[CNBCfix Fast Money Review Archive — January 2018]

[Wednesday, Jan. 31, 2018]

Erin Browne says stock market has already made half the year’s gain

Steve Weiss on Wednesday's Halftime Report contended that stocks are in a "small consolidation period," but that as we get into the heart of earnings season, "We'll probably take off again."

Weiss said, "The snapback's not all that convincing because it's losing steam."

He said he bought more BABA on Tuesday and "tried to buy some other things."

Joe Terranova suggested getting into GS. Joe actually said, "Howard Marks was excellent yesterday in highlighting the fact that it's not a time to add risk if you're long, stay long, there's no need to get aggressive." See, that's having it both ways, avoiding a "sell" call while professing caution. What's that line from Karen Finerman, if you go home long a stock, it's the equivalent of buying it at the day's close?

Joe said a correction would be "welcomed" but that the market is now "Apple-dependent."

Erin Browne said she thinks the market has "probably marked about half the gains this year, year to date thus far," but there's still "room to run" in stocks.

Kari Firestone said she wrote a piece for CNBC.com about the "absence of cynicism," so she is "very pleased" to see signs of cynicism this week.

Josh Brown reiterated that there's no better time for a correction.

Erin Browne said more and more money goes into low-vol funds, which "exacerbates the problem" when volatility picks up.

Josh Brown pointed out that stocks typically don't run in overdrive forever, asking, "Why should Apple add $50 billion a quarter? That's what it's been doing. It's up 200 billion in market cap over the last 24 months." (Psst: We barely know 2+2, but it sounds like 200 billion in 24 months would be $25 billion a quarter.)

Joe Terranova said the market is "building in the disappointment on the product side" for Apple.

Judge mentioned "euphoria" at the 3-minute mark.

Steve Weiss twice suggests Kevin O’Leary, or someone, is maybe kidding themselves

Kevin O'Leary on Wednesday's Halftime Report trumpeted BA and reiterated it's a "subscription" business now.

Kari Firestone said it's hard to commit new money to a stock such as BA with big recent returns.

O'Leary said he's not trimming because he's been studying balance sheets of companies he owns. Steve Weiss said, "Let's not kid ourselves though, I mean, Boeing is at a valuation that hasn't been seen, and part of that is from the market."

Weiss said the company has been executing, but "This is also a product of the bull market. ... Let's not kid ourselves. This isn't trading on its balance sheet. It's trading on a bull market with good execution."

O'Leary rebutted, "It's trading on my favorite term: cash flow. And that's why I own it. ... I don't see any reason to sell it."

Weiss questioned a Trump crackdown on defense spending largesse. O'Leary said "That's not what (sic) happening," stating Wilbur Ross is going around the world telling people, "You buy these planes from us."

3.0 is market’s scariest number,

unless ...

On the heels of the BA discussion on Wednesday's Halftime, Judge abruptly brought in Rick Rieder, who downplayed the notion of this week being a turning point of some kind in rates, stating they'll "keep trending higher."

Rieder said high yield could trade down a bit, but there's still demand for yield. Rieder shrugged off the possibility of 3.0% but said mid-3s might be a slowing issue.

Steve Weiss said that how the stock market looks at 3.0% depends on ... you know what it's gonna be ... how fast the yield gets to 3.0%. (At least he didn't say "whether it's rising for the right reasons.") Weiss said he's short the 10-year and the longer end.

Judge doesn’t bring up the experts’ campaign against Messenger Kids

Josh Brown on Wednesday's Halftime Report said FB is great at managing expectations but this could be time to "reset the table so to speak" in the wake of the announcement of the news feed changes. (This writer is long FB.)

In a curious line of questioning, Judge questioned how loyal Mark Zuckerberg is to shareholders. Brown said Zuck basically cares about everyone. Judge suggested "shareholders have dropped further down that ladder."

Kari Firestone said re-evaluating the news feed is "absolutely the smart thing" for Facebook to do.

Judge persisted with his theme, stating, "The guy's got half the money in the world. Maybe he doesn't care about shareholders as much as he did a few weeks ago." That's an odd one. Zuck's concern for shareholders has dropped precipitously in 3 weeks?

Joe Terranova grumbled that "Nobody talks about Microsoft," even though the Najarians (who weren't on Wednesday's program) do it all the time. Joe predicted MSFT goes "well north" of $100.

‘Zero interest’ in FL

Judge on Wednesday's Halftime announced that Oppenheimer is hanging a $70 on FL (snicker).

Kari Firestone wasn't impressed given the recent gains; Josh Brown credited FL's recent spike on "massive short interest ... every retailer's up 30%." Joe Terranova said he has "zero interest."

Joe said LLY had a great report, but "there's too much contention" in the space; he likes devices instead.

Judge said EA hit a "new all-time high" (sic first word redundant). Kari Firestone said she's been buying.

Josh Brown said he doesn't like JNPR and that "Cisco is better." (This writer is long CSCO.)

Steve Weiss said you've got time to buy BIIB.

Erin Browne said she's underweight utilities.

Jeff Kilburg said the 14-day forecast is "just crushing nat gas." Jim Iuorio pegged it to 2.80 in the short term and ultimately 2.50.

Erin Browne's final trade was emerging markets. Kari Firestone said SHW. Firestone said she bought SMG before it became a "pot play," and some of the growers have lost court cases that have affected the stock. Steve Weiss said FCEa. Josh Brown said GOOGL, predicting it has a shot to overtake AAPL in market cap. Joe Terranova said WMT.

[Tuesday, Jan. 30, 2018]

Psychic-Tax prof is

targeting Facebook too

In early January, Judge conducted a lengthy Halftime Report interview with folks from Jana and CALSTRS about the curiously benevolent campaign to get Apple Inc. to revise the parental controls on the iPhone. (You can thank this page for keeping tabs on this subject given that Judge has utterly dismissed it since the interview dubbed by the Jana guy as "ridiculous" because Judge was relaying comments from Jim Cramer.)

We noted that one of Jana/CALSTRS' 2 academic expert partners, Jean M. Twenge, believes in a "Psychic Tax" that is levied on kids using the Internet NOT when a kid gets bad news about likes and followers but as that kid "anxiously awaits the affirmation of comments and likes." (See below; there's plenty there.)

According to the Associated Press on Tuesday, Twenge is one of numerous "child development experts and advocates" who has signed a letter "urging Facebook Inc. to pull the plug on its new messaging app aimed at kids," called Messenger Kids.

We took a look at the letter. It is addressed, "Dear Mr. Zuckerberg."

It includes the assertion, "Social media use by teens is linked to significantly higher rates of depression." (We assume that study does not have cause confused with effect.)

So ... here's the deal.

It may be that social media use harms people.

Honestly, it's entirely possible. A lot of harmful activities have taken decades or centuries for society to figure out.

We don't know. We don't understand the infield fly rule, to say nothing of scientific theory.

The experts writing and signing these papers seem to think social media is fine for adults. But not kids.

Charles Penner of Jana told Judge this month, "As you get older the negative impacts that we're seeing with social media actually start to phase out, are gone by the time you're 30."

That puts social media in an unusual health category. Can you imagine someone saying smoking/soda pop/football is OK at age 30 and beyond?

Penner also said, "The research suggests actually limited levels of use actually ... probably beneficial; kids who use their phone about an hour a day actually have more positive mental health outcomes than, uh, kids who don't use it at all."

Those are interesting assessments. Can you imagine Dr. Spock stating that if a kid plays a little bit of football/smokes a little bit, he feels better than a kid who plays no football or doesn't smoke, and that by age 30, people who play football/smoke have equal mental health as those who don't; the losers are the ones who overdid it at age 16?

So here's what we had to wonder: If social media is driving children to depression, isn't this a dangerous product?

And if that's the case, instead of writing letters to Tim Cook and Mark Zuckerberg, shouldn't the signees be demanding congressional hearings?

We did Google searches for Professor Twenge and "Congress" or "House" and "Senate" and, after several pages listing media interviews, saw no hits indicating any testimony to Congress or any demands that Congress investigate these companies.

Among the signees of the letter to Facebook is the ACLU of Massachusetts (it's not clear to us how this is a legal-freedom issue) and the "Badass Teachers Association, Inc."

Still not sure why no one talks about Carl’s ‘Day of Reckoning’

And you thought eliciting an opinion from Mario Gabelli was like pulling teeth.

Judge welcomed Howard Marks to Tuesday's Halftime Report with a question about why the market is tumbling this week, and Marks answered, "You know, I've always been mystified by where people go to find out what made the market do what it did on a given day."

Well ... if you're asking questions about the stock market, isn't the floor of the New York Stock Exchange as good a place as any to start?

Whatever.

Josh Brown mentioned Marks' memo that floated the idea of a market so good, "that in and of itself, it causes a recession," and basically endorsed the concept.

Marks said, "I think you've hit on something."

Marks addressed the year-to-date gains. "I wouldn't call it euphoria," Marks said. "What you're seeing is complacency," he added citing the VIX.

