[CNBCfix Fast Money Review Archive — June 2018]

Ten. Years!

Time.

Flies.

We don't actually know the exact date this site surfaced on the World Wide Web, only that it was the end of June 2008.

Somehow, we're still here.

Happy 4th ... and happy trading!

[Friday, June 29, 2018]

Today, Citi owes $335 million for failing to adjust credit card rates

On Friday's Halftime Report, Jim Lebenthal got the first crack at guest host Mel's top subject, CCAR, a government contraption that at this point in time is 1) about 12 years too late and 2) completely unneeded and 3) has never accomplished anything, stating, "A lot of the banks were approved to give payout ratios above 100%," so maybe the government had been a bit too conservative in the past. (Ya think?)

JJ Kinahan said it "really surprises" him that GS and MS were down and apparently penalized for a "1-time tax charge."

As for the supposed trade war, "I think the jury's still out," JJ said. (It'll all be over if Donald Trump gives up Formosa (see below).)

Josh Brown said he disagrees with the entire previous conversation that indicated CCAR is a major catalyst. "There is nobody that was looking at CCAR like it was a question mark," Brown said. Rather, it's the "narrowing yield spread" that's affecting banks, Brown said.

Brown even said, "In fact, you may be getting to the point where people start using the "R" word, um, if this current trend continues."

But JJ said he thinks banks got "punished too much." But Jim said Brown is "absolutely right" about the yield curve.

Jim thinks the curve is as flat as it is because the long bond is too low and contended that even if the 10-year doesn't begin with a "4," the 10-year/30-year spread will widen into a "steeper yield curve."

Brown said, "Jim, I don't think that's true."

Honestly ... we say this just about every day on this page ... we have no idea why people on this program obsess over these stupid bank trades, which is like trying to outguess (that's the correct verb here) the entire market rather than doing the supposed bottoms-up research they often claim to do and find truly undervalued stocks.

And wouldn't you know it ... it's almost like we script the program ... halfway into the program, Sue Herera delivered breaking news that Citigroup has to pay customers $335 million, boy that's just incredible management 10 years after Chuck Prince, just the latest in the incredibly embarrassing spree of fines and settlements racked up seemingly weekly if not monthly among America's biggest banks (this page mentions this just about every other day, but someone's still going to be boasting about "aggressively adding to Citi" in 2 shakes of a lamb's tail). #1590SATscorerswatchTheSocialNetworknotWallStreet

Kevin O'Leary explained the importance of Quebec seats in Canadian politics. Technical problems interrupted Kevin's connection.

Josh does far more talking than Mel or anyone else

Halftime panelists don't talk about NKE as much as they used to, which unfortunately would've been helpful this week.

Josh Brown and Jim Lebenthal both admitted they missed this week's trade, even though Brown has recently touted the breakout over 70. Jim by contrast has warned about the high-20s multiple, even though most people believe multiples don't matter for short-term trading.

Jay Sole said NKE's North America rebound is "quite convincing," even citing the "sneakers app." Brown mentioned Nike benefitting from the "ultra low-quality shoe offerings aft- even after all these years that we're still seeing out of competitors like Under Armour." Brown said he looks on StockX at 11 p.m. to find the VaporMax in Size 13.

Jim asked Sole if he's comfortable with a 30 multiple even in the wake of these earnings. Sole said there's more optimism about getting to $50 billion in revenue.

Brown asked Sole when Nike's offerings on Amazon would really begin to "make a big splash." Sole said the percentage of overall U.S. products on sale is down to 45% from 60% last year. (We weren't sure if he meant only Nike products or all U.S. retail products; Mel never clarified.)

Sole indicated he likes JWN, his top pick, even more than NKE.

JJ Kinahan said he owns Under Armour; "obviously Nike had the- would've been a better choice, had the big jump today."

JJ (and everyone else) should just stick to FAANG

Stephen Tusa, perhaps Judge's favorite analyst or at least his go-to guy on GE, dialed in to Friday's Halftime guest-hosted by Mel to dub the latest GE news "neutral" or "net negative."

Mel asked Tusa about this curious $60 billion number, which Tusa says is what they "basically need to bring them in line with their peers when it comes to their balance sheet."

According to Tusa, the way the execs explained it this week, "Somehow, um, a net $5 billion in actual cash coming in in 12 months, OK in 12 months, became $60 billion of cash, problem solved."

As for the dividend, "It is going to get cut," Tusa declared, stating "that's actually the new news."

Mel had to break for presidential remarks as Donald Trump even said former inmates are being hired "in record numbers" and businesses are saying "they are fantastic."

After the Trump remarks, Mel revisited GE. Jim Lebenthal said he doesn't like GE and offered to "simplify" the situation: "There is no way of knowing, no way at all, what they're gonna earn this year or next year," Jim said.

JJ Kinahan, who seemed to mention a lot of tough personal trades on Friday, admitted he owns GE; "I bought it on the way down ... some of it's definitely a loss."

Kinahan explained, "I'm a believer in the management team." But he cautioned, "If you're doing this for a short-term play, it probably will not turn out well."

Josh Brown bluntly stated, "The dividend should be cut to zero." Mel said the stock is in dividend mutual funds, and going to zero would get it kicked out. Brown said "tradition" is no reason for having a dividend. JJ said he doesn't see a zero dividend. Brown said buybacks are better and decried the double taxation of dividends.

JJ trying to thread the needle on TSLA (not sure that’s any better than Karen shorting NFLX (snicker)

Underestimating the simple demand for the stock, JJ Kinahan on Friday's Halftime said he's short TSLA (snicker) through options. He said his time frame is "a month and a half" and suggested the stock "could go all the way back down to 320."

Josh Brown said TSLA has been richly valued ever since it came public.

Jim Lebenthal claimed other companies' electric cars are "selling like hotcakes" (snicker). Brown said that's been the bear case "for about 38,000% now." Jim said Tesla makes "1/100th the number of cars that GMs (sic plural) makes," and "they have no profitability in sight."

Rather than Josh, who has to interrupt everyone on the program every episode, it's more entertaining when Jim tangles with Weiss, who will cut in during Jim's point only to have Jim protest, "Hold on, hold on ... hang on a second ..."

#revenuelite: Mel goes entire program without a commercial

On Friday's Halftime, Jim Lebenthal said Bank of America's upgrade of KBH with a 37 target is the "right" call. He called the sector a "very good buy." JJ Kinahan said the builders are confident about traffic if not so happy with lumber prices.

Jim said AXP is "not my favorite stock"; he wonders why not own (yep) C or JPM, or V or MA, instead. JJ said he's got "a lot of faith" in AXP.

Josh Brown said he wouldn't overreact to STZ's slide if he were long.

Jim said GBX is as cyclical of a company as you can find and said its results suggest the trade war is not actually "hitting home." (Translation: Starting to realize nobody should believe what they're hearing about a supposed trade war unless they also believe in George Strait's oceanfront property in Arizona.)

JJ likes NVS.

Jim said he sees the XLE continuing higher. Josh Brown said he doesn't make investment decisions based on a quarter ending. JJ predicted we'll "continue to see a lot of volatility."

Josh Brown said he's still long ALB and called it a "long-term play."

We had to wince near the end of the show while Mel insisted for some reason on going ad-free for the whole hour and wearing us out. But begrudgingly to her credit, she crammed in a lot of stuff in a news-shortened window.

CNBC superfox Seema Mody on the 5 p.m. show referred to the "sleep (sic) slide" of bitcoin.

[Thursday, June 28, 2018]

As Donald Trump woos North Korea, China bickers over Taiwan (a/k/a predictable and stale presidential politics)

If you show a world atlas to an American person and ask the person to define what all the bordered spaces of land represent, the person is likely to use one term: "countries."

Or possibly "nations," although that has a broader meaning.

But that's about it. Our vocabulary doesn't allow a whole lot of nuance here, one reason we prefer math to English or history around here.

Those who occasionally notice our home page know how much we like this subject. Take your pick. Gibraltar. Monaco. Ukraine. Puerto Rico. We like it so much, even if we were somehow having a conversation with Seema Mody/Joumanna Bercetche, if someone brought this up, we'd drop what we're doing to discuss it. And oh yeah, the mothership of this mental exercise. It's in the news again, as China is balking at U.S. airlines NOT referring to "Taiwan" as a part of "China."

This is Mr. Xi's way of alerting the Western World that, if we expect the Koreas to unify, toss out some of the lingering bums and dump the nukes, we better be preparing a 1997 Hong Kong-esque ceremony in Taipei.

The thing is, Taiwan is as much a part of China as Cuba is part of the United States. Unlike the airlines, Wikipedia at this point is not so bullied, dubbing Taiwan a "state" (though not one of the "United States"). Up until about 1971 or so, the Western World claimed China IS Taiwan.

Optimists hope North Korea is ceded the way East Germany was. China is not nearly as weak as the Soviet Union in 1987.

The decades-long game that's been played is for China to pretend to endorse sanctions on North Korea while the United States pretends to consider Taiwan one of Mao's provinces.

