.

Once again Thursday, as is basically the case every quarter, the Najarii fell for the call-buying in SNAP. (Sometimes it pays off; other times, it doesn't.)

Doc says DIS crowds will be coming back ‘in a big way’

The beginning of Wednesday's (5/27) Halftime Report was partly interrupted by Bob Chapek's Squawk Alley interview; moments later, Judge asked Joe Terranova about DIS.

Joe mostly just grumbled about not catching the shares at the bottom.

Jon Najarian was much more effusive, asserting Disney's theme parks will be "coming back," and, "I think crowds are gonna be coming back in a big way."

The star guest was Brad Gerstner, who was given an extraordinary amount of time and made a lot of compelling points about FB, except for Oculus (Zzzzzzzzz) (#useless).

Gerstner also kept referring to UBER as "we."

Asked about airlines (this writer is long AAL and UAL), Gerstner said if he were Warren Buffett, mentioning the 89 years old part as if that has anything to do with it, that taking stakes in airlines was still just a "small investment" in Buffett's portfolio and that he'd probably sell airlines too. But he also said there's a "band of outcomes," and "One of those potential outcomes is that these things are barnburners over the course of the next 12 to 18 months."

Update: Karen Finerman was heard to mention "too fast too soon" (as a concern) on Wednesday's 5 p.m. Fast Money, but she still sounded reluctantly bullish because of the Fed. A day earlier, Guy Adami was heard to say something about (not exact quote) "today's market is actually more expensive than the February peak." (Snicker) (Double snicker)

Jim indicates he’s happy as a clam

In a sleepy episode of the Halftime Report Wednesday (5/20), Judge once again got a chance to ask Jim Lebenthal about Jim's cash horde of 13% or whatever it is.

"I don't want to give the wrong impression. I'm really enjoying this rally," Jim explained. (Yes, but he's been talking it down since early April, not realizing that stocks are going straight up until the Fed starts to hint "maybe it's time to withdraw some of the stimulus.")

Jon Najarian, who typically assesses the market trends of the day or even hour better than anyone else on the show, gushed about several stocks or sectors and took up Tom Lee's baton in asserting "there's all this pent-up demand."

That's exactly right. We've been hearing for months now from a lot of bearish-leaning folks on CNBC about how (not an actual quote) "Even though they're opening restaurants and maybe playing some sports games, nobody's gonna want to go." That seems like a startling underestimation of the American consumer.

"Ricky Sandler was exactly right," said Doc, that this will be the "Raging '20s."

Grandpa Joe Terranova warned that in the 2nd half of 2021, "You are going to have an avalanche of debt maturity for the energy sector (snicker) that is going to have to be dealt with in a refinancing capacity." (Second snicker, basically for the whole sentence.)

A day earlier, Judge brought back the guy with the 800-point S&P range who always claims he's right. "When a recession comes, it usually marks the end of the bear market," the guy said.

Joe seems to say JPM can’t reach January high but says he’s ‘not sure’ he said that

The most interesting element of Monday's (5/18) Halftime Report was the notion, expressed by a couple of people, that Warren Buffett is now a "contra-indicator" of stock market direction.

It was Judge, in fact, who bluntly suggested Buffett exiting airlines and GS and trimming JPM "can be looked by some as a contra-indicator." (This writer is long AAL and UAL.)

Later, Pete Najarian added this: "He's almost doing what he used to criticize people for, when there's blood in the streets, that's when you should be buying."

However, rather than tackle that fascinating subject, Judge was interested in less-compelling material; he actually at the 6-minute mark asked Pete if it's true that "Finally you can buy some value (snicker) names."

Jonathan Krinsky claimed banks are due for a mean reversion trade of sorts and stand to benefit from an "unwind" in the momentum trade.

Judge tried to talk up the idea of buying banks to Kevin O'Leary, but O'Leary scoffed, "It's never time to buy banks."

O'Leary also bluntly told Pete Najarian that selling upside calls means your investment in the stock is "dead." (snicker)

Judge and Joe Terranova clashed once again, when Joe insisted on talking about JPMorgan but NOT THE REST OF THE BANKS, despite the fact Judge spoke of the banks as a group.

"I'm talking about JPMorgan," Joe stressed a couple times, pointing out how great the stock was in January (actually very beginning of January).

"Who cares that it hit a new high in January?" Judge scoffed. "I felt great about everything in January" (snicker) (Must've been backing the 49ers.)

Joe expressed a cheery outlook for the stock but said "clearly it's not" going to reach the "same future" as in January. Judge said, "You just told me though, you didn't think it can get back to the highs of January."

"I'm not sure that I said that," Joe said, "but if I did say that, that's not something that I believe will be true over the next 3 years."

Judge sounds taken aback by Jason Calacanis’ suggestion UBER has been defanged; Josh Brown calls it ‘Ayn Rand’ stuff

Possibly overbooked, Judge waved his panelists and guests through a revolving door on Friday's (5/15) Halftime Report and still seemed pressed for time at the end.

Star Guest 1B was Jason Calacanis, who relished the idea of making political points that Judge attempted to avoid.

Calacanis pointed out the various places where people can congregate, such as subways and Trader Joe's, and suggested government leaders at odds with Elon Musk are "singling him out for some reason."

Then Calacanis started dropping bombshells, stating "California's doing everything they can in terms of taxes, in terms of regulation, to get great companies out of here, and Silicon Valley right now, is, the entire conversation is, 'Why am I here?' ... People want out of this town."

"San Francisco is going to get demolished," Calacanis asserted. "The commercial real estate is going to collapse."

Well, that sounds like a bit of hyperbole. Indeed, the conversation about how far work-from-home will extend beyond the pandemic is a fascinating one.

But we don't think we're quite at the point where, when you walk into Denny's, you'll be speaking into a Zoom conference, ushered to your table by a robot and served a Grand Slam out of a chute by some kid pressing a button in Fayetteville.

Judge asked Calacanis if Uber should consider its drivers as "employees." Calacanis said there's a "very simple answer here," then delivered a lengthy speech, and we're not sure what the answer was, except that he seemed to think it shouldn't be a binary system of "employee" vs. "contractor." (This writer is long UBER.)

Star Guest 1A, The Moochmeister, Anthony Scaramucci, said SkyBridge has got new investments with Ray Dalio and Howard Marks and Stevie Cohen and has switched into Dan Loeb's "juicier fund."

Judge spent much of the show requoting from the latest grab bag of legends' opinions of the market that Judge has been running into the ground, Tepper, Peltz, Druckenmiller, etc.

Jenny Harrington offered that "everybody's a little bit right."

"There still is nervousness out there," said Pete Najarian, who otherwise gushed about a lot of stocks including DIS; "This is one of those names that I absolutely love."

Pete said if live sports come back, "That would be huge."

Joe Terranova observed, "We're all watching the 'Last Dance' about the Chicago Bulls."

What’s the bigger problem: If David Calhoun is wrong, or if he’s right?

The star guest of Wednesday's (5/13) Halftime Report was NFL owner David Tepper, who in fact jousted with Judge on that subject of pro football (in other words, are A) they going to play at all and B) if they do play, will there be any fans) but seemed uninclined to provide any news on the issue.