Judge said he was leading a panel conversation Monday night and asked whether people are too bullish or not bullish enough. "And the feeling I got (was) ... we may not be bullish enough," Judge revealed.

Marks said, "The tax bill will put a lot of money in a lot of corporations' hands. ... But how are prices for stocks relative to that reality?"

Marks referred to the president as "Donald."

Marks said, "The market multiple is the 3rd-highest in history."

Then he mentioned 1929 (ding ding ding) and 2000 (ding ding ding). (See? Told ya it happens all the time!) (We basically count 1999/2000 as interchangeable.)

Marks pointed to P.E. ratios in the 20s and said he likes P.E. ratios of 6 or 9.

Marks said he only shorted a bond once, "and that was a trading error."

Joe Terranova asked Marks about the lower dollar. Marks said, "I'm not a guy who spends a lot of time thinking about currencies." (It was that kind of day.)

"I don't even think about commodities as an investment vehicle," Marks said.

Jim Lebenthal had to give up his seat to Marks, which means there couldn't be a debate about "sell point."

We'd have to say the Republican applause was robust enough for "Donald's" speech Tuesday that it's probably safe to put a cork in the "President Mike Pence" talk; they can talk about firing Mueller, liking Russia, etc., doesn't matter.

What happened to ‘too much euphoria?’ (a/k/a now it’s called ‘pent-up selling’)

Joe Terranova claimed at the top of Tuesday's sleepy Halftime Report that the new health care alliance was "clearly having an impact" on the stock market.

Stephanie Link said "It's about maybe just getting overbought."

Jim Lebenthal said it will be "healthy" if the 10-year gets to 3.0, 3.1 in the "context" of 2% inflation and sub-4% unemployment.

"I would love for us to have the correction now Scott, if we're gonna have it," said Josh Brown. "Let's get that conversation out of the way; I'm tired of it."

Josh Brown said the XLV, including Tuesday, is up 8.7% on the month.

Judge suggested there's "pent-up selling."

Jim touted CSCO, INTC and IBM. (This writer is long CSCO.)

Jim looked straight into the camera and said you should buy AAPL "if you don't own it."

Joe cautioned against "bond-like proxies."

Stephanie Link drew a contrast between UNH's scale of 46 million members vs. the Amazon-Berkshire-JPMorgan coalition of maybe 1 million. "I think a lot of this is overdone," Link said. "I actually added to United Healthcare today."

Joe said PBMs "have a problem here going forward." He planned to buy TMO and BSX "on the close."

Addressing the Jamie Baker UAL call, Jim Lebenthal said there's going to be more demand for airline capacity; Judge still sounded confused and felt compelled to ask, "But is this call a good call."

"Yes it is," Jim said, "as a trade." Stephanie Link said to watch for oil prices. Link said it's hard for her to see multiple expansion in the airline space.

Judge said he didn't want to be a "flamethrower in any way," but he asked if Oscar Munoz is "in it for the long haul." Joe said, "Unfortunately, maybe he will be."

Jim said if Munoz isn't there, UAL has "plenty of lieutenants" to take his place.

Brian Stutland tied oil to the dollar's performance. Anthony Grisanti predicted a "62 print" before 69 or 70.

Jim's final trade was QCOM. Stephanie Link said GS. Josh Brown said JPM. Joe said "defense stocks."

[Monday, Jan. 29, 2018]

Jim covering his eyes after Weiss’ latest AAPL-non-innovation argument

Jim Lebenthal early on Monday's Halftime Report said "Apple's down, could be a buying opportunity."

To determine whether it actually is, Judge brought in Toni Sacconaghi (whatever happened to Tavis McCourt?) and proceeded to get even fewer answers ... than he was getting from Mario Gabelli.

Toni said the December quarter will be "fine." But that's not the issue. "Clearly, folks are bracing for tough numbers going in," Toni said, while waffling like l'eggo my egg'o as to whether guidance will be worse than expected.

Jim Lebenthal stated, "They reached in the average selling price with the iPhone X."

Jim said he's "not that worried" because those average selling prices aren't going down, and consumers will get used to a 4-digit price for their phone (snicker).

Steve Weiss butted in, "I don't see that; I don't agree with it." Weiss said the iPhone X last year was "ubiquitous."

Seizing the opportunity for another grand statement, Weiss called AAPL a company in "transition" and declared, "This company needs new management. Period." (Maybe he can join forces with Jana/CALSTRS and the Psychic-Tax prof and wage an activist campaign.)

Joe Terranova said AAPL has been a "product story," but if the stock appreciates in 2018, "it's a cash story."

Weiss pinned down Judge for a debate on whether AAPL is expensive; Judge expressed disbelief. Joe pinned down Jim as to whether AAPL does a good job "managing the cash." Jim admitted, "That's not my favorite compliment of Tim Cook." Weiss said, "The answer's no."

Weiss said holding huge amounts of cash is a "penalty" for AAPL. "They could've bought Netflix at 50 billion. They've done nothing," Weiss said, adding, "I've got a CEO who's been late with every product loss- uh, launch. Has not innovated at all since he's been there and has been a terrible steward of the cash."

"It does not need new management," Jim concluded.

Jim: 60% of every digital advertising dollar goes to 2 companies

Judge on Monday's Halftime yielded to Joe Terranova to outline the Citigroup 1,600 AMZN call. Joe gave a nice summary and concluded, "I'm not fighting the momentum."

Jim Lebenthal said the advertising angle to the AMZN call is interesting. "But something like 60% of every digital advertising dollar goes to 2 companies. Facebook and Google. I might have the exact number 60% wrong, but I'm in the ballpark," Jim said, explaining that AMZN entering the space is "gonna drive down price."

Kevin O'Leary said, "I think this call falls into the category of how can I just call a higher number and get lots of exposure on my call." As Joe predicted, O'Leary grumbled about AMZN lack of cash flow and dividend. O'Leary hailed how JKHY and OLN were getting a big tax benefit.

Steve Weiss said O'Leary's right, the analyst just wanted to "find a way to stay involved" after the stock hit his target.

Jane Wells summoned for 5 p.m. Fast Bitcoin, expertly explains the WYNN/Steve/Elaine situation

Whew. Talk about a runaround.

Mario Gabelli on Monday's Halftime said he owns 300,000 shares of WYNN; he also owns MGM and recommends that one.

That much was fine. Then Mario started talking about how Massachusetts is the "question mark" for WYNN. Judge and Joe Terranova tried to get Gabelli to opine on whether WYNN is ownable without Steve Wynn. Gabelli never answered, simply repeating that there's no problem with WYNN in Vegas or Macau but there's a "suitability" (he said that about 3-4 times) problem in Massachusetts.

So there you go.

Judge on Twitter is entertaining debate on greatest jocks in individual sports

On Monday's Halftime, Leslie Picker tried to decipher the meaning of the Pershing Square leverage. Picker concluded they're "abandoning this kind of asset-gathering idea."

Steve Weiss said it's "so tough to turn the tide when you've had 3 down years." Joe Terranova asked Weiss if Ackman is not "at least doing the right things that you want to see" regarding fees, etc. Weiss said, "He doesn't have any choice."

Mario Gabelli called Bill's ADP venture a "mistake."

We got a ‘euphoria’ and ‘1999,’ but no ‘1987’ or ‘in and of itself’

Mario Gabelli, the special guest of Monday's Halftime, spoke of all the "cross-currents" in the stock market but said he's still "very optimistic" for 6-9 months.

Gabelli said it's not like 1999, but the animal spirits have really been "stoked."

Gabelli actually mentioned the elimination of the Uptick Rule. (And when is the government going to crack down on those oil speculators who are driving the price up?)

Joe Terranova said, "The year so far is playing out as scripted."

Steve Weiss noted how guidance was hitting CAT.

Weiss predicted "3% by mid-year" on the 10-year.

Jim Lebenthal said the 60 basis points between the 2-year and 10-year is "troubling."

Nevertheless, "Where else is money gonna go still," Weiss said.

Gabelli said he's interested in companies that make jets for private aviation.

Gabelli: Buying GE at 16

Pete Najarian on Monday's Halftime said options paper in energy has finally been getting it right, for a month or so. He said OIH July 32 calls were popular. Pete actually claimed he'd ride the trade "all the way up to and through that July expiration."

Mario Gabelli said he likes energy now and touted TWIN, prompting Judge to gush that this lightly traded stock was moving during the conversation.

Gabelli said he's a buyer of GE at 16. "Because I think they have a wonderful management in the engine business," he said, predicting in 2 years, the stock will be in the "low 20s."

Kevin O'Leary said he likes GE at 13, predicting it gets there on "more misery, more accounting stories."

Gabelli touted TXT and BATRK and MSG.

Steve Weiss' final trade was KBR and GVA. Jim Lebenthal said WGO, "a great buy right here." Joe Terranova said LMT, with defense stocks having "tremendous momentum."

Gabelli suggested FIZZ would be next for a beverage buyout.

