[CNBCfix Fast Money Review archive — August 2015]

[Monday, August 31, 2015]

‘What have you’ — Sara demands to know what happened to ‘imminent’ TWTR announcement

It was heaven on earth for viewers of Monday's Halftime Report as unanimous CNBC superfox Sara Eisen took the reins as guest host.

And she picked up where Judge generally leaves off, inviting Bob Peck for another chat about the "triumvirate."

Peck said TWTR sentiment is "completely washed out," then he predicted a series of catalysts including the "rumored board meeting" this week, CEO announcement next week, then Project Lightning and Google integration.

Sara pointed out that Peck was calling the CEO announcement "imminent" a couple weeks ago and asked, "who are you talking to."

Peck said he talks to industry people, investors "and what have you," and the company is just making sure that when the announcement is made "that they've really done their homework."

Yes, let's hope they've done their homework and aren't anointing a CEO on the willy nilly.

Peck, consuming serious Kool-aid on this topic, called Jack Dorsey the "inspirational" (snicker) leader of Twitter while Adam Bain "is very much the monetization (snicker) leader."

Peck hailed the Google deal and how, if you're searching for Video Music Awards, you'll get tweets popping up and if you click on them, "you're brought straight to Twitter."

But there's a safety net if that doesn't work. "Ultimately if the products don't work, it's an M&A target," Peck said.

Pete Najarian expressed concern over the logged-out users. Peck pointed to Project Lightning and the "curated content by top pundits in the space ... creating an easier-to-use experience for the mass market."

Peck predicted a "modest positive" on the CEO announcement. Joe Terranova told Sara, "I tried to buy it; I got myself stopped out."

Jeff Kilburg dominated oil prediction of 38-to-46 last week

Tony Dwyer, maintaining his 2,340 (snicker) year-end S&P target, told guest host CNBC superfox Sara Eisen on Monday's Halftime Report that it's time to go "all in" on stocks (he said he made that call a week ago Monday) while conceding, "It's very possible that the market may retest that low" of last week.

Josh Brown questioned what happens to psychology if the S&P can't break the old high. Dwyer acknowledged that's a good point; "you really need to break through it," which would seem mathematically necessary to reach 2,340.

Brown said energy is recovering from a "very, very deeply oversold" situation.

Joe Terranova said oil's rebound is "part of the equation" that will enable a "token" hike by the Fed in September.

Joe also said Berkshire's stake in PSX is a sign "Warren" understands the "state of domestic oil." Josh Brown backed buying the name.

Pete Najarian clarified for viewers, "This is not Warren Buffett saying Tony Dwyer's 2,340 is right on 'This is the bottom in oil."

Joe said he doesn't like the word "defensive" for September, preferring "opportunistic" and stating that what's really important is the "window for buybacks is now beginning to close."

Josh Brown said, "I do not fear the talking Fed," claiming this is a "mildly overvalued market" relative to history.

Steve Weiss said he'd add seasonality to indicators he doesn't care about.

Pete hangs an 18 on BAC, doesn’t call it the Kevin Durant of banks

Pete Najarian on Monday's CNBC superfox Sara Eisen-led Halftime Report called DIS an "absolute buy" under 100, stating the ESPN issue was "overplayed."

Joe Terranova said DIS will be "completely fine."

Josh Brown said he needs 3½% on the WMT dividend to get interested in the stock.

Stephen Weiss and Josh Brown cautioned against buying stocks for dividend purposes, suggesting capital losses can wipe out the returns.

Weiss said the Epix deal was not advantageous for Netflix. "Not a big deal" for the stock, he said.

Weiss said he still likes airlines.

Pete Najarian hung an 18 on BAC.

Joe Terranova said JCP is "running into upside resistance," and he'd sell the gains.

Josh Brown said the stock action in FIT is "terrible," and he'd avoid the name.

Doc said he ditched ASNA (that's the Dress Barn folks) in favor of BBY for his Halftime Portfolio, saying BBY is "refinancing debt at just a phenomenal rate." But the important thing is that "they were buying September 36 calls in big numbers."

Pete Najarian said BBY has been able to "recapture" customers lost to AMZN. (Yeah right.)

But Josh Brown said BBY tends to fail at 40 and that "a lot of the easy money (Drink) from a tactical standpoint may have already been made."

Stephen Weiss likes M and DKS.

Stephen Weiss revealed "I actually traded out of JD because it did bounce," Weiss said, adding that JD.com is more like Amazon.com than BABA is. (This writer is long BABA.)

Josh Brown asserted PYPL "could be a home run" and said it "sits in the middle of almost every Uber transaction."

[Friday, August 28, 2015]

Stocks incredibly flat for most of the year; Guy Adami blames 2 weeks of volatility on Federal Reserve

Steve Grasso, fighting a currently losing battle against entering face-ripped-off land with his 10-15%-more-prognosis this week, used the telestrator or whatever it's called on Friday's 5 p.m. Fast Money to say we're in "no-man's land" and that you want to sell the market from 1,985 "basically all the way up to 2,032."

"It's not safe to be a buyer, unfortunately, until we break through that level," Grasso said. (Except if you sell it right now, and it goes through 2,032, you'll feel like a knucklehead.)

Guy Adami, who has a bizarre bias against typical Federal Reserve policy, complained to host Melissa Lee about Stanley Fischer.

"He said that the committee doesn't like to move in times of heightened market volatility — the volatility that they helped create. I mean that's a soapbox thing. We can talk about that on a 1-hour show, when I got some real estate. But that- that's preposterous to me. Thank you," Adami said.

No. 386 chimed in that "it's a lot of doubletalk, tripletalk, quadrupletalk," and if the Fed does raise, "it's a huge mistake."

David Seaburg said there's "real pent-up demand" (Drink) that will drive TOL on a rate move, but to buy BMY if the Fed doesn't raise. Guy Adami said to buy CME with a hike. Steve Grasso said buy ETFC if they raise and SO if they don't.

MCC doesn’t get it — Fischer is saying they won’t hike if the market is cratering

Guest host Michelle Caruso-Cabrera on Friday's Halftime Report aired clips of Grateful Dead broadcaster Steve Liesman interviewing Stanley Fischer.

Caruso-Cabrera praised Liesman for questioning if a decision on rates should be affected by data in the next 2 weeks, as Fischer had indicated.

MCC and Jim Lebenthal said the market on Friday seemed to be ruling out 2016 for the rate hike.

Lebenthal volunteered, "I can't say that September is on or off," pointing to next Friday's jobs report.

Tom Lee opined, "I think markets are really confused."

But Lee offered hope for crude watchers, stating that "100% of the time," oil after falling 60% year-over-year has rallied in the next 3 months, 6 months, 12 months.

"Oil stabilizing would be universally popular," Lee said.

MCC admitted again she's "obsessed" with Chevron's dividend.

If JPM is the LeBron James, perhaps C is the Russell Westbrook

Guest host Michelle Caruso-Cabrera on Friday's Halftime Report told Eric Wasserstrom that C has "so much exposure overseas, particularly to China."

Wasserstrom said that's "a big misconception; it actually doesn't have that much exposure to China."

So there you go.

Furthermore, Wasserstrom said that valuation seems to account for emerging-market setbacks; "we'd say the market has already priced it in."

Wasserstrom said he's not so much focused on the uncertain Fed hike, but banks that can "control their own destinay (sic), uh, destiny in terms of driving asset growth."

Josh Brown said that while earnings may not take a global hit, that could keep a "lid" on bank multiples.

Wasserstrom said "that's really a Citi-directed comment," and the stock is trading below tangible book, so "that to me seems like a reasonable downside."

Jim Lebenthal said, "Let's put 2 and 2 together here" and noted that Citigroup has been allowed to start buying back shares and opined that if it does begin buybacks below tangible book, "that's just a home run."

Brown concluded that JPM's pedigree makes it a more appealing stock than C.

Sarat Sethi, like virtually every panelist and guest in the history of Fast Money and the Halftime Report, likes the regionals (Drink).

Wonder if there’s a Chasing-Ukraine Motif for all those folks without ‘true’ wealth

In an understatement, Hardeep Walia on Friday's Halftime Report said his Motif of the Month is "kind of boring."

It's property and casualty insurance.

Walia said there have been "no major disasters" since Katrina and Sandy, so balance sheets have strengthened.

He asserted the industry has seen increasing profits despite price decreases. Guest host Michelle Caruso-Cabrera said "that doesn't make any sense to me."

Walia said "it has to do with the balance sheet; when you're not paying out operating expenses, uh, you know, in payouts, you're able to go in and actually, uh, compete on pricing and still make money."

Jim Lebenthal said he almost always agrees with Walia, but this time he doesn't; he said the reason this sector has been so profitable is because "there haven't been major disasters recently."