Tepper definitely didn't want to go there in terms of speculating about an NFL season without fans or games. He seemed to think baseball was a more pressing issue. (He perhaps has heard Judge and Marc Lasry getting nowhere on this subject for the hoops season for the last 6 weeks or so, other than Lasry's cheery (not exact quote) "Oh yeah, something'll get worked out" that we've had to hear every week.)

Tepper got Judge to talk like a schoolkid about the Redskins; honestly, we can't fathom how any Redskins fans would be excited about this season, it would probably be a blessing NOT to watch them play.

Meanwhile, the signature comment referred to the stock market when Tepper said, "I would say that you know, 99 was more overvalued, 99-2000, but, uh, yeah I would say it's one of the most overvalued markets, maybe the 2nd-most overvalued I've ever seen, at that day."

But Tepper didn't seem hell-bent on shorting anything and even made note that stock averages had fallen for a couple of days; it's hard to believe that meager drops such as those would be enough to correct the 2nd-most-overvalued market of all time.

On Closing Bell, Judge recapped and analyzed the interview for Sara Eisen, telling Sara, "I like interviewing Tepper on, on our air, because I think he is, I think he's a straight shooter. I think he's completely honest."

Well, OK, but he really hardly divulges anything of significance, Judge.

Calling a money manager of this stature "completely honest" is like calling Lou Holtz "completely honest" at his Notre Dame press conferences.

Anyway, Judge told Wilfred Frost, "He made it clear he doesn't hate the market."

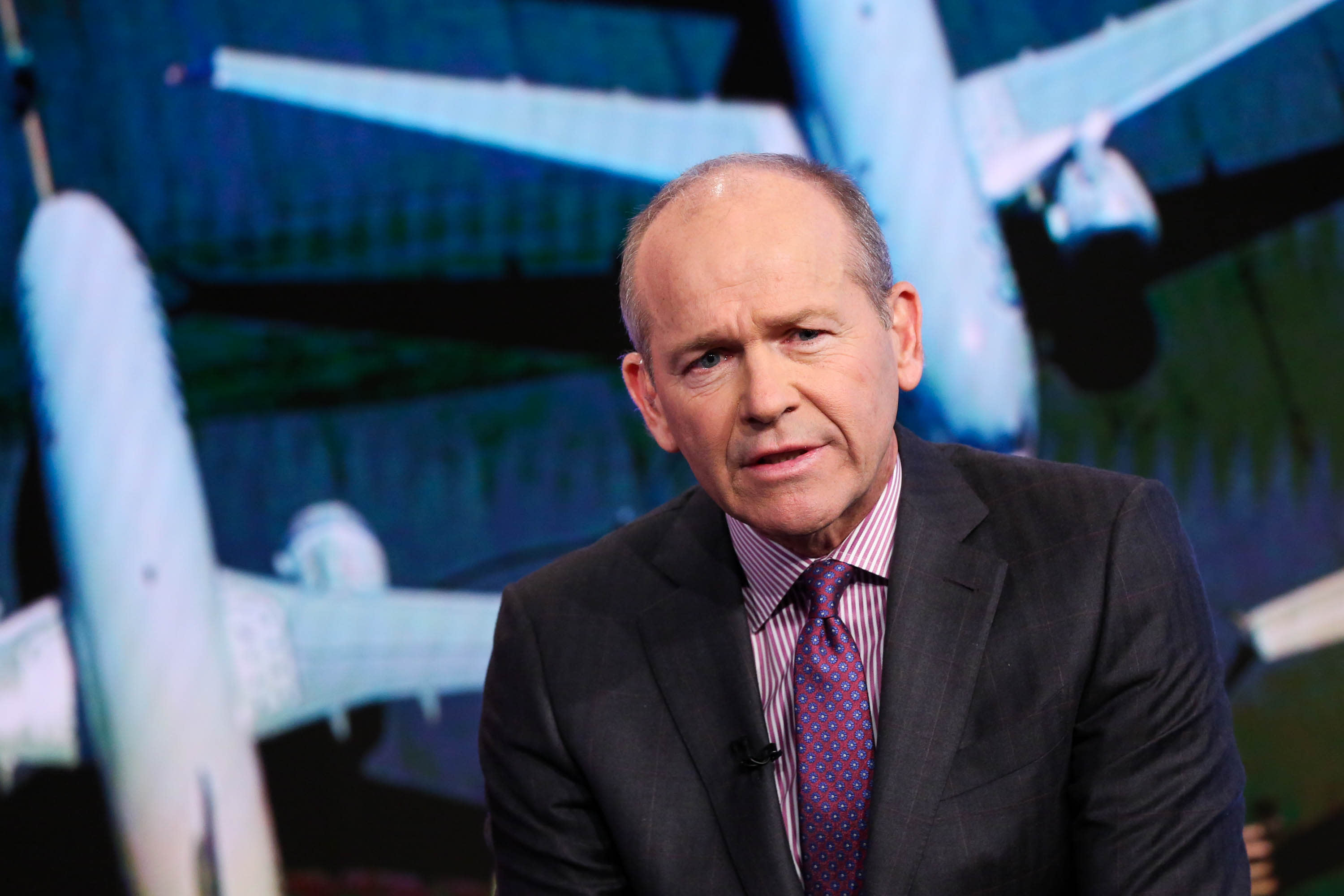

All well and good. We couldn't help but keep mulling for a second day the topic of Tuesday, which was Boeing CEO David Calhoun's casual answer to Savannah Guthrie's question about whether a major airline will have to go bankrupt.

"Most likely," Calhoun said, adding mysteriously that "something will happen when September comes around."

Now, Calhoun sat down for this interview and presumably was prepared. It's not like Maria Bartiromo grabbing Ben Bernanke at a banquet and getting a quote about how the "markets got it wrong."

The guess here is that he was supposed to say something along the lines of, "If we don't get relief to the airlines, somebody will go bankrupt." (See, Boeing and the airlines are kinda like Goldman Sachs and AIG in 2008.)

Instead, what he said actually sounded as though the Boeing board has been actively determining which accounts are going to go bad, and when, and has concluded at least one big airline bankruptcy is inevitable.

But honestly, we can't see how it makes any sense for the government to let any airlines fail, including smaller ones. (This writer is long AAL and UAL.) The biggest air-travel problem before February (other than usual gripes) was that every flight was full, that capacity had been limited in ways that weren't previously practiced.

Sure, that capacity is not needed RIGHT THIS MOMENT, but what should the government do, let all airlines fail and then ask Gordon Gekko to start one from scratch in October? (Uh oh, better not suggest that, Chamath "10 and a half million Twitter views" Palihapitiya might recommend that to Judge.) (Provided Gekko also invests in one of Palihapitiya's IPO offerings.)

Boeing is in major crisis, and observers are still in the process of determining whether Calhoun is the next Larry Culp ... or the next Gerald Levin.

Conclusion: If Calhoun's right, it means at least one of two things: 1) Government gets stingy about bailouts, and/or 2) This pandemic is going to be worse than everyone wants to believe.

Conclusion II: If Calhoun's wrong, it means you gotta wonder how one of the world's most important companies chose this fellow, whose every interview gets clarified later by a spokesman, to be CEO.

David Calhoun has a habit of making comments that get walked back

Judge on Tuesday's (5/12) Halftime Report managed to tout and scoff at valuations of tech giants at the same time.

Judge asked Stephanie Link whether they're "fully valued or overvalued." (Apparently, undervalued is not possible.) "At what point does this start to look kinda ridiculous?" Judge wondered.