Weiss: Friday ‘as close to euphoria as you could possibly get’

Steve Weiss on Monday's Halftime recapped the remarkable previous day of trading.

"What we saw on Friday was as close to euphoria as you could possibly get," Weiss said.

However, not everyone's aboard. Judge said Howard Marks will be at Post 9 on Tuesday and is going to say "the easy money's been made," which is basically what he was saying in August.

Much more from Monday's Halftime, including Weiss' call for new management at AAPL, later.

[Friday, Jan. 26, 2018]

Judge wonders if there’s

‘too much euphoria’

Opening Friday's Halftime Report, the crew struggled to find anything that's NOT working.

Josh Brown pointed to huge gains in NFLX and elsewhere and said "the sore thumb" this week is AAPL.

Judge keeps saying "new record" (first word redundant). It was only in the 2nd minute when he said Bank of America sees "nonstop euphoria."

Kate Moore said, "I think there's been a bit of a catch-up."

Judge asked Weiss if there's "too much euphoria."

Weiss reiterated, "This bears no relation to other times."

Erin Browne expects "incremental add" from retail investors as well as a "huge bid from the corporate side."

Jim Lebenthal recalled the "horsemen" of 2000, MSFT, INTC, CSCO, ORCL, and noted MSFT has tripled in 5 years and insisted INTC and CSCO are "just starting" to play catch-up. (This writer is long CSCO.)

Nothing against those names, but we're not sure INTC and CSCO are going to do what MSFT just did just because they were all megapopular 18 years ago.

Weiss asserted that analysts are just making calls based on the "best relative buy" among their group. But Weiss said "the market is discriminating," pointing to airlines recently and AAPL since the beginning of the year.

Weiss said of Toni Sacconaghi, "Frankly, he's late," and Katy Huberty "was late too."

Vinik: Probably 7th-8th inning

Judge on Friday's Halftime brought in Jeff Vinik, a prominent investor who unfortunately wasn't as great with Magellan as Peter Lynch was, who observed that stock markets have "looked good almost every day this year."

"There's a good amount of euphoria out there," Vinik said, mentioning Judge's newfound favorite word, but he didn't opine on whether there's "too much."

Vinik said it's probably the "7th or 8th inning" or "3rd period of this bull market."

Judge kept trying to get Vinik to make market calls, but Vinik mostly wanted to talk about how great Tampa Bay (the metro area, not the Buccaneers) is.

Judge cleverly tried to ask "what would be in" a Vinik fund.

"I don't know. I don't do that for a living anymore," Vinik said, adding, "I'm generally an advocate for index funds."

All Vinik would say about not sending NHL players to the Olympics is that it's a "complicated issue."

Judge said, "Sounds like you're shorting my questions."

Nothing more on Jim’s prediction that within 5 years, Amazon will be broken up like Standard Oil

Leslie Picker, back to talk about Bill Ackman on the Halftime Report, said Friday that taking a stake in NKE is "not necessarily out of the ordinary" for Bill.

Picker said the information on the NKE position came from someone who was at an investor dinner Bill held Thursday night. (That sounds good; we could've used a hot meal, the problem is, it probably takes at least a million dollars to get an invite to this one.)

"His traditional activist strategy has not necessarily been working that well over the last 3 years since he's posted losses in each of those," Picker added.

Jim Lebenthal said 51 or 52 was the "right price" to buy NKE (for those with a time machine).

"I'm holding it, OK," Jim said, adding, "I think it's overpriced right now."

Josh Brown identified a "substantial breakout" of NKE at 66. Steve Weiss pointed out UAA has "had no lift" and is "still very vulnerable to going lower." Weiss said he would sell UAA and wouldn't buy NKE at 68. But he bought BABA in the morning.

Jim argued that UAA is "getting to takeout value." Josh Brown pointed out the separate ownership class of shares. Weiss insisted, "The valuation's still egregious."

Jim persisted, "All you need, OK, is some international marketer to take the brand and say, 'We're gonna get this distribution thing in China done.'"

"You know what? They could package it with JCPenney," Weiss said.

"So seriously, if you're bringing that up, then you know I have a good argument," Jim said.

First time we’ve heard Joel Osteen mentioned on the Halftime Report

Judge on Friday's Halftime noted Goldman Sachs removed SBUX from its conviction buy list but kept the buy.

Steve Weiss said "this is a serial-missing candidate" that has made "terrible" acquisitions. That's a good point; we never could figure out why they wanted Teavana.

Weiss said Jim Cramer's idea of a separate company for Starbucks China is "a good idea."

Josh Brown said to focus on breakouts and breakdowns with a flat stock such as SBUX. Jim Lebenthal said that's "absolutely right," but, "It's reminding me of Nike."

Weiss said, "This is why it's not Nike. I can give you 4 coffee places, name brand I'd rather go to in New York than Starbucks. ... Starbucks is not a fresh concept anymore, it was. Not only that, they're on every corner."

But Jim persisted, stating, "Brand recognition is so similar for the two of these," a comment Judge wasn't buying.

"It's almost like you're making a negative case when you're trying to make a positive one," Judge explained. "Brand recognition is as strong as Nike, and yet, they're having a problem. What does that tell you."

Jim said it goes back to "pattern recognition." Weiss said, "You're coming off like Joel Osteen in this stock."

Andrew Left says TWTR is a buy over other social media names because he’d rather see Bill Gates tweets than pictures of Mark Zuckerberg’s barbecue

Judge on Friday's Halftime brought in Andrew Left via phone to talk about Left's new long, TWTR.

Steve Weiss wasn't impressed; frankly, we too had no clue why Left is suddenly calling this a buy.

Left said it's a "compelling platform for where it's trading," which doesn't really mean anything, and then he added, "I wouldn't be surprised if Tencent decided to go ahead and buy Twitter this year." (Didn't they put themselves up for sale a while back and found no takers?)

Left kept trying to insist it's a long because he'd "buy it lower."

Left actually said, "My favorite person to follow on Twitter is let's say Bill Gates" (a fellow who happens to be one of the business world's most boring individuals) and then, in a really strange argument for backing TWTR, said, "I really don't wanna see Mark Zuckerberg's dog or pictures of his barbecue." (This writer is long FB.)

He twice called TWTR a "much better platform" than Snapchat (snicker).

Steve Weiss was shrugging that Left is a "smart guy," then described this position as, "Let me pick a stock that I can buy, then go and tweet, that's ready to move and I'm gonna take advantage of that, and by the way, I'm not gonna tell ya how long I'm gonna be in there."

Yep. Judge got bamboozled into putting together this interview.

Seems like AAPL has slumped ever since Jana-CALSTRS and ‘psychic tax’ prof demanded better parental controls

Judge barely spent more than a soundbite on Friday's Halftime on the news about Steve Wynn, which if nothing else makes Ross Levinsohn's "hotness" list look like smaller potatoes.

Josh Brown said WYNN would be "a totally different story to investors" without Steve Wynn. "This could spell trouble," agreed Erin Browne.

Will Rhind, who has founded a new ETF firm, predicted 2018 will be a "good year" for commodities.

Josh Brown credited Rhind for eliminating "all the negatives of the existing commodity ETF marketplace," which are K-1s and contango issues. Rhind said his goal was to solve the problem of "high management fees" and "sub-optimal structures."

Erin Browne's final trade was European stocks. Kate Moore said older tech. Jim Lebenthal said IBM; "this stock has turned around, period." Steve Weiss said BABA and JD. Josh Brown said TWTR.

Sue Herera and MCC experienced a bit of dead air when Michelle joked about Nutella being delicious.

Mel introduced Friday's 5 p.m. Fast Bitcoin as "Fear and Loathing in Las Vegas," which seems kind of a flip way of characterizing dozens of sex misconduct allegations over a decade.

[Thursday, Jan. 25, 2018]

Ackman, Icahn are a scratch for Judge’s commemoration of 5-year phone-call battle

We figured that because Judge was commemorating the 5-year anniversary of the Ackman-Icahn phone confrontation on Thursday's Halftime Report, he'd bring both parties on the program.

Instead, Judge brought Leslie Picker and former CNBCer Kate Kelly to reveal scorecards over the last 5 years (Zzzzzzzz) and express amazement over how the phone standoff happened. (Zzzzzzzzzz)

Finally, Judge got to the lede, revealing he actually wrote a book about this feud; "a look inside that war ... some of the stories have never been told before."

The book is available for pre-orders.

Of course, he should've asked us to edit it, but not everyone sets their sights that high. We're thinking this one's going to get a review, so Judge better have his ducks in a row. (If we find a typo ... or an "in and of itself" ... anywhere ... can't say they weren't warned.)

The description of the book on Amazon.com includes this line about Ackman-Icahn: "But what happens when they run into the one thing in business they can't control: each other?"

Really? The "one thing" Ackman and Icahn can't control is "each other"?

On Thursday, Judge brought in former CNBC hand Kate Kelly, who sort of switched places with Picker in going from CNBC to the Times and said the Ackman-Icahn showdown was "just surreal" but that she "had an inkling that day" that something explosive would happen.

