[CNBCfix Fast Money Review Archive — October 2015]

[Friday, October 30, 2015]

If we had to guess, we’d have to say Mario Gabelli is predicting a GOP win in 2016

Mario Gabelli joined Friday's Halftime and shrugged about "0 to 5% for the year" in stocks and pronounced 2016 "OK."

Gabelli curiously said, "Obviously we're a country that is AWOL in terms of America without leadership but that's gonna change in 9 months or a year."

Judge doesn't believe in asking panelists about politics or even the CNBC debate, so nothing else was said on that subject.

Sarat Sethi pointed out we're "kinda at the same place" as a month ago.

Judge resuscitated the (Zzzzz) growth vs. value debate for Mario Gabelli. Gabelli said he doesn't look at things that way; he's only looking at margin of safety and financial engineering.

Josh Brown noted the technical damage done to the markets in late summer but admitted, "A lot of that technical damage has been erased."

"I think the next phase of this is the buybacks," Brown said.

Which 3 companies?

Mario Gabelli acknowledged on Friday's Halftime Report he bought a whole 300 more shares of NFLX.

In the media space, Gabelli said government policy is "tilted" toward helping the Internet but the market cap of "those 3 companies" are "7 times" the distributors/cable, then later made the same point.

Gabelli touted CBS, said you want to be in anything "Malone" and Brian Roberts are involved in, and he said Sumner Redstone "has got all of his mind-set."

Gabelli also referred to the Paramount movie "Panamoral" (sic).

In a show in which many loose ends remained loose, it also wasn't clear whether Gabelli likes Ferrari (RACE) more than Fiat Chrysler (FCAU).

Gabelli predicted NAV would be bought within 5 years and said he likes DISCA for the next 5 years.

Doc said he loves FIT, then referred to the "Apple haters" who apparently will heckle him for affirming he thinks the first Apple watch is a failure.

Gabelli likes GIS, LNCE, CAKE and FLS.

How come Mario wasn’t asked about the CNBC Republican debate? (He’s the one who brought up the subject)

Kate Kelly reported on Friday's Halftime that Bill Ackman thinks VRX has underinvested in PR and government relations and "even took a swipe at their PR firm."

Nevertheless, Kelly said, Ackman thinks Valeant is a "good business model" with "superlative" management.

But Kelly also reported that Citron predicted in a tweet "that Valeant would go to zero."

That gave Judge an opportunity to reveal that Citron's Andrew Left will be on the show Monday.

Sounding like he was saying "CBS," which was just mentioned earlier, Judge asked Mario Gabelli about "CVS." Gabelli explained why CVS is down but asserted both WBA and CVS have a "very interesting model particularly if they can go online."

But Gabelli said his analyst was still "absorbing" the details of that notion from the call when Gabelli left the office for his TV appearance.

Kelly asked Gabelli about Amazon filling prescriptions; "does that make any sense to you?"

Gabelli said he's "delighted" that Amazon is thinking about stuff like that rather than auto parts.

"Jeff is a good guy," Gabelli said.

Sounds like treadmill time might be in order for Judge

Mark Mahaney on Friday's Halftime Report said LNKD longs have to ask themselves, "Does it get any better than this?"

Mahaney said he thinks it does.

"They keep layering in more functionality to the site," said Mahaney, who said LinkedIn still has margin expansion.

Doc said he bought LNKD on Thursday and asked Mahaney about mobile expansion. Mahaney claimed this is "definitely a mobile-first company."

Mahaney also called FB a "small buy" but cautioned about an "expectations miss."

Josh Brown reaffirmed he sees LNKD as "the most defensible moat" of the social-media names and that 20-30-somethings "can't afford to not be on there" especially if looking for work with a Fortune 500 company or multinational.

Mario Gabelli told Josh Brown that despite what they spoke about off-camera, he's "not in a position of talking about Facebook."

Judge brought in Chris Klug to talk about his foundation; Doc said he has skiied with Klug in Aspen and said Klug goes 55 mph down the hill on a board while Doc is chasing with skis.

Judge admitted, "I don't know if I could walk 26 miles."

Mandy's off this week; Sara Eisen in scorching black delivered the Power Lunch tease again.

LeBron James: the JPM

of pro basketball players

Asked to referee the Najarians' pointless go-round on banks a day earlier, Mario Gabelli on Friday's Halftime Report said "the question is timing" with bank stocks.

Isn't that true for every stock?

After all, if you owned NFLX from 300 to 58, you probably didn't do as well as the guy who owned it from 58 to now (post-split).

Anyway, Gabelli said he has liked the trust banks including BK. He also likes WFC and the voting stock of LEN, which he said is LEN.B.

Sarat Sethi, who had a quiet show, said he likes the regionals.

Gabelli said he bought some AXP on Thursday but didn't sound too enthusiastic.

Doc said the AXP management is "paralyzed."

[Thursday, October 29, 2015]

Judge silent on big debate

Well, if all you watched on CNBC was the Halftime Report (snicker), you'd never know a debate happened Wednesday.

For all the promotion of this event, you'd think Judge on Thursday would've at least asked his panelists to render an opinion.

After all, Jeb Bush thinks the biggest problem facing his country is his home-state senator's attendance record.

And, a bunch of folks reported that the government is stealing your money and calling it Social Security.

Honestly, what in the world on this particular day is more relevant than analyzing where the presidential race stands in the wake of the CNBC debate? And for that matter, why can't we hear from Steve Weiss, Jon Najarian and Joe Terranova on the performances of CNBC's moderators assuming it is delivered courteously and respectfully?

Becky was a bust, Carl bungled the kickoff, and Harwood got a little too petty. You can read all about it here.

(We don't understand why Sara Eisen wasn't there, and we really wonder what Andrew Ross Sorkin thinks about not being there.)

Anyway, as for Thursday's Halftime Report, Tony Dwyer claimed he went "all in" on Aug. 24 because, "If you don't believe we're goin' into a recession, it's actually been a buy signal to have this kind of a move off the low."

Dwyer likened this market to 1994; "you absolutely wanna buy weakness."

"You have at least 3 years before you should get any kind of risk of an economic (sic redundant) recession as long as the Fed doesn't go nuts like they did in 1994," Dwyer said.

But, Dwyer admitted, "My credibility on the first rate hike is about zippo."

Dwyer told Pete Najarian he watches the VIX, at least the extreme moves, but then pointed to 24% bullishness among Investors' Intelligence newsletter writers. "We're acting a lot like 2011," Dwyer told Pete Najarian.

Joe Terranova said the Fed watches the VIX for guidance "now's the time" to start thinking about 2016.

Jim Iuorio told Jackie DeAngelis, "I think it's one thing to talk about hiking rates, and it's a far different thing to do it."

Jeff Kilburg said, "Don't believe the hype" of hiking forecasts and touted "lower for longer."

GoPro is making ‘big hires’ to create original content

Given the amount of time, it seemed a little bit overkill.

But the extensive single-stock discussion of GPRO on Thursday's Halftime Report was revealing in that it offered little more than a Hope Case for bulls.

Fantasyland began with Jon Najarian revealing he bought GPRO on Thursday in both "real money" and the Halftime Portfolio because it's 1/6 of the price for what Facebook paid for WhatsApp, and he figures FB could buy GPRO too.

"Could you imagine Oculus with GoPro?!?!!!!" Najarian gushed.

"Yes I bought it at 25 bucks," Najarian affirmed.

Star guest Alex Gauna, who somehow has a $90 target after dropping it from $105, conceded the fact GPRO doesn't have a new "flagship" device for this holiday season is a "pretty big fail."

But Gauna said there's not too much "hubris" at GPRO and that the company "hasn't buried its head in the sand."

"They're making big hires to create original content. They're investing in new technologies like the drone," Gauna said.

Gauna mistakenly said "Pete" claimed that GPRO is now attractively priced.

Backing the Doc Trade, Gauna told Joe Terranova, "We do think M&A is a reality."

"We still have an abundance of confidence in Nick Woodman," Gauna said.

Thankfully, reality set in during the conversation.

"They're still sort of learning as they go," Judge concluded, pointing to issues with Wall Street expectations.

Stephen Weiss said "it's actually been a big short across the Street."

"There are many more players coming in" the GoPro space, Weiss added, asserting "this never should've been selling at what it was selling in terms of valuation," throwing in an "at the end of the day" (Drink).

Joe said "retail is all about momentum," and you have to "call into question" why GPRO lost the momentum.

Pete thundered that GPRO lost the momentum because "going into the session (sic), they completely screwed it up."

But Pete told Judge that GPRO is trading at a 22 P.E. right now.

Weiss said "it sounds like there are more issues here than 15 bucks on a price target."

Joe said "Goldman Sachs went from 50 to 29," so there's a "wide disparity" in GPRO views.

Doc: End inversions

Dynamite Meg Tirrell told Judge on Thursday's Halftime that analysts are using the term "Pfizergan" regarding the latest health-care talks.