We don't know how that's going to turn out. We do know that in defining this particular patch of island, it's clear a lot of Ph.D.s and supposedly brilliant people aren't really sure what they're talking about.

Alli insists banks ‘should be up’

Alli McCartney, a cute chatterbox, said on Thursday's Halftime that she is "absolutely" a buyer of banks; "we're buying on this weakness."

"These should be up already; they're down almost 5% on the year," McCartney said, ignoring that the banks are dinosaur trades claiming CCAR would "embolden" the banks trade.

"Why do you care about volatility?" Steve Weiss asked McCartney. "We definitely care about it less than you do," McCartney asserted. "You don't know I- I don't care about vol at all," Weiss explained.

Everyone talked about his/her favorite oil names.

Seema Mody reported on the dollar's impact on emerging markets.

Alli said her shop took its overweight on EM to neutral on Monday. "We were overweight about 2 quarters," Alli said.

Jim Lebenthal said "you have to have an active manager" in EM; he doesn't like the ETFs. Mike Farr suggested GOOGL, JNJ and PEP as alternatives to international companies.

The panel took up Amazon's move into pills and self-delivery. Weiss admitted "McKesson was a terrible call yesterday," but he said he doubled his ABC stake. Jim Lebenthal said the delivery news is more important; "there's real risk for UPS and FedEx."

Guest host Mel's Call of the Day was CFRA downgrading FB to hold with a 215 (snicker) target. Mike Farr likes the stock and doesn't understand why someone would change their call. Jim pushed the argument that young people don't like Facebook and it's become the "soccer mom" app. (Jim wasn't asked to opine on whether FB or GS would be first to $300.)

Mel said BMO made CRM its top pick. Weiss said it's one to "hold and put away."

Light-news day from the Chauncey Gardner presidency

Jim Lebenthal on Thursday's Halftime Report said IBM is a "fairly complicated situation." He said it won't get a multiple above 10 or 11 "until they fix the margin problem."

Guest host Mel asked what happens to the stock if it's announced that Ginni is leaving. Steve Weiss cracked that if Jim is brought in as CEO, it goes lower.

Jim said MSG has been great, but "I'm out of it now."

Mike Farr, a chap who's impossible to dislike, said MKC "makes sense."

Pete Najarian said he thinks BBBY is losing to TGT and TJX.

Weiss said CMG is "hitting reality" after surging on the arrival of the new CEO, who was "paid in advance in terms of the stock price for what he was gonna do." Weiss said the stock is "so overvalued."

Pete said the buying in DVN January 50 calls was so big, he had to get in. CAKE January 60 calls also got his attention.

Pete said NKE is a "buy," but he's "putting it at a hold" apparently before earnings. (He should've skipped the hold, based on afterhours trading.) (This review was posted overnight Thursday-Friday.) Jim brought up the 27 multiple. Weiss claimed "they lost their entire management team to the #MeToo movement."

Anthony Grisanti said 1,245 is the next level of support in gold; he'd buy here.

Pete hung a 25 on UAA.

Jim claimed people negative on INTC would have to think the new CEO will find "a lot of things that were swept under the rug a la GE." He said it's "definitely" a buy.

Weiss said he likes NVDA, but "now's not the time" to buy it.

Jim's final trade was REGN. Weiss said MCK and ABC. Mike Farr said FDX. Pete said HLT.

[Wednesday, June 27, 2018]

Supposed trade-war selloffs are gifts, though it’s true they can become even better gifts

Kari Firestone opened Wednesday's Halftime stating, "I think it's clear that the president cares about the stock market's performance."

But Kari questioned if the White House was trying to "test" how much it can affect the market.

Steve Weiss said, "I think you're giving the White House a little too much credit in saying, uh, in thinking they are testing the market to see how far they can go. They're not."

Rather, Weiss said, "The volatility is just tremendous; most of it coming from the White House." Weiss said it's not a rising tide anymore and there's still a lot of "carnage"; look at MU. (This writer is long MU.)

Pete Najarian explained that it's all a negotiation "each and every time."

Kari said, "I can't remember an administration that had this style of, uh, reacting and responding to the market. It's too much."

Kari curiously said, "I think it's best to put blinders on ... and try to avoid listening to all of the noise outside." (That hasn't worked for Jim Lebenthal, who arrived late and indicated he actually believes what the White House is saying and pronounced us in a "trade war.")

Steve Liesman, invoking Wall Street Journal headlines, pointed out the roller coaster nature of the 2018 market. Liesman said 5% (snicker) is the top of the range for Q2 GDP growth and that the bottom number was 3.7%.

Jim Lebenthal claimed Q2 GDP "really hangs on trade war right now," then, in a howler, actually said with a straight face, "There could be a very bad outcome (snicker) of this trade war."

What difference does it make if it’s BABA; doesn’t Pete like ANY stock in which the options fire up?

Pete Najarian on Wednesday's Halftime mentioned having so much energy exposure, we can't even list it all.

Steve Weiss talked up DNR. Kari Firestone said her shop owns PSX and SLB.

Jeff Kilburg insisted crude's still in a 64-75 range.

Meanwhile, Weiss mentioned potential opportunities in names such as AGN and IQ, and Pete talked up BABA but said he's not in it right now; he wants to see the options "really start to fire up."

After Weiss basically already said it, guest host Melissa Lee correctly said, "Nobody has cared about anything when it comes to financials except for the yield curve. That's the problem with this trade."

Jim Lebenthal claimed GS and MS are also in the "crosshairs" of this "trade war."

Sounds like ISRG’s tape might be more useful than Steve Liesman’s GDP survey

Guest host Missy Lee's Call of the Day on Wednesday's Halftime was Bernstein initiating ISRG, BSX and ABT with double-digit upside.

Kari Firestone tossed in ABMD. Pete Najarian trumpeted "unbelievable option activity" in MDT. Pete (sorta) explained why he sometimes buys the stock instead of just the calls.

Pete called ISRG a "great measuring stick of the economy itself."

BTIG also upgraded YUM to buy with a $92 target. Jim Lebenthal said "the valuation is terrific" and he likes it as a "middle of the fairway" stock.

Pete said he'd stay away from YUMC. That stock got Jim's attention, stating Yum China is held in a lot of China ETFs and mutual funds and is probably being dumped with those funds.

Kari said TEVA is in a "search for identity." She said if it can "produce some earnings," it can continue higher. That's true for many stocks.

Not clear why Pete continues to own PEP given the face he made while discussing it

Leslie Picker on Wednesday's Halftime reported on whatever proxy controversy ISS is involved in (something about holding companies "hostage"); one chap likened the system to a "protection racket."

Kari Firestone said, "If Salesforce dropped any further, we would buy more."

Pete Najarian doesn't expect "a whole lot more" upside in PEP.

Jim Lebenthal said you "have to make a call" on the (yep) U.S.-China "trade war" before buying X.

Steve Weiss explained why CAG and PF were both falling; he said the multiple is high, so while it may eventually be a buy, "not here."

Pete hailed WWE's deal.

Jim said he "wouldn't read too much into this" regarding SONC's slide.

Pete said UAA July 23 calls were popular. Also, COP July 70.50 calls.

Weiss recapped MU's China issues. (This writer is long MU.)

Pete's final trade was BP. Kari said FRC. Weiss said MCK. Jim said RDSa.

[Tuesday, June 26, 2018]

Jim silent on INTC takedown

Guest host Melissa Lee's Call of the Day on Tuesday's Halftime was Bernstein's Stacy Rasgon turning bearish on INTC, even saying he "regrets" upgrading the stock in April.

Rasgon conceded, "I do regret it," rationalizing it with something about investors were going to look for this but are now looking for that, but he said he thinks the "surface logic" of his upgrade was correct.

Rasgon said the resignation of Brian Krzanich was "important," because the stock is "much less likely to inflect sharply upward if numbers continue to go up."

Rasgon admitted he "hesitated to speculate in print" as to who should be CEO. But he said the tapping of Bob Swan indicates internal as well as external candidates.

Jim Lebenthal, who a week ago Monday basically said you'll be sorry if you don't buy INTC at 53, was on the show but wasn't asked about Rasgon's call.

And nothing about the furious battle for those all-important Fox film assets either

About halfway through Tuesday's Halftime Report, Joe Terranova said, "I think that's a record for the month of June. We went 25 minutes, we didn't talk about the FAANGs."

How in the world could anything GE says still surprise someone?

Morgan Brennan on Tuesday's Halftime Report summarized CNBC's earlier interview with John Flannery, stating GE revealed plans to become "more focused, stronger, simpler."

Brennan said Flannery said that as far as any more surprises or skeletons, "we're done."

Brennan thinks it's "safe to say" that the GE dividend won't be eliminated, though it could be lowered in 12-18 months "when health care is its own company."

Jim Lebenthal said he'll "thaw" a bit on GE, but he's not buying yet. He said Tuesday's outlook confuses balance sheet with income statement.

Rob Sechan said the GE power business "continues to deteriorate." He views the stock more as a "trade" than an "investment story."