Lebenthal said the time to buy the P&C insurers is "after a major disaster."

Walia conceded there's "definitely a risk" of disasters and weather but that the prospect of rising rates, the need for low-volatility plays and the underwriting cycle are reasons to like the Motif, which he insisted is filled with high-quality names.

Sarat Sethi robustly agreed with Lebenthal.

Nothing more on that 12½ bps theory

Rick Ferri joined the Halftime Report desk on Friday to offer 3 reasons to embrace rising rates.

MCC seemed skeptical of Ferri's No. 1 reason, reducing investor "anxiety."

Ferri insisted there's been a "great weight" hanging over the market that is actually "holding the economy back."

In what feels like a strangely circular argument, Ferri said that raising rates actually gives the Fed the "hammer" to deal with a recession (without conceding that if we're on the borderline of a recession, raising them would presumably push us over the top).

Ferri said Stan Fischer's implication of a possible rate hike was a "positive."

Ferri endorsed BND and LQD.

Still waiting for those updates on the CAM call-buying inquiries

Continuing one of the strangest storylines in the history of Fast Money/Halftime Report, Jon Najarian — who appears to make a living piling into unusual options activity and then flags people who bought options just before major announcements — on Friday's Halftime reported that on Wednesday and Thursday, January 10 calls in FCX were being "aggressively" bought.

Doc said it's "probably not Carl himself," but "this is very likely the people that supplied Carl the ammunition."

Nobody on the panel expressed interest in getting back into the materials space. Josh Brown said the sector is plagued by "plunging demand, plunging prices, way too much excess capacity," and not only that but "geopolitical problems in places like Indonesia."

Meanwhile, Doc bought SDRL for his mythical Halftime Portfolio. (Maybe SDRL options buyers think Carl Icahn's gonna do a deal.)

Josh Brown exited ESRX in his portfolio over a "broken" trend line.

Jim Lebenthal advised viewers to "pick a little bit away next week."

Sarat Sethi said we might get "even more" of an opportunity to buy next week.

Josh Brown told MCC, "I had an egg sandwich the size of your head."

"And I got a big head, honey," MCC replied.

Sue Herera uncorked her signature line, telling MCC, "It's always about the hair" (Drink)

MCC said she'd love to be a "Hair Ambassador."

[Thursday, August 27, 2015]

Karen in new red-striped top; Mel smoldering in black leather

"I don't think the worst is over," said Guy Adami during Thursday's 5 p.m. Fast Money, but he still was heard to mention the possibility of a "benign tape" and even suggested a possible climb to 2,050

Karen Finerman said she finds it "really difficult" to buy stocks on a day they're up, and so she finds a day like Thursday "very challenging."

Brian Kelly said this looks like "some kind of a bull trap."

Karen Finerman brought up the 12½-basis-point (snicker) Fed hike to Steve Liesman and asked him if it's possible. Liesman said, "It just feels a little wimpy to me."

Oops — Doc thinks Rob Sechan is trashing MLPs with 7% yields, but Sechan actually was recommending them

It's the business-television equivalent of putting one's foot in one's mouth.

Rob Sechan, special guest of Thursday's Halftime Report, touted MLPs that are yielding 7%.

That got the attention of guest host Michelle Caruso-Cabrera, who said that when she hears of 7% dividend yields in energy, those seem "very risky."

Jon Najarian agreed with MCC, which was fine, except he went on to say that a guy like Sechan is not putting "true wealth" into "crazy things" like that and asserted, "I think people that don't have wealth are the ones chasing into things like the Ukraine, quite frankly."

This despite the fact that moments earlier, Sechan had called energy stocks an "interesting story," not because of fundamentals, but valuations. "It's a time to be shopping in that sector," Sechan said, a comment that obviously didn't sink in with Najarian.

After Najarian's asssessment, Sechan explained, "Yeah, but MLPs are a different story. It's a build-out of the entire energy infrastructure theme here in the U.S. ... like turnpike munis."

Stephen Weiss backed up Sechan's bullishness on those "crazy things."

Now we’re hearing ‘blip’ selloff

Forced to explain the market's sudden recovery just after he spent Tuesday forecasting another 10-15% down, Steve Grasso on Thursday's Halftime Report called the gains a "relief rally or a relief bounce-back."

Grasso said 2,000-2,032 is the "sell zone" of the S&P cash, and if we get above that, "all bets are off" and it proves the last week was just a "blip" selloff.

No. 386 even said China was "due for that shock," but "I think until the smoke clears you have plenty of time to be a buyer on momentum moving higher again."

Rob Sechan characterized the selloff as a "growth scare married with policy confidence being shaken."

But, "The degree of upside we have from here is certainly more limited," Sechan said.

Stephen Weiss boasted again, "I'm not dealing with the market; I'm dealing with individual stocks."

Weiss patted himself on the back for his AMBA move that was "just a great trade" and said he's out of it.

Weiss also said he bought M and THC and HEDJ; he doesn't deal with the market, just stocks.

Weiss claimed, "I think you drive yourself nuts and drive yourself broke by trying to figure out what the market's gonna do." (So why does he decide the market wasn't going to crater another 500 points, in which case not even a knucklehead would be buying M and THC ahead of time.)

China has done "nothing," Weiss asserted.

Grasso credited GS for pointing out risk of China exposure and noting M doesn't have any; he said owning M against 55 is "extremely compelling."

Jon Najarian pointed out that the Dax is up 5% for the year after all of this selloff but it was up 26% earlier in the year. (But only people without "true wealth" are buying Ukraine.)

Joe Terranova said it's "very interesting" that we're hearing calls for $20 crude. "If shorts don't cover today, that means there's more upside to come," Joe said.

Grasso recommended utilities "just in case" there's a recession.

Still waiting to hear updates on those CAM call-buyers being busted

Ben Silverman dialed in to Thursday's Halftime Report to tell guest host Michelle Caruso-Cabrera that 3 insiders are buying CVX, MCC's favorite stock (to discuss).

He also said AMAT's CEO and a director were buying shares this month and also drew some buying from Greenlight and Glenview Capital.

Silverman said 5 insiders were buying BEAV.

Stephen Weiss called BEAV "interesting" and a "really good story," but he doesn't like the "concerted effort" of 5 insiders buying the stock, which MCC found to be a quality theory.

Joe Terranova shrugged that if oil does "aggressively" bounce back, investors won't look so much for CVX's yield, but the shale plays for high beta.

Doc reminded folks he bought XOM on Monday and insisted it's superior to CVX.

Just get it over with

Tom Porcelli joined Thursday's Halftime Report to say there's "no question" that September odds for the Fed "took a shot" from Dudley's comments this week.

But, Porcelli said if it's not September, then people will just start guessing about October, and if not October then December, etc., and "we're just gonna go meeting by meeting."

Please, no.

Whatever happened to the fiscal cliff and sequestration by the way.

Porcelli made a quality point that energy is simply part of the overall consumer spending pie, and if gasoline prices go down, that means other sectors are simply getting money that used to go to energy; it's not a case of the whole pie growing larger, and "this point should not be lost on anyone," so basically Old Navy clerks prevail over Freeport McMoRan foremen.

Steve Weiss butted in that "there are different owners of pieces of that pie."

Dear CNBC producers: We’ve put a 34 on BAC and called it the Jordan Spieth of banks, can we get an interview?

Jim Iuorio told Jackie DeAngelis on Thursday's Halftime that the "short answer" to the question of whether crude's rally is for real is "no."

Brian Stutland said 42 is "right near a very critical level" in crude.

Jim Lebenthal said "there is no comparison" between TIF and SIG, which would've been a fine point had he stopped there, except Lebenthal even seriously endorsed Jon Najarian's loopy recent observation of TIF as an Ashley Madison trade.

Joe Terranova questioned why Lebenthal couldn't get on the computer on Thursday and buy it down 3% rather than wait until he's not on vacation. Lebenthal said these selloffs tend to be more than 1-day things.

AMZN watcher Aaron Kessler proved the latest analyst to snag TV time with an eye-catching note, telling Michelle Caruso-Cabrera he's got a 640 target on AMZN because it's "showing some leverage on the operating margins."

Kessler said Amazon Web Services (Drink) is due for 40% growth next year, and the company also has nice gross profit growth in 3rd-party sales.

Stephen Weiss, who must be referring to that New York Times article, curiously said AMZN now has "more transparency."

Joe Terranova predicted Amazon outperforms the market and accused MCC of not paying attention to him.

Doc said "lower for longer" on rates and reported "a lot of unusual activity" in IYR.

Stephen Weiss said he bought JD on Thursday.

[Wednesday, August 27, 2015]

Doc implies another curious options trade could lead to legal trouble even though like most of them, we’ll probably never hear about it again

On Wednesday's Halftime Report, Jon Najarian said that on Friday, there was "suspicious" January 50 call-buying in CAM.