Kelly suggested Bill's HLF venture was "probably a bit heartbreaking."

Kelly and Picker looked great. Hopefully both are thriving in current posts.

We heard from multiple sources 5 years ago that a huge amount of credit went to (and was deserved by) CNBC producer Max Meyers, who put the separate phone calls together.

Does anyone ask Terry Lundgren if he buys stuff at Amazon.com?

Lessee ... is it easier to predict a stock being acquired, or facing an antitrust investigation?

Judge on Thursday's Halftime Report said D.A. Davidson has given AMZN an $1,800 target.

Joe Terranova said it "could happen."

Really. A FANG stock could actually rise 33%.

Who knew.

Joe said he'll never question AMZN again on its ability "to finally show profit margin expansion."

But Pete Najarian said one thing to keep in mind is AMZN gets its margins from the cloud space, and "everybody wants that piece."

Jim Lebenthal said he can't buy AMZN as a value investor when its 100 multiple could go to 80 while it remains the same company.

Fair enough, but then Jim uncorked a drastically-overthinking-it-type-of-analysis, stating, "There comes a point in time where regulators will look at this within the next 5 years, regulators will look at this and say, 'Wait a second, this is exactly what Standard Oil was. This is exactly what AT&T was."

Seriously? Jim thinks regulators are going to declare AMZN the Standard Oil of 2023??

Did we hear Jim correctly?

Rather than offer the best argument — that this company unlike those others is enormously popular, possibly ... possibly ... the most popular company of all time ... and thus has nothing to fear on the regulatory front — Joe Terranova suggested that antitrust reviews are at the discretion of Donald Trump.

"I disagree with that," Joe said of Jim's prediction. "Why would they do that; it's driving the economy. Why would- this is a president that wants the economy and the stock market to thrive."

"I'm not talking about the president. I'm talking about the FTC or a similar regulatory agency," Jim explained.

"All I know is, I see those green Amazon Fresh boxes all over my neighborhood," Joe said.

"Yeah, yeah yours and everybody else's," Judge confirmed.

About every 3 days, Jim warns viewers against buying stock in Sears Holdings

Jim Lebenthal on Thursday's Halftime Report said the only names to avoid that he can think of are "some of the more desperate retail."

Judge pointed to what KSS has done. Jim said "this might not be the right time" to buy KSS.

Jim mentioned 2 possible roadblocks to the stock market, saying of the first, "I'm not scared of inflation," and then there's this summer's election cycle, but that's "5 months from now."

Grandpa Rob Sechan said it would be interesting if student loan debt could be rolled into mortgages he wanted to add that there's a "risk that expectations have ratcheted up."

Joe Terranova said "Caterpillar is the poster child for synchronized global growth."

Joe said GS might have had "the kitchen sink for FICC" and trumpeted being overweight financials.

Joe said $70 oil is not a headwind, pointing to nat gas climbing from 2.60 to 3.60 "in a matter of 3 weeks." Rob Sechan said rising crude brings more supply on the market.

Joe said currency competitiveness could be a "little bit of an inherent (sic redundant) risk" to the stock market.

Nobody said 1999 or 1987

Joe Terranova on Thursday's Halftime said SNAP will continue to go lower; it has "tremendous difficulties."

Pete Najarian didn't say "single digits" (we Fast-Fired him on that in our year-end review because Judge didn't have the brass to do it) but did say it's "not a good spot" for SNAP between FB and TWTR.

Pete said June 60 EEM calls were getting bought. Pete said PBR calls took off and he scaled down the position he was supposedly going to hold for a couple of weeks.

Reid Walker was the Portfolios With Purpose representative and noted that it's kind of an all-or-nothing tournament.

In a snoozer of a Futures Now, Jeff Kilburg said we're expecting other central bankers to react to the lower dollar. Jim Iuorio said if the dollar "closed below 88.20 or so ... it would suggest a lot lower."

Joe's final trade was "Texas banks." Jim Lebenthal said GM. Pete said T. Rob Sechan said IEMG.

On the 5 p.m. Fast Bitcoin, Guy Adami said it's a "dangerous game" for the president and Treasury secretary to opine on the dollar.

Karen Finerman, in sizzling new aqua top, said she bought MTW.

Jim: ‘Don’t be early

selling this rally’

A day earlier, it was "euphoria."

On Thursday's Halftime, it was, "Go big or go home."

Judge said earnings season is "littered" with great reports, prompting Joe Terranova to opine, "2018 is all about the strength and the momentum."

Jim Lebenthal topped Joe's glee, shrugging that the markets and VIX being up at the same time is a "total decoy" and adding, "The bottom line here ... it's momentum."

"Don't be early selling this rally," Jim advised, a day after Scott Minerd said the key is knowing when to get out.

Rob Sechan was the lone Grandpa, stating, "The recipe for market success is strong fundamentals and skepticism. I'm gonna tell you what's not out there right now. There is not a lot of skepticisim. We are all on the one side of the boat. We all agree that this is gonna be a great year." (Except Jeremy Siegel and Mike Wilson agreed just recently that it won't nearly be anything like 2017.)

Jim admitted skepticism is "really hard to find."

Sechan concluded, "If you're putting money to work, you wanna be patient about how you do that, and you wanna do that over time."

More from Thursday's Halftime later.

[Wednesday, Jan. 24, 2018]

The key is to get out before the collapse (a/k/a Judge and Richard Fisher no longer combative)

This page noted Tuesday that we hadn't heard "euphoria" on the Halftime Report this week.

Judge made sure we did Wednesday, introducing the show with "euphoria" as the first word, pointing to "more record closes in a January than we ever have before."

The centerpiece of that argument apparently stems from none other than Scott Minerd's comments in Davos about how he's "troubled by the euphoria undergirding (snicker) the gathering."

Minerd also said, "The key is to know when to get out."

That prompted chuckling from ... yes, hard to believe but true ... Richard Fisher, CNBC's buttoned-down Fed watcher who in his most recent Halftime appearance accused Judge of handing him his most combative interview ever on CNBC.

Fisher noted Minerd's theory, "the key is to get out at the right time. Duh. I mean, we were, we were just laughing about that."

Moments later, he mocked it again.

Meanwhile, Kevin O'Leary said companies have never been "gifted" by the president so much free cash flow. "It's not euphoria," O'Leary insisted.

Pete Najarian carped about people saying tax overhaul was priced in. (Zzzzzzz. Last time we're posting a comment on that subject. #fairwarning)

Steve Weiss said we haven't had this kind of easy-money environment but doesn't think it's infinite. "People I speak to, whether it's Dave Tepper, whoever, look for an end or a cooling in 6 months, 3 to 6 months," Weiss revealed.

Judge even quoted Howard Marks; "I don't see a reason to be aggressive" (snicker).

Almost seems like Halftime guests get paid to say ‘1929,’ ‘1987,’ ‘1999’ or ‘2007’ (that must be how Bob Shiller really cashes in)

Richard Fisher on Wednesday's Halftime Report called the tax package "a huge boost." Not gullible to the euphoria, Fisher said, "I do think we oughta be cautious here."

Fisher, whose jokes about Scott Minerd's comment were as much a surprise as if Mohamed El-Erian shipped us his Top 10 Movies of 2017 List, predicted 4 rate hikes in 2018.

Fisher said he doesn't think Steve Mnuchin has the "same finesse" as Jim Baker.

Steve Weiss said he bought BABA calls.

Kevin O'Leary again trumpeted how Boeing is in the "services business" and asserted, "I'm buying cash flow."

Fisher sounded reasonable until he uncorked one of those years that has no relevance to anything, stating, "This lack of volatility and this seemingly uniform bullishness reminds me of portfolio insurance in 1987. ... That's when I made my money."

Congrats.

Judge doesn’t ask Toni about the Jana/CALSTRS prof who thinks kids using Internet pay a ‘Psychic Tax’

Judge on Wednesday's Halftime Report brought in Toni Sacconaghi for another ... not particularly specific assessment of the next AAPL quarter.

Toni said he did a "pretty detailed analysis" of AAPL's supply chain and thinks there's a "very real risk that numbers are gonna come in meaningfully below consensus."

That doesn't sound good.

But wait. There's more.

"Revenues probably end up being a bit lighter than we had envisioned before, but EPS, with tax rates being lower, could be higher," Toni explained, adding "it's difficult to know how, how folks might react to that scenario."

Toni said the iPhone X price was a "dramatic increase."

Judge never asked Toni about the Jana/CALSTRS campaign to get Apple to save kids by improving parental controls on iPhones, a sign of the traction (or lack thereof) of that initiative. Judge merely told Toni the stock will "suffer" if it guides "well below consensus for their bread and butter product."

Toni said "the challenge is that Apple never guides to iPhone units let alone to any type of unit."

So, we really don't know much of anything, including the iPad subscription plan that Toni was touting a year or two ago that Judge never challenged.