Guest host Mel questioned if it takes "just a small improvement" in the GE balance sheet to move the stock. Joe Terranova said it could work as a trade, but "pension liabilities are a big issue." Doc said those amount to "$30 billion."

Doc said Flannery's timing was "impeccable" as far as not talking about selling Baker Hughes in February.

MCC pointed out on Power Lunch that CNBCers are allowed to own 2 stocks, GE and CMCSA.

Isn’t it about time for Congress to investigate if traders are inflating the price of oil?

At the top of Tuesday's Halftime Report, Joe Terranova raised eyebrows if not howls by mentioning the possibility of an "SPR release" (snicker).

Rob Sechan said, "We've encouraged clients to migrate from growth to value." They might want to be careful about that type of migration; might get separated from profits.

Joe said, "Iranians will be the losers" of whatever's going on regarding world oil production, pointing to the widening gap in dated oil futures and the narrowing with Brent. Joe said it's "bad for refiners" but good for energy equities, though they won't move as much as the spot price.

Joe suggested PXD, OXY and EOG, and even CHK as a "high-beta play."

Jim Lebenthal said "short-term issues" in the oil space "can be overturned relatively quickly." He touted Royal Dutch Shell again and SLB.

Jon Najarian talked up frackers. Lindsey Bell said there's a ".92 r-squared correlation" between WTI oil prices and the energy earnings.

Doc said rising fuel is a problem for FDX, UPS, JBHT and other truckers, cruise lines.

Jim said consumers are "used to" $3 a gallon. Can't really argue with that.

Sully, at the World Gas Conference in D.C., said maybe Texas won't be able to ramp up as much "easily replaced" barrels as people think.

Later, Sully tried to explain whether Rick Perry was really mad at OPEC or not. (And Karen Finerman is surprised to learn that administration officials aren't really all on the same page.)

Doc said he dumped his AAL calls but held on to DAL (citing the refinery, which suddenly matters again). Doc said he likes BA. Rob Sechan touted MLPs again. Sechan joked that interest rates are "stable and volatile" at the same time.

Rob told Jim that the pace of rate increases is "likely to slow," while energy prices look sustainable. Lindsey Bell said the consumer can handle $70 oil, but if it goes to 80-85, "then we're gonna have a little bit more of a problem." (Translation: Crack down on the speculators.)

Jeff Kilburg said crude will stay range-bound. "I think you sell this rip," Jeff said. Jim Iuorio though said he can see 74 or 75.

Karen Finerman, dynamite in gray and prominent necklace, said on the 5 p.m. show, "I don't find value in oil right now between Friday and today's moves," suggesting other countries may not go along with Donald Trump's policies.

Once he gets tired of tariffs, it’ll be back to Obamacare or Birtherism

Lindsey Bell said on Tuesday's Halftime that she doesn't see a recession around the world for at least a year and a half; she said the global growth story "might not fully be over yet."

People selling 90 BUD puts were buying BUD August 100 calls, according to Jon Najarian, who also said BABA September 210 calls were getting bought.

Joe Terranova likes the diversification of MGM for the longer term.

Doc said of Spotify, "a lot of folks are piling into this space."

Jim Lebenthal said LEN shows that rates are more important than tariffs.

Rob Sechan is taking profits in retail because of tariffs.

Rob said he reduced his overweight-EM position.

Jim said you can get in CAT, "but you may have to wait for a couple of months." He even suggested "dollar-cost average" (translation: thinks it's going lower, so makes no sense to buy until he thinks it's going higher).

Doc likes FB.

Joe said, "I still don't believe that the coast is clear" regarding trade.

Rob Sechan's final trade was buying XLF (snicker). Doc said ENB. Jim said CELG, "ridiculously cheap." Joe said ISRG.

[Monday, June 25, 2018]

Steve Grasso: When market stumbles on trade, it’s always ‘ripped right back’

Evidently waking up for the first time since 2016, Karen Finerman on Monday's Fast Money said she was concerned about the comments from the White House because "it didn't seem like everybody was on the same page."

Steve Grasso theorized that Donald Trump restarted this trade war after returning from his summit with Jong Un; he "wants to put pressure on China," Grasso said.

While Tim Seymour and Guy Adami actually claimed the Fed put is gone (snicker), Grasso said, "Every time the market has sold off on trade concerns, the market has ripped right back on some type of a positive headline. I don't think that this is any different." We'll take it a step further and, regarding Monday, throw in the term "gift." (Translation: 1) This isn't the fall of Lehman Brothers, and 2) after the market rockets back, the others will say "Anybody who makes trades based on what Donald Trump says or does is really dumb.")

Jon Najarian goes from 5% cash to 77% cash; Erin Gibbs says ‘definitely’ buy in September

Uncorking a curious verb at the top of Monday's Halftime, Joe Terranova said that last week, "Pete and I dialogued about the volatility being very low."

"I bought QQQ puts last week," Joe added, asserting, "Technology clearly is rolling over."

Joe again mentioned "the blackout window." As for the market shellacking on Monday, Joe said it's "temporary ... but I don't think this is over."

Steve Weiss asserted, "There are lots of problems, lots of issues to navigate."

That's curious, because on June 14 (see below), Josh Brown said, "I never say this, but it's, it's like too good right now." #pickyourpundit

Meanwhile, on Monday, Erin Gibbs said it was "already concerning" that growth was getting so far ahead of value (snicker) and that tech was outperforming by so much.

Jon Najarian seemed to be recapping not Monday but the previous golden age of tech stocks (that is, about 10 days ago), saying that his calls were getting called away, and "I'm even out of Apple."

Typically, Doc tends to be a reassuring voice during scary selloffs, but Monday, he said he's in 77% cash, "and I'm usually at 5% cash."

Sarat Sethi though was talking about buying. "Now, start legging in," Sarat said, predicting in a few years, this will just be a "blip," though he said the market could go "another 5 to 10% lower."

Sarat trumpeted industrials at 16-17 times earnings. He also called financials "a big area" (snicker) that's trading below last year's P.E.

Doc mentioned the yuan hitting a "new low for the year" and said there's "a lot going on with the German market."

Joe explained, "It's important to keep things in a very simplistic capacity. ... This is not a portfolio event. ... This is a trading event."

Joe questioned if the short-volatility trade has been re-levered. Doc said the VIX made a "huge move" and that people are buying "way out-of-the-money puts" in September. (Are they people who previously bought puts and then rolled them down after making a huge profit?)

In the latest instance of threading the needle, Erin Gibbs said the market might "hold steady" for bit, but, "Definitely September, get back in."

Weiss: Probably have to ‘give up the ghost’ on big banks

Jonathan Krinsky on Monday's Halftime said it's "nothing new" that GS and C "have been kind of relative laggards for a while now," and he thinks they have maybe 5-10% more downside.

Actually, early in the year, they couldn't get Judge to stop talking about how GS was hitting a 52-week high (snicker).

Steve Weiss reaffirmed he "shaved" C recently but not enough of it; impressively, Weiss again questioned this dog of a popular trade and said at some point, "you have to give up the ghost on these."

Sarat Sethi tried to suggest C is "the value play" of financials but admitted it's a "value trap right now."

Krinsky said there's "relative weakness" in financials and homebuilders but "relative strength" in consumer staples and REITS. Sarat touted EQIX.

Thought it was a ‘stock-picker’s market,’ but it seems like everything getting tossed at once

Guest host Melissa Lee on Monday's Halftime said the Call of the Day was Atlantic Equities upgrading MSFT with a $125 target.

In not the most resounding endorsement, Sarat Sethi said MSFT is a good place to "hide."

In another not particularly effusive endorsement, Joe Terranova said MSFT benefits from IT spending; he'd stay with it but suggested you "hedge against it."

Joe added, in the wake of FB controversies, "Microsoft, there's something about this company, that management makes the consumer feel secure that privacy is present."

Steve Weiss said MSFT is a "good place to be" though not "impervious" to days like Monday. And we thought it was a "stock-picker's market."

Jon Najarian said he likes MSFT, but in more minutiae about his recent options positions, he said that in his tax-deferred account, "I let it get called away." Doc said he really likes the "re-occurring (sic not 'recurring') revenue."

Joe said MSFT "could easily fall to the low 90s."

Weiss at one point said NFLX is down only because "it shouldn't be where it is." Later, he said he likes NFLX even though the valuation is "a little higher for me." Kind of odd how often he wanted to talk about this stock out of the blue despite not liking the valuation.

‘Everybody thinks they’re an energy expert’

Steve Weiss on Monday's Halftime said HOG's problem is a "perfect example" of what a trade war can do.

Weiss and Jon Najarian sounded amazed that HOG would eat the whole costs without passing them along. "It's crazy," Doc said.

Seema Mody reported on CCL's tough day. Weiss noted the impact of rising fuel costs and noted how airlines don't hedge anymore.

Doc said he's tried to catch the AAL falling knife a few times, and it hasn't worked. He said he's got calls, "in all likelihood," he'll have to "dump" those calls. He also mentioned bottom-picking and "stinky fingers."