Doc and Jim Lebenthal agreed that for regulators, it's "easy to identify" who bought those calls.

Regarding SLB, Lebenthal said "this is one of the few times this year" that an acquirer's stock price has fallen upon news of an acquisition.

Jim Lebenthal said he hates to say it, but there needs to be more "pain" and "bankruptcies" in the energy sector before the "true savvy buyers" will start piling in.

Guest host Michelle Caruso-Cabrera admitted she's had an "obsession" with CVX's dividend all week. Josh Brown said the company has "serious problems" that are reflected in the stock price.

Doc said he got OptionMonster Wealth Management clients into XOM, claiming "Rex Tillerson was a big buyer" the last time the stock was in the 60s. (Rex was also a "big buyer" of XTO in the $40 billions.)

Jim Lebenthal called BP "most likely" of the group to have a dividend cut.

Greatest trading environment of the year; panelists sitting on their hands

Michelle Caruso-Cabrera was back guest-hosting the Halftime Report, but after an impressively spirited start to the week, Wednesday's offering was flat as a Denny's pancake.

Jim Lebenthal made an analogy to a person (the economy) walking a dog (the stock market) down a park path, the person going nice and steady down the middle while the dog goes from one side to the other.

"We'll survive what's going on in China," Lebenthal said.

Jon Najarian said "there's a lot of resets that go on for a whole bunch of reasons," specifically with leveraged ETFs.

Jim Lebenthal said Dudley's remarks gave him no comfort because he's in the camp (Drink) that believes "the Fed needs to raise rates soon."

Josh Brown asserted, "The only data that matters is where the S&P is. That's- that's what the S- that's what the Fed is following day to day."

Brown pointed out, "The only way a correction can ever be healthy is when you're looking at it (in) the rear-view mirror."

Scott Nations grumbled that gold should be up a "ton" more this month if it's really any kind of safe haven; he predicted a sub-$1,100 price.

Brown pointed out how the HEDJ fell 12% in the last week because of the "massive spike" in the euro, a deeper dive than what a non-currency-hedged Europe fund returned.

Brown and Doc clued in viewers on how people are getting ahead of other people's margin calls.

Brown also pointed to flagging momentum in CMG even while the stock price stayed flat and noted that a "positive divergence" in RSI for any stock is "one of many clues" that sellers are exhausted. Doc said he agrees that RSI is a "great" short-term indicator. So, take that and run with it.

Jim Lebenthal said that to play emerging markets, "you have to have an active manager who knows what they're doing."

Still waiting for confirmation of Bob Peck’s TWTR ‘triumvirate structure’

Josh Brown on Wednesday's Halftime Report contended that a rate hike could spur people to start buying housing, a point Michelle Caruso-Cabrera called "super interesting" and "counter-intuitive."

Jim Lebenthal said "there's a lot of cash buyers out there" in the housing market, which he said is a "very good sign."

Doc trumpeted his annual buy-retailers-on-Labor-Day-sell-on-Black-Friday trade. MCC was impressed that BBY, COST and WMT were all up double digits during this span in 2014 while the S&P was only up 2%.

Jim Lebenthal said railcar loadings will "confirm or deny" Doc's trade.

Meanwhile, Doc said he cashed in his winning EXPR trade. Doc and MCC agreed that if you can make 17% in a day, who needs to work (which means Doc doesn't actually make 17% every day even though options go up in value so much higher than stocks).

Jim Lebenthal said it's "perfectly fine" for Goldman Sachs to add GOOGL to its conviction-buy list.

Josh Brown said AMZN is just going to trade with the broader Nasdaq.

Jim Lebenthal touted AAPL, BA and C, the latter being "the Rodney Dangerfield (Drink) of, of the markets."

Doc said he likes TIF as an "Ashley Madison play."

Doc also cited big weekly call-buying in AAL.

Eric Chemi joined the desk late in the program and said traders don't care how much higher the S&P is, they want to see it break the trend line, around 1,925.

MCC said the panel was only offering "call the close" predictions under "deep protest." Jim Lebenthal predicted a close "in the red." Doc said, "I think we go positive." Josh Brown didn't make a call, admitting "I don't know."

[Tuesday, August 25, 2015]

Steve Grasso thinks stocks are going down another 10%; Tim Seymour wants 12 bps from the Fed

Let us know when it's over.

Apparently as bored with the meltdown as most people, Karen Finerman said on Tuesday's 5 p.m. Fast Money, "I gotta step back from this market."

No. 386 though was once again on his nightly warpath, declaring, "I think the market probably corrects another 10 or 15%," without conceding that quite possibly much of that 10-15% will probably occur in the span of 1 morning before it's face-ripped-off land to the upside in the afternoon.

Grasso seemed to think we're long overdue for some reason. "We haven't seen a real selloff in years now," he said.

As usually happens in these moments, Grasso's commentary was accompanied by the refrain that "it feels different this time" when in fact it's no different than anything.

Is it any different than October 2014 ... August 2011 ... whenver the taper tantrums were ... or the fiscal cliff ... or Greece ... or how about that China-related cratering on Feb. 27, 2007, sending Dylan Ratigan onto "The McLaughlin Group," where he asserted it'll take 6 months to undo the damage when in fact it took about 2 whole weeks.

Tom Lee, sometimes accused of being too bullish, had it right in saying Tuesday, "90% of bottoms, once you bottom, are V-shaped."

Mel demanded clarification for when the big rebound gains are made. Tom Lee said it's taken 35 days since the high, and it generally takes about 1.4 times as many days to regain the prior high as it took to bottom.

In other words, by the time Bill Fleckenstein gets his purported short fund off the ground (snicker), he'll have already missed a golden opportunity to score a 200-point S&P drop in a week and (assuming this fund ever happens) will be spending most of his time covering.

Karen Finerman on Tuesday suggested the Fed might even cut by 12 basis points (snicker) but that whatever the move is, "I wouldn't know whether the market would go up or down on that."

Tim Seymour actually said "10 bps or 12 bps would be the right thing to do," (double snicker) because it would send a message that we're gonna move slower."

Banks aren’t regulated like utilities, but the more they get a ‘utility-like outcome,’ the more multiple expansion they get

It started out as an utterly loopy dialogue pegged to an analyst gimmick of putting clever titles on his reports in order to score business television airtime.

But thanks to guest host Michelle Caruso-Cabrera's considerable value added, Mike Mayo's visit to Tuesday's Halftime became a productive bank conversation.

Mayo started out likening JPM to LeBron James, stating the company is "very good for defense" as well as offense.

"JPMorgan is the LeBron James of the global universal banks," Mayo said, suggesting taking your money out of your JPM bank account and putting it into JPM stock.

Additionally, "This disruption in Asia might be the ideal opportunity for JPMorgan to expand and gain additional share," Mayo said.

Mayo said the "best restructuring story" among big banks is C, but JPM is No. 2.

MCC then started dishing, pinning down Mayo as to whether banks will ever be a growth sector or just something that's "hopefully like a utility."

Mayo then curiously said he makes a distinction between banks run as utilities and those with "utility-like outcomes."

MCC said they're regulated like utilities. Mayo said, "Well, that's a little extreme," prompting groans from MCC.

Mayo said if banks can produce utility-like outcomes, there should be multiple expansion, which sounded a bit circular especially when he actually hung a 107 in 4 years on Citigroup.

"What is your downside risk with banks when you have yields of like close to 3% at JPMorgan," Mayo said while asserting, "We're in the 9th inning for the legal issues" despite MCC pointing out there are fines every quarter.

Mayo said MS is "still up there" among his favorites but said JPM's yield prompted him to tout the latter on Tuesday.

"I'm still a bear on the banks," said Mike Block, stating he's not chasing BAC.

Prior to getting started, MCC made a joke to Mayo about Sue Herera's report that some kind of "mayo" can't call itself "mayo" because it doesn't have eggs, asking Mayo if he has eggs. CNBC also did its usual promotion of the next John Madden football game (oh joy).

CNBC senses the gravity of these times, cuts back on Halftime Report commercials

Mike Block on Tuesday's Halftime Report said he wouldn't call Tuesday's advance a "real rally" or a "head fake" but said he'd call it "part of this healing process after the damage that was done; it's necessary."

Block said he looked up the "similar selloff" in October of last year though it's not apples-to-apples. He said "it took about 2 weeks" to recover from the start of that month's problems.

Jon Najarian said China's move was designed to "trap the shorts" and predicted an 11% gain in China's market tonight.

Stephen Weiss said China has done nothing but put "lipstick on a pig;" Weiss said we're in sell-the-rip mode.

Joe Terranova said the correction is actually in its 67th day, since May 21, and this is "more of a time correction" than a "price correction."