But both Judge and Jon Najarian agreed that big tech is "where everybody wants to be."

Doc said he and "an awful lot of our subscribers" bought GRUB calls because he saw the options activity "about 40 minutes beforehand."

Really, the show's only interesting commentary centered on airlines. Stephanie Link curiously scoffed, "I think they're trading stocks at best." (Isn't this supposedly a trading program?) (Otherwise why isn't it on only once a month?) (This writer is long AAL and UAL.)

But that really wasn't the interesting part. Judge referred to Boeing CEO David Calhoun's curious claim in a Savannah Guthrie interview that "most likely," a major airline will go under.

Josh Brown called that a "weird comment."

Doc sort of tried to shrug it off, stating that the question "was posed by one of the hosts ... an off-the-cuff response. ... He didn't go there to deliver that message."

"So what?" Judge asked/scoffed, about 3 or 4 times. (Admittedly, Judge is right.)

Doc suggested "probably the first one to fall" would be a discount airline; he said the 3 majors are "pretty strong here," apparently an opinion based on options activity.

Doc said there hasn't been as much put-buying in the major airlines as the smaller ones. Judge complained that the big carriers got bailouts. Doc said the smaller airlines also got bailouts. Judge said the smaller airlines didn't get bailouts "to the magnitude" of the majors.

Why doesn’t Jim take Doc’s advice, sell DIS puts $10 below current price (a/k/a did you hear about the California Tesla factory??)

Well, if nothing else, Monday's (5/11) Halftime Report was a break from CNBC's endless discussion of Elon Musk's tweet. (About every 10 minutes.) (Seriously.) (See, kind of a slow news month for business media.)

Once again, our favorite guest was Jim ("Denial") Lebenthal, who told guest host Dom Chu, "I'm gonna take a stand here (snicker) ... my next move is likely to be to sell more equities."

Jim cited "the work-from-home phenomenon" that he said would put ongoing pressure on commercial rents, and a lingering hit to restaurants and "high-end retail" that cater to business customers who presumably won't be spending as much time at the office.

Eventually, Jim got around to his real bone of contention that has lasted weeks with no end in sight. "The problem is the market is pricing in a recovery rate that is simply too strong for the fundamentals that I see," said Jim.

Jim also mentioned "a lot of headlines" about United Airlines flying a plane at capacity, "and they were lambasted for that." (A full airplane!!!! DUMP YOUR STOCKS!!!!)

But Jim's most revealing comment was when he said of DIS, "it'a a solid hold for me ... a 10% decline in price would get me to add here."

OK. That sounds like a can't-lose simple put strategy. Sell a put with a strike price 10% lower than market. If the stock doesn't get there, you collect the put premium. If it does get there, you're going to buy it anyway at that price. Is Jim doing that?

The Dominator didn't ask.

Also trying to time the market on a weekly basis, Steve Weiss claimed we're at the "upper end of the trading range" and said he bought some cheap, out-of-the-money puts. He said he doesn't want to make money on those but decided that buying them is the "responsible" thing to do.

Dom Chu said that from a "disclosure standpoint," he's been doing projects at his home, "although I'm not really letting contractors in my house these days."

Wonder if Judge’s interview with the Silicon Valley rich guy who wants airline investors and hedge funds to go broke (except the ones who invest in his IPO) is up to 11 million Twitter views yet

On Thursday's (5/7) Halftime Report, Judge curiously told Jon Najarian that there's "a lot of people scratching their heads" about this market.

Yes, none moreso than Judge himself (as well as Jim (More Pain Ahead) Lebenthal).

The star guest was Tom Lee (unless you count Marc Lasry), who observed, "Stocks generally bottom before fundamentals."

Lee, who has a 3,400 year-end target that Judge says is not the highest on the Street, said stocks are pricing in a "pretty vigorous earnings recovery."

Judge wondered if "no part of you" (snicker) thinks that "we've come too far, too fast." (Remember when we used to do that CNBC Drinking Game, when we put (Drink) after certain comments that tended to be heard several times a day? We might have to restart that.)

But Lee insisted, "I would still be a buyer here," stating "the chances of the S&P making a new all-time high really have increased in the last 2 weeks."

Later, Lasry said he was listening to Lee and concluded, "I don't see how you're gonna have that." (But there's surely great opportunities right now in the credit markets.)

Joe Terranova and Doc gushed about TWLO's "monumental move," and Joe said he thinks it's got more to go.

Josh Brown said that what Bill Ackman did in CMG is "worthy of a chapter in a book somewhere" (snicker).

Judge sounded thoroughly amazed that the VIX has fallen recently from 32 ... to 30.

It's amusing that Judge's 7 p.m. Eastern (since March) "special report" show is called "Markets in Turmoil," when the markets are doing great; it should be called "Economy in Turmoil."

S&P closed at 2,529.19 on March 17, when Ricky Sandler said to ‘refinance your mortgage and take the money and buy some stocks’

Judge offered up another Halftime Report Tuesday (5/5) that once again went through the motions.

Judge has spent the last 3 weeks basically talking down the "too far too fast" market while Ricky Sandler, a controversial guest on March 17, has proved basically exactly right.

Jon Najarian on Tuesday talked about winners in the tech space (that aren't just holding their own but seem to be thriving) and then singled out, in a beautiful point we wish this page had made, those people who keep talking about wanting to buy stocks lower.

"If you're really committed to it, sell that put $10 lower," Doc said.

Jim Lebenthal said Tuesday he's looking for stocks that "dislocate" (translation: Jim wants everything to go back and retest the March 23 lows so he can buy at the bottom).

Bryn Talkington called the GILD drug "Resminivir" (sic). (Not to be confused with "Mrs. Miniver.")

Karen Finerman on the 5 p.m. Fast Money revealed, "I actually have 12 college kids living here now." Mel clarified moments later, "The 12 kids are not all hers, although 4 of them are."

Warren Buffett likely exited airlines so that his name wouldn’t be attached to bailout headlines

Judge's Halftime Report on Monday (5/4) launched into a discussion of Warren Buffett's airline sale.

Apparently not wanting to sound critical of Mr. Buffett on television, Pete Najarian posed his obviously correct assessment in the form of a question, asking Judge, "Was he getting out on the lows?"

Yes, Pete. (This writer is long AAL as of Monday.)

Andrew Ross Sorkin, not normally on this program, suggested Buffett is not saying it's a "probability" that we're having a "deep, deep recession," but more like a "possibility." (Zzzzzzzzz)

What nobody hypothesized is that Warren Buffett is likely not making a business judgment at all, but a political one, that he doesn't want to see headlines suggesting the government bails out industries to help billionaires.

Meanwhile, Bryn Talkington said of DIS, "Thank goodness they did Disney+ when they did it, because I think that gives 'em, you know, a baseline of, of, of revenue streams."

A baseline of revenue streams. That's an interesting one.

She could've said, "Streaming doesn't actually make money, and Iger didn't want to do it, but he felt like he had to because everyone else is, and because Wall Street pros watch all this stuff at home, and that's why they buy NFLX."

But she didn't.

On the 5 p.m. Fast Money, Karen Finerman said stocks have moved "way too far too fast." She also lamented the lack of "clarity" in airlines.