Tirrell said the deal looks appealing to some for the tax inversion and access to overseas cash and by the way could allow for a split of Pfizer, which seems kind of odd, buying a company in order to do a split.

"Folks saying, this makes a lot of sense," Tirrell said.

Pete Najarian said if PFE can pull this off, it's "absolutely amazing." Pete said in September there was "very aggressive call-buying" in Pfizer, "they're literally (sic) looking at Pfizer."

Doc though called the possible inversion "a bad thing" and wants Carl Icahn to mobilize others to "stop the practice."

Joe Terranova called NXPI "really interesting" but said he wouldn't buy it because "the momentum is gone."

Pete Najarian said regarding BWLD, that if your guidance is below the Street, you'll get hit.

Steve Weiss said he unloaded both his TWTR and AKAM trades; "made money in Twitter; lost money in Akamai, that's how it goes."

Doc said MGM soared on a "triple up" on earnings.

Joe said he likes what the PYPL CEO said, and he would "take a look at" owning the name.

Pete Najarian thinks GPS can go lower.

Stephen Weiss said you want to be in the auto sector at least in the names not too leveraged to China.

Pete Najarian pounded the table for banks citing the recent earnings catalyst; "all of these have shotten (sic grammar) up." (But who's the LeBron James of banks?)

Doc though told Pete that the Fed has "no guts" and that's a tailwind for banks.

Steve Weiss said he still owns C (snicker) and likes LPLA and SCHW; he's in the "camp" (Drink) of a December hike.

Joe said to "be tactical" because you can find opportunities in financials "all the time."

Joe admitted Rex Tillerson's $40 billion purchase of XTO was "awful."

[Wednesday, October 28, 2015]

Judge seems to think analyst is having it both ways

Andy Hargreaves on Wednesday's Halftime Report admitted to Josh Brown that Hargreaves is the guy who called the iPhone "the most important consumer product in the history of the world."

But Hargreaves said, "I don't think it's hyperbole."

Still, he said he "won't take any issue" with Toni Sacconaghi's assertion that AAPL's best days are behind it.

Hargreaves explained his AAPL buy; "Quite frankly the cycle doesn't look like it's gonna be quite as bad as we feared."

Judge said he was having "a problem" with Hargreaves' use of "stagnant" in such a call. Hargreaves chuckled that maybe he should consult a thesaurus, but "everything has a price, right."

Stephen Weiss said it may be fine, but AAPL is not the place "to make real money in the market."

Josh Brown said one of the only number that matters is AAPL maintaining 40% gross margins. Weiss said those outsized margins suggest AAPL is on "borrowed time."

Doc says Jack Dorsey belongs with Musk & Zuck and not Marissa

Meanwhile, Scott Devitt on Wednesday's Halftime seemed to make the "everything has a price" argument in explaining why he's finally upgrading TWTR.

Devitt said it's "pretty short-sighted" to expect TWTR to have changed in the 23 days between Jack Dorsey was named CEO and the quarterly report.

Devitt then offered up mumbo jumbo about the potential of Twitter "much higher" than what the company was executing on, but now "with that change that took place in people, that they may execute against that, that actually could lead to change in numbers and the beginnings of outperformance." (Translation: Dick sucks, and Jack will probably do better.)

Judge called that an "interesting take" but didn't have the wherewithal to ask what it really meant.

Devitt told Josh Brown that TWTR doesn't just "buy users" because investors want "organic user growth" (snicker).

Devitt acknowledged to Judge he has never had a buy on TWTR. Judge called that "interesting in and of itself (sic last 4 words redundant)."

Stephen Weiss said of TWTR, "I bought it. I sold it a couple days ago; I didn't want to take the quarterly risk."

Jon Najarian said he bought the stock Wednesday and called Jack Dorsey a "visionary" and then in a slam said it's still up to Dorsey to prove he's not in "Marissa Mayer status" by "basically not running this company."

Consuming the Bob Peck Kool-aid, Devitt even touted the "triumvirate approach."

"Technically the stock's double-bottomed at 25," said Josh Brown.

Honestly, this one historically has been a buy under 30, so it's hard to argue with these bull calls. (This writer has no position in TWTR.)

Doc: ‘Guilty party’

leaked RAD deal to WSJ

In a heavily debate-promoting episode of the Halftime Report on Wednesday, Judge actually told Stephen Weiss that "repatriation" chatter at the debate could move stocks on Thursday.

Doc said energy and defense will be a "huge focus" not just Wednesday night, but "over the next 6 years, regardless of who's president," for those day-trading.

Josh Brown said "hopefully" someone will ask the candidates about climate change; "obviously Fox doesn't bother asking the question."

As for "candidate" stocks, Doc touted NOC. Stephen Weiss said he's looking at managed-care stocks but "wouldn't buy them now." Josh Brown likes hospital REITs and senior-living REITs, specifically HCN. Pete Najarian said AAPL.

Meanwhile, Steve Weiss said it's interesting that activists are going after "safer companies" evidenced by Carl's interest in AIG.

Doc said AIG is a "far, far cry" from its 2008-debacle level.

Pete Najarian said he likes GILD (Drink).

Doc said the WBA-RAD deal, if it happens, will be a "great deal," and of course, there was unusual activity on Oct. 13 in RAD 7 calls. Doc said it was "the guilty party calling the Wall Street Journal" and "not a Bud Fox," and "I have a real problem with that."

Stephen Weiss said he bought AKAM on Wednesday. "I'm in it for a trade right now," Weiss said.

Doc added SUNE for his Halftime Portfolio in anticipation of a "big short squeeze," and he also added ECA. Weiss added TWTR to this game during the program. Josh Brown had a good line, asking Weiss if he made that trade on the "FanDuel" exchange.

[Tuesday, October 27, 2015]

DeAngelis in glasses

o.m.g.

We were coasting through another installment of Scott Wapner's Halftime Report on Tuesday when Futures Now arrived about midway through the program like a lightning bolt — unleashing blazing superfox Jackie DeAngelis' new look.

In the category of "whatever," Brian Stutland said the decline in oil volatility has reversed, "so that's some fear ... that could take oil lower."

Scott Nations said he thinks crude breaks 40; supply is just "absolutely huge."

Then Nations cut to the chase, noting DeAngelis was on vacation last week, probably "on the beach."

Joe Terranova said "oil doesn't look good right now" and, pointing to 2011, said the market could pull back in November. But Joe didn't say that, like nat gas, the show doesn't talk enough about DeAngelis on the beach.

Judge makes a risk/reward call

Call it a double knee-buckle day.

Sara Eisen turned up with the Power Lunch teaser on Tuesday's Halftime Report in an exquisite gray ensemble.

Meanwhile, Josh Brown said he's now "in the green" in BABA, though he's not sure how much longer he'll stay long. (This writer is long BABA.)

Brown said there was good news for BABA longs. "There really weren't any negatives here in the quarter," Brown said.

Joe Terranova said Eisen's outfit the BABA mobile number is "incredibly staggering."

Pete Najarian said BABA's quarter "ties into" how AAPL is doing in China.

"I think the risk is to the great side," Judge opined.

Karen Finerman asserted on the 5 p.m. Fast Money that AAPL is not priced for extraordinary growth. "At. All."

Finerman also told Dan Nathan "the time has passed" for TWTR to be sold. Bob Peck of course suggested TWTR is a buy on the selloff (Drink) and suggested "conservative" guidance about 3-4 times.

Did you know CNBC is airing a Republican debate on Wednesday?

Kate Kelly reported on Tuesday's Halftime Report that Glenview's Larry Robbins is down 20% this year, and "that's obviously not good."

Steve Liesman reported that "lower for longer is in the cards here" according to CNBC's Fed survey.

Joe LaVorgna, who hasn't been on the show for a long time, said he sees "virtually no chance of the Fed moving in December," suggesting the "optics" of holiday shopping won't look great.

"I think March, at the earliest, and they may not go at all next year," said LaVorgna, who suggested a 15% chance of a recession, up from 10% 6 months ago.

Pete Najarian said he ditched AXP and UPS from his Halftime Portfolio and added UA and JBLU. (This writer is long UA.)

Stephanie Link endorsed UNP and said she'd add DAL on a pullback.

On the news of the day, Link said RAD is a "turnaround story in itself (sic last 2 words redundant)."

Joe Terranova pointed to RAD's horrible September and said the WBA report demonstrates how shorts don't always work.

Joe predicted the price of WBA's deal will require it to "lever up."

Karen Finerman on the 5 p.m. show said there have long been rumors about RAD and this transaction will take a while to complete and now that the news is out, there's no trade.

AAPL’s ‘best days are behind it’

Pete Najarian opened Tuesday's Halftime Report stating "yesterday's read was an overread" on AAPL.

Apparently not convinced about his own point, Najarian moments later asked Toni Sacconaghi if it was indeed an "overread" yesterday on Dialog.