Joe said it's "comforting" that Monday's activity didn't breach last October's low. Joe also said fixed income traded very well on Monday.

Can’t believe this chart makes an ounce of sense

Ari Wald visited with Tuesday's Halftime and diligently said he thinks we've bottomed, but "it's gonna take more than a day to correct from an 8-month top."

Wald also presented a long-term chart of seasonal headwinds that we couldn't figure out in the slightest. (Apparently, stocks tend to go down in August.) (But what about years ending in 5 or 7th year of presidential cycle.)

Joe Terranova claimed it sounds as though Wald was "outlining" exactly what Joe was talking about, that this is more like a "time correction" than a "price correction."

Steve Weiss scoffed that technicals are "backward-looking."

Aflac just ducky

Eddie Perkin sounded a bullish tone on Tuesday's Halftime Report, saying in the last couple days he's been selling defensive names "to buy more cyclical stocks."

Sort of like Bill Nygren a day ago, Perkin said the rally has "staying power," and it's a good time to "put money to work."

Perkin likes AFL, KR, WFC, though "I don't like the banks overall." He seemed reluctant to acknowledge to MCC that he likes OXY as well, cautioning there could be a 12-18-month down cycle for oil prices. He predicted OXY's 4.4% yield will hold.

Mike Block asked if further Japan easing would be bad for AFL. Perkin said Japanese policymakers don't want to see the yen much weaker than 120 and that AFL "has a lot more going for it than just the currency."

MCC is on safe-dividend prowl

Anthony Grisanti on Tuesday's Halftime Report said the fundamentals in crude "haven't changed at all," and rallies are to be sold.

Jeff Kilburg sort of boasted that he/Futures Now predicted a $38 crude bottom and even hung a 44-46 target.

Mike Block said he started liking crude in the low 40s, it's a "repair process," and said the big oil-services stocks are in his "crosshairs" as at some point they'll stop being ATMs.

Michelle Caruso-Cabrera questioned why not buy CVX with a 6% yield. Stephen Weiss said he's not sure those yields are sustainable, and "buying a stock solely for yield is a bad reason to buy a stock."

Steve Weiss said Andy Hall got "decimated" trying to pick the bottom in crude. Weiss said he's watching CNX.

Joe Terranova said that to make money in energy now, you should buy the distressed debt in the high-yield market.

Mike Block agreed and suggested looking at asset managers who look at distressed energy.

What happened to Bob Peck’s imminent announcement of the ‘triumvirate’?

Bob Pisani, who a day ago was talking about "panicked buyers," reported on Tuesday's Halftime that the SDY and other ETFs took crazy drops not in synch with the underlying stocks.

"The concern is that some market makers may be quoting excessively wide prices during volatile times," Pisani said.

Pisani said there's a suggestion of creating "specific rules for ETF market makers," which sounds like more regulation of the financial markets (kinda at odds with what Mike Mayo was just protesting).

Mike Block said he thinks "this only gets worse" with the ETFs.

Joe Terranova indicated AAPL, down only 19%, is a better chase than some of these Dow names down 30-40%.

Stephen Weiss endorsed FEYE and praised himself for buying GILD a day ago.

Jon Najarian said OptionMonster put out a list to subscribers on Friday touting AAPL, DIS, FB and XOM and said "we bought all 4 for clients yesterday."

Mike Block said the bottom-pickers haven't discovered INTC yet but it "won't take much to get that going to the upside."

Steve Weiss said biotech started selling off before the crash of the last several days; he likes big-cap biotech.

Weiss said NFLX "looks like a buy," but he won't chase Tuesday's rally.

Doc said TWTR brass "most probably are not" in buyout talks. Doc predicted a CEO announcement "shortly."

Doc said there was aggressive buying in EXPR options.

Doc said FBR upgraded AEO because it fell a lot. #informative

[Monday, August 24, 2015]

Bob Pisani says he detected

‘panicked buyers’ on Monday; Steve Liesman only answers the half of Guy Adami’s question that he likes

Guy Adami on Monday's 5 p.m. Fast Money asserted that the historic day in stocks seems like the beginning of a bear market because he doesn't see catalysts that will change sentiment "as quickly as we need it to."

Adami said 1,820 is "absolutely in the crosshairs."

Steve Grasso concurred. "It feels like the market wants to go down and retest much lower levels," said Grasso, whose months-long forecast of a correction has finally hit paydirt.

Grasso said to watch 1,930 and 1,970 (as if anyone's taking those levels seriously right at the moment).

Tim Seymour went out on a limb, asserting this is a "growth scare."

David Seaburg, who on Friday suggested buying Monday, stuck to that opinion Monday, contending we've seen "mostly the worst" and, if you have a longer-term horizon, "you should be stepping in and buying stocks."

Tim Seymour waffled like l'eggo my egg'o on buying DIS; "you have to look at the valuations; they are changing with the market."

Mark Cuban said that when people rush to sell, "that's an HFT algorithmic trader's dream."

Bob Pisani offered the most curious observations of the program, telling Melissa Lee, "I didn't see a lot of panicked machines. I saw a lot of panicked buyers and sellers."

Guy Adami in a question that was basically a backdoor slam at the Fed asked Steve Liesman whether the rest of the world has been "emboldened" to mimic the central bank but doesn't have the wherewithal to adequately do so.

Liesman, careful to limit what he was answering to the first part, whether Bernanke has emboldened other nations, said, "Yes, you're absolutely right, that has changed the playbook, probably forever, for how central banks respond at zero."

Bill Nygren: Wish I had more ‘ammunition’ to buy this dip

"I've gotta be careful about disclosing anything that we've done," said Bill Nygren on Monday's stock-shock Halftime Report, adding, "Unfortunately we're pretty much fully invested, so unless our shareholders give us more money to invest, uh, we don't have a lot of ammunition to, to put into the market."

Nygren said he likes BAC, "a cheap stock." He also likes GOOG, with "tremendous tailwinds" and a "really long runway" for high growth.

Nygren trumpeted GE, largely for the 4% yield. Guest host Michelle Caruso-Cabrera asked if that yield might be at risk. Nygren indicated no; "they make about twice what they're paying out."

As MCC repeatedly cheered for a possible recovery and green finish, Stephen Weiss scoffed, asserting, "Capitulation is set by volume, not by price."

Joe Terranova said "flat is the new up" (Drink) twice.

However, Josh Brown said that the RSI on a weekly basis for the S&P 500 hit such "extreme" levels Monday that it's a buy sign; "it's never a sell."

Seeking a silver lining, Terranova reached into the archives again for a PANW call. He also said he'd rather pick up NFLX than go bottom-fishing "in some of the oil or coal (snicker) names."

Weiss said he doesn't want to buy RRC down 80% 70% "when I could buy Gilead down 20 or 30%."

Wonder if this will make the Laszlo Birinyi headline scrapbook dating to 1962

Bob Pisani on Monday's action-packed Halftime Report said there were "a lot of amazing prints" on the ticker on Monday's open, including JPM at 50.

Josh Brown said he bought NFLX and FB "within the first 5 minutes of trading" but he's too "embarrassed" to tell guest host Michelle Caruso-Cabrera how little he paid. (Congrats.)

Jon Najarian said many of the early trades constituted "self-inflicted pain" from folks who just wanted out and that margin selling took the market down another leg.

Joe Terranova said they weren't talking enough about the volatility spike, saying it's "more about quantitative funds being liquidated."

Jim Lebenthal stressed that the morning's gift was over and done with, and now "we're actually probably near to the end of a correction" and that you'll still make a lot of money with AAPL at 107.

But Stephen Weiss disagreed with Lebenthal that the problem is "localized" to China, which Weiss said needs a "major spending project."

Weiss credited Tepper for figuring this out in advance; "he saw this coming ... phenomenal."

Well into the program, with stocks posting a startling recovery, MCC even wondered if we might be "green by the end of the day." (This review was posted after the market close.)

Judge takes vacation on historic day for stock market, tweets taunts about injured Steelers player

Nothing more reassuring on a day like Monday than Jeremy Siegel (sort of) talking about Dow 20,000.

Siegel told MCC on the Halftime Report that he'd been saying that Dow 20,000 this year is a "possibility," but regardless of what happens short-term, "the 4th quarter could be very good" and 19,000 is "not at all impossible."

Siegel said there are "more momentum traders in here than ever before."

Ben Willis credited Tim Cook's comment to Jim Cramer on China for spurring a stock-market comeback.

Josh Brown asserted that "you have to think about this as a Flash Crash" and said this isn't like 2008 or 1987 but that 2011 is the year to compare this to. (Or, August 2007, nearly to the week, when the Fast Money crew correctly called a short-term bottom on that Aug. 16 outside reversal.)