Josh Brown: Markets would be at this level right now even WITHOUT the new coronavirus

Thursday's (4/30) Halftime Report was another day of panelists being personally offended by the level of the S&P 500, even though Jim Lebenthal wasn't there to ringlead it.

Margaret Reid offered that the stock market "has certainly reached fair value" and is "absolutely disjointed" with the facts on the ground. At some point, there must be a "return to fundamentals," Reid claimed.

But Judge said Tom Lee is saying the S&P 500 at 3,000 is "not necessarily irrational" because the market "could be sensing operating leverage."

Steve Weiss stated, "Unquestionably, the market should not be where it is, without a doubt." Weiss said Lee is wrong because "he's talking in a generalization," and that companies will cut capex, and that will "filter through the whole economy."

Judge, who has started to make semi-regular stock calls these days, decided, "All things being equal, Steve Weiss is right. The market doesn't deserve to be where it is. Although that's a loaded word."

Joe Terranova, who clashed with Judge over being able to finish one of his statements, countered that the S&P 500 is "not an equal index." (Although actually, it's more equal than the Dow.)

Even Marc Lasry chimed in about the strength of the S&P 500. "I don't understand it," Lasry said, because every week, there's "more bad news." He said things in Asia are going "really slow."

The whopper came from Josh Brown, who stated, "If there were no coronavirus outbreak this year, I think the stock market would be right where it is now."

Brown said that if in January, you saw the jobless data that we'd be posting right now, you'd think there's been an "alien invasion" and we're at Dow 14,000.

Brown correctly noted that every time there's a couple days of value outperforming, people get excited as if they saw an "oasis in the desert," but unfortunately it's always a "mirage."

Guess they’re not blaming the coronavirus on Cambridge Analytica

Jim Lebenthal, who's been trying to time the market for several weeks now, told Dom Chu on Tuesday's (4/28) Halftime Report, as he usually tells Judge, "We've probably gotten a little ahead of ourselves (snicker) in the market overall."

On Wednesday, we just got a little more aheader!

Wednesday, it was Rob Sechan of all people who revealed to Judge, "I am a little concerned that we've come too far too fast."

Steve Weiss said hope isn't a strategy, but right now, hope is working. Jenny Harrington, on the other hand, said the market's moving not on "hope" but an "increase in clarity."

Karen Finerman, on Wednesday's 5 p.m. Fast Money, said "the political climate" was one of the headwinds against FB before the coronavirus but now seems "almost completely gone."

Judge, who doesn’t even know Joe’s Fast Money handle, faults Joe for semantical lapse of Judge’s own doing

On Monday's (4/27) Halftime Report, Steve Weiss raised a provocative issue.

"I do think the right thing is for the economy to reopen gradually, starting actually yesterday, because the damage is long term," said Weiss, though that wasn't the provocative part.

"And I even said to my wife, I said, 'Look, we may look back in 10 years and say the wrong thing to do was to keep the eoconomy closed as long as we did for a bunch of reasons'; I don't know what they are."

That's the provocative part.

See, people aren't working from home because of the coronavirus — they're working from home because of the Internet.

Had this horrific disease struck in 1990, you can forget about "shelter in place." Virtually no one would be able to work from home. Not lawyers, not bankers, not city councils nor village boards. Schoolkids couldn't do remote learning.

People would've been told, "Wrap yourselves up in masks and gloves and try to keep your distance as much as possible."

Nowadays, we tolerate people being furloughed or laid off at Macy's or Kohl's because we can still buy stuff at Macys.com or Amazon.com. What about 1990, when there was no Macys.com nor Amazon.com.

You got it. Doors open. Masks recommended.

Some elites will pontificate, "Now we've seen a permanent divide in society — those who can work remotely and those who can't." But that's only temporary and fading fast. Before long, we'll find that construction workers, plumbers, garbagemen, lumberjacks and movie theater ushers will be in as much demand as ever.

Anyway, Weiss' point is significant because people may rightly wonder, did we stop too much of the economy for basically no gain. This page doesn't know and isn't faulting any states' or cities' decisions, only saying, years from now, some of those decisions may be faulted. Maybe New York could've prevented its horrific toll; maybe it couldn't have. Maybe it would've been prudent to do this for SARS; the U.S. ended up with zero deaths.

Anyway, Judge got tripped up by semantics Monday, wrongly blaming Joe Terranova for belaboring the point.

"Technology seems somewhat exhausted," said Joe, who called oil's price "troublesome."

Moments later, Judge asked Weiss about stocks being "tapped (sic) out."

"I disagree with the premise. I don't think tech is topped (sic) out," said Weiss, misquoting both Judge and Joe.

When Joe got a chance, he said, "Let me be clear ... I never used the words 'topped out' or 'tapped out,' I said that technology was exhausted-"

"You said- you said- you said- you said 'tired,'" Judge incorrectly cut in.

"Exhausted," Joe said, before going along with it. "Tired, OK."

"I used, I used the words 'tapped out,' in a sense, I mean, it's a similar thought, right; let's not- let's not, uh, go over semantics here," Judge grumbled, even though it was Weiss who misquoted Joe and should've been corrected (but Judge isn't into correcting panelists' mistakes, so whatever).

"Exhausted" or "tapped out" or "tired" seemed to be the terminology of the day.

"I think this rally is gonna get exhausted a little bit," offered Liz Young.

Jeffrey Gundlach told Judge, "All of these markets are looking quite tired these days."

Gundlach uncorked some broadsides at the Cheap Money Era, complaining that under the PPP program, "a lot of people are making 25%" more than they used to, and that he wants to "demotivate people" to stop living life on credit cards, explaining that back when he was a young man and got his first credit card, it felt like he "made it" in society.

Gundlach said a retest of the March 23 low is "very plausible."

One other comment on the show got our attention. Weiss said he looks at the news, reads newspapers (score one for Weiss), "and you see food lines that are miles long."

We wondered, are there really people standing in "miles long" lines for food? Apparently no. Rather, in one or two instances, there are people waiting in cars for a mile or more. (That wasn't really an option for the Joad family in Grapes of Wrath.) According to the New York Times, Reuters and Newsweek (and of course picked up by the Daily Mail), those famously long car lines were in the Pittsburgh area and San Fernando Valley. According to a

recent Business Insider article, people on foot have been "gathering in lengthy lines spanning city blocks or waiting in miles-long traffic to collect groceries from drive-through pantries."

We’re already tired of rich guys knocking struggling companies

The star guest of Wednesday's (4/22) Halftime Report was none other than Chamath Palihapitiya, the rich guy who's glad when hedge funds go bust.

Judge referred to Palihapitiya's polarizing comments a couple weeks ago and described the interview not by its news value but his favorite metric, bot acknowledgments on Twitter. "We mentioned more than 10 million views. I think we're up to 10 and a half million right now," Judge said. (Stop the presses.)

Judge wondered how Palihapitiya can "square" launching a new IPO, as happened Wednesday, to the same type of "speculators" he mocked a couple weeks ago.

"The first thing I would say is, that's not true," Chamath insisted, stating there are "all kinds of differents kinds of hedge funds and investment vehicles."

Referring to his comments about letting airlines fail, Palihapitiya said he wanted to talk about "why it touched such a nerve." He went on to complain about buybacks. Then he hailed Mark Zuckerberg and Jeff Bezos as "great allocators of capital." Palihapitiya said that when companies allocate capital to buybacks and dividends, they're basically saying, "I do not know what to do with this money."