Erin Gibbs touted ULTA and told the male panelists, "You can buy your makeup and get your hair done at the same time." Guest host Missy Lee joked, "They know that already."

Weiss said he still likes EL long term. If you own it, "you don't sell it," Weiss said. Sarat Sethi said it's a "premier" company but "very hard to buy" because it always trades at a premium.

Doc explained why he likes the unusual activity in August 80 OMC calls. (As opposed to all the other options trades he touts.)

Joe Terranova said KR qualifies as a "socially responsible" company.

Sarat Sethi said AXP still has room to go.

Sarat said he's dipping a "very small toe" in the energy space. He touted APA and EOG. Joe spoke of the "paper asset demand" in energy. Joe said the cartel keeps the downside to crude "somewhat limited."

Steve Weiss grumbled that there's always "so much speculation ... everybody thinks they're an energy expert."

Weiss said he's not bullish on LEN ahead of earnings. "It's just not one I'm buying," Weiss said.

Joe said WMT in the lower 80s "is an opportunity."

Doc's final trade was PCG. Sarat said DAL and mentioned the refinery business. Weiss said MU. (This writer is long MU.) Joe said WMT, COST, TGT.

[Friday, June 22, 2018]

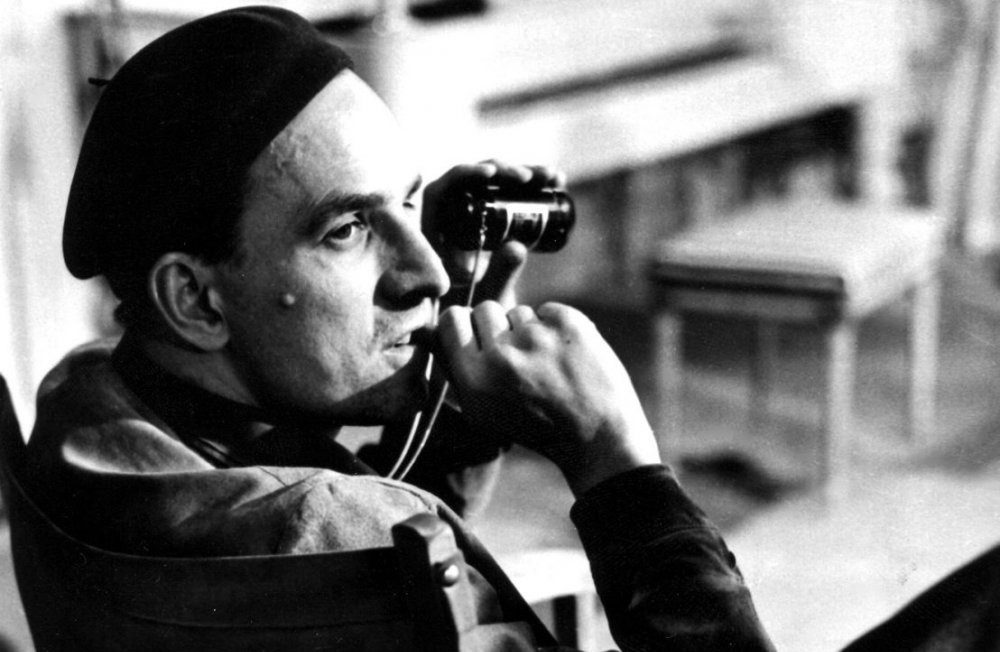

Ingmar

There's an important date coming up, and no, we're not talking about the 10th anniversary of the fall of Lehman Brothers, which will spawn endless special features and interviews on CNBC in which Andrew Ross Sorkin and David Faber will retell the same stories that are even more uninteresting now than they were a decade ago.

Circle July 14 on your calendar. That's what would be the 100th birthday of Ingmar Bergman (he passed away in 2007, the same day as Antonioni). Presumably, theaters and streaming services will be preparing tributes, none of which could be more effective than simply showing the work. (If you're reading this page, you're part of the best audience on the Web, so you know exactly what we're talking about here and totally get it.)

At least 15 Bergman films are in the conversation of the greatest films ever made. Note: Watching these is not the same blast you get from seeing "A Few Good Men" or "Jackie Brown." Bergman films, though usually less than 2 hours, reveal truths that are often slow-moving and uncomfortable. The point is just to relax, perhaps with a merlot (always drink responsibly), and let the images come to you. What may seem like a frustrating 90 minutes will linger forever. The fear, and confidence, on the face of Liv Ullmann in "Persona" ... the dilemma of choosing sides in "Shame" ... the boy wandering the halls in "The Silence" that seems so familiar in Stanley Kubrick's "The Shining" ...

Here's one that even the Bergman experts rarely mention. Known in English as "Sawdust and Tinsel," it was originally released as "The Naked Night," and the Swedish title, Gycklarnas afton, translates roughly as "The Clowns' Evening." This is perhaps the greatest film ever made about humiliation — not the sexiest topic — on multiple levels. People of a lower profession, perhaps of a lower class, at odds with authority figures, unfazed by anything yet incredibly vulnerable, in some ways a bit like the Joads in "The Grapes of Wrath." "Sawdust" stars Harriet Andersson, undeniably on the Mount Rushmore of female film actresses. (If Ullmann is Ali, Andersson is Tyson.)

Bergman wore cheap clothes and disdained the spotlight. He lived on a remote island. But this prince of Sverige had as strong of an edge as any artist who ever lived. He's telling you something. Do yourself a favor and find out what it is.

Weiss actually claims Bulge Bracket CEOs are ‘probably the best CEOs’ of this generation

Honestly, we just don't get it.

But whatever floats their boat.

Kate Moore on Friday's Halftime said she is "still constructive on financials."

Well, whoop de do.

Credit Josh Brown for articulating the reality of this sector, pointing out that banks might sell at low multiples forever because "basically they've become utilities de facto, and they are actually going to be competing with fintech companies." (He didn't say they're competing for elite talent and that today's elite talent watches "The Social Network" and not "Wall Street.")

Brown said non-bank financials are doing well, as is STOR, his favorite REIT.

The howler of this conversation came from Steve Weiss, who actually said the current big bank CEOS "are probably the best CEOs we're gonna see in our generations (sic)."

That's because, Weiss explained, "What they had to go through, to navigate their companies through what hit 'em right between the eyes, is amazing."

Really. Regularly settling embarrassing fines and lawsuits is great navigation.

Apparently.

What happened to the Dow being down 7 straight days and the Nasdaq up 1%?

In an instant stumble, Judge for whatever reason opened Friday's Halftime dragging Kate Moore into some curious conversation about keeping an eye on capex spending by certain companies, typically tech.

Jim Lebenthal said the choppy market comes down to "the China issue." Just for kicks, we're gonna call it "The China Syndrome," which is actually a great movie despite its cartoonish finish.

Steve Weiss said "the overhang" in the market is China.

As for suggestions, Weiss said he's not sure INTC has "corrected enough," but you can start buying.

Josh Brown noted NFLX is up 5% this week and that the price-weighted Dow (snicker) doesn't include the FANG stocks.

Brown retraced the history of the Nifty Fifty.

Judge, who slogged through the first 20 minutes with no focus, basically trying to phrase the same question (what will it take to get the bull market back and no more "zigzag") in multiple ways, grew weary with Jim and Josh for not answering his question, sighing that he doesn't want an "economic roundtable."

Steve Weiss tried to make the case for inflation again.

Jim halfheartedly claimed this is a "great opportunity" to "pick stocks." He added, "You can find bargains, you can find overpriced stocks; this is a stock-picker's market."

Really, Jim, then where have you been on NFLX all year. Oh, he said he thinks "something like a Netflix is too frothy."

Weiss said you can rewind tapes on this show going back 4 years and you'll hear, "breadth is too narrow" and the market can't keep buying back all this stock. "My advice is ignore it," Weiss said.

We usually do.

Josh Brown said the stocks that have been going up are not the low-valuation stocks.

Mel announced that the 5 p.m. show was actually declaring the "funeral" of bitcoin. We're sure they'll be devoting half of Monday's show to cryptogarbage.

Mel says her first car was a 1987 Chevy Blazer

Judge's Call of the Day on Friday's Halftime was NKE being downgraded to neutral by Buckingham despite a price-target hike from 75 to 80.

Josh Brown said NKE just broke out, so why sell now. Steve Weiss said the analyst is not saying to sell it.

Jim Lebenthal said, "It could come down more than a point or two. ... The chart does look a little toppy."

Jim claimed NKE is "well ahead of itself" at 27 times earnings.

Jim claimed "2 years is my time horizon." Judge pointed out, "We could be in a recession in 2 years."

Judge showed a tweet asking whether SQ or PYPL is better but asked panel about CELG

Pete Najarian on Friday's Halftime said there's aggressive buying in August 230 FB calls.

Josh Brown said it's "unbelievable" how fast FB has recovered from its winter stumble. Judge said when Zuck was on Capitol Hill, "Nobody knew what they were talking about ... the questions weren't all that difficult."