Sacconaghi said "it's really been susceptible to data points" but called a lot of the noise "spurious."

However, "I think it- its best days are behind it," Sacconaghi asserted.

Sacconaghi said the "fear" is that AAPL is entering "growth purgatory."

"The law of large numbers does kick in," Sacconaghi allowed, stating the question is whether the iPhone is "largely done growing."

Meanwhile, the Halftime panel spent the discussion hemming and hawing about how they're not really that interested in AAPL right now but would be Katie Bar the Door if the stock plunged.

"I am concerned about Dialog Semi," said Stephanie Link, citing the "guide lower."

Josh Brown said if there's an AAPL disappointment, it'd be an opportunity to get in, not sell.

Joe Terranova said if AAPL goes to 105, "everyone in the world" will call it a buy.

Doc said options were pricing in a 6% move in AAPL. "If it dips here Judge, I wanna be an aggressive buyer," Najarian said.

More from Tuesday's Halftime later.

[Monday, October 26, 2015]

The Hillary Trade (cont’d)

The Halftime Report on Monday got a gift when CNBC superfox Meg Tirrell joined the set with a VRX update.

Tirrell said analysts think VRX did a "great job" addressing Philidor concerns, but "there's a lot more out there that people are still worried about."

Referring to a $100 million option to buy Philidor for nothing, Tirrell said, "there's a lot of concerns about what wasn't disclosed."

Jim Lebenthal said VRX isn't like Enron; "cash flows have increased along with sales."

Josh Brown said drug pricing will be a "major issue" until Sen. Bernie Sanders wins the Iowa caucuses through the election season. But Pete Najarian thundered that "it's about pipelines." Joe Terranova touted PKI, MDT, and MCK.

Hasn’t everyone been in it for about 3 years?

Josh Brown on Monday's Halftime Report said of AAPL, "Everyone's already in it," and that there's no imminent catalyst.

Joe Terranova said it's the suppliers who are "feeling the strain" of what's going on with AAPL.

Judge suggested that the Dialog Semiconductor miss is a "bad omen" for AAPL.

Pete Najarian described that as "obviously an interpretation of what people are looking at right now, right."

Josh Brown said he doesn't like YELP, in part because it's "hugely dependent" on Google to deliver Web users to its pages.

But Brown said LNKD has the opportunity to "shock some people."

Bill Pulte hates to say that his favorite housing trade is the best

Bill Pulte joined Monday's Halftime Report to say Sam Zell is a "pretty smart guy" who's capitalizing on a "plateau" in the housing market.

"I think he's selling at the right time ... the easy money's been made there I think," Pulte said.

Pulte called a lot of the seasonal numbers "just noise."

Jim Lebenthal wondered if existing homes were flooding the market and squeezing new homes. Pulte agreed that they'll work their way through the system.

Pulte said "you hate to say it, but" the suppliers are the best trade in housing.

Josh Brown cautioned against analyzing housing as one big market when it's "very regional." Brown touted DHI and LEN.

Pete Najarian backed HD and LOW.

Joe: The Will Rogers of bank stocks (but not the LeBron James of the bulge bracket; that would be JPM)

Joe Terranova on Monday's Halftime Report said MS delivered an "excellent" and "well-written" report upping GS and downing C.

But Joe stressed "they're not telling you they don't like Citi."

Jim Lebenthal referred to "Nordstroms" (sic) but said it's been clear from data that people haven't been buying "things" as much as "experiences."

Eddie Perkin chuckled about being on the set, then touted CS because the capital issue is addressed. "I think it's a double over the next 3 years," Perkin asserted.

Perkin said, "I think it's time for value to catch up a little bit." But Josh Brown suggested value vs. growth is a "nomenclature issue."

Perkin also likes UTX, which he said has a lot of "self help" going on.

A Tony Robbins moment: If things aren’t being talked about often enough, Joe has the personal power to change that

Jim Lebenthal on Monday's Halftime Report said it seems "way too early to me" to be making acquisitions in the natural gas space.

But Joe Terranova said "we don't talk about natural gas enough on this show."

Brian Stutland said there's a little more downside in gasoline. Scott Nations predicted a retest of the January low of 122.65 "on our way down to 1.20 even."

Eamon Javers at one point cut in with breaking news on Iowa GOP polling.

Pete Najarian said the Yahoo stats are "mixed" but said the "3rd screen" is how people want to "communicate" about football.

Stephanie Link buzzed in to tout the usual auto suppliers (Drink).

Jim Lebenthal said "labor is really chompin' (sic) at the bit" to latch onto the automakers' profits.

Judge had something going with sharp gray suit and turquoise/gray tie.

Joe actually got a Fast Fire on MLM but said he "absolutely" still likes the stock.

[Friday, October 23, 2015]

Judge gives Adam Wyden pop quiz

In the category of Wise Beyond His Years (we mean that in a good way), we have Adam Wyden, who articulated his fund strategies on Friday's Halftime Report like a 40-year veteran of the stock market.

Wyden said his philosophy is to "invest in really great managers and companies that are misunderstood that no one's heard of."

Honestly, that latter comment seemed a bit odd given that Wyden's top pick isn't exactly an anonymous company.

"We love Fiat Chrysler," he said, suggesting it's a great way to play Ferrari.

Wyden offered that he has "about 6 to 7 names right now" in his book and could go up to 10.

Moments later, apparently like those cops who repeat certain questions on the chance a person might give different answers, Judge asked Wyden "how many total stocks" he has in the portfolio.

Instead of stating "I just told you," Wyden said, "About 7."

Josh Brown suggested that with such a concentrated portfolio, one dog could blow a hole in things. Wyden said he doesn't invest in biotech, energy, cyclical companies or companies with leverage.

Stephen Weiss insisted "there's always something to do on the short side." Wyden indicated that shorting is a difficult endeavor. "People are getting carried out" shorting tech companies, and "we think it's not a good return on our time" (a curious description), though at some point he might do it.

Judge pointed out that Wyden's dad is a senator from Oregon. Wyden said, "I think he's, uh, pretty pro-capitalism, pro, uh, pro-investment."

No price target is more important to the Halftime Report than the highest one on the Street

Gene Munster, who perhaps has transitioned from AAPL euphoria to AMZN euphoria (though he was right all along with the former), made the 20-years-long AMZN bull case on Friday's Halftime Report, that right now 9% of stuff is bought online in the U.S. and it's eventually going to be greater than 30% (Drink).

Munster said his $800 target is based on "17 times 2017 EV to EBITDA."

Josh Brown asked Munster if Amazon has "the best business model in the world right now." Munster sort of chuckled, "I think they do."

Judge asked "at risk of becoming too giddy," what are the risks to Amazon.

Munster said traditional retailers are "not gonna give up" and could prompt an "investment phase" by AMZN.

Meanwhile, Josh Brown said if you've got money with a growth manager and the manager is not even in FB, you have to wonder, "Why are you even a growth manager?"

Brown even said "panic buy" in connection with FB.

Guess everybody was right not to be impressed when Judge trumpeted Skechers months ago

In a curious blending of tech and fashion, Mike Block on Friday's Halftime Report said people are going to "crowd into" growth names including UA, NKE, AMZN, MSFT.

Jon Najarian noted the "real pain" in the UA-FL-NKE space and first suggested it's just profit-taking and then acknowledged UA lowered margin guidance. (This writer is long UA.)

Doc said that if you "roll the calendar forward by 2 months," UA will no longer be "priced to perfection," and he called the stock a buy on a day like Friday.

Josh Brown said UA will find support in the mid-80s and that will be an opportunity to buy, not sell.

Stephen Weiss noted "there's real carnage" in the form of VF Corp and SKX. But Doc said SKX looks pretty close to a "washout."

"I added to Dollar Tree today," Weiss said.

Some people actually do run a short fund, unlike Bill Fleckenstein

Brad Lamensdorf, whose Halftime/Fast Money appearances tend to be among the more interesting simply to hear what stocks he mentions, told Judge on Friday's Halftime Report, "All year I have been bearish; I got very bullish down at the lows in September."

But Lamensdorf said "there's too many stocks that are underperforming the indexes" and that this bounce looks just like last year's at this time.

"Coming into next year, markets are very overvalued," Lamensdorf asserted, pointing to GDP vs. market capitalization, market capitalization vs. individuals' new worth in the market, and the ever-relevant Tobin's Q, which quite honestly all sound like the way Karen Finerman constantly claims that KORS is a buy.

Judge pointed out Lamensdorf has covered his AAPL short. "Um, we had a technical stop on that position," Lamensdorf said, stating "we do see a little channel-stuffing in the stock."

Lamensdorf said he's covered half his HOG short but that he has doubled his short recently in CRI.

Not sure S&P went

‘exactly’ to 2,058

Jim Iuorio on Friday's Halftime predicted the dollar "stays stable" and suggested the euro could go back to 105.