He called buybacks a "stupid idea" before complaining about IBM and Ginny Rometty's leadership.

Judge asked about Tim Cook's buybacks. Palihapitiya talked about 2 kids named IBM and AAPL, one of whom spent money and one of whom saved money. (He didn't mention that one of them earns a jillion times the other.) "You only do these things when the stock is low," Chamath explained.

Judge said it's "undeniable" that companies have "wasted away money on buybacks and other things" and claimed, "Your point is well-taken (snicker)."

Judge suggested that without recent government intervention, Palihapitiya couldn't even have done his new deal. "Scott that's not true," Chamath said, claiming most of the Fed actions "will only be visible in the medium and long term."

Afterwards, Judge asked Steve Weiss to opine. Weiss said, "I think he's misinformed on a few ... things."

Weiss said that as far as airlines, no wonder Chamath is OK with them filing bankruptcy, "he's flying private." Judge tried to claim "his broader thought was not so much against an airline so to speak."

Meanwhile, as for stocks in general, Weiss, like everyone else, is trying to time the market on a weekly basis.

"It's too late to add right here, but on dips, you can buy," Weiss said.

A quick word about Mike Curtis

If you view pro football as entertainment, Mike Curtis is a first-ballot Hall of Famer.

If you view pro football as a skills competition, Mike Curtis still belongs in the Hall of Fame.

Curtis died, apparently on Monday, at 77. He did not die of COVID-19, according to a family statement; he had CTE.

Curtis, a rough and tumble NFL player, was certainly one of the greatest characters and personalities to ever play the game. His obituaries bring to the surface the fact he is not enshrined in Canton.

It's time to remedy that outrage.

Our guess is that most would agree that Curtis was not the same caliber of player as Dick Butkus, Ray Nitschke, Sam Huff or Willie Lanier, or Jack Lambert, who came along later in Curtis' career. Perhaps because of that standard, middle linebacker has proved a tough ticket to Canton. Lee Roy Jordan is not in. Neither is Tommy Nobis.

Curtis played in 2 Super Bowls in his first 6 seasons, winning the latter, the spectacular Super Bowl V, one of the most underrated games in history. His teammates credit him for vowing late in the 1970 season not to lose another game. His mistake probably was hanging on too long. Unitas and Bubba got out shortly after the '72 implosion. Curtis remained with the Colts through '75, being injured for the team's resurgent postseason rally, then suffered the humiliation of being made available to the Seahawks-Yuccaneers expansion draft. Curtis was by far the biggest name in this dubious pool, with only Miami's former stellar RT Norm Evans as another headline name. Curtis not only played in Seattle, he played a couple years after that for the Redskins, to little acclaim.

Pro football takes an immense physical toll. Whether it killed Curtis, we don't know. We do know, as Patton says at the end of the movie, that glory is fleeting, that people who put their bodies at risk to compete at the highest level are a special breed, and that Mike Curtis made the most of what he had, to the benefit of the city of Baltimore and old school football fans forever.

Al Michaels’ FAS has crashed more than 75% in a couple months (Welcome back, Melissa Lee)

Honestly, watching a lot of CNBC shows during the Virus Era, it's getting really tiresome listening to people try to talk in synch with 5-second delays only to end up talking over each and having to unpile and sort things out like late false-start calls in the NFL, and then be heard later thinking they're off-mike trying to tell tech support they can't hear anything.

On Tuesday's (4/21) Halftime Report, the opening question, to Rob Sechan, never got quite to its recipient; after viewers heard Sechan complain a few times during the show, while others were talking, about his lack of connection, Judge said Rob is having a "running dialogue with America" on the status of his connection.

In spite of that, Judge spiced things up by relaying commentary from the one and only Gary Kaminsky, a former longtime CNBC figure, who wasn't on the show in video or audio but according to Judge (from presumably an email at some point recently) "raises the issue, as he raised many months ago, that the USO, what we've witnessed in the ETF of the USO, as a result of the collapse in crude, portends bigger issues to come in other passive products, in other ETFs."

Judge might've been interested in that topic, but his panelists and guests didn't sound very concerned about ETFs. Mike Wilson offered that in today's ETFs, "We find the right price more quickly."

Jim Lebenthal said these ETFs bring retail investors into the futures market world, "and they're gonna get picked off," perhaps like Herb Washington in the 9th inning of Game 2 of the 1974 World Series.

Early in the show, Judge's Pack of Momentum Traders® was handing out letter grades.

Josh Brown said, "I'm starting to come around to this L-shaped idea. And I hate that I am, Scott."

Jim Lebenthal said the market has come back in a "V" but contended that it's "more likely to be a U."

Judge claimed the market had rebounded in a "V" because of the tech giants, but then with a straight face, he claimed, "they finally have come" for those names. (Sounds like an allusion to the "tap on the shoulder.") (Remember, "don't try to be a hero.")

Despite all that, "It's tough to bet against this market," said Rob Sechan.

Jim said the Nasdaq 100 is "basically flat on the year," which according to Jim implies that these big tech names are as good now as at the beginning of the year. Well, AMZN is overrun with orders, just made an all-time high and is looking at a potentially rapidly unfolding economy with zero interest rates and unlimited Fed support. (See, the Nasdaq 100 tends to include names such as AMZN and MSFT, not movie theater chains.)

Jim said he's in 12% cash and would like to lower that number, but "it's probably next week." (Translation: Jim is trying to time the market on a weekly basis.)

In an incredibly embarrassing revelation, Judge said he thought the nickname "The Liquidator" was already taken by someone on the 5 p.m. Fast Money but had no clue as to which panelist (that would be Judge's own Joe Terranova). (Startling when Internet folks have a better grasp of Fast Money/Halftime history than the hosts and panelists do.) (Then again, a guy on the 5 p.m. show didn't know the difference between Diane Keaton and Helen Hunt.)

Judge is assessing news value based on Twitter views

Friday's (4/17) Halftime Report included the usual disbelief, mostly from Judge but also some of the panelists, that the stock market should be as high as it is. (Every time during the show's history when we've heard doubts such as this, the market always seems to continue to defy them.)

However, the show included a bright spot, a lengthy chat with the Moochmeister, Anthony Scaramucci, one of the great personalities of CNBC and someone who used to be mentioned on this page quite a bit. (This page, at least in this posting, is not taking any position on Scaramucci's stint in the White House.)

Scaramucci agreed with some of the panel commentary that stocks do seem priced for perfection in an uncertain time, but he also thinks March 23 was the low, citing in part the VIX and the feeling of "full-blown capitulation" like that of March 2009.

"I sort of am very bullish," Scaramucci said, citing the "magnitude of stimulus."

At one point, he explained, "I'm really cautioning people to hold the line here, do not sell in a pandemic," adding that, "When the market firms up, you'll be regretting, uh, those, those sales."

We couldn't agree more with that latter comment. Yes, many smart people regretted not selling in early March, but they're elated that at least they didn't cave on March 23 because they couldn't take the pain anymore. The problem for bears/shorts is how much do you expect to get. It's possible the health scene could actually get worse; the market seems to think it's getting better, and as soon as humans decide the coast is clear, you'll see a stampede back into equities as well as most businesses.

While speaking with Scaramucci, Judge referred to Chamath Palihapitiya's comments recently about the "bailout" of Wall Street and claimed Palihapitiya's comments "ended up getting 10 million views on Twitter, by the way."