Pete said HAL July 47.50 calls were also popular. Josh Brown said HAL looks "trendless."

Steve Weiss said "one quarter shouldn't bother you" in a stock such as RHT, and he advised listening to the CEO on Cramer's show.

Jim Lebenthal said KMX's gains should continue with used-car pricing up.

Judge said a UBS guy says a potentially big MU correction is coming in 2019. Josh Brown said it's a "weird note." (This writer is long MU.)

Weiss said of MU, "The fundamentals are good now," and there's really not a lot of capacity coming on. He made it his final trade.

In a Futures Now that went basically nowhere, Bob Iaccino said supply disruption is more likely than oversupply in the crude space. Jim Iuorio said he thinks oil "turns around" at 68.60.

Jim said he likes CELG, which he said is "insanely cheap because of some blown trials." Weiss said "it needs a catalyst."

Josh Brown's final trade was SFIX.

[Thursday, June 21, 2018]

Remember when this page on April 17 predicted FB would hit $300 before GS does while GS had $85 head start? It’s down to a $25 lead

On Thursday, we started getting a bit jealous about the lucky chap/gal who gets to watch Halftime at Englewood Cliffs and have a 2-hour dinner with Judge and the traders (see below).

For $16,000. (It'll take us a whole lot of unusual-activity scalps to put together a bid that big.)

(Can't help but wonder ... the whole experience is billed as 3 hours ... does that mean the winner watches the show, goes home and changes clothes, then meets Judge at a restaurant in the evening? Or do they go straight through and have the meal take place at 1:30 p.m.?)

Anyway ... Judge opened Thursday's Halftime stating that Bespoke found that only twice since 1971 has the Dow been down 7 straight days while the Nasdaq was up 1%. (And in any of those other times, was President Donald Trump conducting a trade war with China?)

Erin Browne didn't sound concerned.

Joe Terranova suggested buying some QQQ puts, explaining the Nasdaq could "retreat" during the "blackout window."

Steve Weiss contended, "I think you'll see those trade tensions continue through the midterm elections," because "Middle America, America broadly voters, like the policy that Trump's putting forward."

"They're about not to," Jim Lebenthal cut in, citing the Daimler warning. Jim countered that instead of lingering into November, "I think it will be resolved at least 2 months before the midterm elections."

Judge asked if tech can remain so far ahead of the rest of the market. "I'm not sure the Dow's ever gonna catch up," Weiss said.

"I sold some Citi today," Weiss said. "I still have too much left." He said he'd rather have money in AGN or EXPE or MU (this writer is long MU).

Joe mentioned CCAR (snicker) again, the most widely anticipated irrelevant business report. Weiss said, "Does anybody really expect negative CCAR results?"

Pete Najarian said financials look great over 12 months, not so great year to date. Pete trumpted HD and TJX and how consumers are strong.

Katie Stockton sees no reason to doubt the trend of tech leadership.

Karen Finerman, on the 5 p.m. show, likes C, "the most upside," and as a matter of fact, she likes all the big banks heading into CCAR, which will show the "good shape" of all the banks. "I know that everyone knows that already," Finerman admitted. (If only she had the same enthusiasm for FAANG.)

Joe apparently read every bullet point in the Telsey note (if you need more than 2 reasons a stock will rise, it probably won’t)

Courtney Reagan on Thursday's Halftime explained the Supreme Court ruling on Internet sales tax.

Judge questioned the stock market response to certain names, wondering, does it "seem a little overdone" on some of these stocks, are people really going to stop shopping online.

Erin Browne said the W selloff was overdone.

Courtney said the tax-collection process will probably be forward-looking and not retroactive.

Meanwhile, Judge's Call of the Day was the LULU 145 upgrade by Telsey. Steve Weiss said it's a great company, "However, I just don't think it's worth this price."

Joe Terranova said "the 4th bullet point" in Telsey's note "concerns me," it's about exploring footwear. Weiss said the shoes are "very expensive" and don't appear any better than what Nike sells.

Jim Lebenthal shrugged that the Telsey call on LULU was a "momentum call." Jim said UBS' retail call is "a great call" and much more impressive that someone is "calling a turn" in several names.

Joe said he's not getting out of MA and V despite the Supreme Court ruling, which Joe said has "significance." Weiss said he's long V and MA and finds this "basically a non-event."

FAANG-picker’s market, cont’d

Joe Terranova on Thursday's Halftime Report said there's "no reason to believe" DRI doesn't keep going.

Jim Lebenthal is "kinda lukewarm" on VZ; he'd wait to see if its content investments pay off.

Steve Weiss said the grocery space is tough but that KR "is the best management in the space."

Erin Browne expects energy stocks to bounce back.

Jeff Kilburg said he doesn't see a big boost in production of crude. Scott Nations said 60 has been support.

Pete Najarian said PG July 77 calls as well as some stuff that expires Friday June 22 got his attention.

Erin Browne's final trade was to stay long the retailers. Jim said C (snicker) admitting that "a lot of this is probably priced into the stock." Weiss shrugged that banks are "absolute rate proxies" and said his final trade was "sittin' on my hands." Joe said to "pick up some volatility" (Zzzzzzz).

CNBC visit to watch Halftime and have dinner with Judge & traders fetches $16,000

Thursday afternoon, Judge trumpeted the Lulu & Leo Fund charity auction for a chance to watch the Halftime Report at Englewood Cliffs and then have a meal with Judge and "the traders" afterwards.

We paid attention to the bidding and saw it close at $16,000.

We were mulling a bid ... but that one's a little over our pay grade. (Some nights, it's all we can do to secure a hot meal.) Can you imagine all the stuff that could be talked about at such an event ... oh man ...

According to the guidelines, the offer is only for 1 person, "approximate duration" of 3 hours (which presumably means a 2-hour meal), "something small" can be signed, a photo can be taken, and alcoholic beverages are included in the price.

Winner also gets a signed copy of When the Wolves Bite.

Congrats to the winner.

Can you imagine how much money would be raised if dinner included Seema Mody?

Katie. Bar. The. Door ...

Including dividends, INTC up 157% since May 16, 2013, while QQQ is up 155% (a/k/a Jim thinks company he’s been bullish on needs ‘new vision’)

Judge on Thursday's Halftime delved into the Brian Krzanich situation ... and curiously said INTC is up 117% since Krzanich took over May 16, 2013.

This immediately started tingling the Spider Senses around CNBCfix HQ, because Intel pays a dividend, and Judge didn't make clear whether that number includes dividends.

Apparently not. From what we could calculate (snicker), Judge was figuring the return without dividends and also including Thursday's selloff, not the Wednesday closing price.

Steve Weiss correctly wondered, "What's the rest of the market done?"

"It's outperformed, Steve," said Jim Lebenthal, obviously not willing to do the math.

"How much has it outperformed tech?" Weiss said, mentioning "Google. Amazon."

"We're not gonna dispute this; it's been a winning stock," Jim said.

Based on our non-Kensho calculation, QQQ and INTC are about an even match since Krzanich's reign. QQQ has the bigger capital gain; INTC has the bigger dividend.

Bottom line: It suggests Krzanich has been decent but not indispensible.

Pete Najarian said of the whole situation; "it's unfortunate, obviously."

Pete said Navin Shenoy would be his "front-runner" for new INTC CEO.

In a bit of a stunner, Jim Lebenthal said he disagrees with Pete. "You wanna bring in new blood," Jim said, suggesting poaching someone from NVDA, MU or TXN, someone who would bring in "new vision while keeping the rest of the leadership at Intel intact."

It's odd that Jim would just a couple days ago virtually guarantee that you'll be sorry if you don't buy INTC, only to now state that the company needs a fresh vision.

Judge told Jim, "I'm shocked that you say that."

Steve Weiss cracked, "I learned that I was right in trying not to let Jim talk, because he embarrased himself."

Judge said, "Let's not cross the line, all right."

Irked, Jim said, "I do find if somebody has to insult that that takes some of their argument."

Judge for some reason said, "There are a lot of good race cars out there, right, but there aren't that many good drivers."

Much more from Thursday's Halftime later.

[Wednesday, June 20, 2018]

Weiss on fire, suddenly articulates why banks are dogs, caps show with a bang

For the longest time, Wednesday's Halftime Report appeared to be dead money.

Somehow, in the last 10 minutes, Judge uncorked a fantastic show chock-ful of expert soundbites.

Most significant was when Judge announced at the end of the show that the Call of the Day was C (snicker) being upgraded (double snicker) to a buy (triple snicker) by Deutsche Bank.

Rich Saperstein seemed on board with that. "Citi's one of the cheaper stocks out there," he said, adding he likes the stock.

Steve Weiss opined on the stock, and not at all in the way we've grown to expect. Weiss said he's long, but maybe C just isn't worth more than book or even more than a discount to book.

"I'm waiting for an exit," Weiss admitted.

Saperstein countered that if rates rise and the economy strengthens, the money-center banks will do well. Weiss responded with one of the greatest rebuttals we've heard on the show in years (partly because it's been made on this page over the last few months): "What you just described ... is a short-bond call. So why not short bonds?"