Doug King told Michelle Caruso-Cabrera that the oil market has been oversupplied for a while and that crude's price is "going to hit the 2008 lows."

Kate Kelly asked King why there's so much pessimism in the base metals market. King said there are worries about "what's really happening" in China.

Helima Croft said 2008 oil lows are "certainly" possible but that in the event of "dark days," the Saudis could do a December cut.

Stephen Weiss said commodities have been a "terrible asset class" for 5 years, and "Why even play there if you don't have to."

Weiss said he bought PFE and GILD.

Jim Lebenthal said a lot of other shops are going to follow Barclays' 2016 Fed call.

More from Monday's Halftime and Fast Money later.

[Friday, August 21, 2015]

CNBC schedules special broadcast on Sunday night, often a buy signal

Guy Adami said on Friday's 5 p.m. Fast Money that there's a potential to trade around 1,850 "early next week."

Brian Kelly said, "Today's not the day to panic." Then he said it again.

David Seaburg took it further, saying, "The worst thing in the world you can do on Monday morning is wake up, call your broker and sell stocks."

Steve Grasso said the technical damage is "vicious" and pointed out that Seaburg's advice wouldn't have been good on Friday.

Grasso said 1,970 must hold on Monday, if not, look out for 1,920.

Mel said what stood out to her this week was the refiner weakness.

Grasso said he took a "dabble" in DIS on Friday.

FB starting to look interesting

Jim Chanos said on Friday's Halftime Report he has "no idea" when the Fed is going to move or whether it should move.

Doc said the VIX was actually in backwardation, a possible sign of capitulation.

Chanos thanked Judge for bringing up HPQ on a day it's up; Chanos reiterated he just thinks it's in declining businesses. "At some point, you run out of costs to cut," Chanos said.

Stephanie Link though predicted HPQ cash-flow guidance is going to go higher.

Paul Meeks said he agrees with Chanos and disagrees with Link on HPQ, which he called a "dinosaur" of a company.

Meeks said he's starting to get interested in FB, AKAM and DATA.

Josh Brown asked Meeks if FB isn't a "tough name" to get on board the valuation because longs are willing to bet that FB gets 5, 6, 7% of total TV industry advertising by 2020.

Meeks said that in mobile, FB is taking share even from Google and at its present price, it's not a "screaming buy" but a "reasonable" one.

Meeks admitted to Stephanie Link that HAR has been a "dog with fleas," but he still believes in the stock.

Chanos reaffirmed his CAT short, stating, "We're gonna be working off backlogs of construction, mining, oil and gas for years."

It’s Jim Chanos, not Tony Dwyer — guess which way the market’s going

It would seem that having Jim Chanos on the Halftime Report on a day such as Friday is perfect timing.

Chanos told Judge that some of his long-convinced shorts "finally seem to be working," but on the other hand, "I have no idea" how much correction is left, or if there's even a correction.

Josh Brown somehow claimed these troubling stock-market averages "are arbitrary numbers" and played the I-told-you-so game, stating he's been "harping relentlessly on the internals breaking down."

All that said, "It does not necessarily portend the next 2008," Brown said.

And, there's a bright spot: "The economy is outperforming the stock market for the first year since the recovery began," Brown added.

Chanos said that whatever you think about China, "it's worse than you think," asserting Xi Jinping is anti-Western.

Jon Najarian spoke of how great BEE December calls are noted that a lot of things in the market are going south and credited Chanos for being right about the LNG space, even mentioned it twice.

Elon who?

Jim Chanos, in a Halftime Report "exclusive" on Friday (despite the fact he's on TV semi-regularly), revealed a short in SCTY.

Judge noted that SCTY is Elon Musk's company, prompting Chanos to draw chuckles in saying "Who?"

Chanos claimed SCTY "is really a subprime financing company in effect."

"In effect (Drink), if you put on the panels, you have a 2nd mortgage on your home," Chanos said.

He said SCTY is "burning, uh, an awful lot of cash," and "has a lot of debt" and negative EBITDA.

Meanwhile, Judge heard from John Kilduff, who said he has lowered his crude forecast from 32 to "mid-20s."

Chanos offered a little equation about how frackers won't be able to earn their cost of capital over 10 years even with oil at 80 or 90. "We're betting against a number of the big guys" in the space, he said.

Chanos called the LNG space "one of the great white elephants of the next 5 years ... everybody's building capacity ... with maybe no increase in demand."

Stephanie Link didn't protest Chanos' negativity on Royal Dutch Shell but called CVX "completely mismanaged" and said she's not sure its dividend is safe.

Link also said MDLZ has been "totally mismanaged (Drink) for years on end."

Bob Pisani said Toni Sacconaghi took a grand couple of dollars off of AAPL's price with his CNBC comments.

More from Friday's Halftime and Fast Money later.

[Thursday, August 20, 2015]

Rich Greenfield: Bob Iger is

‘not being honest with investors’

It seems to be the stock market question of the summer: How fast is everyone ditching cable?

Rich Greenfield on Thursday's Halftime Report asserted that the last couple of weeks have shown that DIS is not "immune" from consumers' move away from "live, linear" TV and bundling.

Judge claimed Bob Iger's ESPN comments were like a "bomb" being dropped on media stocks last week, but Greenfield said he would "dispute" that and pointed to names such as DISCA and VIAB and SNI and their 1-year decline and said DIS is just an example that no one's safe.

Josh Brown told Greenfield that Iger said Disney can sell ESPN a la carte and questioned if we'll care this fall about some people dropping ESPN.

That's when Greenfield dropped a true bomb, stating Iger is "not being honest with investors" because Greenfield doesn't believe ESPN "is prepared to go direct to consumer."

The gut feeling here — remember, never take investment advice from this page unless you like losing money — is that the TV model is glacially becoming the newspaper model.

Premium pricing for bundled packages is bound to fall as the amount of options for a la carte and Web delivery explodes. There's simply too much good television (whoever thought that would be the case). At some point, the NFL will have no need to distribute games to others; the Super Bowl can just air on the NFL Network. You'll be able to subscribe to NFL Network over the Internet, without Comcast, etc. Same for NBA, baseball, etc. You might order ESPN for 1 or 2 events a month and skip the College World Series, etc.

But while some on Fast Money were pronouncing Disney's recent setback as an affirmation of Netflix, we'd say just the opposite, that Netflix has no hope of premium pricing either. Netflix (and now Amazon) is like fracking; its presence merely means that programming will get cheaper for consumers across the board.

Josh Brown has pointed out that the traditional delivery-vs.-content pendulum regarding cable and media stocks tends to go back and forth. But Greenfield noted Thursday that for Disney and other cable giants, "The entire model is built around subscribing to these very expensive channels for the entire year."

Of course, DIS worth 18% less in 2 weeks is ludicrous. ESPN's not going away overnight and may still have some robust years ahead. But we've seen this movie before.

Karen Finerman: ‘No way’

would I short this selloff

Karen Finerman on Thursday's 5 p.m. Fast Money said Thursday's market felt more "panicky" than Wednesday's, and for a lot of stocks, the selloff just doesn't add up.

"No way would I think about shorting here," Finerman said.

Joe Terranova on the Halftime Report said "weeks ago" was the time to be worried and said now the market seems "death by a thousand cuts."

Josh Brown said people suddenly feel like "there's no place to hide."

Rich Saperstein faulted "the global unwind of the carry trade."

Jim Lebenthal contended that the Fed has its eye on a strengthening dollar.

Jon Najarian said "lower for longer has extended," while Anthony Grisanti said he's surprised "bonds haven't gotten a better bid" given the stock market's slam.

Meanwhile, Doc called the VRX deal "an odd one" because it's buying "not a terribly effective drug" with "questionable side-effects."

Jim Lebenthal called LLY "a great play."

Josh Brown said maybe GPRO longs will "get lucky again."

Joe suggsted showing L Brands footage (but what about converting the ticker symbol to BRA).

Stephanie Link told Judge she dumped MS from her Halftime Portfolio in favor of V, even though "it's not necessarily my style" to buy a high-flying stock. Joe called the move "a good one."

Dom Chu said there's some kind of "Final Four" of high-flying stocks that might be overextended. Joe said he'd pick NKE as a sell over JPM because of ... yes ... almighty Under Armour and God's gift to business, Kevin Plank.

Josh Brown said he rejects the "whole premise of the segment," questioning why people are looking for reasons to sell those names and suggested selling FCX instead.

Sam Hocking told Judge he hopes a lot of hedge funds using his matchmaking system "are short the market today." He said his company provides "new and different ways" to look at data to find the funds that fit the best.

On the 5 p.m. Fast Money, Guy Adami hailed Bill Fleckenstein's chip-stock short.

[Wednesday, August 19, 2015]

Judge doesn’t even pay attention to what his panelists are saying

Joe Terranova on Wednesday's Halftime Report gave viewers another update (Zzzzz) of his Halftime Portfolio trades.