Jeff Kilburg predicted Janet Yellen won't do anything now or in December, and "the dollar's goin' nowhere in a hurry."

Rich Saperstein said it'd be a "net positive" if the Fed moves before year-end.

Knocking P, Josh Brown declared, "Streaming music is a terrible business."

Steve Weiss said health-care stocks are "lapping Obamacare" and there's now an opportunity.

Stephanie Link dialed in to say she sold her Halftime Portfolio positions in RHT and LULU and bought LRCX and WHR.

Josh Brown said he added ADBE and DPS, which (he didn't say) meet his criteria of trading around $90.

Mike Block said he's still negative on financials.

Judge and Sue Herera noted the passing of Tom Stemberg.

Carl’s bust — Stocks on fire since ‘danger’ alert

Everyone else has danced around it, but Doc got right to the point on Friday's Halftime Report, noting Carl Icahn delivered a "September 29th gift to the stock market."

"With global easing going on, you have to be in the market," said Stephen Weiss, who revealed, "I actually bought Netflix today for a trade."

"This is a monster week for tech in general," said Josh Brown, who said the difference between Amazon and Wal-Mart consumers is "literally (Drink) night and day."

"Tech is definitely one of the 3 sectors we like," said Rich Saperstein, who cautioned about emerging markets.

Mike Block said there's been a lot of damage in the health-care space; "don't tell me that guys who are long stocks like Allergan and Valeant aren't also long some of these tech names," and "something's gotta give at some point," which we're not sure is correct because some stocks can go down and others can go up.

That's basically what Stephen Weiss said in asserting, "You've gotta be a stock-picker," insisting it's a "stock-picker's market" (Drink).

Weiss pointed out the market hasn't rolled over with health care leadership.

Kate Kelly reported that Lee Cooperman still sees a continued bull market. Stephen Weiss mentioned that he had a private chat with Lee.

Rich Saperstein predicted 4-6% more into year-end.

More from Friday's Halftime and Fast Money later.

[Thursday, October 22, 2015]

Judge should take a cue from MCC, air ‘Road House’ clips to liven up flat shows

Thursday's Halftime Report was stalled a bit by Benghazi testimony (but then again, that was probably more relevant than a guy with 8 years to mull a presidential bid stating "we're out of time").

But when things got rolling, Joe Terranova declared "it's a chase for performance right now" and happened to predict the market goes "exactly" to 2,058, or unchanged on the year.

Now, our favorite usage of "exactly" is when Wade Garrett is introduced at the Double Deuce (that's a "Road House" line; hence the picture above (though that scene is not the one in which Wade Garrett says "exactly")), but Joe's comment happened to catch our ear.

Because we're not exactly sure what "exactly" means here.

If the S&P goes "exactly" to 2,058, then what does it do the next day? Go up? Go down? Stay the same?

Saying "exactly," it sounded like Joe might've been predicting a climb to 2,058 and then a flatness or pullback of some kind. But he didn't go that far.

The whole of his comments suggest he might more likely have meant "at least 2,058."

But then again, that's not what he said either.

Josh Brown said the rally has been led by the year's dogs, "but it's not necessarily the leadership you wanna see," and that health care, tech and financials haven't retaken charge.

Pete Najarian said he disagrees with Brown in that financials have been strong recently. Doc claimed he "can't disagree more" with Brown about tech, mentioning AAPL, MSFT and LRCX.

Brown insisted that over 20 days, "the tech sector is flat."

One of the Najarians said "What?" and chuckled, but we don't know which one.

Later in the program, Joe had to reiterate to Judge that it's a "chase for performance" (Drink) and chalked up Thursday to possibly more ECB stimulus though the reality won't be "until the string (sic), uh, spring rather."

Had no idea days ago that ‘specialty pharmacy chain’ would be the term of the week

Alex Arfaei served as the Halftime Report's Citron bandwagon-jumper on Thursday, struggling to explain how Citron apparently scooped him on an important element of Valeant's business.

Arfaei asserted, "We can't defend this structure" of specialty pharmacy.

Judge told Arfaei "I'm just surprised" that this component accounting for 10% of VRX revenues would just now be a "revelation" to Arfaei.

Arfaei acknowledged that's a "fair question" but said "What's new here is that we're learning that Valeant has a controlling interest in one of the specialty pharmacy chains."

"That structure appears to be too aggressive ... we believe it's questionable," Arfaei said.

Arfaei said there's no "smoking gun" that would prove financial fraud at VRX and he's not saying there's anything there; rather it's the lack of disclosure and uncertainty that makes him downgrade the stock.

Jon Najarian said the market is rallying, but VRX is still "in its own world of hurt."

Fleck’s vow to restart the short fund Oct. 1 seems like the ultimate contrarian signal

T. Rowe Price's Josh Spencer on Thursday's Halftime said "the stock opportunity" at AAPL has gotten "a lot less attractive" as the market cap has risen the last couple of years.

Spencer predicted "the 6S won't have the same degree of captivation" as the iPhone 6.

Spencer said he loves AMZN but he's starting to see "broader" opportunities such as in semiconductors; "I think we're through the worst with the economy and with China."

Now, the curious thing about that is that Bill Fleckenstein came on the 5 p.m. Fast Money in August and claimed he was either shorting or planning to short semiconductors because the worst wasn't over, they're in an "inventory correction at a minimum" and not at a bottom then because somehow "completely beaten down is a relative term."

Fleck evidently wasn't available (snicker) for a rebuttal.

Judge likes congratulating his guests for their headline-writing ability

Jeff Sherman, who works with Jeffrey Gundlach at DoubleLine, told Judge it's "not a popular opinion" to launch a commodities fund now, but such a fund "can achieve diversification."

Sherman predicted a "prolonged, um, kind of trading range for a while" in energy.

Josh Brown compared notes with Sherman on dealing with client concerns on portfolio diversification. Sherman said the thing to tell clients is, "Stick to your game plan."

Sherman said DoubleLine is "relatively neutral on the 10-year at this stage."

Meanwhile, Judge said Hardeep Walia's Motif partnership with JPM on $250 IPO buy-ins is intriguing "in and of itself" (Drink).

Judge called it a "great headline-grabbing thing" but he had to admit, when he heard about it, he said, "OK, the IPO market, if it wasn't at the top, does this mark the top."

(No, what would mark the top is Bill Fleckenstein stating he would go long IPOs.)

Walia said there are 2 reasons why this type of product does not mark a top; 1) there's actually a "demand by issuers" who want to "broaden their holding," then 2) he curiously questioned why retail investors can't participate in the 19% average pops on first day performances (that's not really an argument against a top).

Doc said there has been "consistent buying" in AAL.

Pete Najarian bragged it up in stating those MSFT options mentioned earlier in the week "have already doubled," and he's already taken off half his position (Drink).

When a stock is always a buy

Occasionally you'll hear the expression — a valid one in our opinion — "don't get emotional about stocks."

But one of the things that we've discovered over the years watching "Fast Money" is that some stocks somehow are always a buy no matter what the fundamental or technical evidence, which seems the epitome of an emotional judgment.

Consider that Karen Finerman on the Wednesday (sic Wednesday) 5 p.m. Fast Money revisited one of her favorite stocks, KORS, and claimed the "core story" with the company is a "ridiculous valuation" and reiterated, "I'm long."

In the last couple years, Karen has liked the stock in the 90s (she recently has said she was concerned about the valuation then), liked it as it slid into the 60s, claimed to be buying more as it cratered into the upper 40s, touted it in the lower 40s ...and is still long now with a 3-handle.

Basically, whatever price it's trading at, Karen seems to think people are going to buy more KORS shares.

Sometimes, the market can be really wrong for a very long time.

[Wednesday, October 21, 2015]

Tree falls in forest; Judge turns over chunk of Halftime Report for Democratic stump speech

It wasn't exactly a scoop.

John Harwood at the top of Wednesday's Halftime Report admitted he had no idea why Joe Biden was about to give a statement in the Rose Garden.

So Harwood tried to indicate that this statement was irrelevant anyway, telling Judge he didn't expect Biden to run for president.

After airing the entirety of an extremely gratuitous and indulgent statement, Judge turned to Harwood for analysis.

Harwood claimed a 2016 Biden bid "never made sense," stating Hillary Clinton is in a "much stronger position" (yes like the strong position she was in before the 2008 Iowa caucuses).

Harwood said now we can get back to the actual campaign and "not the fantasy football version." How many rushing TDs did Joe have last week?

Harwood cited the Most Significant Event of Recent Times, Clinton's "strong debate performance," as a reason for Biden not to run.

But while Joe Biden was given a full allotment of time to say he has never been more optimistic about the country and that candidates should run on the Barack Obama record, Carl Icahn dialed into the program later to claim "this country has a lot more problems than we think."