And we're sure a 3rd party can legitimately verify that A) There really were 10 million people actually viewing these comments on Twitter and B) ... That such supposed viewership ... means anything.

Judge asked Scaramucci whether hedge funds should apply for the government business loan fund. Scaramucci said he thinks they should, and then, stated, in the most unbelievable line of the show (other than maybe Judge claiming 10 million supposedly legitimate Twitter views), that "I don't know if we got ahead of that window or not."

Half-hour after Meg Tirrell reports on ‘patients’ making ‘rapid recoveries’ with Gilead’s Remdesivir, Guy Adami reports that he has determined it’s only a treatment and not a vaccine

Gotta like how, when the stock market goes in the direction they want, Fast Money/Halftime Report panelists will tell you "price is truth," and when the market goes in the opposite direction, it's always "too far too fast."

The latter was the sentiment of at least half the crew of Thursday's (4/16) Halftime Report, led by Liz Young.

Judge opened with a mention that Tom Lee thinks the bottom is in and we're already in a "bull market recovery."

But Liz insisted there hasn't been "a good reason" for stocks be as high as they are now. (Was Liz planning, like Jim Lebenthal, to buy on the late March retest that everyone knew was coming? Probably.)

Young later said she sees "a little bit of misguided risk appetite" and cautioned people not to jump on a "momentum bandwagon" (well, if you're trying to avoid falling for "momentum," this is not a show you should be watching).

For his part, Jim asserted, "The Nasdaq 100 is flat on the year ... the market is a little bit ahead of itself," though Jim thinks stocks don't have to "revisit the lows of March 23rd." (This writer is long QQQ.)

Rather, Jim thinks you "have to be a stock-picker." (So we're back to "stock-picker's market" again.) (Surprised we haven't heard Judge in the last couple months wonder if "the machines are taking over.") (#Judge'sgreatesthits)

For about his 17th appearance in a row, Jim managed to say, "I hate being negative Scott, I'm sorry, but I'm gonna be negative." (This page should note Jim is a fine panelist and investor and a welcome presence on the program; the problem is, for a month or so, he's given himself nothing to do because he's obsessed with either P.E. ratios or momentum trading.)

Kari Firestone allowed that tech gains have been "a little bit extreme." Judge harped on Kari's regular use of "a little bit."

Judge asked the crew about an apparent "bifurcation" in the market in which tech is Wall Street and banks are Main Street, which apparently is Judge's way of saying the stock market is doing a lot better right now than the regular economy.

Joe Terranova offered, "Maybe it is just about the Nasdaq" and not the Dow or S&P, saying the Nasdaq index(es) has "absolutely" bottomed.

But Joe urged investors not to "chase" names such as AAPL and MSFT and AMZN.

Kari Firestone shrugged that banks' problem is interest rates.

Judge asked Jon Najarian if the bond market is screaming, "You guys are way ahead of yourselves." But Doc said refilling the SBA loan fund to businesses could be the next catalyst for stocks, and he also pointed out NFLX subscriptions are going through the roof.

Regarding that loan fund, Judge sounded disgusted about the stalemate in Washington. "They need to figure that out, by the way," Judge agreed with Doc.

Judge heard Eamon Javers' report on glitches with the stimulus checks and noted the business loan fund is running dry too; "We can't deal with that nonsense."

Judge said it was a "shocker" to hear Barry Diller's claim that he "won't spend a dollar" on advertising, as if it's true.

As for the glacial return to normal, Liz Young suggested the market wants/expects to see the economy mostly reopened by May 31. Joe said the fiscal support right now is running about 10% of GDP but probably needs to be more like 15%.

At the end of the show, Judge asked value investor Jim about Jim's favorite momentum stock, ROKU. "Right now, it's still momentum, um, I just don't find that the momentum is very powerful," Jim said. (This writer is long ROKU.)

On the 5 p.m. Fast Money, Karen Finerman said she bought JPM call spreads on Thursday because of the stock's "divergence" with the rest of the market.

Sully actually asked Karen with a straight face if she owns AMZN. Karen smiled and admitted she hasn't been long the name; "I never got comfortable with the valuation, which was obviously a mistake everywhere along the way."

Karen said she "sadly" can't get into this name because of valuation (because stocks trading at 4 P.E. ratios in early February were of course bulletproof) and claimed she also made that statement "maybe, I don't know, 500 points ago." (Actually, she's been making that statement since first appearing on the show in 2007.)

Karen suggested AMZN might have big costs lingering for a while.

Oh sure, all those Lehman employees got a nice ‘package’ deal

On another show in which hyper-cautious panelists (who weren't so hyper-cautious in early February but now feel like any stock they buy right now might go to zero) sat on their hands about what to do in the stock market, the most notable commentary of Monday's (4/13) Halftime Report was a rerun from Thursday.

Judge's star guest was Lee Cooperman, and Judge asked Lee to opine on Chamath Palihapitiya's provocative remarks about letting airlines go bankrupt.

Judge replayed Chamath's most curious statement: "This is a lie that's been purported by Wall Street. When a company fails, it does not fire their (sic "it" vs. "their" mismatch) employees. It goes through a packaged bankruptcy, right."

Ah. Folks at Sears will be glad to know that.

Lee described Palihapitiya as an "intelligent fellow" who is "not consistent in his views."

Cooperman, who said he thinks the bottom is in for this cycle but isn't effusively bullish, said that if a coronavirus vaccine is developed, he could see a scenario a year from today, where, if you're going to a concert or sports event, "You're gonna basically have to have a vaccination card."

That's an interesting point, but we can't see it. People presumably could forge or borrow vaccination cards fairly easily. Expecting 19-year-olds at ticket gates to screen 75,000 customers for the proper papers seems a bit of a reach.

On the 5 p.m. Fast Money, panelists tried to sound like the valuation of a market is a profound subject. (You know the deal, in which Guy Adami looks into the camera and says, "I think, even despite this big plunge, the market might even be MORE EXPENSIVE than it was before," when basically it's as simple as buying stocks if the perception that business conditions are getting better and selling stocks if the perception is that conditions are getting worse.)

Guest host Sully asked Karen Finerman about newfound analyst opinions in which you should no longer sell the rips but start buying the dips, and somewhere along the line, the terminology and question became mangled.

"I don't see this as a pullback actually. I see this as a, you know, giant leap up," said Karen. "I think the market now after the run we've had is so much more expensive than it was at 34 hundred, at uh, 3,400 given the uncertainty that we have."

"I'm not adding new things here because I think this market is really expensive," Karen said.

Silicon Valley bigwig wants airlines to file bankruptcy because ‘Who cares’ if hedge funds get wiped out

Well, this was a curious battleground of capitalism.

Thursday's (4/9) Halftime Report figured to be somewhat celebratory, a sigh of relief that stocks were having such a good week.

Early on, Josh Brown pointed out that more than 80% of stocks are still technically not in an uptrend.

Joe Terranova was heard saying, "You're not goin' back to the lows" before static cut short his commentary.

Even Grandpa Jim Lebenthal said "I don't think we're gonna retest the lows" because he believes you "can't fight the Fed" here. Nevertheless, Jim insisted "this is a bear-market rally" and "you will have buying opportunities" if you wait.

Jim said about 4 times he doesn't think we're retesting the lows.