Judge referred to Joe dumping IBKR after just mentioning it a day ago. "Yesterday, I think it was, you said you might be out of it by the time you finished talking," Judge said.

Except it was CNX that Joe said he might exit by the time he was done talking, not IBKR.

John Kilduff said oil's slide was just more of the "unrelenting story" of increased supply, suggesting a "3 handle" possible on Thursday.

Kilduff said OPEC "absolutely" needs to cut, which he said could be triggered if U.S. production falls under 9 million barrels a day next year.

Kilduff also said "there's been a ton of activity" in the 35 and 30 puts. Pete Najarian said "absolutely nobody" is coming in the options market and saying the oil crash is over.

Joe Terranova, who had mike trouble early (that's often the fault of the gaffers, not the people on-air), said it's not the time "to be increasing investments in energy-related names."

Joe also said Wednesday he's only in VXX as a hedge. (Zzzzzz.)

No sign of that shoppers’ uproar against AMZN over that NYT article

Seems like they covered this yesterday.

Judge decided to enlist Wednesday's Halftime crew for another go-round on TGT and WMT.

Viewers learned that TGT has broader appeal "across segments of the population" than WMT does, according to Stephen Weiss, who likes TGT.

Joe Terranova praised Brian Cornell and said online investment is what's needed and curiously added, "cut back on the brick-and-mortar strategy."

Terranova said he sees no reason to move from TGT to WMT. (Zzzzzz.)

Jon Najarian opened a Pandora's box of nothing in stating Wal-Mart isn't going to see margin expansion given what the dollar/yuan are doing.

Judge protested that WMT is "investing heavily" in wages and ecommerce, and that's an "anvil" around the neck of the company.

Doc responded, "On $120 billion a quarter, that's not a big anvil."

Doc also cracked a joke about "those aspirational shoppers at Wal-Mart."

Smell of napalm in the markets

CNBC's Steve Liesman, chillin' out since the Grateful Dead weekend around July 4 and now gearing up for the next chapter of 3 members minus Lesh at MSG, offered on Wednesday's Halftime Report a stark movie description of today's economic worrywarts.

"I think there's a bit of an 'Apocalypse Now' con- con, you know, um, sense here," Liesman said, shrugging off China, Greece and oil concerns.

Liesman encouraged the panel to close 1 eye and look at job gains and GDP. Then he said to look with the other eye at headline inflation.

Given all that, Liesman said, the Fed will decide it's "OK" to raise rates.

Jon Najarian said "there's a whole bunch of things" occurring before the Fed has to make a decision, so if you're gonna trade it, better be quick.

Stephen Weiss said it's time for "risk off" in this "very apathetic market."

Heidi Richardson said the defensives "have gotten pretty rich," so she prefers cyclicals.

Richardson said she likes Japan and said the U.S. market could see a single-digit advance this year.

Liesman said it's a "possibility" that China could cut rates.

Another Richard Branson reference, but this time it’s not about calling in to trumpet his son’s great rescue

Humin CEO Ankur Jain, who we learned on the Internet is the son of a billionaire, visited Wednesday's Halftime Report to say his app Knock Knock allows strangers to knock on the phone twice, then it "instantly remembers the names, photos, where you met and when you met."

Judge said it sounds like this is something geared for professionals.

But Jain said "it's funny," he's thinking it's useful for "the first week of college."

Jain said his valuation is "somewhere up there."

Doc said he tried to give Jain a business card, but it fell on the floor, and Jain said he didn't need it anyway.

Steve Stevens’ show is available

Jon Najarian on Wednesday's Halftime Report said the Google restructuring is a "precursor" to a possible breakup of parts and thus reason to be long.

Pete Najarian said there's "plenty of room to the upside" in GOOG.

Stephen Weiss said transparency should lead to a higher GOOG multiple, and he doesn't think it's expensive.

Pete Najarian started to say INTC is going into the "variety," er, reality TV business, which he doesn't think is a big market mover for the company.

How did those December

BEE calls do Wednesday.

Really going out on a limb on Wednesday's Halftime Report, Doc said he doesn't have a WTW position but that Morgan Stanley "likes the upside."

Joe Terranova advised viewers to "scale down" YUM positions.

Stephen Weiss said you can own the "group" of HD, LOW, etc. and "do OK."

Anthony Grisanti told Jackie DeAngelis that gold is "a little bit of a safe haven." Brian Stutland suggested sellers will re-emerge around 1,150 or so.

Doc said MET October 55 calls were popular. Pete said somebody bought September 29 puts in ITB and sold the 27 puts. "Really smart trade," Pete said.

Pete Najarian said he still likes airlines. Steve Weiss called the industry "very, very strong." Joe Terranova said JBLU has been a winner, and he thinks Virgin America is "finally seeing some positive traction."

Steve Weiss said he's short Volkswagen and Tata for their China sensitivities.

Sue Herera mentioned the Steelers in a news recap.

Like Judge, Karen Finerman on the 5 p.m. Fast Money also put together a couple consecutive days on opining between TGT and WMT.

[Tuesday, August 18, 2015]

What if it’s HD for 8 months and WMT for 21 months?

Joe Terranova brought up an apparent physical impossibility on Tuesday's Halftime Report.

Terranova said that while customers are coming into Wal-Mart, "They're probably looking at the products, and then they're saying to themselves, on their tablets or smartphones, 'I could get it cheaper or better or quicker at Amazon itself' (sic last word redundant)."

How would you possibly get it "quicker" than standing in front of it at the store and taking it up to the checkout line?

Josh Brown said the important thing for Wal-Mart is that customer approval of the shopping experience is "doing nothing but going up."

But Stephanie Link sounded the alarm about WMT's margins.

"Right now, I think the stock stays where it is," said Dana Telsey, stating WMT will take a couple of quarters for some "incremental investor- investments" to pay off.

Telsey didn't endorse DKS as enthusiastically as Pete Najarian did; she pointed to "encouraging" slightly better comps in core stores.

Telsey also moved EL to outperform, saying she loves the cosmetics category.

Joe Terranova said consumers are spending on their homes, "vs. going into a Wal-Mart and making that discretionary purchase" (that they can probably get even faster from Amazon despite standing in front of it in the store).

Judge asked the panel whether WMT or HD is the better play for the next "let's say 1 to 2 years."

Joe and Stephanie Link said HD.

Josh Brown said WMT, and because Judge didn't say "6 months," Brown didn't fault the time horizon (see below).

Pete Najarian indicated he was leaning WMT, but only over the longer time frame.

Doing double-duty on the Halftime Report and 5 p.m. Fast Money (while still seeking a university athletic director post), Pete Najarian managed to mention TJX (Drink) in each program.

Also on the 5 p.m. Fast Money, CNBC superfox Karen Finerman, in pale blue top, admitted, "I bought more KORS today."

Pete thinks guest isn’t as ‘frazzled’ about China as he should be

The screen text kept billing this segment as a contrarian call on oil.

But Dan Suzuki of Bank of America Merrill Lynch spent his visit on Tuesday's Halftime defending his 2,200 S&P call, stating "everybody's very bearishly positioned" and suggesting it's possible to get "violent moves up."

"If anything, in the near-term, the risks are to the downside for this market," Suzuki said, but "the upside moves can be quite violent."

Which, if we're using our magic-decoder ring properly, seems to suggest it's early to buy the S&P, but it'll be OK into year-end.

Judge did say crude could have a 3 handle "by the end of the hour," then called that a "joke of course."

Judge also said it was Suzuki's first time on the network.

Pete said Dan Suzuki wasn't as "frazzled" about China as Pete is. But Josh Brown concurred with Joe Terranova that a lot of the "carnage" is priced in to stocks with China sensitivities.

Judge doesn’t mention this time what he’s reading about analysts on social media

Josh Brown on Tuesday's Halftime Report said he doesn't get Wells Fargo's DIS downgrade after the stock's already taken a $15 drop.

"I don't understand it at all," said Brown, adding he'd be a buyer.

Judge suggested the annihilation of media/cable stocks was occurring at a greater rate than the subscriber slippage.

But Stephanie Link seemed startled and indicated that Disney's pullback makes sense given how much the stock's climbed this year and 5 years and how reliant it is on ESPN.

But Pete Najarian invoked a Patty Edwards-ism, contending DIS has been a "complete overread and an oversell at this point in time (sic last 2 words redundant)."

Meanwhile, Joe "Palo Alto" Terranova said AMZN was "regathering" momentum for a move to 575 and 600.

Joe said he added PANW to his Halftime Portfolio, plus IBKR, plus CNX, adding he might be out of the latter by "the time I finish speaking."