Judge at least pressured Carl into defending financial engineering especially in regards to repatriation. Carl said for some companies, "a buyback is fine, and in fact it helps the economy (snicker)."

Carl said he has signed the Giving Pledge. (Translation: Hillary can't complain about me in her stump speeches.)

The early portions of the program were devoted to a much more interesting subject, the Valeant takedown, with CNBC superfox Meg Tirrell reciting the details of the Citron report for 1 of probably 7 occasions on the day.

Jon Najarian gushed that on Oct. 5 he was talking about people buying the November 145 VRX puts and selling 190 calls against it.

Jim Lebenthal said he was reading the Citron report for the first time, and "it does seem like there are some smoking guns." But he said if there actually is channel-stuffing, he'd expect to see higher receivables.

Rebecca Patterson told Judge he made a "great point" about the "fragility" of stocks with "little margin for error." (Um, seems like a Citron slam is a little different than "margin for error.")

Patterson said she's "staying constructive" on the markets, specifically semiconductors and health care.

[Tuesday, October 20, 2015]

We think Judge only let Jon Krinsky rattle off 2 of his 4 main reasons, should’ve stopped there

Jonathan Krinsky, the star guest of Tuesday's Halftime Report, said it was important to "clarify" that the Nike long-term story is intact, but he thinks the odds have "significantly risen" for "a bit of a pullback."

Krinsky cited "4 main reasons," and we don't do more than 3.

Joe Terranova pinned down Krinsky on whether his NKE call was a "counter" call to Omar Saad's on Monday, and how is NKE affected by the macro.

Krinsky said it's not a "counter" call but he's just looking for a "modest" pullback to the moving average routine, about the 2nd of 5 times he would say the same thing.

Josh Brown and Pete Najarian and then Joe again asked unnecessary questions that prolonged this quickly tiresome segment at the top of the program.

Pete thundered, "Here's why you don't sell it — you hold onto it, and you buy the lowest implied volatility (Zzzzzzz) ...."

Judge introduced the show stumbling over "game pran (sic)" and Disney.

IBM apparently could use Twitter’s ‘cadence’ of innovation

If you thought an analyst making a technical call for a "modest" NKE correction was unfathomably boring television, wait'll you caught Judge's recap of the IBM report.

Jim Lebenthal was forced to admit on Tuesday's Halftime that IBM's quarter was "really quite terrible," although he deserves credit for a thorough and succinct assessment of it.

Josh Brown said IBM hasn't produced "a single buy signal" since the end of 2012 and suggested "120ish" as the possible bottom.

Dan Niles, who generally has always made the right call in the past, claimed "investors have developed really bad habits over the last 4 years," suggesting the market has been able to "bail out really bad investment ideas" during that time.

Niles said he "can't remember" how long he's been short IBM, but he has been on the show "a lot" and doesn't recall saying anything positive about IBM "in I don't know how long."

Revealing that he still hasn't lost his touch, Niles told Judge he sent him a note about his WMT position and stated on the program that he got out of his position "about a month and change ago."

Niles said he's "legging back into" media stocks.

Joe Terranova advised viewers on IBM, "Because Warren Buffett is in it does not mean you have to be in it. Remember that."

A day without all-day breakfast as a catalyst

Sarat Sethi dialed in to Tuesday's Halftime Report and, pressed to decide which branch of YUM is more attractive, hemmed and hawed before basically indicating Yum China is more attractive for its growth, which is the same point he made last week.

Josh Brown said, "The Street doesn't seem that excited about this."

Pete Najarian said it'll be "quite a while" before the YUM split happens and questioned, "Are they bailing at exactly the wrong time." Pete even mentioned Bucyrus, which he previously called "Bukaris."

Josh Brown said you don't get respect in China until you're "fully Chinese."

Joe warned that "the unfortunate consequence" of the split is that YUM China will be a "proxy for macro conditions in China," and he twice said it'll be "one volatile stock."

Judge thanked Sethi for "jumping out of a meeting" to give 'em a call.

Haven’t had an update in a couple days, but presumably Mike Mayo still thinks JPM is the LeBron James of big banks

Jim Lebenthal on Tuesday's Halftime suggested AAPL might be undergoing another "wholesale changeover of owners."

Josh Brown called DIS a stock to own for 3 months, then made it sound like things look great for 3 years. Jim Lebenthal said it's a mistake to sell short the "Star Wars" franchise. Pete Najarian was even heard to say DIS is a "tech company."

Steve Grasso actually claimed on the 5 p.m. Fast Money that "I don't think that the 'Star Wars' was even priced in."

Morgan Brennan suggested 3 beaten-down stocks — CSX, FDX and MATX — may be worth a buy but "not for the faint of heart." No one seemed that excited.

Joe Terranova said "there's no way statistically" for him to win the Halftime Portfolio contest.

Scott Nations said "lower for longer from the Fed (sic last 3 words redundant) helps gold." Jim Iuorio said 1,225 is "my goal in the next few weeks."

Pete Najarian said he's in DAL and UAL. Joe said to look at look at ALK and JBLU, which have pulled back after strong year-to-date "porm- performances."

Josh Brown surprisingly said "people should not be shocked" that there may be reliability issues with the Model S.

Pete Najarian on the 5 p.m. Fast Money said something about AAPL's "autonomimous (sic) car."

Brian Kelly said "Tim Cock (sic), Cook" on the 5 p.m. Fast Money.

[Monday, October 20, 2015]

Bad calls

A month ago, Pete Najarian and Stephen Weiss predicted the Colts would win the Super Bowl. (Must've been what the options or European hedge funds were saying.)

It’s not exactly ‘Headless body found in topless bar’

Judge on Monday's Halftime Report told NKE watcher Omar Saad, "You know how to write a headline over there," just because Saad apparently called NKE "the next mega-cap juggernaut."

Put this fellow on the copy desk right now.

Saad said he can "really see a change" in how Nike runs its business and twice said "essentially" (Drink) in explaining how the company discovered "massive amounts of pricing power."

It may seem pricey now, but it "looks cheap if you look out a few years," Saad said.

"I don't see why this can't be a 200- or 300-billion-dollar market cap someday," Saad said, prompting a "Wow" from Judge before adding "margins really could almost double from here."

Joe Terranova wondered if Nike will "basically obliterate" UA's growth. Saad claimed they're "much more complementary than supplementary."

Saad even claimed "in almost some ways they don't fall in each other's radar screen."

Josh Brown said he thinks NKE goes higher though he's not sure about 200. Stephen Weiss said he owns LULU, and "frankly I think they should buy LULU."

Tom Lee actually stands behind year-end call of 2,325

It's not quite as bad as if Chuck Pagano called his 4th-and-3 routine impressive, but ...

Tom Lee sat in with Monday's Halftime crew and actually said he still believes in his 2,325 year-end S&P target.

Lee suggested value could outperform growth over the next 6-12 months, citing dollar reverse, steepening yield curve and the curious lagging leadership of health care.

Josh Brown said to back value, you have to be bullish on the global cyclical trade. Lee insisted the weakening dollar is the key. Lee even mentioned GE (because they do slick commercials and sell banking interests rather than make new products that people clamor for).

Stephen Weiss actually claimed the Fed is "tightening" (though not in October).

"The U.S. has pent-up demand (Drink)," Lee insisted.

Judge asked Lee about his backing of LEN. "It's a paradoxal (sic) thing," Lee said, stating that the homebuilders are telling us we're in mid-cycle recovery.

Not sure what kind of 10-year call (or high-yield call) Kristine Hurley was making

Kristine Hurley, like Tom Lee, visited Monday's Halftime desk and said "clearly there's a lot of concerns" about global expansion and the lack of inflation, so don't expect 10-year rates to soar.

Hurley said she's in the camp (Drink) of "hoping" the Fed hikes because ZIRP is an "emergency" situation, and there's no emergency.

Hurley, who mostly used the most formal, press-release terminology (especially when talking to Weiss), said the high-yield market is "aggressively pricing in the downside" and creating opportunities. But she refused to name names to Judge.

Joe thinks October will be an ‘appreciative’ month for stocks

Josh Brown claimed on Monday's Halftime Report that the market doesn't believe Chinese GDP data.

Brown said CELG — Celgene!!!!!!! (Drink) — is starting to break above the 50-day!!!!!

Joe Terranova said October will "lend itself to being an appreciative" month for equities. Joe called the pullback in energy "healthy."

"I still think we're in a trading range," said Stephen Weiss.

Pete Najarian observed that MS was giving back all of its recent nice move but touted the XLF and (Drink) airlines.

Pete crowed that volatility is down despite the fact some folks say "holy smokes," volatility is here to stay. (Now, of course, it's an opportunity to buy protection.)

Pete eats at the same restaurants as Gene Munster

On Monday's Halftime Report, Phil LeBeau said of FCAU, "the world is their oyster" (snicker) and tossed in an "at the end of the day" (Double Drink).