Saperstein said that on the fixed-income side, "we have very short duration across our entire book," so being long banks is his way of playing rising rates on the equity side. Which didn't really answer Weiss' question.

Weiss could not be more correct. Big banks are nothing more than secularly challenged rising-tide trades. There's nothing intrinsic to get excited about here. In fact, if rates are flat or decline for 5 years, these stocks are going to be horrific as Ivy League talent continues to flock westward to reinvent what's still a largely overpriced industry. If you're convinced of rising rates, simply short bonds or do one of those TLT or TBT things (whichever goes in the same direction as rates; actually both charts seem kind of similar this year).

Joe Terranova offered another reason to buy banks besides rising rates: "CCAR's coming!" That's the Mike Mayo Trade, omg, wait'll these tests come out and everyone sees how strong the banks' balance sheets are!!!! Translation: They no longer have enough leverage to fully exploit a roaring economy and seemingly every other day are being embarrassed with fines and settlements.

Weiss correctly stated that if C hits 75, "It's gonna be because rates have rocketed, and then we're closer to the end of the bull market than the beginning."

In a tweener appearance on Closing Bell before the start of Wednesday's Fast Money, Karen Finerman was asked by Kelly Evans about banks. "I think they're, relative to the market, great value," Karen said, adding she's hanging on to BAC, C, JPM. "I agree with Karen," said Pete Najarian, despite being on the Halftime Report hours earlier with Weiss.

If it’s really a ‘stock-picker’s market,’ how come nobody ever pounds the table for NFLX?

NFLX came up on Wednesday's Halftime during a discussion of this ludicrous bidding war taking place over Fox's tired entertainment assets, a subject Josh Brown nailed a day ago.

Pete Najarian said, "I hate the idea of Mr. Iger getting too aggressive ... I don't know that they're there yet." But he said, "This is gettin' pretty real. ... It was an awfully low-ball bid before."

Kari Firestone, skeptical, suggested DIS is trying to pay 7-8-9 years worth of Netflix programming costs for Fox. "I just wonder if that solves the problem for them," Kari said.

Steve Weiss questioned the tandem bidding for stocks such as DISCA and AMCX.

Joe Terranova invoked a time-machine trade, stating, "Think back to a year ago. What was it, 71 billion they're bidding. Throw on another 25 billion a year ago, you coulda bought yourself Netflix."

"Shoulda," Pete said.

That's fine ... but instead of blaming Iger, why isn't Joe chiding his fellow panelists for not buying NFLX when it's apparently the best stock of the year at least among names that get mentioned on the show (and hardly a secret)?

Karen finally admits shorting NFLX last week was ‘just like walkin’ into a buzz saw’

Viewers Wednesday finally got an answer — sorta — from Karen Finerman about that ghastly — sorry, just the truth — move to short NFLX last week based on temporary euphoria of overpaying for entertainment assets and all kinds of spending on new TV shows.

On Wednesday's 5 p.m. Fast Money, debating whether to "trade" or "fade" NFLX and other FANG stocks, Karen Finerman said, "I can tell you, don't fade it last Tuesday, or whenever I did for like a, you know, a day. And that, it's just like walkin' into a buzz saw, just covered, I think that Goldman put out a whatever, 490 doll- billion-dollar price target, maybe. I wouldn't get in the way of that."

We'll ask the question Mel didn't: What in the world were you thinking?? (This writer has no position in NFLX.)

Panelist actually claims ‘There’s a camp that thinks rates are going lower’

This was a mighty head-scratcher.

Judge on Wednesday's Halftime asked Rich Saperstein, who had an iffy show, to defend buying GIS. Saperstein said his clients "are looking to stay rich and not get rich."

OK, fair enough. Take a pass on NFLX.

"I wanna buy names now that have gotten beaten up," Saperstein said, before curiously adding, "There's a camp that thinks rates are going lower."

"What camp thinks rates are going lower? ... I've never heard anybody say rates are going lower," said Steve Weiss.

Saperstein responded, "The ones that are talking about rates going lower are those that believe we're at peak earnings now and the cycle's gonna turn in 2019."

Hmmmm. Not sure we've heard those people talking, but whatever.

Trying to help, Kari Firestone said to Saperstein, "Not lower. You mean not up a lot."

A big chunk of the program was interrupted by Donald Trump's remarks on immigration. Eamon Javers said Trump is doing a "walkback." Javers said there are pictures of Kim Jong Un on the wall in the West Wing.

In January, they were talking about NFLX being in the Greenlight ‘bubble basket’

Our usual note: This page takes no pleasure in stocks going down and isn't rooting for anyone to lose money. Nevertheless, it's true that troubled stocks make for typically the best and liveliest conversations on CNBC.

That was the case on Wednesday's Halftime Report, when Judge declared SBUX's performance has been "just bad."

Joe Terranova said, "I think Jim Cramer nailed it ... the turnaround isn't there." That gave Judge entree to air Cramer's question for Kevin Johnson in the morning that wasn't particularly interesting.

"I think the stock still has more downside," said Steve Weiss.

Weiss said of Howard Schultz's acquisitions, "none of 'em worked, I don't believe."

Also, enjoying an outstanding performance, Weiss correctly pointed out that in SBUX stores, "There's no consistency with anything but the coffee." He could've added that it's pointless to buy any of the food offerings because even the ones that are good will likely be replaced by something else in a few months.

Pete Najarian admitted he bought SBUX "just a couple of days ago." That happens to all of us unfortunately, though it's refreshing to know it happens to a savvy trader too.

Pete said Starbucks should get rid of underperforming stores. Weiss wondered, "How'd that work for JCPenney?" Pete scoffed, "Don't compare them to JCPenney." Weiss said "I'm just sayin', that's not a strategy."

Kari Firestone said SBUX has gone from a 32 multiple to 18 multiple.

Pointing to Asia potential (that's an interesting subject right now), Pete said "everybody knows this number" (actually we didn't), which is that SBUX is opening a new store in China every 15 hours.

Joe Terranova asked what value is left in SBUX if the Asia operation is split off. Kari said, "It's a good place you can go to the bathroom."

Relevancy is why the Dow doesn’t include AMZN, FB, GOOGL ...

Squeezed in around D.C. reporting, Wednesday's Halftime crew got a late crack at GE.

Judge said the GE Dow story is stunning "in and of itself" (sic redundant) (he had been improving recently at avoiding that phrase).

"It's not a surprise logically," Kari Firestone said.

Steve Weiss said GE peaked way back with the dot-com bubble and ever since has been sliding; "frankly there's no reason why it shouldn't continue." Weiss said the Dow dropped GE because it's "trying to stay relevant."

Pete Najarian called GE's debt an "amazing number."

Joe accuses show of paying too much attention to the Dow

Joe Terranova on Wednesday's Halftime Report pointed to highs in the Nasdaq Composite and Russell 2000 and said, "The entire year, we are looking at the wrong thing. We are looking at the Dow."

Actually, we're not aware of the Halftime Report overrating the Dow this year, but whatever.

With curiously low expectations, Kari Firestone said she thinks you can make 2-7% this year, "and then next year, we can set up for a better year for the market."

Rich Saperstein said tax reform is "absolutely powerful" and claimed it's somehow not priced in. Saperstein pointed out that the S&P is basically where it was in December when tax reform was signed.

Pete Najarian said we're in a "summer pause."

Steve Weiss said Powell's comments were "extremely hawkish."

Quibbling with tired cliches definitions, Weiss said, "It's not necessarily stock-pickers, I think it's always a stock-picker's market, it's sector pickers."

"It's growth over value," said Joe.

Pete thundered that it's not just technology that's doing well, look at biotech. Joe said, "That's within technology, Pete ... It's in the Nasdaq."

Kari Firestone's final trade was BSX. Joe said MA, Weiss said AGN, Rich Saperstein said MAS and Pete said PYPL. (This writer is long PYPL.)

[Tuesday, June 19, 2018]

Pete has never thought it’s a stock-picker’s market; he thinks it’s an unusual-options-activity market

Here's a howler.

Pete Najarian was heard to say on Tuesday's Halftime that one thing that's "always true" but not getting "said enough on the network necessarily" is that it's a "stock-picker's market, man."

That's amusing on a couple of levels, because 1) Pete usually doesn't get long a name until he sees the options trading (as a matter of fact, he mentioned that later on Tuesday's show in regard to BA); and 2) Pete usually trumpets how he doesn't even own the common stock of companies he likes but the options instead.

Also, unrelated to Pete, we're under the impression it's not a stock-picker's market, but a "rolling bear market."

Karen found NFLX a short the day the market got all giddy because Brian Roberts was raising his bid (snicker)

Judge on Tuesday's Halftime said Dan Ives' GBH is raising NFLX to 500. (Judge didn't mention that Karen Finerman announced a NFLX short (snicker) last week.) (Karen hasn't been on the 5 p.m. show since to explain this.)