Pete Najarian didn't say "Katy Huberty is better than Toni Sacconaghi" but did gush about "absolutely astronomical" Apple services growth. Sarat Sethi said the danger is "you could get an investor base that changes." Kevin O'Leary shrugged that "there's a floor on the stock."

O’Leary could’ve asked Jim Lebenthal (whenver they’re on the show together) why Jim thought BA was overextended in the mid-200s

Stephen Weiss, who recently lambasted UAL management, said on Wednesday's Halftime, "Munoz has to go."

Weiss said United's report indicates "the old way of looking at the airlines is the right way to look at 'em, which is you rent them, and they always screw it up, they add too much capacity."

Kevin O'Leary asked why "airline guys" such as Weiss "continue to get abused this way" when they can own BA. Weiss said he's "made some great money in the airlines," claiming he had "a 5- or 6-bagger in American."

Judge said Oscar Munoz in the Tuesday conference call predicted Wednesday's stock slam and calls it a buying opportunity.

Judge said Jim Cramer said the United earnings report "was like the biggest joke of a call he's, he's ever heard."

Sarat Sethi said he's keeping UAL, though it could go "a bit lower." He said you can "drive a truck" through UAL's wide earnings guidance.

‘Euphoria’ is mentioned,

and so is GE

Seema Mody on Wednesday's Halftime reported on RCL's bonus plans.

Pete Najarian said February 12.50 calls in PBR got bought.

Pete backed the Nomura buy call on MSFT. He calls the 102 target "very conservative quite honestly"; he sees it going "far higher" than that level.

Kevin O'Leary said Satya has delivered on "100%" of his promises.

Brian Stutland hung a 69 on crude, if not higher by year end. Anthony Grisanti said he attributes the rise to a weak dollar and said 65.55 is next resistance. Pete said he took half of his XOM position off. Pete mentioned the DAL refinery.

Sarat Sethi is still selling GE; he just doesn't wanna be there. Steve Weiss said just because a stock collapses doesn't make it cheaper. Kevin O'Leary said the price to buy it is $12-$13 but said it's "almost a good short here."

O'Leary added, "Take it behind the barn and shoot."

Weiss' final trade was DAL, saying it shouldn't be thrown out with the bathwater. Pete said KR. Sarat said NVS. Kevin O'Leary said Asian and Europe stocks.

[Tuesday, Jan. 23, 2018]

Stocks on ‘staircase’ to heaven

Joe Terranova on Tuesday's Halftime Report admitted he and "many people" were talking at year-end about "potential for a 2016-style selloff that you had in January of that year."

It's wonderful that Joe is honest; we never understood what prompted "many people" to deem this strange possibility worth talking about.

Because it hasn't happened, Joe said, it looks more like another 2017, "where you don't really do anything other than climb the staircase higher."

Joe noted "emerging markets are still doing incredibly well."

Josh Brown said he thinks the Street is "in shock." He noted last year at this time, chief strategists were expecting a strong dollar and favoring U.S. over international stocks. Brown said the Nikkei is at a level not seen since 1991. He noted the dollar's at almost a 4-year low.

DoubleLine's Jeffrey Sherman told Judge that Friday's 10-year yield close of 2.65% was above the 2017 high. He said the one holdout is the 30-year, but it's at "criticial junctures," so he expects rates to push higher.

Sherman said the global growth story "is very accretive for commodities."

Karen Finerman, in exceptional new hairstyle on the 5 p.m. Fast Money, admitted she has felt "chumpish" at times but said that historically, "it's always been OK to buy at a record high, because here we are."

Another day without ‘euphoria’

Addressing the NFLX train on Tuesday's Halftime, Jim Lebenthal stated, "There's nothing stopping this" and that a couple billion more in debt would be a "drop in the bucket."

Jim said someone told him you might want to fade NFLX over 250. He and Josh Brown agreed it wouldn't be a huge pullback.

Brown said NFLX didn't really have an earnings beat, but a "subscriber beat."

"The subs are growing because of the spend," Brown explained.

Brown said if NFLX in 2007 had focused on profitability, it would look like Pandora now.

Stephanie Link called NFLX a "secular grower" that's "first to market."

Scott Devitt, who has a 283 target, stressed NFLX's pricing power and pending incremental leverage from its "global TV platform."

How come Jana/CALSTRS and their prof who detected the ‘Psychic Tax’ aren’t clamoring for more parental controls for TWTR users?

Scott Devitt, who dialed in to Tuesday's Halftime Report to cheer NFLX, said Anthony Noto's departure (Zzzzzzzz) is a "pretty painful loss" for TWTR.

Joe Terranova said he noted last week that the TWTR price action was concerning, so there was "some advance knowledge of this probably." (Usually they only say that when they notice the "options paper.")

Joe called Noto's exit "not a good thing" and said the quants have left the stock.

Judge speculated whether Noto would leave just before a quarterly beat. Somehow we doubt that the shape and timing of the current quarter would have anything to do with whether to take a better job.

Josh Brown noted that previously "indispensible" people such as Adam Bain have left the company. (Remember when Bob Peck was on the show once a week to predict Dick Costolo would get ousted and then that the company would succeed because of its "cadence" of new products?)

Joe said Noto's move will make him think twice about SQ and whether Jack Dorsey will need to spend more time on TWTR. That seems like a little bit of overthinking things.

Tom Lee’s calling a 2029 peak

Stephanie Link on Tuesday's Halftime marveled about how she's often expecting EL to pause only to see it keep going; "the trends are definitely there for beauty," and she's going to hang on to it.

Joe Terranova called ABBV the "clear winner in the space."

Stephanie Link grumbled that JNJ's margins were below expectations. She said she added AGN a week and a half ago.

Jim said Link's buy in AGN "caught my eye." Jim predicted T will be "distracted" this year by the TWX situation.

‘Look out below for copper’

After speaking with DoubleLine's Jeffrey Sherman, Judge on Tuesday's Halftime curiously made an abrupt left turn to industrial stocks.

Stephanie Link said she owns EMR and SWK. Josh Brown said the 3 best charts in the space are FTV, ROK and SPXC. Joe Terranova suggested HON.

In the latter half-hour, Judge turned things over to David Faber for an interview with Lowell McAdam; Faber asked what VZ will do with tax-overhaul cash, and McAdam indicated they're spreading it out over a bunch of things and that employees will get some restricted stock.

It wasn't exactly the most exciting interview of all time.

Pete Najarian said the EEM April 51 calls got bought. He also said FXI March 53 calls were popular.

Bob Iaccino said copper is in "probably a short-lived selloff." Scott Nations contended, "It's look out below for copper."

Stephanie Link said she was buying FB "on the news" recently when it was "10, 15 points below where it is now." (This writer is long FB.)

Joe's final trade was VZ. Stephanie Link said AAPL. Jim Lebenthal said NKE. Josh Brown didn't mention the Barking Dog of the Last 3 Months, ALB. (This writer is long ALB.)

Karen Finerman on the 5 p.m. Fast Money gushed about how much safer the big tech stocks are vs. the big biotechs and said Alphabet is her biggest position.

[Monday, Jan. 22, 2018]

CNBC not interested in Rise Above campaign this time

In a thin episode of the Halftime Report on Monday occasionally interrupted by D.C. news, Judge said "the market seems unfazed" by all the shutdown activity.

Josh Brown said markets tend to be flat during shutdowns. Brown noted an all-time high in the XBI.

Brown said risk appetite is at "incredibly high levels."

He referred to the 87 level in the 14-month RSI in the S&P 500 and said Ari Wald says markets typically top a year after those RSI gains.

Joe Terranova cautioned about the "debt limit issue" if this gets pushed to mid-February and said the deadline for the debt limit "is a little bit uncomfortably close."

Judge and Jim Lebenthal said it's a "kick the can down the road" situation.

Ian Winer said fear of Democrats taking Congress "is going to be an issue as we get later in the year."

John Harwood at one point said, "I think the crisis is going to lift in the next few minutes, but it's not going to go away." Harwood predicted "well over 60 votes."

Harwood said Donald Trump "is very, very unpopular."

In another tiresome chapter in Judge's endless parlor game, Mike Santoli suggested rates aren't going as high as people think, but as for whether they hurt the stock market, "obviously it depends how high they go."

Judge delivered the signature cliché: "I think most would be fine with rates rising for the right reason."

Josh doesn’t think Anthony Noto is nearly as important as Anthony DiClemente thinks he is

Judge on Monday's Halftime brought in Anthony DiClemente via phone to discuss rumblings of a key TWTR departure.

DiClemente said it would be "really difficult" for TWTR to replace someone of Anthony Noto's "caliber" and even said it'd be a "pretty terrible outcome" for TWTR investors.

DiClemente called Noto "an architect of Thursday Night Football."

Josh Brown questioned what kind of "track record" the stock has under Noto and asserted that the stock has actually rallied since Jack Dorsey came back. DiClemente said "cost controls" have improved EBITDA and can be credited to Noto, as well as "sustained improvement over key audience metrics."