Josh Brown called Ferrari "just a traditional wealth brand," while Joe Terranova said it gets "lumped into" the overall auto industry and said both Fiat and Ferrari give him "pause" and are names to avoid for "multiple quarters."

Pete Najarian said he "bumped into" Gene Munster at a dinner the other night, then Pete trumpeted whatever Katy Huberty (Drink) said about AAPL.

Pete said there were "huge buyers" of next week's expiring October 49 and 50 calls in MSFT. Pete said he loves the name and used this data as an "excuse" to get back in.

Joe even hung a potential 650 on AMZN post-earnings.

Josh Brown said he "can't even imagine" what the tone of the YHOO call will be.

Joe said DB's rise is no reason to favor European banks when U.S. banks are better.

Stephen Weiss admitted that "Mattel popped a little bit" last week (even though he warned about dividend safety a day or two previously). Monday, he said it's "appropriate" that HAS took a dive, and he doesn't like the sector.

Judge said "in and of itself" (Drink) in regard to MCD. "All-day breakfast is a hit," said Josh Brown, while stressing we don't know if it lasts more than a quarter.

Pete Najarian said he wouldn't short WTW given Oprah's presence, "this is as big as any activist getting involved."

Anthony Grisanti predicted a 30-handle in crude before a 50-handle. Brian Stutland though said to play the range from 44½ to 50.

[Friday, October 16, 2015]

Why doesn’t anyone question the value of GE’s endless commercials?

This page, actually in one of our earliest successes (snicker), figured out the Jeff Immelt Impact on GE many years ago.

It's all about image and goals and some kind of "vision," and never about the stock. (Witness likely his most emphatic public statement, not about turbines or refrigerators or NBC's Must-See TV, but encouraging the University of Notre Dame community not to heckle President Barack Obama.)

Those considerations are fine, except when you're running such a huge public company, you think you'd be judged on results.

One thing Immelt definitely likes are glitzy commercials. Usually they feature cute kids and moms and suggest that GE is saving the environment.

Do they make you pick up the phone and order a dishwasher? Probably not.

In the past, those commercials were just upstream (or is it downstream) transactions between NBC Uni and its parent. Though we have no knowledge of the deal terms beyond what's been reported, we would probably guess that the terms of the Comcast sale included an obligation to run these ads at a discount (perhaps free) in some kind of corporate trade-off.

So recently, CNBC viewers have been bombarded with some techie bloke who struggles to convince relatives and friends that GE is an exciting place to work.

What nobody tells him in these commercials is that if any of his pay is based on stock options, he oughta head anywhere west of Fairfield.

Take note of the slick wall decorations in this ad. Not only is there an Einstein, there appears to be a concert poster at right. Except it's not real musicians; according to what we dug up, it's from a "Lost" episode and features names of real PR honchos.

So we have not some refreshingly authentic story of a 20-something wiz finding a home at GE ... but slick Hollywood propaganda designed to paper over this company's dreadful performance in this century.

The notion that a company such as GE should have to resort to advertisements such as this is laughable. But the momentum traders on the Halftime Report, Fast Money and Options Action are oblivious, pointing to "breakouts" in the stock in 20s — along with the purported unwind of GE Capital (brought up by Missy Lee on Options Action on Friday) that we've been hearing about for 7 years — as reason to buy.

We have no doubt that, if asked, Immelt would surely insist "these ads are definitely worth it; they get our image out there in ways you don't see yet in the bottom line," which is basically what he says about everything.

Jack Welch, an undeniable business legend, simply had an uncanny sense of which things were undervalued and which things were overvalued. The current fellow has little but a semi-slick PR team.

Dan Nathan at least admitted GE has found a lot of enthusiasm "without any fundamental improvement."

But they've got a new commercial.

Why didn’t Judge ask

if Wal-Mart is a short?

For days, we've been hearing how bad it was.

Jim Cramer called WMT's performance "bush league" and questioned if the CEO's in control.

Karen Finerman said the guidance is "really bad news" and that she has "no urgency" to buy the stock.

Meredith Adler said it might take a "template" of a decade to turn it around.

Liz Dunn said she "wouldn't touch it."

Bill Nygren pointed out he doesn't own it.

Jim Lebenthal said it's only a buy when we're having another recession.

Josh Brown said it's undergoing a "very long comeuppance" that could last "decades."

So if all that is true, why isn't the stock a short?

All Judge asked this week is whether anyone's buying the dip.

And if it's not a short, given all of that sentiment, then isn't it a buy?

On Friday's Halftime, retail watcher Matthew Boss said there are 3 categories of retail expansion, those being off-price, athletic and dollar stores.

Boss said he likes DG but was lukewarm on UA.

"I think Nike can double over, over the next 3-5 years," Boss said.

Judge claimed Namath was a crossover star after his career but his big ads (Brut, hot buttered popcorn from Hamilton Beach) occurred while playing

Judge on Friday's Halftime Report twice referred to Joe Namath as an "NFL (sic)" Hall of Famer (it's actually the Pro Football Hall of Fame, and Namath is famous for his role in the AFL).

Joe said he's been involved in "probably not enough" charities.

Namath called the current Jets quarterback "pretty smart at this point."

Stephen Weiss called Namath his "boyhood idol."

Namath said "I don't care" about Deflategate.

Namath said it was "very depressing" to hear about shenanigans involving Draft Kings and Fan Duel.

GILD, but no CELG

Josh Brown on Friday's Halftime Report actually said it's "healthy" to have some losers in the health-care space instead of 100% winners.

But Jon Najarian said he's seeing "upside bets" in the IBB.

Stephen Weiss struggled to say that a bunch of recent hedge funds came into existence "specifically in biotech and health care," and that ones that started more than a year ago and ones that started less than a year ago (that's pretty much all of them) "have to stay in for a year."

Stephen Weiss said he owns GILD (Drink) because of valuation and it's a "small position."

Weiss is fascinated by Judge's gray hair.

Still wondering when we’re gonna hear about Fleck restarting his short fund

The skeptics were out in force on Friday's Halftime Report.

Stephen Weiss said there's a better chance we trade down to the "1900 levels" than make new highs in the S&P 500.

Stephen Weiss stumbled to say (as far as we can tell) that the bar was set lower than everybody thought.

Steve "1,700 S&P" Grasso said he doubts the rally can last based on the "junk names" that have kick-started it. But he said 2,032 is resistance, and if we "blast through," we get 2,071 "in quick order."

Josh Brown admitted to Judge he didn't see the rally coming.

Oh joy — Steven Ballmer

has an unverified Twitter account

CNBC's Dom Chu gave himself a workout on Friday's Halftime Report giving viewers the details of how the financial media seemed to deduce that Steven Ballmer has a stake in Twitter.

Josh Brown actually mentioned Twitter's "cadence (Drink) of innovation." (They probably made a counteroffer to the kid in the GE commercials.)

Doc said options "pinning" was keeping a lid on Twitter.

Meanwhile, Doc gushed that Steve Wynn is "not afraid to take on anybody," but Doc said to trim casino gains and "reload on the dip."

Sarat Sethi said MAT "overdelivered." (This writer was long MAT a day earlier when Steve Weiss (snicker) warned about the dividend; Friday was a good day to exit.)

Doc was allowed a Brag Trade on NBL options; "take the money and run as they say," he said.

Doc said he bought 1-day AMZN calls in the last 45 minutes. "This is one that I'd buy and hold," Najarian said.

Judge prefers Sarat Sethi

buy momentum

Sarat Sethi on Friday's Halftime said "something's gonna happen" at YUM and that "basically" there's a floor under the stock.

Pushing back against Judge's notion that Keith Meister's plan is going to happen at YUM, Josh Brown said Meister would've been added to the board because management is "desperate" to keep their jobs and avoid proxy fights.

Sarat Sethi said he would want to be in the China-India "growth area" of YUM, drawing disbelief from Judge, who wondered why Sethi wants the part that's "sucking wind."

Stephen Weiss said a REIT would be a "bonus" for MCD but there's already a lot of "pent-up demand" for the stock.

Josh Brown said MCD has the chance this quarter to "really shock people to the upside."

[Thursday, October 15, 2015]

Weiss goes to a conference to hear what he wants to hear (a/k/a try not to ruin your reputation by being known as a VRX long)

Stephen Weiss said on Thursday's Halftime Report he was at a "Barclay" hedge-fund conference and heard large THC holder Larry Robbins talk about buying more, and so Weiss "bought a little more" Thursday morning.

Weiss went to great pains to stress that a long-only outfit (Sequoia) has a big stake in VRX, then admitted, "to me, this is a pure roll-up, and roll-ups have very little flexibility when the business starts to go against them."

"This is Tyco in health care," Weiss said of VRX, then clarified, "There's no crook here; I don't think anybody's doing what Kozlowski did."

Josh Brown stated that funds holding big VRX positions face a "huge amount of reputational risk" based on "how much of this thing can we be seen holding if it gets down to 120, 100."