Pete Najarian said NFLX has "so many different levers" including international growth and improving margins. "The multiple is just insane," Pete conceded, but he said there's talk of even North America growth for NFLX.

Joe Terranova said DIS keeps talking about "direct to consumer."

Josh Brown said $500 is a big number, but Ives' call is merely a $39 stock going to $50. Brown said if NFLX listened to 2011 Wall Street concerns about international expansion and profitability, it would be "probably gone by now." (We're not sure what that means, other than Netflix knows what it's doing.)

Joe correctly said the M&A flurry among Time Warner, Fox, Disney and Comcast "has done nothing to impede the growth of Netflix."

Brown correctly stated, "All they're doing is adding a hundred billion dollars in debt, they are smashing properties together in the hopes that they will be able to create content, but the distribution has proven to be the secret sauce."

So often it seems like the stock market’s Road to Utopia goes through NFLX

Pete Najarian struck an optimistic tone at the outset of Tuesday's Halftime, noting people were willing to buy with the Dow down 400. (Of course, people are willing to buy if the Dow were down 10,000; the only time people aren't buying is when markets are closed or stocks are halted.)

Judge said with a straight face of the trade war, "The risk is that the market does begin to take this a little more seriously for a little bit longer."

Judge noted Ed Yardeni mentioned a "zig-zag" market, but, taking a cue from Bob Hope, Judge said, "The problem with that is, zig-zag gets you a road to nowhere."

Josh Brown trumpeted his call of VZ a day ago. "Your portfolio's gotta be a barbell," Brown explained, trumpeting biotech and noting it was recently in one of Joe Terranova's classic terms, "penalty box."

Joe said he doesn't see whatever's happening this week as a "portfolio event" but rather a "trading event."

"I've been buying-buying-buying," Joe said, adding later that "it's still a cyclical market," and we'll get past the noise "in a couple of weeks."

But that seems a bit at odds with what Joe said at the end of the show: "Generally, administrations have one fire hose, and right now, there's multiple fires, domestic and global."

Stephanie Link quibbled with Joe's assessment of Europe and EM slowing; Link said 89% of international markets are seeing PMIs above 50.

Mike Santoli noted the market had been doing well for a couple of weeks and that the rockiness of the last few days "has not cut into muscle yet."

Judge actually suggested with a straight face that there could be "boycotts of the iPhone" in China.

"China needs the iPhone manufacturing revenue very-very-very badly," Josh Brown explained. Judge said, "I get it, but there are risks to that story ev- every day this thing escalates" (snicker).

Pete Najarian said he's not buying BA on the slide because he hasn't seen the options paper.

Josh Brown painted a bleak picture for those sick of trade headlines; "it's never gonna end." But he said the market "eventually" will tune out the noise and stop punishing names like CAT and BA on every one of these headlines.

Stephanie Link said NKE isn't cheap, but she likes it for the 2nd half of the year. She thinks there's more upside now in Under Armour.

Stephanie Link said companies managed through the "macro" and "circus" last quarter "pretty darn well." Josh Brown said, "Last quarter wasn't particularly hard to manage through," citing tax stimulus.

SNAP has never traded in single digits, despite Pete’s call multiple times of a year ago

Judge on Tuesday's Halftime said Cowen dropped its SNAP target from 10 to 9, maintaining underperform.

"Makes sense to me," said Pete Najarian, who added that Evan Spiegel's interview "gave me more of a reason to like Twitter right now."

Josh Brown said the trade since SNAP went public is to be long TWTR and short SNAP. "The seeds of this thing's demise were, were, were planted way before the IPO when he rebuffed Zuckerberg and then published the emails," Brown said.

Pete said SNAP's all-time high occurred in the "first couple of days of trading," a good point.

Josh Brown and Stephanie Link said they both like SQ but like PYPL better. (This writer is long PYPL.)

Wilf Frost said Lloyd Blankfein seems "relatively sanguine" about the China trade war.

Stephanie Link said she's been buying a "laundry list" of stocks including HDS, Alphabet, Under Armour, OXY, AIG.

Link said she bought FCX a day ago, which looks "silly today."

[Monday, June 18, 2018]

Jim visibly frustrated

by INTC’s slide

Sometimes, things intersect beautifully on the Halftime Report.

On Monday, Judge managed to get Jim Lebenthal's dander up by declaring the INTC downgrade to underperform by Gus Richard of Northland (45 target) as the Call of the Day.

Jim said "I completely disagree," and shrugged about praise for MU; "If I see one more report, about DRAM pricing going up or any other sort of chip going up, I think my head's gonna spin." (This writer is long MU.)

Jim said it's a great environment for chips, and Intel is sure to benefit. Judge asked Jim how much INTC is up year to date or 12 months. Jim didn't know, suggesting 20% for the last 12 months. Judge said it's up 14% year to date. Jim asserted, "This is Year 2 of where Microsoft was in its 5-year program. ... The kicker here, the catalyst is MobilEye."

Yes. "Autopilot" is something motorists really like to hear these days.

Joe Terranova questioned if there's more gains to be had in AMD than INTC. Jim said we've heard that "every year for 20 years," and it doesn't happen.

Meanwhile, Judge brought up Brian Wieser's DIS downgrade. Pete Najarian claimed sports gambling was the "trigger" for him to buy DIS (snicker). Judge said you can't assume Disney will make back all those ESPN subscriber losses because of legal gambling. "And I didn't say that," Pete said, claiming ESPN "gets a Band-aid" (snicker).

Jim basically agreed with Wieser, stating the Fox bidding war is the "worst of both worlds" for Disney, because it either overpays or misses out on content it could use.

Jim also said, "I am getting a little fatigued with the Marvel universe. I can't be the only one in the world who's getting fatigued with that." (Jim is 100% correct.)

Finally, Judge welcomed someone who works for Ritholtz Wealth Management, Michael Batnick, to talk about his new book about investing greats that shows "beating the market is extraordinarily difficult." Steve Weiss said he agrees with the approach and wrote a "similar book" a couple years ago.

See, Jim was making the mistake Gordon Gekko (and presumably Batnick's book) warned about; "Have the steak tartar; Louis will make it for ya" "Don't get emotional about stocks; it clouds your judgment." Jim wasn't gushing over the INTC selloff; he was ticked because it's one of his favorite names. He made it his final trade and said you'll regret not buying it and to view the selloff as a "gift."

It seems here like INTC is indeed a fine stock to own, but, as Batnick pointed out, once a person owns a stock, he tends to think it's worth more than someone who doesn't own it thinks it's worth.

FAANG-picker’s market (cont’d)

Ed Yardeni on Monday's Halftime said he's never seen a president who's "this bullish and bearish at the same time."

Yardeni, who has a 3,100 S&P target, said Donald Trump's tariffs are "not a big deal."

Jim Lebenthal seemed to think Ed called this year a "dog" (we didn't hear Ed say that) and said the S&P is up nearly 5% total return year to date, and if we get 10-11% by year-end, we'd call it a "good year."

Josh Brown gave a lengthy description of the XLF chart; we're not really sure what it means.

Joe Terranova admitted, "I'm stuck in Bank of America," but suggested rotating into "some of the regional banks."

Brown said, "Not all financials have been dogs," pointing to credit card companies and "anything related to wealth management."

Steve Weiss said he bought AGN last week and reiterated he sees inflation getting "a lot more aggressive."

Joe said defensives are richer than cyclicals and predicted a "significant unwind."

Josh Brown said he sold DE and KSU because "they are absolutely subject to the vicissitudes of this trade, uh, debate (snicker)."

Brown said he's been buying VZ and SFIX, the latter "may become the Netflix of apparel," but it's "not for the faint of heart."

Pete Najarian said June 58 SBUX calls were active, as were JD June 45 calls expiring Friday.

Josh Brown's final trade was VZ. Weiss said Alphabet and predicted it becomes a leader. Joe said he's buying more TWLO.

Weiss mentions adding to Citi less than 2 minutes into the program

We weren't actually sure if he was touting it, or lamenting it.

Judge opened Monday's Halftime asking whether the market rally can sustain itself. Joe Terranova said, "The rally is still on where it matters," namely tech.

Steve Weiss agreed, and then made this curiously neutral-sounding observation: "I bought some more Citi when it dipped, and guess what, I could buy it now cheaper."

Judge said C is down 17½% since the end of January. "I know it all too well," Weiss said, adding he's not buying more financials now but isn't selling them either.

If you don't want to take it from months' worth of commentary on this page, take it from Jim Cramer, who on Friday claimed, "There are plenty of younger portfolio managers who think the banks are like Sears and J.C. Penney: they're old-line brick-and-mortar stores that are about to lose their relevance thanks to all sorts of new technologies from bitcoin, blockchain, PayPal [and] Square." (This writer is long PYPL.)

Note he said "younger." We're not saying the Halftime Report is full of Grandpa Joneses (snicker), but ... we've never heard anyone on the show say what Cramer said.