Joe says bank needs to ‘unlock’ ‘absent’ growth

Stephanie Link on Tuesday's Halftime Report said to buy homebuilders on weakness; the trend's in their favor.

Joe Terranova agreed that "the positive momentum is there."

Steve Grasso and Tim Seymour on the 5 p.m. Fast Money said there's "pent-up" (Double Drink) demand in housing.

Joe "Easy Money" Terranova said CHK was up "4% right now" when the screen showed it less than 2% and said he wouldn't do anything with the stock right now.

Pete Najarian said SNDK will be an "incredible buy" in the low 50s.

Josh Brown said to wait for S to hit 5.50.

Stephanie Link said she still likes STI a lot but she'd rather buy it under 40. Judge for some reason indicated confusion over STI and STT.

Joe said BBT needs to "unlock some of the growth that's been absent" but that regional-banking executives since 2008 are "tepid" about doing deals over "regulatary" (sic) concerns.

Jim Iuorio said copper is more of a "China thing than everything else."

The fellow named "Bill" who now appears on Futures Now attributed Tuesday's drop to China and said gold took a hit too.

Pete Najarian said August 118 GILD calls were popular.

Josh Brown said F appears to be breaking out.

CNBC superfox Meg Tirrell talked about "female Viagra" on the 5 p.m. Fast Money and smiled often.

[Monday, August 17, 2015]

Judge says ‘people on social media,’ not himself, are lampooning Adam Jonas

Judge reported on Monday's Halftime that Morgan Stanley's Adam Jonas has hiked his TSLA target to 465 and that Judge sees "on social media and otherwise" jokes that this call came from the "Jonas Brothers."

Jim Lebenthal said it's a "tough call" and acknowledged Jonas is "stickin' his neck out" but that he's "doing it on a lot of vapor."

"It's really based on hope," Lebenthal said.

Judge suggested the TSLA story has always been about hope.

"If it is, it's not a good strategy," Lebenthal said.

Judge went on to clarify, "He is the top-rated analyst ... I'm not ridiculing, uh, Adam Jonas at all, I'm just telling you what people on social media are saying."

Josh Brown chuckled that Tesla just did a "pretty sizable equity offering."

Stephen Weiss grumbled that Tesla has missed a bunch of forecasts, "and you always get another opportunity to buy this stock."

Judge allowed Divya Narendra to have an extended soundbite defending TSLA's valuation; Narendra asserted "everyone should be driving electric cars."

AMZN interviewees called ‘crybabies’

Josh Brown on Monday's Halftime Report called the subjects in the New York Times AMZN profile "crybabies."

"I think the reporter rounded up 5 or 6 people that had an extreme situation. ... That's probably not indicative of every Amazon employee's life cycle working at the firm," Brown said, assuring he's talked to some employees.

Judge brought in Peter Cappelli from the University of Pennsylvania to discuss the article, but frankly, Judge made enough quality observations on his own that Cappelli's fine responses were a bit superfluous.

Judge suggested the profile might make AMZN investors happy but most other readers outraged. Cappelli agreed and added that if it's more about "individual contributors" in a Wall Street-type culture, Amazon's approach sounds fine, but if it's more about teamwork, "probably not so great."

"This sounds like an individual contributor model," Cappelli concluded.

Judge suggested such a story would prove a backlash for a typical brick-and-mortar store and wondered if Amazon would experience a shopper's "uproar" against this type of management style.

Cappelli said there is "some concern" about a backlash for Amazon's blue-collar warehouse workers, but, "Nobody's very concerned I think in the U.S. about how executives are treated," he chuckled, before asserting that some people thinking about working for Amazon are having "2nd doubts (sic) now."

Pete Najarian said "I hate to say it," but he thinks AMZN investors "probably" don't care about this story.

Steve Grasso said on the 5 p.m. Fast Money, "It's Amazon Web Services, that's the reason why you buy this, there's growth all over the place there ... but at this point maybe you do take a little bit off the table."

Killir on crude: $38, then $50

Dubravko Lakos of JPMorgan told Judge on Monday's Halftime he is standing by his 2,250 year-end target and thinks financials "will have some juice" into year-end; he also likes health care and housing.

"A short-term correction might be needed," Lakos said, while pronouncing longer-term strength in this market.

Josh Brown questioned if health care already reflects high expectations. Lakos said "certain parts of health care," such as biotech, are concerning, but health care as a whole, "if you will" (Drink), continues to print "positive, organic growth."

Pete Najarian said oil "looks like it wants to really spike." Then he added, "In terms of volatility."

Stephen Weiss said a guy from RBC who was nonchalant about oil "beat my butt" in golf, but Weiss is sure "it's still uninvestable."

Someone named Bill told Jackie DeAngelis that bids could be coming in for oil through Thursday's futures expiration.

Jeff Kilburg said oil will make a "short visit" to $38, then climbs to 50.

Weiss not worried about China

Josh Brown on Monday's Halftime Report said there is "mass indecision" ahead of what the Fed appears to be doing.

But Brown pointed to "historic breakouts" in ITB and XHB.

"There's no reason to come back from the beach to put money in the market," said Stephen Weiss. But, "I still like the market."

Jim Lebenthal said "there's a lot of indications" that the Chinese growth rate is more like 5%.

"I'm not really worried about China," said Steve Weiss.

Lebenthal insisted China's effect goes "beyond just the cyclicals."

Pete Najarian said "I think we're stuck in this range," as the typical opening conversation on the state of the 2015 market again went nowhere.

How much should backup guards earn for playing college football in the Mountain West?

Sue Herera on Monday's Halftime Report said "an (sic) historic" while reporting on the NLRB ruling on college jocks.

Pete Najarian said the ruling "makes some sense to me" because if "competitive balance" is affected, "it's gonna have to be something more universal." (Sure. Whatever)

Josh Brown revealed that for some reason, he bought BABA. (This writer is sadly long BABA.)

Brown assured, "I'm not calling the Alibaba bottom" but said he has noticed buyers have come in at the end of the day recently and thinks that "when this thing turns, it's gonna be a nasty reversal that no one's ready for."

Stephen Weiss said one of the problems with IPO stocks that fizzle is that some of them shouldn't have gone public.

Josh Brown said he could tell from the "mood" of the crowd at his early screening of "Straight Outta Compton" that it was going to be a hit, though he cautioned, "Don't take your children."

Judge a couple of times gushed that "our own, um, Universal Pictures is on a roll. There's no other way to say it."

Stephen Weiss said forward guidance was sinking EL.

Pete Najarian said he likes JPM, but "there could be a bit of a breakdown."

Jim Lebenthal said the recent DIS shellacking was "a bit overdone."

Divya Narendra announced another SumZero contest.

Pete Najarian said he has already trimmed some of his December 15 BEE calls. (Let's see, could the University of Minnesota Athletic Department open an OptionMonster account and make far more money than they otherwise would in stocks?)

Steve Liesman delivered breaking news — about the Dallas Fed, not about 3 of the 4 Grateful Dead members reuniting at Madison Square Garden.

Pete wants to be A.D.

at University of Minnesota

Asleep at the switch, out to lunch, etc.

It's always painful to get scooped by Judge (no biggie, happened to Gasparino last week with Peltz-Sysco) — but that's precisely what happened to this page when Judge revealed on Monday's Halftime that Pete Najarian is angling for "an open athletic director job in Division I college football."

That would be the University of Minnesota, Pete's alma mater.

(Hey there's a lot of chaff on the Internet, and last week when this stuff started circulating in Minneapolis media, we barely had time to sift through the wheat.)

(So, we'll consider it a "teachable moment.")

Presumably if such a hire is made, U. of M. will be lining up sponsorship deals with Kevin Plank.

Judge on Monday botched a golden opportunity for an absolutely phenomenal conversation. How, exactly, does one measure the performance of a university athletic director?

Everyone wants to hire the next Mike Krzyzewski or Tom Osborne. Almost none of them will.

Athletic departments, in terms of participants, are far bigger than football and men's basketball. In terms of money, those are the only 2 things that count; when it comes to women's swimming at U. of M., Pete would be nothing more than scheduler.

Much of the job involves schmoozing alumni into sending cash.

Minnesota, among big schools, is like many in a "tweener" situation. There is some public demand for good football and basketball.

But it's not Ohio State or Duke.

So basically, the job comes down to hiring good coaches who haven't been discovered yet ... and hoping they don't take bigger dollars at Michigan, USC, Tennessee, Miami, etc.

Even if that happens, overachieving most likely is contingent on loosening the recruiting strings. Minnesota is an average Big Ten team with few if any high draft picks in football and men's basketball.

In the 1990s, the basketball team suddenly got good and even made the Final Four. Afterwards, the coach was forced out "due to one of the worst academic fraud scandals in the history of NCAA sports," according to the coach's Wikipedia page.