Judge asked if TWTR has had a "punk move" in 3 months.

A show without GE

— or ‘euphoria’

Waffling like l'eggo my egg'o on Monday's Halftime, Joe Terranova said to "get a coin" on NFLX earnings.

Jim Lebenthal said he thinks the stock goes higher on earnings.

Bernstein's buy on LOW was the Call of the Day. Jim Lebenthal said "there may still be room to run" because even though it's up 30% in 3 months, it's only up 50% over 3 years; he suggested that "you nibble a little bit."

Joe Terranova said he doesn't see a reason to sell LOW as long as there's momentum. But Ian Winer said he's not so sure it's a buy at 106. Josh Brown agreed with Winer and questioned buying at an 89 RSI while it's up 14% in 2 weeks. But Brown agreed with Joe that it's not a sell.

Pete Najarian, via satellite, said February 24 calls in HBI were getting bought. Pete also said someone's buying this Friday's January 60 calls in DAL.

Pete (who predicted a home game Super Bowl for the Vikings) said there was incredible activity on Dec. 20 in JUNO calls. We don't have any record of that coming up on the Halftime Report that day; Doc on Dec. 20 mentioned CBS, FCX and THC.

Judge brought in Kari Firestone via satellite. Firestone's apparently a Patriots fan. (Gee, isn't that exciting cheering for 5-yard passes all day.)

Firestone likes EA, which she said is trading at a discount, a 23 multiple vs. historic 28. Jim Lebenthal said it's not a "1-trick pony" because it's got Madden and FIFA as well as "Star Wars" something or other.

Joe Terranova called JNJ and ABBV strong names. Jim Lebenthal finds VZ interesting. Judge promised Lowell McAdam on Tuesday.

Ian Winer's final trade was AOBC. Josh Brown finally brought up ALB, a disaster for several months, stating he's still long. (This writer is long ALB.) Jim said MET. Joe said he's long MAR but will sell "a little."

[Friday, Jan. 19, 2018]

Could Dave Tepper save

the Pittsburgh Steelers?

In the wake of one of the most embarrassing playoff games in NFL history (for one of the 2 teams), Mike Florio at profootballtalk.nbcsports.com reported that "a small group" of limited partners of the Pittsburgh Steelers want to see a coaching change.

We don't know which of the limited partners are calling for change.

We do know that David Tepper is one of the limited partners.

And if he's not calling for a coaching change, he should be.

Mr. Dan Rooney ... God bless that gentleman ... one of the finest figures in sports as was his dad ... his dad didn't care about winning, but Dan did, and when Dan was given the reins of the franchise in the late 1960s, he looked up the top coaching candidate in the NFL, Chuck Noll, and convinced him that things were going to be different in Pittsburgh. Noll signed on, shored up the roster, ushered in a succession of some of the most staggering drafts in history with a great deal of credit to scout Bill Nunn, and produced perhaps, given the stature of pro football, the most spectacular glory in American sports.

Many years later, Dan realized that Noll's time had passed and made the difficult but necessary decision to nudge Null into retirement. The result was the hiring of Bill Cowher, quite possibly the greatest coach in NFL history (and even once a guest on Fast Money). (Seriously.)

Dan has passed on, and the franchise is helmed by his son, Art Rooney II, a modest gentleman and presumably capable businessman. Unfortunately, he is presiding over a disaster, a God-awful team that embarrasses itself virtually every week, the phoniest 13-3 in NFL history.

At the ground level, which means the product on the field, the Steelers are one of the worst-run outfits in the league. There are talented athletes here for sure, but some of them often don't seem that interested in playing, and some would never be welcome on a Noll or Cowher or Belichick roster.

It would take way too long to list all the problems. (Cutting a legend, still one of the team's best players, so he can join the New England Patriots at the end of the season has to be near the top of the list.) Laughably, replacing the offensive coordinator with the quarterbacks coach only adds to them.

We know the coaches try. We don't know honestly why it's so bad. But it is. This team doesn't know what it's doing.

Here's why that all matters now. The greatest gift in sports is an elite NFL quarterback, one of those half-dozen individuals in the entire world who are difference-makers in the NFL Playoffs. Most franchises go decades without one. When you don't have one, you can generally forget about the Super Bowl. When you do have one, you have to maximize every moment you've got with him.

The Steelers still have one. He is going to be 36 entering next season. He has a bizarre moodiness that is sometimes part of the team's problem. He's also one of the greatest competitors in NFL history. As long as he's standing, they've got a chance.

Once he's gone, don't expect the team to find the next Aaron Rodgers. It'll probably be more like the next Tommy Maddox.

The team doesn't need the next Don Shula. It only needs a fresh start with a credible boss who can hang it up after a couple years. We've got a few names, if anyone needs some names.

It's one thing if a fan feels emotionally brutalized by this monstrosity. It's another to be a paying stakeholder.

Someone please tell Mr. Rooney.

Mike Wilson has heard the chatter from all 4 million clients (apparently) (while Tom Lee makes a 2029 market call)

Judge started off Friday's Halftime with Mike Wilson, telling Wilson, "You're throwin' around the euphoria word."

That proved to be a curious and elusive term.

Judge questioned why we're not in "reality" rather than "euphoria." Wilson curiously faulted the "quality" of earnings growth.

"There's no doubt that the quality of the earnings growth we're gonna get this year is lower than it was the last 2 years," Wilson said.

Really? "No doubt?" And what does that actually mean?

Steve Weiss asked Wilson for his "indicators" of "euphoria." Wilson said, "I got a list of 'em."

Wilson said his top 5 indicators include "AAII bull-bear spread." Weiss questioned if that's "relevant." Wilson said it is, for sentiment.

Wilson also said he's got 16,000 advisors, and 4 million clients, and, "Yeah, the chatter is pretty euphoric, I mean people are really reaching now for that, for that kind of activity."

People are "reaching" for euphoric "activity."

Wilson also declared that volatility is starting to pick up this week; "the VIX is quietly kind of creeping up."

Then he said, "You can't hold as much risk if volatility goes up."

Weiss quibbled with Wilson over exposure, with Weiss finally stating, "Just because you moved higher in your exposure, right, doesn't mean you're at euphoria yet."

"It's all subjective, I agree with you Steve," Wilson said.

Jim Lebenthal said that if this is euphoria, "We're early in euphoria. And you know what, you're supposed to enjoy that. As soon as it starts, you don't just head for the exits," an undeniably accurate point.

Judge asked, "Can you truly be in euphoria with a 10-year at 2.63?"

Wilson also curiously said he's got 2 targets.

One of them is a 2,750 "base-case, year-end" target. He's also got a 3,000 "bull case" and thinks "we think we could actually hit that in the first half."

So it sounds like, if stocks go up, "I was saying 3,000 all along," and if they don't, "I had 2,750 all the way."

"This is not a better risk/reward than last year ... because this is the end of the cycle," Wilson said.

Tom Lee was also on the panel, quietly. Lee, who's got a 3,025 target, said, "I think that it's important for investors to think long term" and cautioned against "misallocation of capital."

Most importantly, Lee told Judge we're in something like the 4th or 5th inning of the bull market; he thinks it's "more like 2029 is the peak of this equity market cycle."

Wilson said he agrees with that from a "secular bull case" but not from a "cyclical bull case."

Josh Brown asked for the "right answer" about stock and bond allocations. Tom Lee pointed to negative interest rates in some bonds, "Even in equities, you can buy things that have better yields than bonds anyways."

Wilson said, "I think that stocks are gonna beat bonds handily, particularly on a real basis, over the next 7-10 years."

Brown countered, "There are no 10-year periods historically where you've had a cyclically adjusted P.E. ratio anywhere near where it is, and stocks have done better than bonds. None."

Oddly enough, Weiss seemed to agree with Wilson's timing even if not the term euphoria. Weiss told Wilson that "people see ... a finite end to this next move in the market, generally picking, like you are, and like I agree with, the 2nd quarter of the year is when you know the music really stops."

The more Wilson talked, the more curious his market call sounded.

"This is a secular bull market, OK," Wilson said. "And this is the first half of the secular bull market. You're not gonna get 1998-99 euphoria in the first half of the bull market. That comes later. Maybe many years from now."

So apparently we're having a little euphoria, but not the really big euphoria. That may be years away.

"The QE era is over," Wilson continued, and we'd like to get that in writing. "OK. And the QE era favored large-cap companies. And, over-regulation, OK, favored large-cap companies," Wilson said, predicting operating leverage in small caps will "shine through this year more than large caps."

Josh Brown noted "dramatic moves" in utilities and real estate yield plays. Wilson spoke of how he made the shift at the beginning of the year from U.S. to international stocks and "sold the rest of our high yield." (See, he's never made a wrong move.)

Wilson asserted, "We think the credit markets ... have much worse risk/reward than stocks here." He argued, "Rates are going up in the short term ... but at some point in the back half of the year, rates are likely to come down again."