Also note that unlike Jim Cramer, this page has never referenced bitcoin or blockchain in making this point, but the completely obvious facts that 1) the really big money is going to Silicon Valley not Wall Street and 2) the Ivy League/etc. talent follows the money and 3) that talent is rapidly reinventing all kinds of sectors including the financial space and 4) the financial space still includes some atrocious fees that are only bound to come down and 5) (if you really wanna lay it on) the traditional banks (think WFC) seem to have to resort to embarrassing bait-and-switch schemes that enrage lawmakers just to show any growth.

So there you go.

Again.

Much more from Monday's Halftime later.

[Friday, June 15, 2018]

Stunner: 2 panelists agree that P.E. ratio means basically nothing

Jim Lebenthal on Friday's Halftime said you can expect FAANG and other leaders to go higher "until there's a reason for it to go lower." Then he said, "This is still a stock-picker's market."

Jim stated, "The trend is your friend." Judge said if the trend's your friend, it's not really a stock-picker's market. "Not in the next 3 weeks, you're exactly right," Jim agreed, but then earnings season. So we're threading the needle again; buy now, stop after 3 weeks, then after X amount of time, jump in again, etc.

Judge noted that Julian Robertson is catching on to us said Thursday what this page has been saying for a while, that most of the leading tech stocks are ridiculously cheap (he didn't explain that it's because everyone's so absurdly afraid of March 2000 Part II that they won't bid up these names to ever reach the point of March 2000 Part II, so while they remain great stocks, expect permanently constrained multiples for absurdly powerful companies, but whatever). Josh Brown said those "are all separate stories" and pointed to different multiples within FAANG. Jim said, "I don't think you said this strongly enough," again noting the different multiples within FAANG.

Erin Browne said the rally in momentum stocks is "likely to continue" and called tech "reasonably valued."

Josh Brown likened AMZN-esque multiples to cable companies of the 1980s, specifically TCI.

Jon Najarian started to talk about DBX (almost like he was Ivy Zelman), then said he doesn't see a reason for the rally to be "thrown off the tracks."

Josh Brown said it's riskier to buy TWTR now than in the teens.

Mike Santoli said this is an "uneven market."

In one of the show's most provocative comments ... EVER ... Erin Browne and Josh Brown agreed that valuation has "no correlation" on returns over 1-3 years.

Somewhere, Ivy Zelman is still talking about the state of the U.S. housing market

(Sigh) Sometimes, we wonder why we even bother with this endeavor.

Judge decided viewers of Friday's Halftime Report were entitled to a couple of speeches from Ivy Zelman; during the 1st, Ivy actually had to stop herself to allow questions, and during the 2nd, we actually exited CNBCfix HQ, only to find upon returning that Ivy was still talking.

Back in the day, Krakower would've been screaming in the host's ear, "Put a cork in it."

Ivy, who is a fine guest, nothing wrong in general, just the length, presumably bought time mentioning "Wolves Bite" (a title, as we pointed out, that doesn't make a whole lot of sense, unfortunately) to Judge right off the bat, "I read it, and I think it's a great book. Good job!"

Ivy basically said housing inventories are at "all-time record lows," millennials are looking to buy homes, and, invoking a cliche no one has ever used in or about the construction industry, "I used to tell the builders, 'If you build it, they will come,' and they're finally doing that."

Ivy called LEN a "great buy here relative to the other large caps."

Judge finally ended this conversation with, "Don't be a stranger."

We can't believe the panel was still awake afterwards when Judge asked for opinions on the homebuilder space, a space that has absolutely never interested this panel. Jon Najarian said he likes HD, HDS and LOW much more than the builders. Erin Browne told Josh Brown that rising rates affect both home-sale volume and home-sale pricing.

Karen stunning at Wharton forum (hopefully, she didn’t have to explain that NFLX short) (sorry, have to say it)

Leslie Picker on Friday's Halftime said Ackman's publicly traded vehicle is up 22% this quarter.

Judge said Bill is "ever confident" that "he's gonna make it back."

Judge's Call of the Day was something about FAANG Morgan Stanley's overweight/160 on UTX (Zzzzzzzz). "I like this call a lot," said Jim Lebenthal. Jon Najarian said the outlook for closing the Rockwell Collins deal was seen as bright a day before this call. Erin Browne said there's a "really strong trend" in capex, but tariffs will "weigh" on industrials.

DE August 150 calls and WPX July 19 calls got Jon Najarian's attention.

Jim's final trade was MYL, Erin said XBI, Doc said FDS and Josh said NOW.

[Thursday, June 14, 2018]

Karen hasn’t been on the 5 p.m. show to discuss her NFLX short, prediction that the valuation would be ‘coming in a little bit’

Here's a friendly media tip.

CNBC's David Faber is still covering dinosaurs, putting himself at risk of becoming one himself.

For example, Faber thinks National Amusements and Comcast and anything to do with John Malone are a big deal.

These are great stories — in 1987. The truth is, these are incredibly boring stories about mostly boring assets; does anyone care in the slightest whether the next time they watch "Wall Street" it's distributed by Comcast or Disney?

Put another way: Does anyone care in the slightest that CNBC is owned by Comcast and not Jeff Immelt? (Sure, we get emails about that subject all the time ...)

The AT&T deal and Comcast offer, soaking themselves in lard, sound a lot more like Gerald Levin buying AOL and a lot less like Mark Zuckerberg buying Instagram or Larry Page buying YouTube, which is the space that Faber should be spending his time on, but whatever.

Nevertheless, Josh Brown on Thursday's Halftime said the media war is "exciting" because we haven't seen such a bidding war in a long time. The guess here is that the Fox "bidding war" turns into the supposed TWX bidding war.

Steve Weiss said the fact CMCSA and DIS are both trading up is a sign of "excess" in the stock market.

Brown contended that DIS needs the Fox content more than CMCSA does. "The 20th Century Fox library is insanely valuable," Brown said.

Brown said DIS doesn't have the content it needs for 2019, so "they gotta make the deal."

FAANG-picker’s market (cont’d)

(a/k/a they really just don’t get it)

Steve Weiss on Thursday's Halftime claimed, "We're overdue for a correction." Jim Lebenthal said we just had one, then said, "you're saying that was the one that was overdue."

Later, Weiss said, "There is froth in the market," but followed, "Where else you gonna put your money?"

Oh boy. Sounds like it's a Stock. Picker's. Market.

Jon Najarian said DISCA has been up for a couple weeks and that the gaming stocks are "on fire."

Jim touted biotech and pharma and called financials "huge pockets of opportunity" (snicker). Jim claimed, "This is an active stock-picker's market."

Jim said he's mostly trimming PFE to get into pharma and biotech. He also called MSG an "absolute hero."

Judge had the audacity to ask, "Are we walking into what could be a midterm election wall?"

"The GDP numbers are going well," said Steve Liesman.

Weiss at one point said that worst-case trade scenarios are "assumed" by the market, and if things on that front improve, you'll get "another leg into the market."

Josh Brown: ROKU

‘looks like TiVo to me’

Judge's Call of the Day on Thursday's Halftime was Macquarie's initiating ROKU as outperform. (This writer is long ROKU.)

Jim Lebenthal, who has touted the name off and on since February despite a purported small position, said, "Echostar is the model here," which frankly made us cringe.

Josh Brown said, "This looks like TiVo to me, where anyone can get into this business and destroy them." That's an interesting point. However, we've heard that said about a lot of companies on this program, and it rarely seems to happen, regardless of what the stocks do.

Jim said that's a "very good point," but "Until I see that, I'm not gonna be worried about it."

"I do think this is going back to 50 easily," Jim asserted.

Doc said he agrees with Jim but agrees with Brown that others can get into the space. Jim said it's a "direct attack" on the cable companies' model.

The thing about ROKU, it enables the opportunity to watch the Antonioni trilogy, which we expected Judge to bring up when Italian bond yields (remember those?) spiked, but it didn't come close to happening. For now, Jim's argument seems to have the upper hand: while TiVo was/is part of the cable model, Roku is about cord-cutting, so if you believe cable companies are the dinosaurs, it's not a bad gambit.

Is Jeffrey predicting a 6% return on his FB short?

Josh Brown opened Thursday's Halftime with an interesting pronouncement about the stock market.

"I never say this, but it's, it's like too good right now," Brown said.

Nevertheless, Brown said you don't have to go all-in, you'll get these "periodic washouts." Possibly, yes, but don't expect to see FB at 150 again.

In what should've been alerted as Breaking News, Judge said he got an email from a "billionaire investor" who is "constructive still" on U.S. stocks.

Even semi-Grandpa Steve Weiss seemed to endorse the rally, stating only a black swan event can derail the market.

Rebecca Patterson slightly played the killjoy, stating she and a group of female investors wonder if inflation won't creep into the trucking industry and later sounding a little iffy about small caps beyond the near term.

Judge said Jeffrey Gundlach sees a 6% 10-year in 3 years. Josh Brown questioned how a 6% 10-year coincides with a 2020 recession.

Steve Liesman told Steve Weiss that what the president is doing regarding tariffs isn't just "negotiating tactics."