The retail analyst’s Altamont moment (a/k/a why didn’t Doug McMillon tell Squawk ‘these numbers are gonna suck but we can’t release them for a couple hours’)

Meredith Adler told Judge on Thursday's Halftime that "I was there" at the WMT disaster and wasn't too surprised at the market reaction.

"I think people were not completely clear that the investments were not about wages," Adler said.

Adler said some of the company's challenge is about competition, and "some of it is about them needing to change the way they run their business."

Adler said she "inherited" the stock in her analyst sphere a couple years ago and took the Barclays "buy" off in February.

Judge questioned if it might even take "a million years" to turn the WMT ship around. Adler suggested KR as a "template" and suggested a horrifying timeline of 2002 to 2012. "I would say it's a long process" and "not short," Adler said.

Adler said she likes DLTR and SFM and BIG much better than WMT.

Josh Brown said Adler is "dead right" about the company's challenges. "This could be dead money for a long time," Brown said.

Jim Lebenthal asserted the consumer is "delevering" and bringing pain to WMT and others.

Karen Finerman said on 5 p.m. Fast Money she feels "no urgency" to be in WMT as it possibly takes "a shot" at a delivery service.

Weiss cautions about the MAT dividend (to all those momo folks who have been stampeding into the stock for the last month)

Stephen Weiss said on Thursday's Halftime Report he'd "be cautious" with MAT and that the dividend might not be safe. (This writer is long MAT.)

Josh Brown suggested FB could climb another $20.

Jim Lebenthal said if you ever see Dunkin start outgrowing Starbucks, then you buy DNKN, but right now SBUX is on a tear.

Judge said he didn't want to "waste time" discussing Barclay's overweight on AAPL.

Steve Weiss predicted "much more M&A" in tech but insisted on talking about AAPL, stating he's hearing about "disappointing" 6S sales and warned the suppliers will feel the pinch from sluggish sales.

Rich Greenfield is really adamant that NFLX churn is down

Stephen Weiss didn't have the greatest rationale for his NFLX non-position on Thursday's Halftime Report, stating, "I'm not inclined to buy it here because momentum cuts both ways," this about a stock that has been yo-yo'ing between 95 and 115 and is about smack in the middle.

Josh Brown, reissuing his Brag Trade about how he "stole" NFLX in late August, shrugged off the latest stumble, stating, "they tend to have 1 or 2 quarters each year ... there is a slight shortfall," and people start wondering, "Uh oh, is this it."

"The business is in great shape. There's nothing like it," Brown claimed.

Rich Greenfield then stormed on for his quarterly update, assuring Judge, "Forecasting Netflix's growth is certainly more art than science."

Then, opting for his Word of the Day, Greenfield asserted, "No. 1, churn is down," and the "5.7" subs were actually "pretty incredible."

Regarding the credit card chip claim, "The reality is, I can't explain it," Greenfield said, insisting again that churn is down (Drink).

Nevertheless, "The stock I think probably deserves to get tagged today," Greenfield said, citing a miss.

Betcha Jim would excel at finding bargains on Draft Kings (or is that more of a Bill Nygren thing)

Jim Lebenthal on Thursday's Halftime spoke of picking up cigar butts on the sidewalk contended that "in these big money-center banks and investment banks, you still have a lot more gains ahead of you."

"A lot of these stocks are very cheap no matter what multiple you put them up against," Lebenthal said.

Josh Brown conceded the bank stocks are "undoubtedly cheap," but at least tried to make the emperor-has-no-clothes argument; "If you look at price action, they're going nowhere."

Stephen Weiss claimed for Goldman Sachs, it's "very very difficult to go quarter-by-quarter." He said he likes it long term but cautioned that the IPO calendar is slowing down.

Weiss later invoked Wayne Gretzky (Drink) and even claimed "you could've made money if you bought Goldman today pre-market."

Brown said the preferreds are where the money's being made in the banks; "essentially, these companies have been turned into utilities."

No warning to tweeters this time that the Futures Now crew is not like Peter Schiff

Anthony Grisanti told Jackie DeAngelis on Thursday's Halftime that gold bulls are "emboldened down here by the Fed's non-action: They don't think there's gonna be a rate hike this year, and they don't think there's gonna be one next year either."

Jim Iuorio hung a 1,225 on gold but said he's "not positive" of a permanent turnaround.

Josh Brown expressed admiration for gold's comeback and asserted, "There really aren't that many sellers."

Meanwhile Kathleen Smith said "the positive news is deals are getting done" in the IPO market, but for issuers, "deals are getting done at great discounts."

Stephen Weiss noted that a small number of FDC shares seemed to be trading and wondered if the others are being traded "off board, in, in the dark markets." Smith said she "wouldn't be too concerned" about where FDC is trading and predicted investors will find it a "reasonable investment" after it trades for a bit.

Smith said Jack Dorsey also having a TWTR job is a "big issue" for Square, and it seems "fairly unlikely that Square will be able to come to market at anything above even maybe close to that last round of 6 billion."

Jon Najarian reported on how IEX is making a donation to fight ALS. Najarian said he sold QCOM on Thursday and bought GS and FEYE.

Bob Pisani on the 5 p.m. Fast Money said he's sure the gang could show him to the "nearest bars" in Midtown.

[Wednesday, October 14, 2015]

If anyone deserved a Cubs title, it’s this gentleman

They're starting to get a little bit carried away in Chicago.

Bill Nygren on Wednesday's Halftime Report curiously cited "the similarities between a general manager of a baseball team's job constructing a team to a portfolio manager's job constructing a portfolio of stocks. You're trying to take advantage of market inefficiencies, and you, you end up looking for imperfect stocks or players for those imperfections are ones you can deal with (sic last 9 words grammar stumble)."

Perhaps, but a portfolio manager can buy as many Carl Icahn stocks as he wants, while a baseball general manager (one of the most overrated professions in history) can't exactly buy 5 Jake Arrietas.

Nygren, who said Oakmark succeeds by "using a very long-term time frame," touted CMI.

He also likes APC, stating that over 5 to 7 years, "It's much more likely that oil will be in the 70s than in the 50s."

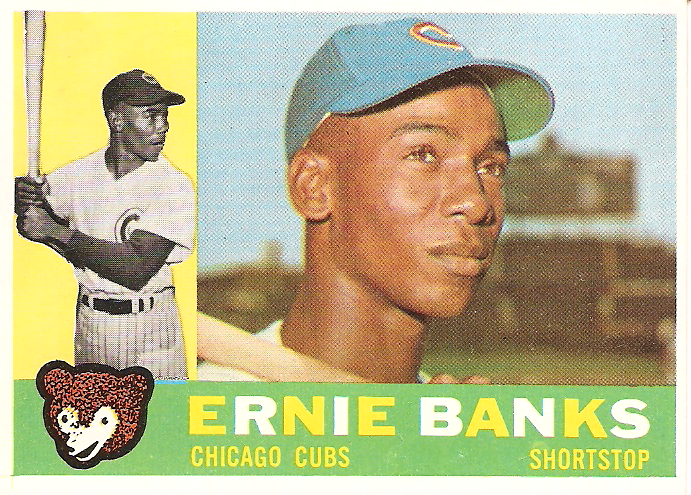

Bringing up a mini-tragedy, Nygren referred to the death of Ernie Banks just months ago. "It's a shame that Mr. Cub can't be here to enjoy this season," Nygren said.

Low bar: Mike Mayo says JPM isn’t as bad as WMT

A lot of analyst terminology gimmicks are good for 1 CNBC appearance.

Mike Mayo on Wednesday's Halftime received an encore with his JPM-as-LeBron-James routine, stressing the offense-and-defense thing.

"We'd be big buyers here around $60 a share," Mayo said.

Judge actually told Mayo, "Defense may win you championships in the NFL" (snicker), but doesn't JPM need to play better offense.

Mayo insisted JPM is gaining market share in investment banking and deposits, and "we think this is a one-off."

Mayo even invoked the WMT disaster and stressed, "There's not a strategic issue at JPMorgan," stating the company's in the "3rd or 4th inning of this restructuring program."

Josh Brown asked Mayo why higher volatility wouldn't be great for JPM's trading desk.

"Volatility yes, volume, that's not always the case," Mayo responded.

"So now they need both? What else do they need?" Brown persisted.

"You don't pay up when you have a big trading gain. How much do you want a haircut because trading falls a little bit short," Mayo answered.

"So it's a distraction from the core business," Brown concluded.

Company gives guidance for 2019

Well, that was one of the more interesting guys-in-suits-making-choppy-webstreaming presentations we've ever seen.

Much of Wednesday's Halftime Report was devoted to Wal-Mart's live Q&A, which basically amounted to, Everything's great except the stuff we already told you about a while back.

Judge summoned Jim Cramer, whom Judge called "a pro's pro," for an analysis.