Judge also asked Wilson if the market would sell off 5% in a shutdown. Wilson said "it could get there because things are so extended."

So let's see if we've got this straight ... we're in "euphoria," and that will continue up to July, except volatility is picking up, and you can't "hold as much risk" if volatility is rising, even, apparently, if we're in "euphoria" ... and then there may be a shutdown, in which "euphoria" would take a 5% haircut before re-establishing itself. Then starting in July, rates and stocks will both fall. But the big "euphoria" is still to come, perhaps years away.

Jim Lebenthal argued that CSCO and INTC are among "plenty of stocks" that are "well below the market multiple." (This writer is long INTC.) Weiss said those names are "always below the market-." Jim said, "Not by a 20% discount."

Josh Brown said, "You think a low multiple is gonna protect investors if we go to the other side of euphoria?" Jim said, "We're not anywhere near the other side of euphoria."

Weiss said he would "love to see" a 5% correction.

Weiss: Flannery is no more qualified to run GE than I am

Judge on Friday's Halftime noted GE, everyone's favorite disaster stock, fell to 16.02 before bouncing.

"Why would you wanna own it," said Steve Weiss. "I think you just avoid it, and you come back to it maybe in 6 months when it's closer to 10 or 12."

Judge re-aired Bill Nygren's GE comments from a day ago. "In what universe should this company be at a market multiple," Weiss asked.

Josh Brown questioned buying a falling knife such as GE "in a market where 9 out of 10 stocks are going up."

Jim Lebenthal made it unanimous, stating, "There is clearly more bad news coming," adding, "The day when bad news comes out and the stock rallies, that's when you buy it."

Josh Brown suggested maybe you could buy "the day Warren Buffett makes a loan to them for preferred stock."

Weiss said Flannery's been there "22 years or so ... and apparently he's surprised about what he saw. ... He shouldn't be running this company any more than I should."

Important note: We like to dump on this stock, too, because it's kinda fun, but we're not taking any pleasure in anyone taking losses on this stock or any other; we've had our share of bungles, and they're never any fun.

Weiss: KSS, TGT are ‘euphoria’

Judge on Friday's Halftime noted KSS got a $100 target (snicker) from Jefferies.

Steve Weiss said "he had to go out to 2020," the "he" meaning the analyst, but Weiss said the call is "reasonable" even though Weiss is "skeptical."

Jim Lebenthal said the problem is, "We know there are store closings coming this year."

Josh Brown said KSS is up 100% in 6 weeks and has an RSI of 84.

Tom Lee said Chuck Grom thinks KSS will "maybe partner with a grocery company" (snicker).

Weiss said KSS and TGT are "just so extended. That's euphoria right now."

Brown asked Weiss, "Did you buy that coat at Kohl's." Weiss said "No, I don't think Kohl's sells real (something unintelligible)."

We thought it's a great jacket.

Judge says ADT’s IPO is ‘touché’ to the euphorians

Seema Mody on Friday's Halftime explained ADT's IPO slide.

Judge said, "That's a bit of a disaster," which seems a bit of an overstatement.

Stephen Weiss said the company was "challenged" before it was taken private, and it was a "pretty quick turnaround for the IPO." Judge told Mike Wilson, "Touché to your euphoria."

Eamon Javers reported that Chuck Schumer would visit the White House on Friday.

Pete Najarian, via satellite, said February 22.50 calls in DSW were getting bought.

Pete said FCX February 22 calls were getting bought, "all in one print."

Josh Brown said to stay long SQ.

Mike Wilson said AXP's spending is "really good for the long-term growth but probably not so great this year."

Jim Lebenthal said to stick with NKE and avoid the "value trap" of FL.

Weiss explained why Jefferies initiated WYNN at "buy."

Pete said he likes IBM and will sell calls against it next week. Jim said he agrees; "margins are fixable."

Pete said "it's gonna be fun" watching the Vikings play in Philly this Sunday.

Jim predicted INTC will "move to new highs" after earnings next week.

Weiss said he'd love to see NFLX miss on sub growth, which would be "the time to buy."

Weiss said "CAT would be in my top 5 of indications of euphoria ... the stock should not be where it is."

[Thursday, Jan. 18, 2018]

Judge’s next interview with Ross Levinsohn is probably ... at least a few years away

Back on Aug. 22, former CNBC contributor and newly installed Los Angeles Times publisher Ross Levinsohn spoke to Judge on the Halftime Report with starry-eyed visions of reporting in video or "shorts" and thinking about California "culture" and turning 2 times EBITDA into 10 times EBITDA.

Nowhere did we hear an emphasis on "damage control."

Less than 6 months into these endeavors, Levinsohn is already under investigation by his parent company after an NPR report about his alleged "frat-boy" behavior in previous work environments.

One thing we sorta realized in August is that Levinsohn — who has been an eloquent CNBC guest and appears to be a talented person, though that has no bearing on the current issues — seems to have worked for gobs of media companies. The biography that remains posted at latimes.com dubs him a digital media "pioneer," but it seems as though "stopgap" might be a more relevant term.

We're guessing we probably won't see Ross on CNBC for a while.

Panel unanimous in not understanding why Bill Nygren continues to own GE

Bill Nygren, whose GE bull call last year was obviously a bungle, impressively owned up to it on Thursday's Halftime, telling Judge, "It was clearly a swing and a miss."

Unfortunately, it sounded a bit like Bill's still in denial.

He said "typically" he'd sell that kind of disaster, but the company has had "tremendous change in people," and the problems are "largely contained in the power division."

"We like the new people," Nygren said (which is curious because Flannery is sort of a GE lifer), asserting the assets should get high multiples in sales.

Judge asked Bill if he's buying more GE on the dip. Bill curiously said, "We've been buying and selling ... we are rotating through adding shares, subtracting shares." Finally, he said, he has "more shares, smaller percent of the portfolio."

Nygren said he puts a higher multiple on GE's jet and health care businesses than others (probably Stephen Tusa) do.

On other stocks, Nygren said he exited MSFT because he sees "better long-term opportunities." He mentioned AAL and CVS and PCLN as new buys.

Judge told the panel that "Bill has a great track record" and was "very contrite" about getting GE wrong.

Kevin O'Leary said that a year ago, the company was guiding to about $1.97. "And then, I don't know how this happened, but all of a sudden within a matter of 6 months, it was a dollar gone. Evaporated. ... How is it that they don't have a class-action suit on that dollar that evaporated. And Bill made a point that there's been a lot of change in management. I don't think so. The new guy came out of the business. He was part of that board. ... I think the stock is worth 13 bucks."

Stephen Weiss bluntly stated, "I think the stock's more of a short. I wouldn't buy here. I agree they should've brought new blood in. Flannery was complicit in the decline of this company."

Judge hailed Jim Cramer for "carrying the flag for shareholders" of GE. Weiss chipped in another observation, that "health care grew organically 4%," which isn't huge, and noted Nygren's claim of high multiples. "When you're a fire-sale seller, how do you get more for your assets?" Weiss wondered.

Jon Najarian stated, "I'm not second-guessing Nygren. Brilliant guy. But I am saying that I like Microsoft a hundred times over General Electric. Not- a hundred out of a hundred times, I'll take Microsoft and jettison, which I made a bad buy on, I bought J- GE at 20.50. Um, you know, luckily got out with most of my backside intact at 18 bucks a share. Um, it's, it's a horrible slide in that company."

Pete Najarian said there's more competition for GE in aviation "than Nygren actually is thinking there is."

Judge said, "If it goes from here down to 13, I know you guys are gonna tell me, 'Don't do it.'"

Pete said it depends on whether the company has "done something."

Regarding other Nygren picks, Doc said people don't focus on PCLN being a lender.

Still wondering why CNBC isn’t doing a ‘Rise Above’ campaign this time

Steve Liesman on Thursday's Halftime predicted this market is "not gonna be spooked" by rate hikes.

Mike Santoli said "sentiment is very stretched" but said "all the news is good."

Pete Najarian said the week's volatility is "significant" and "huge."

But Judge noted the VIX was hardly moving.

Jon Najarian said there's been a "binary bet" on whether there's a shutdown.

But Steve Weiss said generally the market trades down an average of 0.6% during shutdowns; "that's nothing to worry about."

Kevin O'Leary said of the recent roller-coaster ride and climbing VIX, "I think this is great." But Doc said if the government kicks the can to February, "Then watch how fast this goes right back to 10."

Weiss said "rates have typically ended rallies when they've risen quickly." But, he said, "Real rates are still ridiculously low."

Everyone kind of agreed that tax reform isn't fully priced in yet.

Judge actually said "buyback" is "like a dirty word around here."

In a couple of admittedly good laughs, Doc called Steve Liesman "ratings gold." Partly related, Weiss said, "The makeup room ran out of makeup when I got there after these 4 guys."

Whew — no one told to ‘Piss off’

Brian Stutland on Thursday's Halftime said bitcoin has had "significant selloffs" over the last 3 years from mid-December to mid-January.

Anthony Grisanti said, "I would sell any rallies."