Then came the star guest, Chamath Palihapitiya, who complained apparently about the direction of government relief.

"This rally is effectively our desire to essentially not listen to what I think is relatively evident and hope for the future, but the problem is that hope isn't a strategy (sic grammar)," Palihapitiya said.

He called the Fed's moves Thursday "dumbfounding." (Remember a few weeks ago when a few folks on these programs were personally offended because the Fed cut rates from something like 1.75 to 1.25?)

Evidently missing out on Q4 2018, Palihapitiya claimed the market had "basically seen no vol up until this period."

Given a chance to cut in, Josh Brown said 80% of layoffs are considered temporary, either by employer or employee, according to a new survey. Brown also asserted, "We're in a war," and this is what governments do in wartime.

Palihapitiya insisted the bill will come due some day with "land mines," a curious term for national debt.

Jenny Harrington agreed but then actually said with a straight face, "To us, at Gilman Hill, the way out of this, is incumbent upon voters to in the next round of elections be super-conscious that we're voting for fiscally disciplined leaders (snicker)."

Jenny also wondered, "When does inflation kick in?" (snicker).

Questioning or criticizing government response here is fair enough, but things got wacky the longer Palihapitiya spoke, including this assessment: "We are headed toward all the worst parts of Europe without the best parts."

He even added, "Some form of austerity (snicker) may be required after this period of flagrant spending."

Judge said that in 2008, there was concern about "moral hazard," but right now, "it would be almost immoral" not to do what the government's doing and "to help make people, in Jay Powell's words, whole."

Palihapitiya disagreed with the notion of "whole," prompting Judge to insist he "get" what he's saying anyway. Palihapitiya insisted, "I don't get the point because it's not accurate ... It's basically, you know, treating the American people as if they're stupid."

Palihapitiya said making people whole would only happen if the government would "basically take last year's W-2 for every single United States citizen and say, 'Guys I'm gonna give you the monthly wages that you got last year until this thing is over.' That's how you could make us whole."

OK. Interesting. 1) Not every single U.S. citizen gets a W-2, and 2) would Palihapitiya want guys making $100,000 a month and who haven't lost their jobs to be made "whole" this way?

Josh Brown observed, "Mailing checks of cash to people is the most European thing I've ever heard." Palihapitiya countered that the European thing we're doing is "propping up zombie companies."

Judge asked Chamath if he's arguing to let airlines fail. "Yes," Chamath said, adding that sophisticated investors "deserve to get wiped out."

Judge questioned why anyone would "deserve" to get wiped out by this crisis.

"We're talking about a hedge fund that serves a bunch of billionaire family offices? Who cares? Let 'em get wiped out. Who cares. They don't get to summer in the Hamptons? Who cares," Palihapitiya said. (Oh sure, bankruptcy is a breeze for employees; no pay cuts, no layoffs, no loss of benefits, etc.)

"You have to wash these people out," Palihapitiya concluded.

At one point, Judge suggested maybe "more money is, is, is needed everywhere, perhaps."

That's an interesting outlook.

Dubravko Lakos virtual-heckled by ‘very well-known hedge fund manager’

As Grandpa Jim Lebenthal keeps waiting for something to spend his 8% cash hoard on, Steve Weiss actually summarized the stock market better than anyone on Wednesday's (4/8) Halftime Report.

"When I come out of this, I'm gonna have just an incredible bull market," Weiss correctly concluded, a far more solid assessment than his typical momentum-chasing comments of 2020.

Weiss, though, was also a bit qualified as to the timing, telling Judge he agrees with Howard Marks that it's time to stop playing defense, even though, "We don't know what the earnings are gonna be."

Later, Judge asked Weiss about the impact of a "therapeutic" on the S&P 500. Weiss said, "I think you can see a 20% move in the S&P, maybe it's over 2 days."

Meanwhile, Grandpa Jim said, "In the short run, I just think there is bad news that's yet to come in terms of what the impact on earnings for corporate America is, and we have no insight into it, none."

Jim called his 8% cash "dear currency" for him.

Sarat Sethi, one of our longtime favorites who is modest, doesn't try to time yesterday's move and is often correct, dialed in and told Judge, "I'm not selling into this." Sethi spoke of why he likes AMZN and XPO.

Judge's star guest was Dubravko Lakos; Judge opened up the interview by stating Lakos is predicting another 700 on the S&P by next year.

"How in the world are we gonna do that?" Judge demanded, as if Lakos were claiming 7,000 points instead of a highly reachable 700.

"Frankly we get a lot of pushback on that," Lakos conceded, though we don't know why, but he argued (correctly) that there's an "unconstrained" policy response to this economic crisis.

Judge asked Lakos about "the hit to the American psyche ... We are a resilient population, but we're also not stupid," saying Americans won't walk into a "hornet's nest" if they still think there are "issues" with the virus. (Translation: People might sit one seat apart at the next "Star Wars.")

Lakos said that point is "very fair" but asserted the country can't stay in a lockdown for "a long period."

Judge said that while Lakos was talking, Judge heard from a real Grandpa hedge fund manager who apparently disagreed with Lakos' commentary and thinks low rates signal a weak economcy and that the government's getting involved in business, and that's not good, and demanded Lakos explain what normalized earnings will be and what is a "reasonable" multiple.

Lakos responded that it's a "fair point" that rates are low and earnings are hard to forecast. But he insisted the Fed has "unlimited power to inflate financial assets."

Jim Lebenthal said the hedge funder's comments might be in regard to the government taking equity stakes. Judge said the comment wasn't referring to that, but Jim said it's not a "leap" to go there.

Weiss bluntly suggested the hedge fund manager was simply "missing out on the rally."

Jon Najarian correctly noted with enthusiasm the opportunities in this market.

Meghan Shue, even more stunning from home camera than at Englewood Cliffs, pointed out the average recession historically is 12-18 months long, and while this one will be deep, "it's probably going to be much shorter."

Shue, who we learned was swimming co-captain at Princeton, conceded continued pressure on dividends "could be a real headwind" for value stocks. But, "You can't get too defensive," Shue advised, though she remains "a little bit" defensive.

Shue concluded with an observation that a lot of panelists on Halftime and the 5 p.m. Fast Money need to hear: "If you wait for everything to be in the all-clear, you're going to miss the bottom. And not that you need to time the bottom perfectly, but the market is generally ahead of the worst of the economic data."

Morgan Stanley guy tells Sara he called the recession

Usually he appears on either the Halftime Report or Fast Money (and he manages to have time to appear on those programs quite often), but Tuesday (4/7), Morgan Stanley's Mike Wilson surfaced on Closing Bell with Sara Eisen and Wilfred Frost.

Mike's new call is basically that happy days are soon to be here again. Sara sounded skeptical from the get-go, stating, "I think we should just review your call ... Before this crisis even broke out, you were one of the most if not the most bearish analysts or strategists on the Street."

Mike took credit for supposedly calling the recession. "Our call, uh, you know, basically this recession was gonna happen. Obviously nobody predicted the coronavirus," Mike claimed.

But Sara questioned the suddenly upward bias, saying the only times we get moves like Monday's "are during bear markets."

"Well yeah, we're at the end of the bear market," Mike claimed.

As the interview was winding down, Sara interrupted Wilson for more clarification. "Can you just clarify how you can make this view without knowing when America can get back to work," Sara asked.