Cramer called the WMT presentation "one of the more bush league things I've ever seen," grumbling that Doug McMillon came on Squawk Box and never hinted at this, leaving Cramer wondering if he's even in "control of this situation."

Cramer said that COST pays its workers "far more" than WMT, whereas WMT's strategy to "starve the employee" to improve margins has been an "abysmal failure."

At least Judge hit Cramer with a good one, questioning why, if this is just a WMT problem, were COST and TGT down. Cramer attributed that to the "ETF-ization of retail," whatever that means.

Courtney Reagan, who was called "our retail analyst" by Judge, reported that Doug McMillon said at the top that "you know I thought we kinda gave this information to you guys" and that McMillon sounded "a little defensive."

Josh Brown grumbled that WMT shares have rolled back 3 years of gains and noted the previous buybacks are basically a "waste of money."

Later, Brown ramped it up a bit, stating Wal-Mart is experiencing a "very long comeuppance" that could take "years if not decades."

Jim Lebenthal curiously said some people view value investors as the folks who pick up cigar butts on the street for a puff, then said "I've never owned Wal-Mart" while explaining he doesn't want to take "gratuitous shots at the company," but it's late in the WMT expansion and the time to look at the stock is when we're nearing the next recession.

Judge asked Bill Nygren for his thoughts on WMT. "We don't own Wal-Mart, and, uh, because of that, I don't have much to say about it," Nygren said, using the opportunity to tout Amazon.

At least one person was backing management. Liz "I believe in the Ron Johnson plan" Dunn, who was hard to understand through her cell connection, stated "it looks like it's a little bit of a case of maybe mis-modeling by the Street" because it "should've been somewhat anticipated."

As for the stock, "I really wouldn't touch it," Dunn said, calling it "dead money."

Karen Finerman on the 5 p.m. Fast Money called the WMT communication problem just a "sideshow," downplaying Mel's (and every other CNBCer's) irritation that McMillon didn't spill the beans on Squawk Box.

"What's he supposed to do, sort of go into it, but then not?" Finerman said, adding the guidance is "really bad news."

In other retail news, Josh Brown suggested that all those GoPro devices bought by "every single teen" last year are now "sitting in a drawer somewhere."

Doc, barely relevant on this program, told Judge he's not sure if UA has had enough of a dip to start buying it.

Guy Adami said on the 5 p.m. Fast Money that NFLX's quarter gives bears "ample ammunition" to "lean in" to the stock, but he said you can own it against 95.

[Tuesday, October 13, 2015]

Flash — Mary Barra thinks science and math classes are important

Judge hyped this as an "exclusive."

Kate Kelly, who looked very glamorous, spoke with Mary Barra on Tuesday's Halftime Report, but the best Kelly could come up with for her first question was what does Mary think about mentoring young women.

Barra said science and math are important for both girls and boys.

Kelly asked Barra, "What's at the top of your worry list?" Barra observed, "We're a cyclical industry," and then sort of pointed to driving efficiencies in South America (Zzzzzz).

Judge determined that no one on the desk owns GM or F (with the exception of Pete Najarian's F calls).

Stephanie Link touted the auto suppliers (Drink) including LEA (Double Drink).

Oh joy — half-positions in banks

Anton Schutz on Tuesday's Halftime told Judge he expects "nothing glamorous" out of the big banks' earnings.

But he thinks there's enough negativity in the sector that it's a buy on "a break."

Pete Najarian questioned if JPM has already had the "break." Schutz said, "I don't think you get hurt by buying it now," suggesting you can start with a half-position.

It wasn't until very late in the program that Pete revealed, "I put on a half position just yesterday" in JPM.

Dan Greenhaus asked Schutz, "leaving the political arguments out of this," are the big banks too big to manage or grow.

Schutz said, "There's a lot of sides to this argument," stating it's tough for them "to create returns," but that they need to be big to compete globally with "4 giant Chinese banks."

Schutz reaffirmed he likes YDKN.

Doc said months ago he got OptionMonster wealth-management clients into WYNN in the low $100s

Joseph Greff of JPM said on Tuesday's Halftime Report that it's been "a mixed year, to say the least" on gaming names.

He said he sees the most upside in MGM because of its Vegas Strip exposure.

Greff also called PENN "an interesting growth story" with 25% upside over 12 months.

Joe Terranova pointed out that Macau names have rallied after the Chinese government has suggested support "almost like Cash for Clunklers- uh, Clunkers, rather, years back."

Greff wasn't high on the growth but rather "less bad results."

Greff said his best buy in the hotel space is HLT.

Judge then asked Doc for a call on this conversation because Doc talks about these stocks more than anyone else. "Obviously this guy is spot-on," Doc said, claiming "even Chanos was thinking about perhaps covering shorts."

Doc said there was unusual activity in LVS and MPEL, and also in MAR and HOT.

Jackie DeAngelis indicates Futures Now crew is receiving Peter Schiff-caliber heckling

In what can only be considered a sleepy program, Judge's Halftime Report Tuesday struggled to elevate with some market calls.

Joe Terranova said financial and tech earnings are the most important thing for the market now (Zzzzzzzzz).

Joe said it's been a "very difficult year in the macro trading world," and "the fastballs are coming in on those type of trades (sic not sure what type of trades he was referring to) at 99 miles an hour."

Dan Greenhaus said he'd side with Joe against Cramer in that it's not about oil as much as it is the dollar.

Pete Najarian said, "Volume is absolutely absent."

Judge said he's "assuming" that all of his panel read the front-page USA Today story on deal froth.

Pete Najarian and Dan Greenhaus for some goofy reason decided to trip over each other to see who could best declare how important the CSX earnings are ... to something or other.

Dan Greenhaus reported that "a fairly prominent sell-side person" was telling a "very prominent client" about the U.S. already being in recession. "So, that concern exists," Greenhaus said.

Among who?

Stephanie Link called GE a "very underowned stock."

Joe predicted TCK and CNX will emerge the winners of the coal space, and that there is "no value" at this point in JPM putting BTU at an underweight at 16.

Dan Greenhaus said not to expect a "growth explosion" in housing.

Pete Najarian said JBLU's pullback represents "a little bit of an opportunity."

Anthony Grisanti told Jackie DeAngelis that gold has experienced a lot of short covering. Jeff Kilburg said "you have to be a seller" at 1,170.

Stephanie Link admitted it's "hard to get really excited" about JNJ.

Joe said ETSY would fall victim to the "revenge of Goliath."

Pete Najarian said before you plow into TWTR's bounce, you have to make sure "there's more to it" than just a couple news stories.

Dan Greenhaus said twice (yes twice) said there's nothing "inherently" (Drink) (snicker) bad about beer giants making a deal out of weakness.

[Monday, October 12, 2015]

$80 crude next year

In a show that was undeniably weak, Bob Brackett was a rare highlight.

Brackett, an elite oil-watcher making his first CNBC appearance, said on Monday's Halftime Report that the cure for low crude prices is always low crude prices. "Market forces are starting to work," he asserted.

Articulating a bull case, Brackett added that if you look at marginal producers, "these folks are losing money on every barrel. Historically that's been the point at which oil bottoms."

Jim Lebenthal asked if a bunch more producers won't come back on if the price gets to 55 and then the cycle repeats itself. Brackett said "there's a misconception out there that oil, shale oil, will come back in a couple weeks. ... Takes much, much longer."

Brackett, who slightly resembles a young Col. Harlan Sanders, said he's gone from "fairly neutral" a year ago "to a much more bullish stance," given his belief that the price returns to 80 next year.

He likes Cobalt (CIE), "a way to play that deep-water trend." He also likes COP for lower-beta and occasional Joe Terranova favorite EOG for mid-beta on a rising oil price.

Honestly, this page doesn't share Brackett's view. But he did such a thorough job of defending it, we can't figure out why he hasn't been on the show previously.

Believing it doesn’t make it happen

Apparently unwilling to talk about tech M&A or anything else that would wake people up, Judge opted to put viewers to sleep on Monday's Halftime with a value-vs.-growth conversation.

Judge questioned if value, "in and of itself" (sic 4 redundant words), has staying power. Stephen Weiss said "it's too early to call the rotation from value into growth at this point."

But Jim Lebenthal explained that he's "not yet ready to make the call that value is here to stay."

Judge even asked Stephanie Link at the end of the show if value is really coming back. Link said, "This trend can last for a while."

Eyebrows were definitely raised when Rob Sechan said, "If you believe that the recovery remains intact, and this was a bull-market correction and one that you wanna kinda buy going forward, there's gonna be a spreading out to the cyclical sectors, there's gonna be a spreading out to some of the value, uh, areas of the market."

No. Believing (or not believing) that the recovery is intact is not what will make investors spread out to cyclical sectors.

Sechan observed that "individual stock ownership is at 54%, lowest in 15 years."

Steve Weiss said we've just had "unquestionably just a pause in a bull-market trend."