Minnesota's football team is decent; its coach was just named Big Ten Coach of the Year. But he is in his 50s and has had a series of health issues.

A lot of these posts end up being filled by search committees. Someone identifies likable alumni and gauges interest, etc.

Like most sectors, there's an insider nature, which would presumably work against Najarian's hiring.

The gut here is that Pete Najarian, an overachiever at everything, would succeed as an administrator. Those doing the hiring should note something important — Pete is one of the most measured voices on CNBC, this is the Iceman in "Top Gun," he thinks about absolutely everything he says and does not make off-the-cuff mistakes.

Recently though Najarian's biggest sales pitch has not been about higher education but pushing regular Joes to invest in the options market. Whether that plays well at a Big Ten university remains to be seen.

Judge could've taken care of the interview process in one soundbite Monday. All he had to do was ask Najarian, "How big should Minnesota football and basketball be?" That's all the search committee needs to know.

More from Monday's Halftime later.

[Friday, August 14, 2015]

Remember: Peltz measures stock moves from the time he buys the shares while Jeff Sonnenfeld measures from the time Peltz gets board seats

Judge handed viewers of Friday's Halftime Report a scoop.

Judge reported that Trian is taking a 7% stake in SYSCO, "the food-service company Sysco, again, not the technology company."

Stressing the importance of the timing of Peltz's filing, Judge laboriously if meticulously laid out the timetable for board negotiations, etc., but said it's unclear if Peltz will try to get on the board.

Jim Lebenthal said Peltz "smells blood in the water," thinking SYY management "took their eye off the ball."

Josh Brown said, "I can't see how the outcome could be negative this early in the game."

Doc said that as soon as Judge mentioned the SYY story, "the options did pop pretty dramatically" in just minutes.

Sarat Sethi said, "it could be a good long-term investment." But curiously, Sethi also claimed that "more than 5 years ago," SYY was a "go-go momentum stock," then "at some point they hit a wall," and the Street has seen the stock "underperform for 5 years."

But we looked at a chart (uh oh) and noticed it seems to follow the S&P and has done OK since February 2009.

Being CEO of 2 companies at the same time and needing a triumvirate is a ‘good 2nd-choice solution’

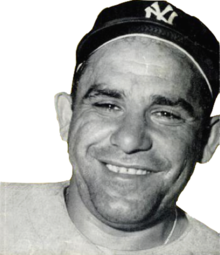

Bob Peck on Friday's Halftime Report told Judge that, sensing the need to "keep the product cadence on track," TWTR's board is leaning toward imminently adopting a "triumvirate structure" of leadership involving Jack Dorsey as CEO, Adam Bain as president and Evan Williams as chairman.

Or, basically the same people they've already had, minus Dick.

The CEO also happens to have a side job as CEO of another company.

Peck said the "ideal" situation would be for Dorsey to not also be CEO at Square, but having the triumvirate at Twitter "is probably a good 2nd-choice solution."

Judge said he thought the board made it "pretty clear" it wanted a CEO "solely focused" on TWTR. Peck said the triumvirate presented its "cohesive plan" to the board and that may "trump" (sic not Donald) the "solely focused" sentiment.

This is a "good secondary choice," Peck reaffirmed, stating his price target is 38, which was probably about the level when Dick got forced out.

Josh Brown said with a straight face, "I think the announcement will be treated positively, provided it's not some kind of wacky, out-of-left-field thing."

Owning CMCSA called ‘controversial’

Peter Dixon from Fidelity told Judge on Friday's Halftime Report that this is "a great time for active management," and "you just have to be selective."

Dixon touted HLT and LB (sic should change the ticker to "BRA") and suggested auto-parts manufacturers, lodging and even homebuilders.

Josh Brown asked Dixon if it's OK for those who have missed the LB run to buy now on the dip.

Given that Dixon already told Judge he likes the stock, it wasn't a surprise to hear Dixon answer that it's "very early in their international expansion," which he said is about "as fat of a pitch" as he could imagine (careful talking about "fat pitch" in a lingerie discussion).

Dixon defended DIS and even conceded being bullish Comcast is a "controversial" call given media uncertainties.

APC ‘best of the worst’

Jim Lebenthal told Judge on Friday's Halftime that oil's decline is "gonna end in tears," asserting "the only way it really ends is when companies get taken out through bankruptcy."

Fadel Gheit, via phone, told Judge that oil with a 3-handle is "possible" but not "sustainable."

Gheit actually said APA, APC and HES are buyable because they're the "best of the worst."

Gheit didn't answer Judge's question as to whether oil dividends are at risk, merely noting that some companies have cut dividends and others have frozen them.

Sethi said he owns refiners and cautioned that oil dividends of 5-7% aren't sustainable.

Jim Lebenthal said the pipeline argument is that it's not contingent on the price of oil but cautioned that some producers will simply stop transporting oil because prices are so low.

They should allow the president to make a choice, pass a resolution against it, then have the president veto the resolution like they’re doing with the Iranian nuclear pact

On Friday's Halftime Report, Carlos Gutierrez told Michelle Caruso-Cabrera that it was "surreal," "joyful" and "happy" to wake up in Havana.

MCC on the other hand said that when her mother returned to Cuba for the first time, "she was devastated."

Gutierrez said you can see the "grandeur" of the city and what it can still be.

Gutierrez told MCC he was never approached about being ambassador to Cuba. "That was never on the table," Gutierrez said.

Curiously, he downplayed interest in the job with this rationale: "Getting through the Senate is almost impossible."

No follow-up on the purported 15-basis-point hike by the Fed

Jon Najarian on Friday's Halftime Report said there aren't many catalysts in the market besides buybacks.

Sarat Sethi suggested good stocks will be buyable as the market stumbles.

Josh Brown cited an "utter loss of risk appetite" and warned of a "very obvious head-and-shoulders top" in the IBB.

Sethi called WFM "the Starbucks of healthy food" and said long term it's in the right place.

Doc admitted the SHAK options activity was "not as robust" as AAPL and said the put side is "skewed" because a lot of people want to short it, "almost triple the price of the calls."

Doc answered a viewer's tweet and said UA is "pausing." Sarat Sethi wonders if UA won't "consolidate" and pull back a bit. Jim Lebenthal said it's "mostly a pause" and reiterated he's a value investor, not a momentum trader.

Sethi said he thinks there's "still a lot of hair" on DD.

[Thursday, August 13, 2015]

We’re gonna call this one the Daniel Kaffee Trade®

In a curious conversation on Thursday's Halftime Report, Judge asked panelists to answer a viewer's Twitter question (remember when they used to do those all the time? Funny how no one mentions that when Bob Peck talks about the stock) as to which ETF is the best to own for the next 6 months.

Josh Brown was the only one to question the premise, stating, "I guess maybe I'm reading too much into this, but, the next- for 6 months? Meaning, you need the money in 6 months? I'm gonna tell you IEI ... if that's what the question is."

Judge carped, "I think the question is, what ETF is gonna perform well over the next 6 months."

"I've never heard somebody phrase it that way, a specific time frame to try to make money in with an ETF," Brown said.

Indeed. The only thing we can think of is that it's coming from Daniel Kaffee, who tried to persuade beleaguered Marine Harold in "A Few Good Men" to take his deal of 6 months in jail.

Harold told him to shove it.

Pete Najarian and Joe Terranova both backed the XLF.

Doc said the XLY.

Yeeessssss! 7,000 heads successfully cut!

Brad Reback of Stifel made a fine case for MSFT's management on Thursday's Halftime Report, but he needed Jon Najarian to do the consoling.

Reback said he upgraded MSFT because "the Windows business is bottoming."

Then Judge asked if the jury isn't still out on Nadella's leadership. That's when Reback said the team has proved themselves, especially "cutting 7,000 heads" in Nokia.

Doc opined that "Satya's done almost everything right" and assured he's not trying to "gloss" over the Nokia job cuts but that things were "a little bloated."

As for the stock, "55 does not seem ridiculous to me," said Pete Najarian. But Joe Terranova said he was "surprised" it didn't break through 50 after earnings and thinks it might be returning to growth-stock land. Josh Brown cut Joe off and said the time to buy is after a break through 50.

Josh shrugged off the Bernstein upgrade of YHOO. "You have to tell me what's gonna be the catalyst," Brown said.

Joe said CSCO "looks good" and pegged it to top 30.

15 basis points, yeah, right

Joe "Easy Money" Terranova hung a "sub-$40" on oil on Thursday's Halftime Report and asserted, "If you're focusing on the S&P, it's a fool's game."

Joe suggested buybacks drove the AAPL turnaround a day earlier, a good point.

"Certainly that had to be part of it," agreed Jon Najarian, with everyone failing to acknowledge the panel was asleep at the switch while this was actually occurring during the live show.