"That's why we have an opportunity Sara because nobody knows," Mike said. "We're getting paid to take some of that risk on."

omg, Someone please help the Halftime/Fast Money panelists with all this uncertainty

As this page has been saying recently (see below), airing episodes of The Halftime Report or Fast Money is pretty pointless until panelists start to accept a new bull market.

See, basically they want a crystal-clear signal from the daily index action to give them 100% guarantee that stocks are going higher from here, and, omigod, someone to straighten out all the uncertainty about how much GDP and earnings are going to be this year. (Which is odd, because most if not all of them had no trouble recommending at least some stocks to buy in early February. Didn't they probably see more value lost from that point than potentially from any stocks they might be thinking of buying right now??)

On Tuesday's (4/7) 5 p.m. Fast Money, Karen Finerman lamented the huge gains Monday followed by the disappointing close Tuesday and stated, "I would much rather have had a flat day ... than this kind of action."

Too bad, we guess.

Buying a stock can be so difficult.

On the Halftime Report, Joe Terranova offered all kinds of agonizing qualifiers. Tom Lee held true to form in suggesting a possibly strong recovery, stating, "The crisis could be ending faster than expected."

Grandpa Judge grumbled that a V-shaped recovery "just seems impossible."

Lee also claimed everyone's going to move to the suburbs now. We're not quite sure of that one.

Marc Lasry, as usual, talked about the better opportunities in the debt market (Zzzzzzzzz).

If we have to hear one more person say "The question is," as Joe Terranova and Marc Lasry mentioned Tuesday, well, it'll be time to watch Gasparino on Fox.

Judge asked Joe to clarify what Joe meant by talking about 3-7 of the New York Yankees.

Richard Fisher credited Judge, but until panelists believe in a new bull market, the show is like watching paint dry

The stock market enjoyed a monster upside day on Monday (4/6).

Yet, the Halftime Report (guest-helmed by Dom Chu) was as sleepy as most of today's downtown streets.

Steve Weiss on Monday claimed, "My view has been that we've seen the bottom."

Well, he did say that last week ... but then came April 1, when he boasted, "Right now, I've been selling exposure ... I sold some more yesterday, and I'm selling some more today," and then mocked anyone making a "once-in-a-lifetime" call.

So who knows which direction he thinks the market is going.

Late in the show, Chu brought up airlines. Joe Terranova said he made his "contribution to, uh, the airlines' P&L by buying Delta way too soon." Joe said airlines are facing a "secular" and not "cyclical" challenge.

Shannon Saccocia said she's long DAL and isn't interested in buying more but finding an "appropriate exit point."

On Friday's show, Richard Fisher thanked Judge for a "great service" for hosting the show.

Rob Sechan has an autographed Steelers helmet; camera too far away to determine which signatures are on it

It was a commercial-free Halftime Report on Thursday (4/2).

The star guest was Jim Chanos, who kept calling 2020 a write-off year and basically reiterated his long-running favorite shorts.

In a timely type of comment, Chanos said, "You have to avoid these Chinese companies like the plague, I'm sorry."

Discussing energy, Chanos twice said "integrateds." Years ago, Joe Terranova used to say that term about 3 times per program (along with "penalty box").

Jim told Jenny Harrington, "Avoid the frackers ... it's not a business, it's a scheme."

Chanos spent a lot of time knocking Uber, arguing the trick to it is not having the drivers classified as employees. Josh Brown pushed back, stating "mass transit might be more at risk than Uber" in the wake of the outbreak. Chanos suggested people will be leery of getting into Uber vehicles also. (This writer is long UBER.)

Jenny Harrington concluded that the "super important" thing that Chanos said is that everyone's writing off 2020.

Guess who got to talk first on the program? (Hint: lower right)

If you are one of those people hoping to find that sentiment has bottomed, you might want to check out Wednesday's (4/1) Halftime Report.

(Yes, you also need to check out Bill "Apocalypse Now" Ackman's speech 2 weeks ago, but we're into the here and now.)

Or, you might just as well get Steve Weiss to run your portfolio, because he "can't imagine" how he's going to get this wrong.

Judge opened by asking Jim Cramer to say something; that's not unusual. Joe Terranova explained what the problem is with markets: "I don't want to have a conversation about negative rates introduced once again," Joe said. "The banks are the issue right now."

Then Weiss, who was initially shown on audio before the feed cut out and he had to dial in, took over.

"Right now, I've been selling exposure ... I sold some more yesterday, and I'm selling some more today," Weiss said, despite the fact he said on Monday that he thinks the bottom was in on March 23.

Weiss then mocked those bulls using the "once-in-a-lifetime" refrain. "If you look at all the people who have said 'once-in-a-lifetime buying opportunities,' you can't have 3 once-in-a-life-time buying opportunities. You can only have one. And right now, this is not it," Weiss said.

Judge, who just a few days ago touted John Rogers' "once-in-a-lifetime" call as though Judge endorsed it, said he wanted to be "careful" about characterizing those making a once-in-a-lifetime call, stating they weren't claiming to call the exact bottom.

Weiss said that when he takes a position, long or short, he assesses how he might be wrong. Right now, "I can't imagine where I'm gonna be wrong," he actually said.

"The only place I could be wrong is that the virus- is that we conquer the virus in a shorter period of time, which would be a week," Weiss said.

Summarizing the show, Jim Cramer said at one point, "I think that a lot of us agree that you should just be selling everything here." (That sounds like a buy signal.)

Once again, nobody mentioned how, as soon as the data start improving, there's going to be a dam break in the stay-at-home restrictions across the country and, shortly after that, general global euphoria the likes that we haven't seen.

Once again, nobody mentioned that the economy's problem is hardly lack of demand, it's that the government is (correctly) preventing people from working. This isn't "The Day After."

Judge thought he was being dramatic by interrupting Mike Mayo multiple times to ask if Mayo was standing behind his overweight on C, BAC, JPM and GS, despite lowering estimates. Mayo didn't flinch, saying this is an "earnings recession" and not a balance-sheet crisis.

Joe Terranova apologized for having to look away from the camera.

We got excited to see Karen Finerman on apparently home video twice this week on the 5 p.m. Fast Money, but Karen didn't exactly knock our socks off with her commentary Tuesday and wasn't quite Ricky Sandler-in-fuchsia on Wednesday, saying of the banks, "I'm concerned about credit quality" and adding, as far as price-to-book valuations, "We don't know what book's gonna be.

"You have to be in companies that have balance sheets that can survive," was Karen's advice.

Karen did allow that it was surprising to see the Carnival Cruise Lines bond offering oversubscribed.

Karen, who said she's long SBUX, suggested people might keep buying treats from Starbucks (but she didn't use the term "affordable luxury," although that's what she was saying).

Regarding the trucking sector, Karen pointed out that finding drivers recently was a big problem, but now it might not be such a big problem, plus gas prices are low.

On Closing Bell, James Gorman actually told Wilfred Frost with a straight face, "I really don't look at the stock at all now. I don't care." But he was able to rattle off what price the stock traded at 3 months ago, 12 months ago and even today.

Moments later, Sara Eisen noted the day's slide in the Dow and said, "President Trump last night warning of a very, very painful period here for the next few weeks for America. That's clearly impacting sentiment." If you're trading based on Donald Trump's assessment of the coronavirus, you're likely making a mistake.