Meanwhile, every quarter, Doc reports heavy call-buying in SNAP; this time it's the February 15s. Judge said, "This sounds like a dice roll, Doc." Doc said it's a "really cheap shot."

Doc said April 25 calls in ON were getting bought.

Pete Najarian said July 210 calls in AAPL had "pretty big buying."

Pete said March 105 LOW calls were popular.

Kevin O'Leary said IBM's business may be "more of the same." Pete said he's been long "for a little while" and he sells IBM calls "almost every month."

Pete said he prefers TGT to WMT. Kevin O'Leary said TGT has got "really smart young people" and is going to do "amazing things online."

Steve Weiss' final trade was to sell WDC. Doc said MSFT. Pete said AAL. Judge mistakenly referred to Pete's voice as "Bobby Brady" before being corrected that it's "Peter Brady."

[Wednesday, Jan. 17, 2018]

Dan Nathan tells Rich Ross

to ‘piss off, seriously’

Wednesday's 5 p.m. Fast Money apparently produced a spontaneous personal argument between chart expert Rich Ross and options watcher Dan Nathan.

Ross had delivered a presentation on bitcoin and ethereum technical levels; frankly we didn't really know what he was trying to say.

Ross then took a seat at the desk. This is somehow a daily highlight for this program, cheering the guest walking over from a TV screen to the desk (that's when they're not taking the 5-minute break at the 24-minute mark) ... except maybe things aren't as chummy between panelists and guests as they might typically have you believe.

Ross took up Melissa Lee's question about "weak hands" and said he likes stocks a whole lot more than cryptocurrency, a much more concise point than what he was trying to say with the telestrator.

Nathan called Ross "Chris" (then corrected himself) and argued that a lot of "smart people" think cryptocurrency is the next big thing.

"I just think it's a little glib to come on here and say, you know, say things like-" Nathan said.

The "g" word didn't go over well with Ross. "You guys like it when we fight, so let's fight for a little bit," Ross said, asserting, "Smart people can go broke too."

"But the charts are gonna save 'em, right. The charts are gonna save 'em?" Nathan said.

"What's gonna save 'em," Ross said. "You've been bearish for 2 years, and the stock market's gone up 100%. So where are you? You're not helping people make money. I mean, let's call it what it is. You haven't liked Trump, the market's soared, and the politics aside, you've been wrong, so don't say that I'm glib. It's right or wrong. It's not about glib or serious."

Guy Adami tried to cut in on behalf of Nathan, "Well now that's, that's not true ... I think Dan's done a good-"

Nathan told Adami and viewers, "We're good. We got, we got, you know, we got the chartist here, he's got his stick, and it's, and it's fantastic, pal." Then tone suddenly changing before Ross could respond, Nathan bellowed, "Don't come on here and tell me I haven't made- you don't know what I've done, you don't know what my, my call is, OK, so go piss off, seriously."

"OK. Well tell me, what's the call now?" Ross demanded.

"Dude. Seriously," was Nathan's call.

"OK. A tough moment here on Fast Money," Ross concluded.

Then someone — guess who — announced, "We're gonna leave it there." (As opposed to "gotta.")

Had there been any reason for this particular discussion other than to talk about bitcoin as much as possible, we might've gotten all jazzed about it.

But there wasn't.

Joe suggests stock market is going from Tim Wakefield to Aroldis Chapman

Assessing the 2018 stock market, Joe Terranova on Wednesday's Halftime invoked a curious baseball analogy.

Joe said that investors last year were "stepping to the plate in 2017 and using what's relatively a light bat against a 75 mph pitcher. OK, now the 95 mph pitcher is there. And you're going to use a lighter bat in 2018."

Jim Lebenthal stressed that individual stocks will continue to be "far more volatile" than the broad averages.

Jon Najarian opted to revisit his comment a day earlier (when Jim wasn't on the show) about how Jim was talking about how the market could fall in January (even though others talked about it just as often, see below).

Wednesday at Post 9, Doc addressed Jim and said, "Yesterday Jim I was talking about you on the show. Not in a bad way."

"It may have been bad, but he turned it good," Judge said.

Doc attempted to clarify (or "amplify" as Senator Geary says in Part II), explaining that "smart men ... and women" were "pointing out things that might happen in the new year." (Lessee ... stocks could go up ... stocks could go down ... stocks could be flat ... such wise commentary ...)

Sarat Sethi told Judge the Tuesday pullback is already a "distant memory."

Dan Nathan on the 5 p.m. Bitcoin Money said he saw "a lot of panic buying" on Wednesday.

Doc suggests Goldman Sachs traders need a pep talk

Uncorking sports analogies right and left, Joe Terranova on Wednesday's Halftime said GS' performance in commodity trading is equivalent to "the New England Patriots going 2-14 next season."

"I don't understand what's wrong, because Morgan Stanley was fine," Joe said.

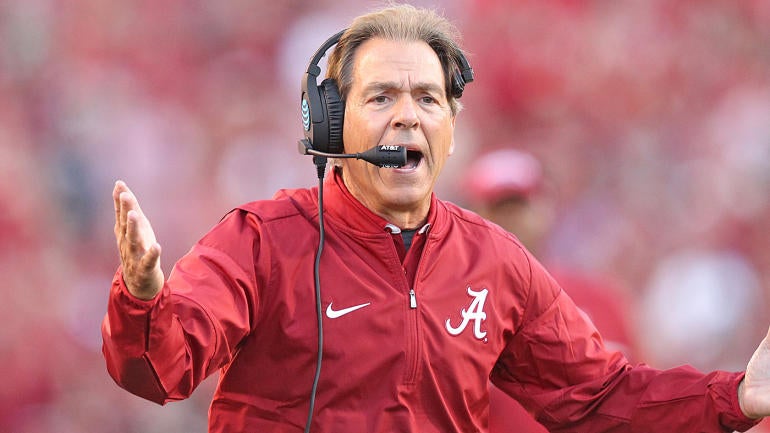

Jon Najarian was equally perplexed and called for some cage-rattling. "You'd like to have a guy like Nick Saban go after these guys," Doc suggested, before questioning, "How did you guys screw this up so bad?"

Doc even suggested "Lloyd needs to get down there on the trading floor ... to get these men and women's heads right."

Joe opined, "I do think they miss Gary Cohn."

Meanwhile, Judge said Bank of America upgraded AAPL to 220 while Longbow downgraded it to neutral. Jim said they have "identical estimates" for this year's earnings, so the question is the multiple. Jim said he doesn't think 15 1/2 is too much.

Joe said he doesn't see why anyone would sell AAPL here.

Jim said he'd like to add to his IBM half-position and is looking for confirmation from this week's report, declaring that if the revenues are growing again, this stock "is going to be heroic."

Jon Najarian said the Barclays analyst made a "really brave call" to upgrade IBM because he/she raised the target by 59 bucks.

Joe mentioned SAP and CRM and suggested ADBE too. He suggested IBM at 190 would put AAPL at 210, 215.

Judge said Stephen Tusa "maintains his, his sell" on GE with a 16 target. Joe reiterated seeing opportunity in UNM and CNO in GE's slump.

Jim buys ROKU

Jim Lebenthal on Wednesday's Halftime said his new buy is ROKU, "not a typical value stock," but he likes it for recurring services revenue.

Judge said it's down 21% in a month and suggested it "could be a little dangerous" getting into it ahead of the lockup. (Actually SNAP recovered nicely after the lockup occurred.)

Scott Nations said stock investors shouldn't "pooh-pooh" the idea of bitcoin contagion to stocks. Anthony Grisanti said he'd be a seller of bitcoin and even hung an 8,000 on it.

Pete Najarian likes the MRK SunTrust upgrade, stressing the pipeline. Jim said he likes PFE; Pete said he likes both. Pete predicted "more and more" in the pharma M&A space. Judge said MRK made "kind of a lame move for an upgrade." Jon Najarian explained that it made the move a day earlier.

Doc said MRO July 20 calls were getting bought. Doc said the EFA (for developed markets) February 75 calls were getting scooped up. Doc said HAWK got taken out at 45 while he reported Jan. 4 the calls getting scooped up at 35.

Pete Najarian said February 7 calls in AKS were getting bought on top of others previously bought.

Judge said special guest Sarat Sethi's fund made 26% last year, outpacing the S&P.

Sarat said FRC has been oversold. He also touted CELG as an opportunity. He even mentioned Hudson's Bay (which trades in Canada).

Sarat also touted DAL, and he thinks "there's more room to run" in UAL.

Pete's final trade was UPS. Doc said CORT. Jim Lebenthal said INTC though he admitted that when it comes to the chip flaw problem, "I don't know if they fixed it or not." (This writer is long INTC.) Joe said TXN and lamented selling it at 81.

[Tuesday, Jan. 16, 2018]

Unfortunately for GE, Rex Tillerson is not available to buy stuff for XOM

David Faber, at Post 9, spoke on Tuesday's Halftime about his report on a possible GE breakup.